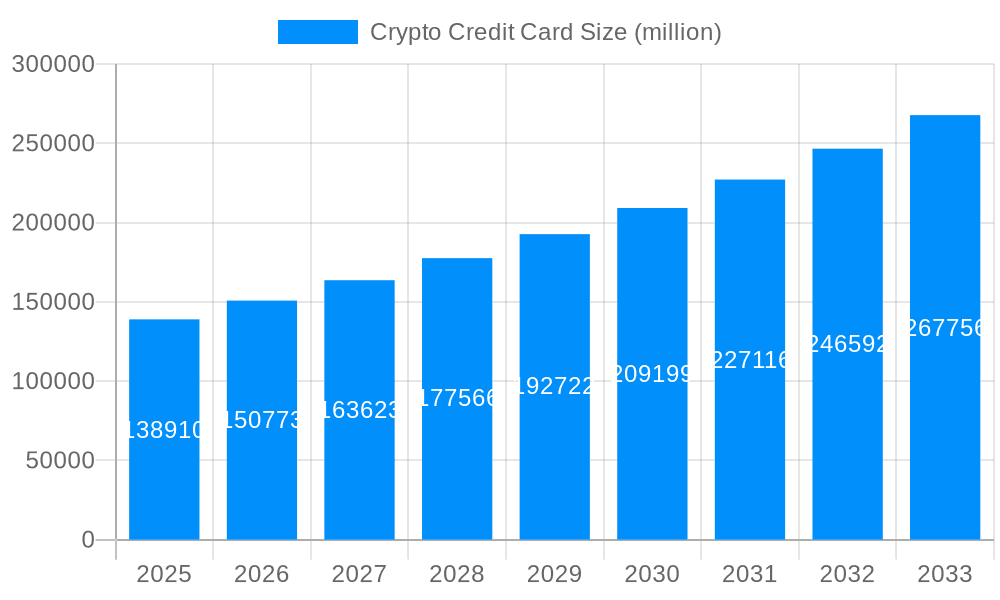

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crypto Credit Card?

The projected CAGR is approximately 8.4%.

Crypto Credit Card

Crypto Credit CardCrypto Credit Card by Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), by Application (BFSI, Personal Consumption, Business, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global crypto credit card market, currently valued at $138.91 billion (2025), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing cryptocurrency adoption among consumers and businesses is a primary factor, driven by the desire for greater financial freedom and reduced reliance on traditional banking systems. The convenience and ease of use offered by crypto credit cards, allowing users to seamlessly spend their digital assets, is another significant contributor. Furthermore, the innovative reward programs offered by many crypto credit card providers, including cashback in cryptocurrency or other attractive incentives, are proving highly appealing to a growing segment of the population. The market is segmented by card type (regular, rewards, others) and application (BFSI, personal consumption, business, others), reflecting diverse user needs and preferences. While regulatory uncertainty and potential volatility in cryptocurrency prices pose challenges, the overall market outlook remains positive, indicating substantial growth potential in the coming years.

