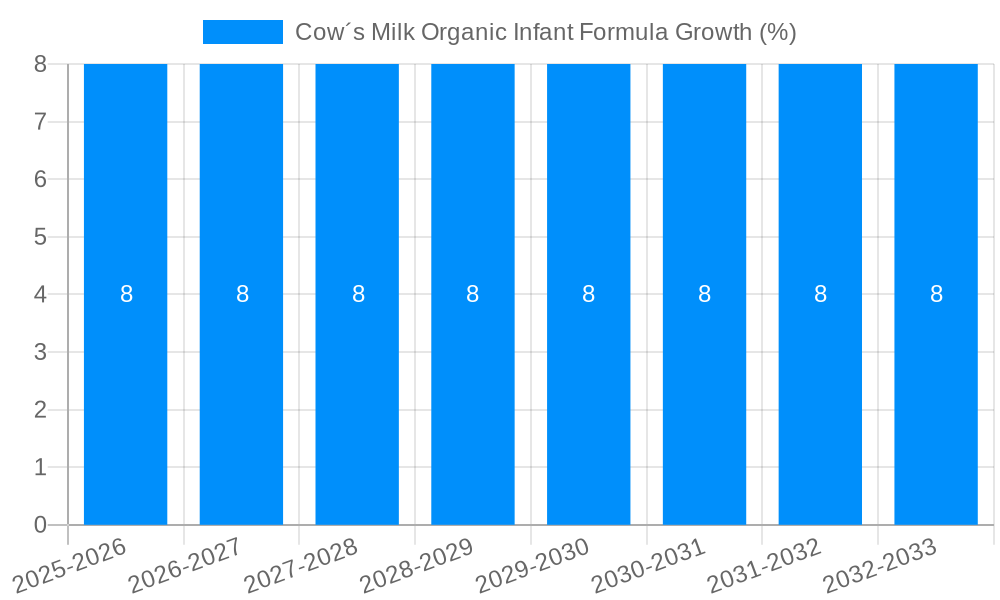

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cow´s Milk Organic Infant Formula?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cow´s Milk Organic Infant Formula

Cow´s Milk Organic Infant FormulaCow´s Milk Organic Infant Formula by Type (Wet Process Type, Dry Process Type, Others, World Cow´s Milk Organic Infant Formula Production ), by Application (First Stage, Second Stage, Third Stage, World Cow´s Milk Organic Infant Formula Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

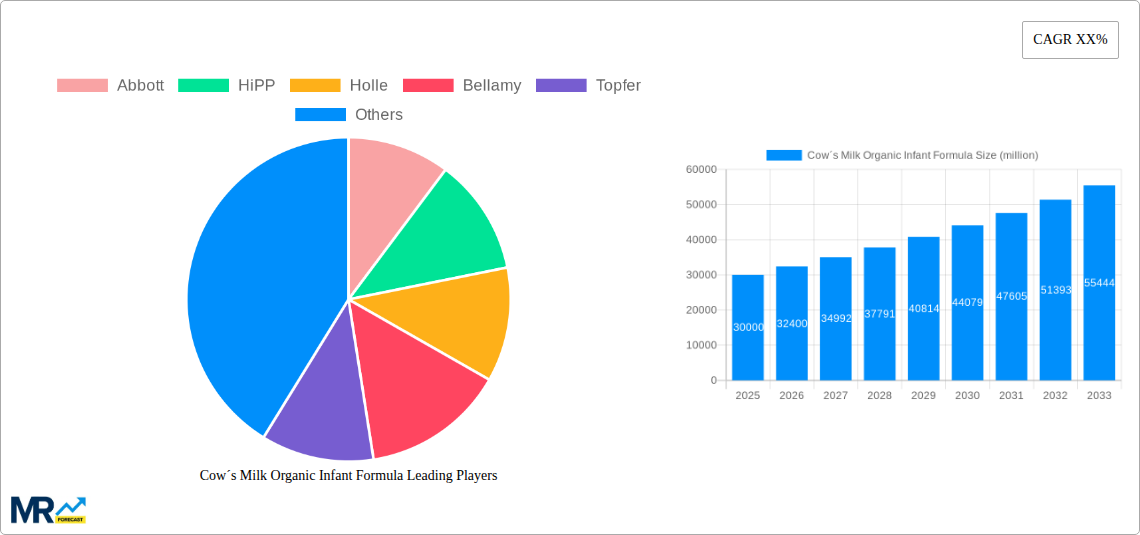

The global Cow's Milk Organic Infant Formula market is poised for substantial growth, driven by increasing parental awareness of health benefits and a rising demand for organic products. With an estimated market size of approximately $30,000 million in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of around 8% through 2033. This upward trajectory is significantly fueled by a growing number of health-conscious parents actively seeking alternatives to conventional infant nutrition, prioritizing formulations free from artificial additives, pesticides, and GMOs. Key market drivers include the perceived higher nutritional value and safety of organic ingredients, coupled with a global increase in birth rates and a corresponding rise in disposable incomes, particularly in emerging economies. The market is segmented into Wet Process Type and Dry Process Type, with Dry Process Type dominating due to its longer shelf life and ease of transport. Applications span First Stage, Second Stage, and Third Stage formulas, catering to the evolving nutritional needs of infants at different developmental phases.

