1. What is the projected Compound Annual Growth Rate (CAGR) of the Crypto Software Wallet?

The projected CAGR is approximately 10.3%.

Crypto Software Wallet

Crypto Software WalletCrypto Software Wallet by Type (Cloud Based, Local Deployment), by Application (Enterprise, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

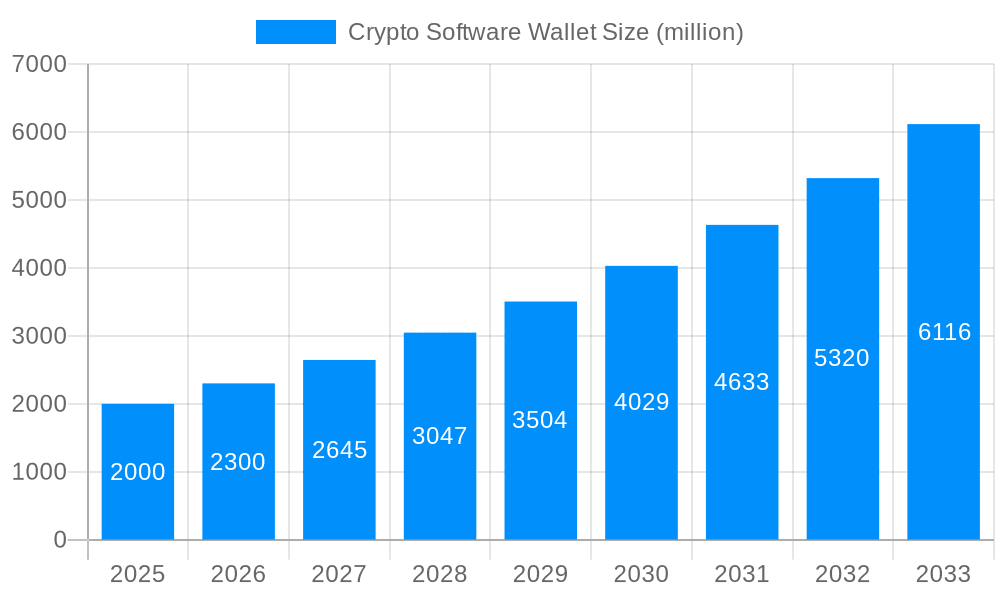

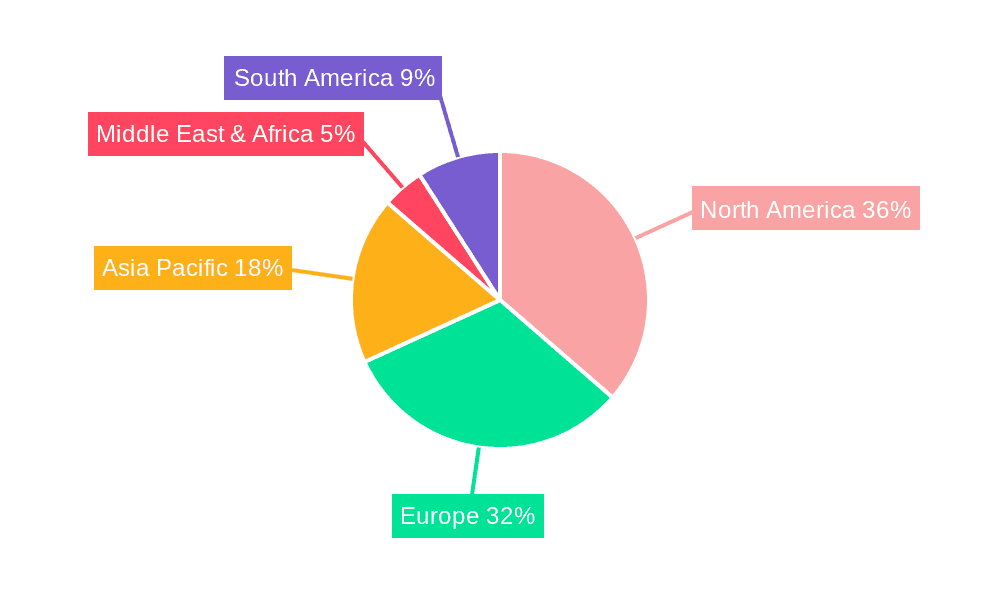

The cryptocurrency software wallet market is experiencing significant expansion, propelled by increasing digital asset adoption and the demand for secure, intuitive management solutions. The market, valued at $11.61 billion in its base year of 2025, is projected for substantial growth through 2033, driven by a compound annual growth rate (CAGR) of 10.3%. Key growth catalysts include the burgeoning popularity of decentralized finance (DeFi), which increases the need for versatile, secure wallets for diverse digital assets and platform interaction. Furthermore, an evolving regulatory environment, while presenting complexities, is enhancing awareness and adoption of robust wallet solutions among individual and institutional investors. Ongoing technological innovation continuously improves security features, user experience, and integrates advanced functionalities such as hardware security modules (HSMs) and multi-signature capabilities. The market is segmented by deployment type (cloud-based and on-premise) and application (enterprise and consumer), with cloud-based solutions gaining traction due to their accessibility. Geographically, North America and Europe currently lead market share, with Asia-Pacific demonstrating high growth potential. However, persistent challenges include security vulnerabilities, regulatory ambiguity, and the intricacies of private key management.