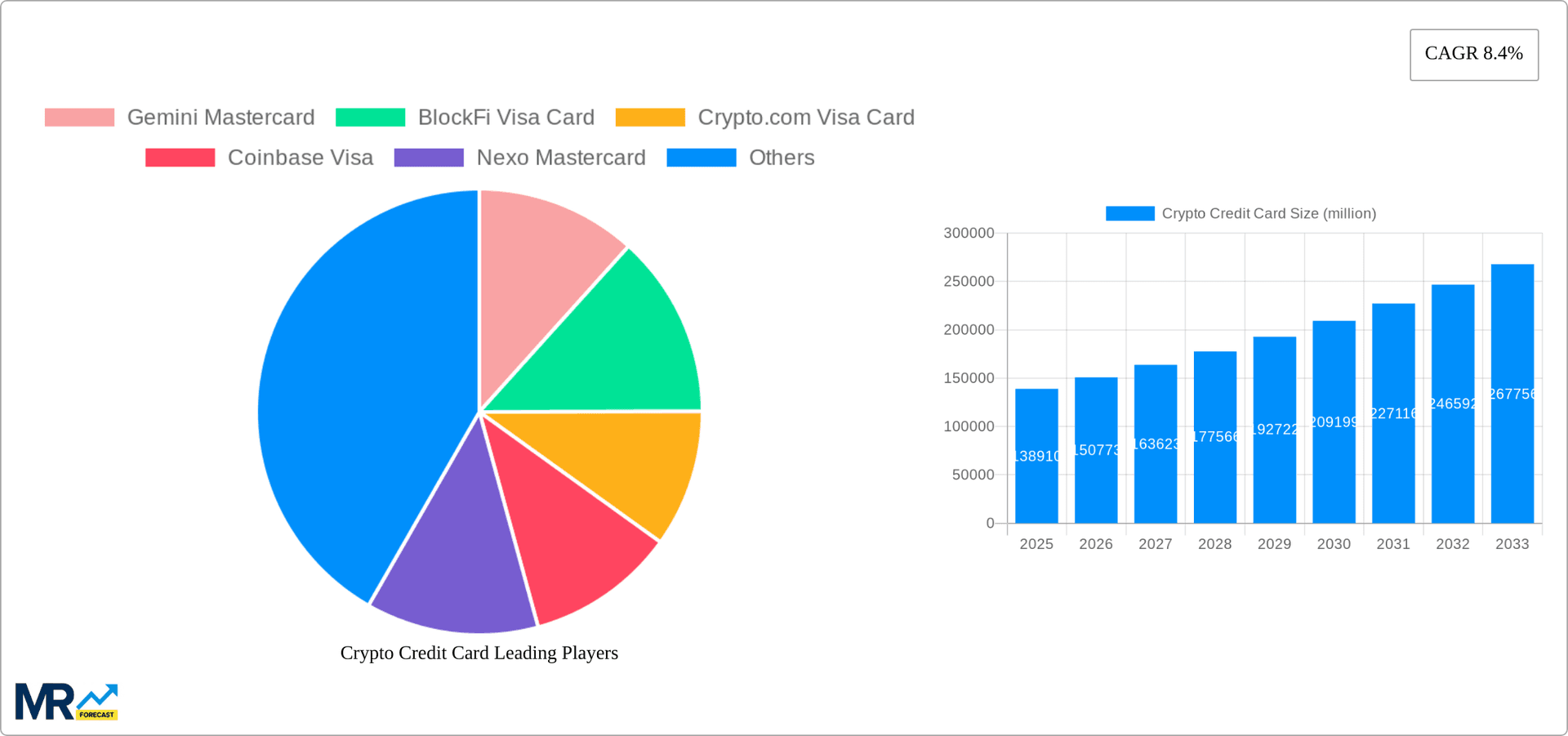

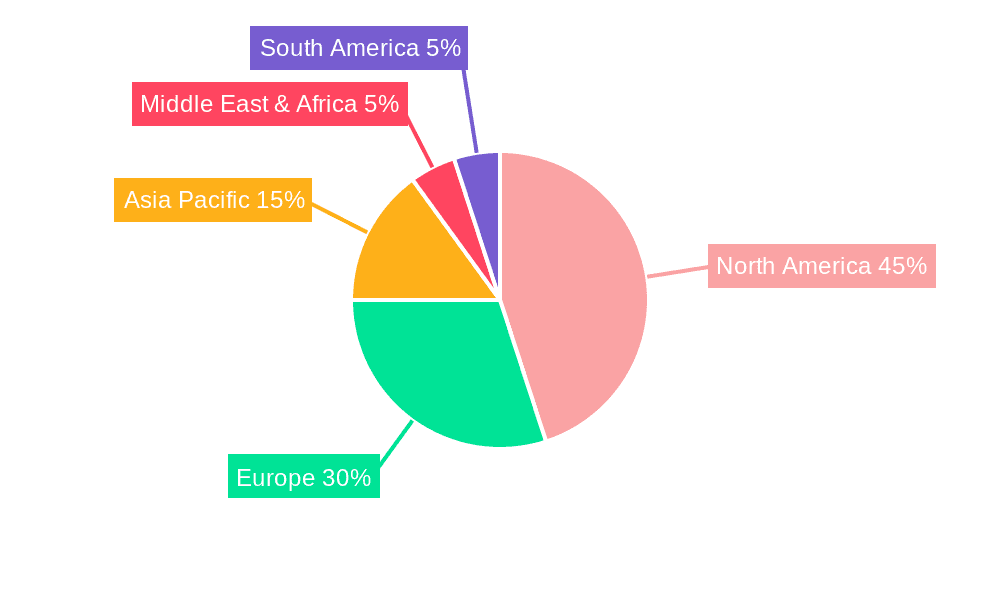

The market's geographical distribution reveals a strong concentration in North America and Europe, initially, which have witnessed higher levels of cryptocurrency adoption and technological infrastructure. However, regions like Asia-Pacific are anticipated to show substantial growth in the near future, driven by increased digital literacy and financial inclusion initiatives. The competitive landscape features a range of established players including Gemini, BlockFi, Crypto.com, Coinbase, and Nexo, each vying for market share through various strategies such as offering unique rewards programs, expanding partnerships, and enhancing user experience. The continuous development of blockchain technology and improvements in security measures will further contribute to the market’s expansion. The increasing integration of crypto credit cards with existing financial systems and the growing acceptance by merchants will drive mainstream adoption, shaping a promising future for this rapidly evolving sector.