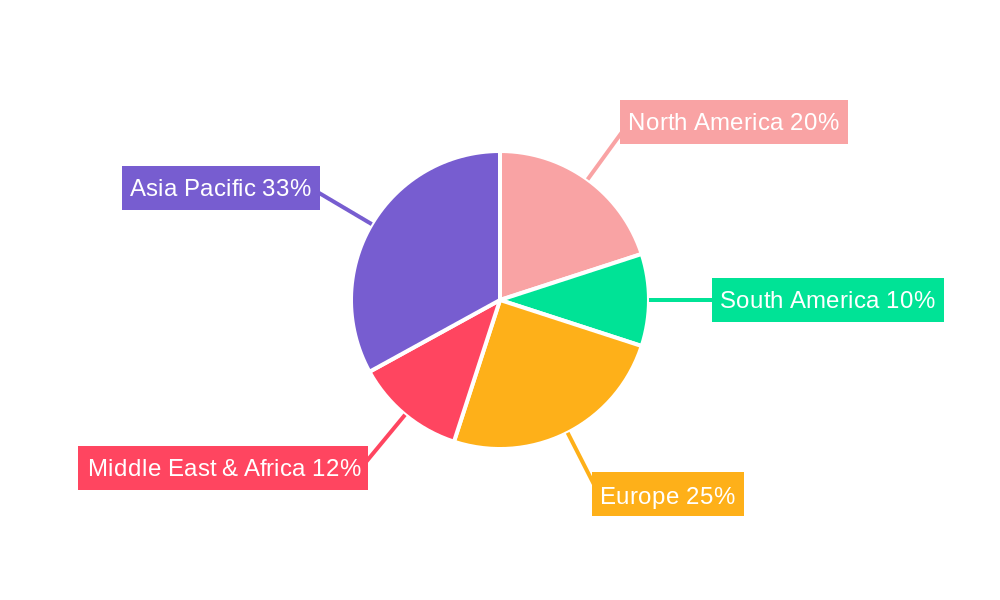

The competitive landscape features a mix of established global giants like Nestle and Wyeth, alongside specialized organic brands such as HiPP, Holle, and Bellamy. These companies are actively investing in research and development to innovate product formulations, focusing on ingredient sourcing, bioavailability, and meeting specific dietary requirements. Emerging trends include the incorporation of prebiotics, probiotics, and DHA/ARA for enhanced cognitive and digestive development, as well as a focus on sustainable packaging and transparent supply chains. However, the market faces restraints such as the higher cost of organic raw materials, stringent regulatory requirements for infant formula production, and intense competition. Geographically, Asia Pacific, particularly China, is expected to be a major growth engine due to its vast population and rapidly expanding middle class. Europe and North America remain significant markets, characterized by high consumer demand for premium organic products.

Here is a unique report description on Cow's Milk Organic Infant Formula, incorporating your specified elements:

The global Cow's Milk Organic Infant Formula market is poised for significant expansion, projected to reach an estimated $35,200 million by the end of the Base Year 2025. This robust growth trajectory, spanning a Study Period of 2019-2033, is underpinned by a confluence of evolving consumer preferences, heightened awareness regarding infant health and nutrition, and advancements in production technologies. During the Historical Period (2019-2024), the market experienced a steady climb, laying a strong foundation for the anticipated surge. Key market insights reveal a pronounced shift towards premiumization, with parents increasingly prioritizing organic certifications and the perceived nutritional superiority of cow's milk-based formulas. This trend is further amplified by growing disposable incomes in emerging economies, enabling a wider segment of the population to opt for higher-quality infant nutrition. Innovations in formulation, focusing on the inclusion of prebiotics, probiotics, and DHA/ARA, are also contributing to market dynamism, addressing specific developmental needs of infants. The increasing prevalence of lactose intolerance and cow's milk protein allergy, while posing some challenges, simultaneously fuels innovation in hypoallergenic variants and specialized organic formulations. The market is witnessing a growing demand for formulas tailored to different developmental stages, from First Stage to Third Stage applications, reflecting a nuanced understanding of infant nutritional requirements. Furthermore, the increasing penetration of e-commerce platforms has democratized access to a wider array of organic infant formula brands, fostering competition and driving market accessibility. The overall sentiment suggests a market characterized by sustained demand driven by health consciousness and a willingness to invest in premium infant nutrition solutions.