The long-term outlook for the crypto software wallet market remains optimistic, underscored by increasing institutional engagement and growing investor sophistication. This trend is fostering demand for professional-grade security and management tools, leading to the development of specialized wallets for institutional-grade security, multi-currency support, and advanced features like staking and yield farming. The competitive landscape is dynamic, featuring established entities alongside innovative new entrants. Market evolution will be shaped by continuous technological advancement, regulatory shifts, and the maturation of the broader cryptocurrency ecosystem. User experience and enhanced security will be paramount for success in this competitive arena.

The global crypto software wallet market is experiencing explosive growth, projected to reach a valuation of several billion dollars by 2033. The study period from 2019 to 2033 reveals a dramatic shift in user behavior, with a significant increase in adoption driven by the burgeoning cryptocurrency market and the growing awareness of digital asset security. The estimated market value in 2025 is already in the hundreds of millions, highlighting the rapid expansion. This growth is fueled by several key factors, including the increasing ease of use of crypto software wallets, the rising demand for secure storage solutions for digital assets, and the integration of these wallets into existing financial technology ecosystems. Furthermore, the market is witnessing a diversification of offerings, with wallets catering to specific user needs and preferences—from basic storage to advanced features like decentralized finance (DeFi) integration. The historical period (2019-2024) saw substantial growth, laying the foundation for the anticipated exponential expansion during the forecast period (2025-2033). This trend is further reinforced by the increasing regulatory clarity surrounding cryptocurrencies in certain jurisdictions, which fosters trust and encourages broader participation. Competition amongst existing players is intensifying, leading to innovations in security features, user experience, and functionalities. This competitive landscape drives market expansion and promotes the development of more robust and secure crypto software wallets. The market is also witnessing a convergence of traditional financial services with cryptocurrency technologies, further broadening the appeal and accessibility of crypto software wallets. This integration helps bridge the gap between traditional finance and the decentralized world of cryptocurrencies, ultimately accelerating market expansion.

Several key factors are propelling the growth of the crypto software wallet market. The rising adoption of cryptocurrencies globally is a primary driver. Millions of individuals and institutions are investing in crypto assets, creating a significant demand for secure storage solutions. The increasing sophistication of these wallets, incorporating features like multi-signature support, hardware integration, and robust security protocols, is also attracting users. Furthermore, the simplification of user interfaces and the development of mobile-friendly applications have made crypto software wallets more accessible to a broader audience. The growing integration of crypto wallets with decentralized finance (DeFi) platforms opens up new possibilities for users, facilitating participation in lending, borrowing, and other DeFi activities. The increasing number of merchants and businesses accepting cryptocurrency payments is also expanding the utility of crypto software wallets, fostering a more integrated and seamless user experience. Finally, the ongoing development and implementation of more secure and user-friendly solutions continue to stimulate market growth. The focus on user experience and enhancing security continues to drive higher adoption rates.

Despite the significant growth, the crypto software wallet market faces several challenges. Security breaches and hacking incidents remain a major concern, potentially leading to substantial financial losses for users. Regulatory uncertainty in various jurisdictions poses a significant hurdle, impacting the development and adoption of crypto software wallets. The complexity of cryptocurrency technology can deter potential users who lack the technical expertise to navigate the landscape effectively. Competition among numerous wallet providers leads to a fragmented market, making it difficult for users to choose a reliable and secure solution. The constant evolution of cryptocurrency technology requires wallets to adapt continuously to accommodate new features and protocols, presenting an ongoing challenge for developers. Scalability limitations can also affect the performance and usability of certain wallets, particularly during periods of high network congestion. Furthermore, the risk of losing access to funds due to forgotten passwords or compromised devices remains a significant concern for users. Addressing these challenges requires collaborative efforts from developers, regulators, and the broader cryptocurrency community to promote security, simplify usability, and foster trust.

The Personal segment is projected to dominate the crypto software wallet market. This is driven by the ever-increasing individual adoption of cryptocurrencies for investment, trading, and payments. Millions of users worldwide are managing their personal cryptocurrency holdings, leading to significant demand for user-friendly and secure software wallets.

The forecast indicates continued dominance of the personal segment, with a substantial increase in adoption across North America, Europe, and Asia. The cloud-based segment's growth is closely linked to improvements in security protocols and user trust. The millions of users in the personal segment will continue to be a major driver of growth in the overall market.

