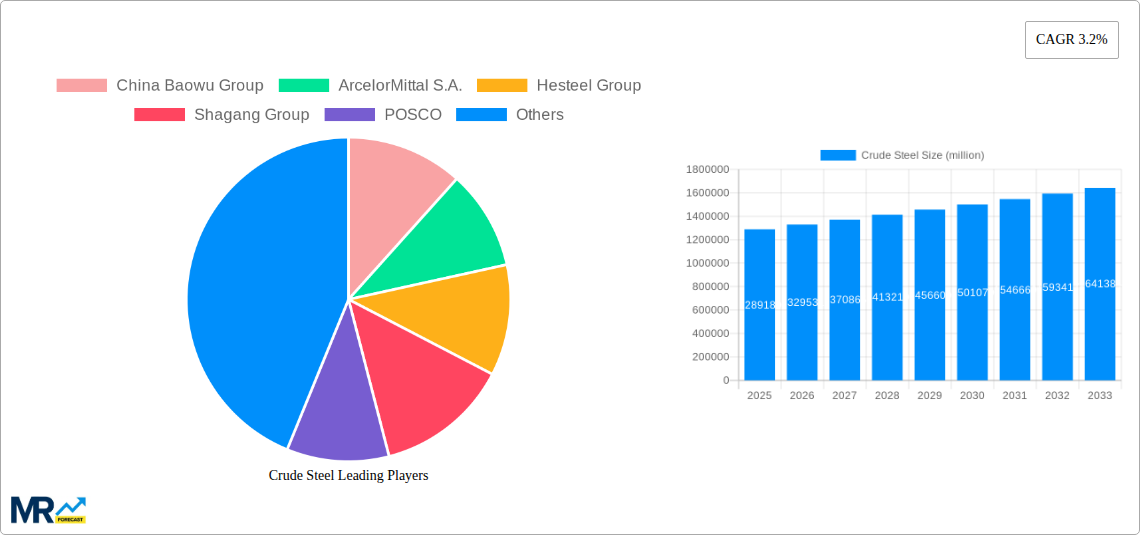

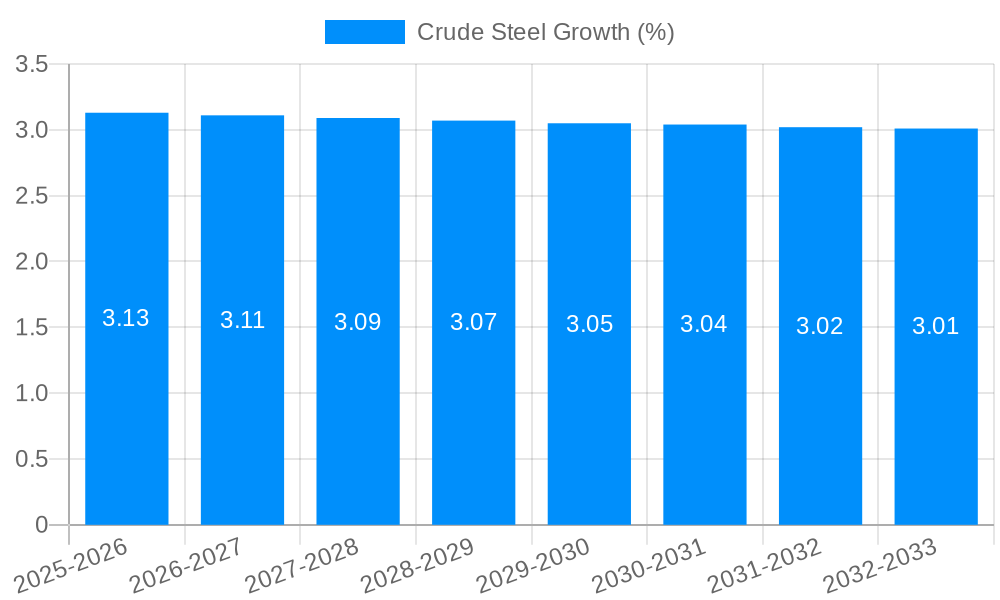

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crude Steel?

