1. What is the projected Compound Annual Growth Rate (CAGR) of the Delta-9-Tetrahydrocannabinol?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Delta-9-Tetrahydrocannabinol

Delta-9-TetrahydrocannabinolDelta-9-Tetrahydrocannabinol by Application (Pharmaceutical Industry, Research Organization, Others), by Type (Purity 98%, Purity 99%), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

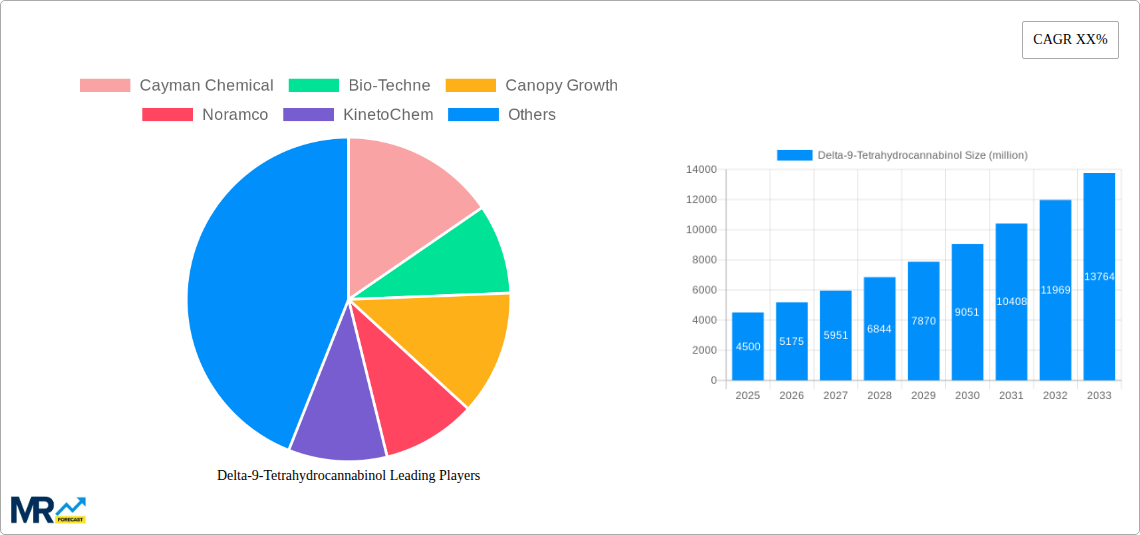

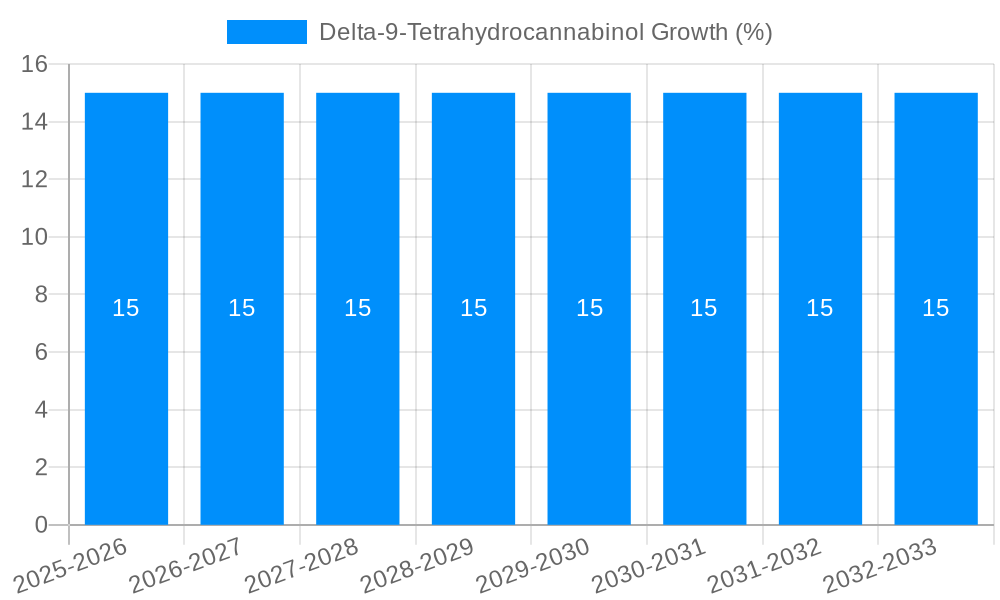

The Delta-9-Tetrahydrocannabinol (THC) market is poised for substantial expansion, projected to reach an estimated market size of $4,500 million by 2025, with a remarkable compound annual growth rate (CAGR) of 15% from 2019-2033. This robust growth is primarily propelled by the increasing legalization and decriminalization of cannabis and its derivatives across numerous regions, fueling demand for THC in both pharmaceutical and research applications. The pharmaceutical industry is a significant driver, leveraging THC for its therapeutic properties in managing chronic pain, epilepsy, and other medical conditions. Research organizations are also contributing to this growth by exploring novel applications and understanding the full spectrum of THC's potential benefits. The market is further buoyed by advancements in extraction and purification technologies, leading to the availability of high-purity THC (98% and 99%) essential for precise scientific research and pharmaceutical formulations.

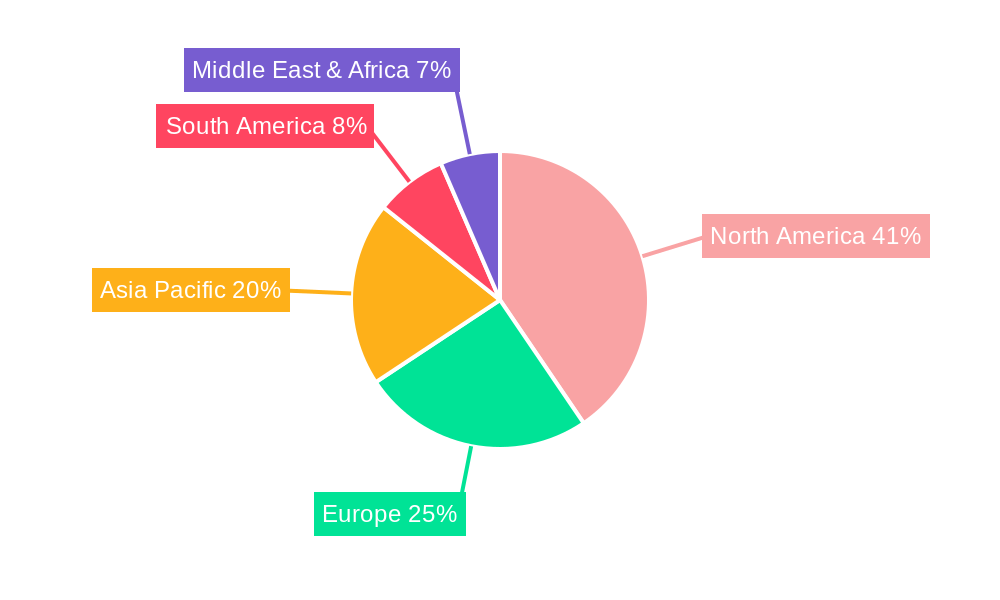

Despite the promising outlook, the market faces certain restraints, including evolving regulatory landscapes and stringent compliance requirements that can impede market entry and expansion. However, these challenges are being mitigated by an increasing focus on product innovation and the development of diverse THC-based products. Emerging trends such as the rise of medical tourism for cannabis-related treatments and the integration of THC into wellness products are expected to open new avenues for market penetration. Geographically, North America is expected to dominate the market, driven by the United States and Canada's progressive cannabis policies. Asia Pacific, particularly China and India, presents significant untapped potential due to growing research interest and a large patient population. Key players like Cayman Chemical, Bio-Techne, and Canopy Growth are actively investing in R&D and strategic collaborations to capitalize on these opportunities, further shaping the future trajectory of the Delta-9-Tetrahydrocannabinol market.

This report delves into the dynamic landscape of Delta-9-Tetrahydrocannabinol (THC), offering an in-depth analysis of market trends, driving forces, and significant developments. The study encompasses a comprehensive examination of the market from the historical period of 2019-2024, with a base year set at 2025. The forecast period extends from 2025 to 2033, providing valuable insights for strategic planning and investment decisions. The report aims to provide a 360-degree view of the THC market, highlighting key opportunities and challenges.