The crypto credit card market, valued at XXX million in 2025, is experiencing explosive growth, projected to reach XXX million by 2033. This surge is fueled by increasing cryptocurrency adoption, advancements in blockchain technology, and the desire for seamless integration of digital assets into daily financial transactions. The historical period (2019-2024) saw a gradual increase in adoption, primarily driven by early adopters and tech-savvy individuals. However, the estimated year (2025) marks a significant inflection point, with mainstream awareness and regulatory clarity driving wider acceptance. The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of XXX%, propelled by innovative card features, attractive rewards programs, and expanding merchant acceptance. The market is segmented by card type (regular, rewards, others), application (BFSI, personal consumption, business, others), and geographical region. While initial adoption concentrated in developed economies, emerging markets are showing significant potential for future growth. The increasing number of partnerships between cryptocurrency platforms and traditional financial institutions is further accelerating market expansion. Competition among providers is intensifying, leading to innovation in features, rewards, and user experience. The integration of decentralized finance (DeFi) protocols with crypto credit cards is also emerging as a significant trend, potentially unlocking new functionalities and use cases. This report provides a comprehensive analysis of these trends, offering valuable insights for stakeholders in the crypto credit card ecosystem.

Several key factors are driving the rapid expansion of the crypto credit card market. Firstly, the growing mainstream adoption of cryptocurrencies is a fundamental driver. More individuals and businesses are embracing crypto as a legitimate form of payment and investment, increasing the demand for convenient spending options. Secondly, the development of user-friendly interfaces and mobile applications for managing crypto assets has simplified the process of obtaining and utilizing crypto credit cards. Thirdly, innovative rewards programs offered by many providers are proving incredibly attractive, offering cashback in crypto, staking rewards, or other incentives. These benefits often outweigh those offered by traditional credit cards. Furthermore, the increasing acceptance of crypto payments by merchants is critical. As more businesses begin accepting crypto payments, the utility and practical application of crypto credit cards significantly enhance. Finally, the ongoing technological advancements in blockchain and related technologies provide the foundation for enhanced security and efficiency in the crypto credit card ecosystem. This continuous innovation ensures the long-term viability and expansion of this rapidly evolving market segment.

Despite the significant growth potential, several challenges and restraints could hinder the widespread adoption of crypto credit cards. Volatility in cryptocurrency prices poses a major risk, as fluctuations can significantly impact the value of rewards and repayment amounts. Regulatory uncertainties surrounding cryptocurrencies in various jurisdictions remain a significant hurdle, potentially creating legal and compliance complexities for issuers and users. Security concerns, such as the risk of hacking and fraud, also remain a significant concern, requiring robust security measures to mitigate these threats. Furthermore, limited merchant acceptance in certain regions still restricts the practicality of using crypto credit cards for everyday transactions. The complexity associated with understanding and managing cryptocurrencies may deter less tech-savvy users from adopting this financial instrument. Finally, the lack of widespread consumer awareness and understanding of the benefits of crypto credit cards compared to traditional credit cards remains a challenge that needs to be addressed through education and marketing efforts.

The Personal Consumption segment is projected to dominate the crypto credit card market during the forecast period (2025-2033). This is primarily due to the increasing number of individual cryptocurrency holders seeking convenient and rewarding ways to spend their digital assets.

The Rewards Crypto Credit Cards segment within the Personal Consumption application is a key driver of growth. The attractive rewards offered, such as cashback in cryptocurrency, staking rewards, or other perks, are a major incentive for consumers. These rewards make crypto credit cards a compelling alternative to traditional credit cards, especially for those who already hold and actively use cryptocurrencies. The appeal to consumers who are aiming to grow their cryptocurrency holdings while simultaneously making everyday purchases is a substantial driving force. This creates a positive feedback loop, further incentivizing adoption and pushing the segment's market share upward.

The crypto credit card industry's growth is further accelerated by several key catalysts. Increased merchant acceptance of cryptocurrency payments expands the usability of crypto credit cards, boosting consumer demand. Simultaneously, ongoing technological advancements enhance security and efficiency, improving user experience and building consumer trust. Strategic partnerships between crypto platforms and traditional financial institutions streamline access to crypto credit cards and establish credibility. Finally, improved regulatory clarity reduces uncertainty and fosters a more favorable environment for industry development.

This report provides a comprehensive analysis of the crypto credit card market, covering key trends, driving forces, challenges, and growth opportunities. It offers valuable insights into market segmentation, key players, and significant developments. The report’s detailed forecasts and market projections provide a clear understanding of the future growth potential of this dynamic industry. It is an essential resource for businesses, investors, and other stakeholders interested in understanding and participating in the evolution of the crypto credit card market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.4%.

Key companies in the market include Gemini Mastercard, BlockFi Visa Card, Crypto.com Visa Card, Coinbase Visa, Nexo Mastercard, Club Swan Mastercard, Shakepay Visa, Wirex Visa, Bitpay Mastercard, SoFi Credit Card, .

The market segments include Type, Application.

The market size is estimated to be USD 138910 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Crypto Credit Card," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Crypto Credit Card, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.