The projected CAGR is approximately 3.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Crude Steel

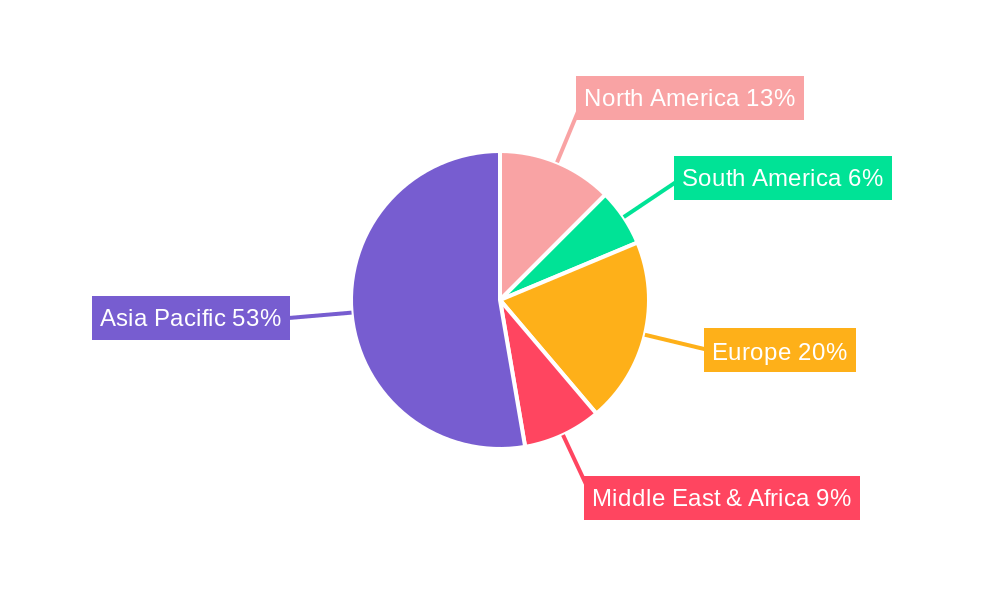

Crude SteelCrude Steel by Application (Construction, Automotive, Transportation, Energy, Packaging, Tools and Machinery, Consumer Appliances, Metal Product, Others), by Type (Fully Deoxidized Steel, Semi Deoxidized Steel, Not Deoxidized Steel), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global crude steel market is poised for steady growth, projected to reach a substantial USD 1289.18 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.2% through 2033. This robust expansion is primarily fueled by the insatiable demand from the construction sector, which continues to be the largest consumer of crude steel, driven by rapid urbanization and infrastructure development across emerging economies. The automotive and transportation industries also represent significant growth avenues, propelled by increasing vehicle production and the need for lighter, stronger materials in modern designs. Furthermore, the burgeoning renewable energy sector, particularly in solar and wind power, is contributing to market expansion through its requirement for steel in towers, foundations, and other structural components. Emerging economies in the Asia Pacific region, led by China and India, are at the forefront of this demand surge, supported by government initiatives promoting industrialization and infrastructure upgrades.

While the market benefits from strong demand drivers, it also navigates key trends that will shape its trajectory. The increasing adoption of advanced steelmaking technologies aimed at improving efficiency and reducing environmental impact is a notable trend. Innovations in producing higher-strength, lighter steel grades are catering to the evolving needs of the automotive and construction sectors. However, the market is not without its challenges. Fluctuations in raw material prices, particularly iron ore and coking coal, can impact profitability and influence pricing strategies. Stringent environmental regulations and the push towards decarbonization in the steel industry present both a challenge and an opportunity for investment in greener production methods. Geopolitical uncertainties and trade policies can also introduce volatility, affecting global supply chains and market access for key players. Nevertheless, the inherent versatility and essential nature of crude steel in numerous critical industries ensure its continued relevance and a positive growth outlook.