The global Delta-9-Tetrahydrocannabinol market is experiencing a transformative surge, driven by evolving regulatory frameworks and a growing scientific understanding of its therapeutic potential. From its historical roots primarily associated with recreational use, THC is rapidly transitioning into a compound of significant pharmaceutical and research interest. Projections suggest a market valuation expected to reach $5.2 billion by the end of the forecast period, a substantial increase from its estimated $2.8 billion in the base year of 2025. This growth trajectory is underpinned by an expanding array of applications, particularly within the pharmaceutical industry, where THC is being explored for its analgesic, antiemetic, and appetite-stimulating properties. The historical period of 2019-2024 witnessed the initial stages of this scientific exploration and regulatory shifts, laying the groundwork for the current expansion. The report will meticulously analyze the compound's journey, from its initial perception to its current standing as a subject of intense scientific investigation and commercial development. Factors such as the increasing legalization of medical cannabis in numerous jurisdictions and the subsequent rise in research activities have significantly contributed to this evolving trend. Furthermore, advancements in extraction and synthesis technologies are enabling the production of high-purity THC (98% and 99%), catering to the stringent requirements of the pharmaceutical sector. The market is also observing a diversification of product offerings, moving beyond raw extracts to more refined formulations and isolated compounds. This shift is indicative of a maturation of the market, moving towards greater sophistication and scientific validation. The estimated market size in 2025 is projected to be $3.1 billion, a testament to the accelerating pace of adoption and development. The interplay between scientific discovery, regulatory adaptation, and market demand is creating a complex yet highly promising environment for THC.

Several interconnected factors are acting as powerful propellers for the Delta-9-Tetrahydrocannabinol market. Foremost among these is the accelerating pace of scientific research into its myriad therapeutic applications. Over the study period of 2019-2033, a growing body of evidence is illuminating THC's potential in managing chronic pain, nausea associated with chemotherapy, and appetite loss in various debilitating conditions. This scientific validation is a crucial catalyst, encouraging investment and regulatory approval. Secondly, the progressive relaxation of regulatory frameworks across key global markets is a monumental driver. Jurisdictions are increasingly legalizing medical cannabis and, in some cases, adult-use cannabis, which in turn facilitates the legitimate research and commercialization of THC. This has opened up new avenues for market growth, moving it from a niche to a mainstream consideration. The estimated market size in 2025 of $3.1 billion directly reflects these advancements. Furthermore, the increasing demand for novel pain management solutions is significantly bolstering the THC market. With a growing global population experiencing chronic pain, the search for effective and alternative treatments is paramount, and THC is emerging as a promising candidate. The pharmaceutical industry's active engagement in developing cannabinoid-based therapeutics, alongside the contributions of dedicated research organizations, is also a critical driving force, pushing the boundaries of what is understood and achievable with this compound.

Despite the robust growth, the Delta-9-Tetrahydrocannabinol market is not without its hurdles. A significant challenge lies in the complex and fragmented regulatory landscape. While progress is being made, varying legal statuses and stringent approval processes across different countries and even within regions can impede market access and expansion. This regulatory uncertainty can also impact the investment climate, as companies navigate a patchwork of rules. Another restraint stems from public perception and historical stigma associated with cannabis. Overcoming decades of negative associations requires concerted efforts in education and scientific dissemination to establish THC's therapeutic credibility. Furthermore, challenges in consistent and standardized production can affect market reliability. Ensuring high purity levels, particularly for pharmaceutical applications (98% and 99%), requires sophisticated extraction and purification techniques, which can be costly and complex to scale. The estimated market of $3.1 billion in 2025 needs to contend with these production complexities. Lastly, limited long-term clinical data for certain indications can create hesitation among healthcare providers and regulatory bodies, slowing down widespread adoption. The historical period of 2019-2024 provided initial insights, but extensive, large-scale trials are still crucial for full market penetration.

The dominance within the Delta-9-Tetrahydrocannabinol market is anticipated to be a confluence of specific geographical regions and key market segments, driven by a combination of regulatory progress, research infrastructure, and patient demand.

North America (United States and Canada): This region is poised to be a dominant force due to its comparatively progressive regulatory environments for both medical and recreational cannabis. The United States, with its vast healthcare system and robust pharmaceutical industry, coupled with the legalization of cannabis in numerous states, presents a massive market opportunity. Canada's early legalization of recreational and medical cannabis has established a mature market with significant research and development activities. The projected market value in 2025 for the global market, estimated at $3.1 billion, is heavily influenced by the contributions from this region. The presence of leading companies like Canopy Growth, Benuvia, and Noramco further solidifies North America's position.