Several factors act as catalysts for the crypto software wallet industry's continued growth. The increasing mainstream adoption of cryptocurrencies, fuelled by rising media attention and technological advancements, is a key driver. The ongoing development of user-friendly interfaces and improved security features is further enhancing accessibility and trust. Integration with existing financial ecosystems and the expanding use of cryptocurrencies for payments and transactions are also driving market expansion. Finally, favorable regulatory developments in certain jurisdictions are creating a more conducive environment for the growth of the crypto software wallet industry.

This report offers a comprehensive analysis of the crypto software wallet market, providing invaluable insights into market trends, driving forces, challenges, and growth opportunities. It presents a detailed overview of key players, regional performance, and segment-specific growth projections, equipping stakeholders with the knowledge to make informed business decisions. The detailed forecasts, covering the historical, base, estimated, and forecast periods, offer a complete understanding of the market's dynamic evolution.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.3%.

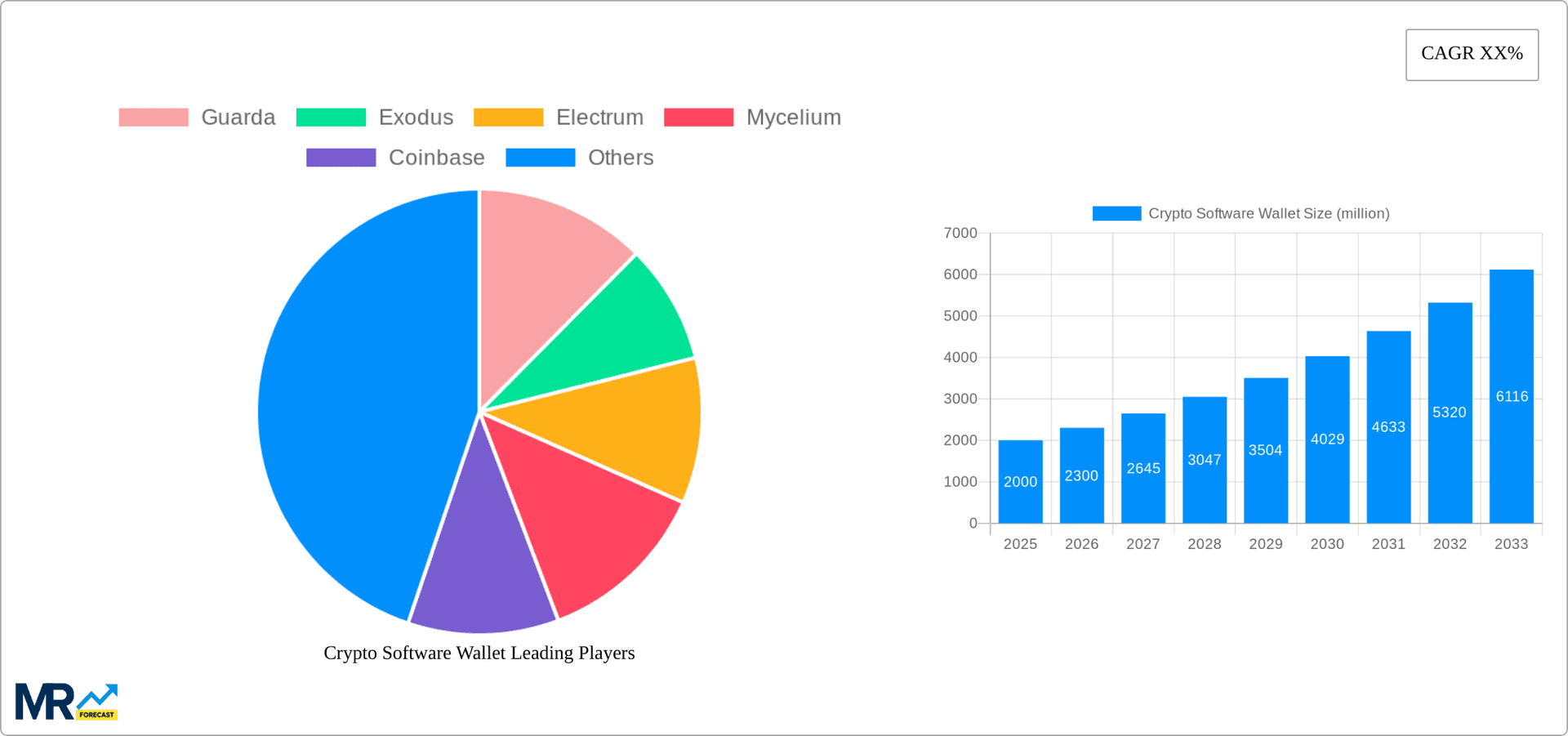

Key companies in the market include Guarda, Exodus, Electrum, Mycelium, Coinbase, Ledger, Arculus, CoolWallet, ELLIPAL, KeepKey, Keystone, Safepal, SecuX Technology, Trezor, .

The market segments include Type, Application.

The market size is estimated to be USD 11.61 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Crypto Software Wallet," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Crypto Software Wallet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.