This report offers an in-depth analysis of the global crude steel market, providing critical insights and forecasts for the period spanning 2019 to 2033, with a specific focus on the base year 2025 and the forecast period of 2025-2033. The study meticulously examines historical trends from 2019-2024, delves into the present market dynamics of 2025, and projects future growth trajectories. The report encompasses a comprehensive understanding of crude steel production, consumption, and key drivers impacting the industry's evolution. It will provide valuable data and strategic analysis for stakeholders navigating this dynamic sector.

XXX The global crude steel market is a behemoth of industrial activity, consistently demonstrating resilience and adaptability amidst evolving economic landscapes. For the study period of 2019-2033, the market is projected to witness a steady, albeit nuanced, growth trajectory. The historical period of 2019-2024 saw significant fluctuations, influenced by global events such as the COVID-19 pandemic which initially disrupted supply chains and construction projects, followed by a robust recovery driven by infrastructure development and pent-up demand. As we approach the base and estimated year of 2025, the market is anticipated to stabilize, with production volumes expected to hover around significant figures. For instance, global crude steel production in 2025 is estimated to reach approximately 2,000 million tons.

The forecast period of 2025-2033 is expected to be characterized by a sustained upward trend, albeit at a more moderate pace than the immediate post-pandemic rebound. Factors such as increasing urbanization in developing economies, continued investment in renewable energy infrastructure, and the persistent demand from the automotive sector will underpin this growth. The increasing adoption of advanced manufacturing techniques and a growing emphasis on sustainable steel production are also emerging as significant trends that will shape the industry. Moreover, the market will continue to be influenced by geopolitical developments, trade policies, and the fluctuating costs of raw materials like iron ore and coking coal. Understanding these intricate dynamics is crucial for forecasting market size, which is projected to reach 2,250 million tons by 2033. The report will further segment this growth across various applications and steel types, offering granular insights into specific market niches and their future potential. The interplay between these macroscopic trends and microscopic segment-specific movements will define the overall health and direction of the crude steel industry in the coming decade.

The crude steel industry's sustained momentum is propelled by a confluence of powerful economic and developmental forces. Foremost among these is the unyielding demand from the Construction sector, which remains the largest consumer of steel globally. Ongoing urbanization, particularly in emerging economies, necessitates continuous infrastructure development, including residential buildings, commercial complexes, transportation networks, and public amenities. This translates into a constant and substantial requirement for steel as a fundamental building material. Furthermore, the global push towards green energy is a significant catalyst. The expansion of renewable energy sources such as wind farms and solar power plants, as well as the modernization of electricity grids, all rely heavily on steel for their construction and support structures. This sector is expected to contribute a significant portion to the projected market growth.

The Automotive industry, despite shifts towards electric vehicles, continues to be a major driver, with steel remaining a crucial component for vehicle bodies, chassis, and various internal parts. The growing global vehicle fleet, especially in developing nations, ensures consistent demand. Additionally, advancements in steel alloys and manufacturing processes are enabling lighter, stronger, and more fuel-efficient vehicles, further solidifying steel's position. The Transportation sector, beyond individual vehicles, encompasses the development and maintenance of railways, bridges, and shipping infrastructure, all of which are steel-intensive. Investments in high-speed rail networks, port expansions, and logistical upgrades worldwide directly translate into increased crude steel consumption. Finally, technological innovations and the development of new steel grades with enhanced properties are opening up novel applications in industries like Tools and Machinery and Consumer Appliances, indirectly fueling demand and driving market expansion.

Despite the robust demand drivers, the crude steel market is not without its significant hurdles and restraining factors. A primary challenge revolves around environmental regulations and sustainability concerns. The steel industry is a major contributor to greenhouse gas emissions, and increasing pressure from governments and consumers to decarbonize production processes is leading to higher operational costs associated with adopting cleaner technologies. The transition to more sustainable steelmaking, such as the adoption of hydrogen-based direct reduced iron (DRI) or electric arc furnaces powered by renewable energy, requires substantial capital investment, which can strain profitability, particularly for smaller players. Fluctuations in the price and availability of key raw materials, namely iron ore and coking coal, present another significant restraint. These commodities are subject to geopolitical instability, supply chain disruptions, and speculative trading, leading to price volatility that directly impacts production costs and profit margins for steel manufacturers.