Europe: While facing more fragmented regulations than North America, Europe is rapidly emerging as a significant player. Countries like Germany, the Netherlands, and the United Kingdom are demonstrating increasing openness to medical cannabis, driving research and adoption. The growing awareness of THC's therapeutic benefits and the efforts of pharmaceutical companies to develop cannabinoid-based medicines are fueling this growth. The study period of 2019-2033 will witness a substantial expansion in European market share.

Within the market segments, the Pharmaceutical Industry is projected to be the primary driver of dominance for THC.

Application: Pharmaceutical Industry: The intrinsic therapeutic properties of Delta-9-Tetrahydrocannabinol make it a prime candidate for pharmaceutical development. The historical period of 2019-2024 saw initial breakthroughs, and the forecast period of 2025-2033 will witness an acceleration in the development and approval of THC-based drugs for conditions such as chronic pain, multiple sclerosis, epilepsy, and chemotherapy-induced nausea. The demand for highly pure THC, specifically Purity 99%, is paramount for pharmaceutical applications to ensure efficacy and safety. Companies like Bio-Techne and Cayman Chemical are crucial suppliers of high-purity compounds and research tools, supporting this segment's growth. The estimated market size in 2025 of $3.1 billion is significantly influenced by the pharmaceutical sector's increasing investment. The stringent requirements for drug development necessitate a deep understanding of THC's pharmacokinetics and pharmacodynamics, driving substantial research investment. The ability to synthesize and isolate THC at high purities, like 99%, is a key enabler for this dominant segment.

Type: Purity 99%: The demand for Purity 99% THC is intrinsically linked to the pharmaceutical industry's dominance. Regulatory bodies mandate the highest purity levels for active pharmaceutical ingredients to guarantee product safety, efficacy, and consistency. This segment is critical for the development of prescription medications. While Purity 98% also holds importance, particularly in certain research applications and for some medicinal products, the highest echelon of pharmaceutical research and commercialization will increasingly rely on 99% purity. The significant market valuations projected for the base year of 2025 and beyond are heavily reliant on the ability of manufacturers to consistently produce THC at these elevated purity standards. Companies like Noramco and KinetoChem are instrumental in this regard, focusing on high-grade synthesis and purification.

Application: Research Organization: While not directly generating revenue from patient treatment, research organizations play a foundational role in the THC market's dominance. They are instrumental in uncovering new therapeutic applications, conducting preclinical and clinical trials, and advancing the scientific understanding of THC. This segment is vital for the long-term growth and validation of THC in various medical fields. These organizations are significant consumers of high-purity THC (both 98% and 99%) for their studies.

The synergy between supportive regulatory environments, a burgeoning pharmaceutical sector actively pursuing cannabinoid-based therapies, and a strong research ecosystem focused on understanding THC’s full potential, positions North America and Europe as leading regions, with the Pharmaceutical Industry and the 99% Purity segment at the forefront of market dominance.

Several key catalysts are poised to accelerate the growth of the Delta-9-Tetrahydrocannabinol industry. The expanding pipeline of pharmaceutical research and development focusing on cannabinoid therapeutics is a primary catalyst, promising novel treatments for a range of conditions. Furthermore, the ongoing global trend towards regulatory reform and legalization in various countries is opening up new markets and reducing barriers to entry. The increasing investment from venture capital and established pharmaceutical companies signifies growing confidence in the market's potential. Finally, advancements in extraction and synthetic technologies are leading to more efficient, cost-effective, and higher-purity production of THC.

This report provides a truly comprehensive overview of the Delta-9-Tetrahydrocannabinol market, extending its analytical reach across the entire value chain. From detailed trend analysis spanning the historical period of 2019-2024 and projecting forward to 2033, to an in-depth examination of the driving forces and restraints, this report equips stakeholders with a nuanced understanding. It meticulously dissects the market by key regions and segments, with a particular focus on the dominance of the Pharmaceutical Industry and the critical role of high-purity THC (99%). Furthermore, it highlights crucial growth catalysts, identifies leading players, and documents significant industry developments in a chronological format. The report’s depth and breadth ensure that readers, whether investors, researchers, or industry professionals, can make informed strategic decisions based on robust data and insightful analysis. The estimated market size of $3.1 billion in the base year of 2025 serves as a key benchmark for understanding the current scale and future trajectory of this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cayman Chemical, Bio-Techne, Canopy Growth, Noramco, KinetoChem, Aphios, Benuvia, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Delta-9-Tetrahydrocannabinol," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Delta-9-Tetrahydrocannabinol, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.