Furthermore, global trade tensions and protectionist policies can disrupt established supply chains and create market uncertainty. Tariffs and trade barriers can hinder the free flow of steel products, impacting export-oriented producers and leading to regional market imbalances. The intensifying competition within the global market, particularly from emerging players with lower production costs, also exerts pressure on established manufacturers to optimize their operations and pricing strategies. Overcapacity in certain regions can lead to price wars, diminishing profitability across the board. Lastly, technological obsolescence and the need for continuous investment in modernization pose a challenge. Companies must consistently invest in upgrading their facilities and adopting new technologies to remain competitive, which requires substantial financial resources and strategic foresight, potentially limiting growth for those unable to adapt.

The global crude steel market's dominance is intricately linked to specific regions and crucial application segments, both of which are projected to exhibit significant influence throughout the study period (2019-2033).

Key Dominant Regions/Countries:

Asia-Pacific, particularly China: This region is unequivocally the powerhouse of the global crude steel market.

North America (United States): While not on the same scale as Asia, North America, led by the United States, remains a significant market.

Key Dominant Segments:

Application: Construction: This segment is the undisputed leader in crude steel consumption and is projected to maintain its supremacy.

Type: Fully Deoxidized Steel: While overall crude steel production is vast, certain types of steel cater to specific, high-demand applications.

The interplay between the dominant production hubs in Asia-Pacific and the unwavering demand from the construction sector, complemented by the specialized needs of industries utilizing fully deoxidized steel, forms the bedrock of the crude steel market's current and future landscape.

Several key growth catalysts are expected to propel the crude steel industry forward. The ongoing global push for infrastructure development, particularly in emerging economies, will continue to be a primary driver. Investments in transportation networks, energy grids, and urban expansion require vast quantities of steel. Furthermore, the global transition towards renewable energy sources, such as wind and solar power, necessitates significant steel for the construction of turbines and solar panel structures. The automotive sector, despite evolving technologies, continues to rely on steel for vehicle manufacturing, with a growing emphasis on high-strength, lightweight steel alloys. Lastly, technological advancements in steel production, leading to improved efficiency, reduced environmental impact, and the development of new steel grades with enhanced properties, will unlock new applications and further stimulate demand.

This report provides a holistic examination of the crude steel market, offering a comprehensive overview of its current state and future trajectory. It meticulously analyzes the interplay of production capacities, consumption patterns, and the evolving demands of key end-use industries. The report delves into the critical factors that are shaping the market, including technological advancements, environmental regulations, and geopolitical influences. By presenting a detailed forecast from 2025 to 2033, supported by historical data from 2019-2024 and a focused analysis on the base year 2025, it equips stakeholders with the necessary insights for strategic decision-making. The report's comprehensive nature ensures that all facets of the crude steel industry are addressed, from raw material sourcing to the diverse applications of finished steel products, offering a truly invaluable resource for industry professionals.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.2%.

Key companies in the market include China Baowu Group, ArcelorMittal S.A., Hesteel Group, Shagang Group, POSCO, Nippon Steel, Ansteel Group, Jianlong Heavy Industry Group, Shougang Group, Shandong Steel Group, Delong Steel Group, Tata Steel, Valin Group, JFE Group, Nucor Corporation, Hyundai Steel, Fangda Steel, IMIDRO, Benxi Steel, Liuzhou Steel, Jingye Steel, Novolipetsk Steel, Baotou Iron & Steel, SAIL, JSW Steel, Rizhao Steel, Sinogiant Group, China Steel Corporation, CITIC Pacific, EVRAZ, .

The market segments include Application, Type.

The market size is estimated to be USD 1289180 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Crude Steel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Crude Steel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.