The relentless ascent of the Cow's Milk Organic Infant Formula market is propelled by several interconnected driving forces. Foremost among these is the escalating global parental consciousness surrounding infant health and wellness. Parents are increasingly scrutinizing ingredient lists, actively seeking out products that are free from synthetic pesticides, GMOs, and artificial additives, thereby embracing organic certifications as a benchmark of quality and safety. This heightened awareness is particularly pronounced in developed nations but is rapidly gaining traction in developing regions. Furthermore, advancements in scientific research related to infant nutrition have underscored the benefits of specific ingredients commonly found in cow's milk-based formulas, such as essential fatty acids like DHA and ARA, and nucleotides, which are crucial for cognitive and visual development. This scientific backing lends credibility and fuels parental confidence in these products. The increasing global birth rate, coupled with a growing trend of delayed first-time parenthood, means that a significant portion of the population is in their prime childbearing years and often has greater financial stability and a willingness to invest in what they perceive as the best for their newborns. Economic growth in various regions also plays a pivotal role, expanding the middle class and consequently increasing purchasing power for premium infant nutrition products like organic formulas. Finally, the robust marketing efforts and distribution networks established by leading manufacturers are effectively communicating the benefits of organic infant nutrition, further stimulating demand and expanding market reach.

Despite its promising growth trajectory, the Cow's Milk Organic Infant Formula market is not without its inherent challenges and restraints. A significant hurdle is the higher price point of organic infant formula compared to conventional alternatives. This cost factor can limit accessibility for a substantial segment of the global population, particularly in price-sensitive markets or for lower-income households, thereby acting as a considerable restraint on market penetration. The complex regulatory landscape surrounding infant formula, especially for organic certifications, can also pose challenges for manufacturers. Stringent testing, sourcing requirements, and differing standards across various countries can increase production costs and complicate market entry strategies. Moreover, the growing concern and prevalence of cow's milk protein allergy (CMPA) and lactose intolerance among infants necessitates the development of specialized, hypoallergenic, or lactose-free organic formulas. While this also presents an opportunity for innovation, it adds complexity to product development and can bifurcate the market. The supply chain volatility for organic raw materials, including organic milk, can also impact production and pricing. Factors such as adverse weather conditions, farming practices, and global demand can influence the availability and cost of these essential ingredients, potentially leading to supply disruptions or increased costs. Lastly, consumer skepticism or misinformation regarding the actual benefits of organic versus conventional formulas, or confusion about different organic certification standards, can sometimes create barriers to adoption or lead to brand loyalty challenges.

The global Cow's Milk Organic Infant Formula market is characterized by a dynamic interplay between regional demand and segment preferences, with certain areas and product categories exhibiting a pronounced dominance. The North America region, encompassing the United States and Canada, is a significant powerhouse in this market. This dominance stems from a combination of factors, including a well-established consumer base with high disposable incomes, a strong emphasis on health and wellness, and a mature regulatory framework that supports organic certifications. Parents in this region are generally well-informed about nutritional science and actively seek out premium products for their infants. The Europe region also represents a substantial market share, driven by a long-standing tradition of valuing organic products and stringent food safety standards across countries like Germany, France, and the United Kingdom. The awareness and acceptance of organic infant nutrition are deeply ingrained in the consumer culture.

Analyzing the segments, the Dry Process Type is projected to maintain its dominance in global Cow's Milk Organic Infant Formula Production. This preference is largely attributed to its longer shelf life, ease of transportation, and cost-effectiveness in manufacturing and packaging compared to wet processed formulas. The convenience factor for consumers, allowing for easy preparation by simply adding water, further solidifies the market position of dry infant formula.

Within the Application segment, the First Stage formulas, designed for newborns from birth to six months, are expected to lead the market. This is due to the critical developmental phase of infants during this period, where nutrition plays a paramount role in establishing a healthy foundation. Parents are particularly vigilant and willing to invest in high-quality, organic options for their newborns. The increasing global birth rates contribute to the sustained demand for first-stage formulas.

Furthermore, the World Cow´s Milk Organic Infant Formula Production is increasingly influenced by emerging economies in Asia-Pacific, particularly China. While historically a market dominated by domestic brands, the growing purchasing power of the Chinese middle class, coupled with a strong desire for safe and premium infant products, especially following past food safety concerns, has propelled the demand for imported and organic international brands. This region, along with other developing Asian countries and parts of Latin America, is anticipated to witness the highest compound annual growth rates (CAGR) in the forecast period. The increasing adoption of organic lifestyles and the rising awareness of the benefits of organic infant nutrition in these regions are key drivers behind this growth.

The Cow's Milk Organic Infant Formula industry is being propelled by several key growth catalysts. The rising global birth rates, particularly in emerging economies, directly translate to a larger consumer base for infant nutrition products. Coupled with increasing disposable incomes, this demographic trend creates a fertile ground for market expansion. Furthermore, the escalating consumer awareness and preference for organic and natural products are paramount. Parents are increasingly associating organic certifications with safety, quality, and superior nutritional value for their infants. This conscious choice fuels demand for premium offerings. Advancements in R&D, leading to the development of enhanced formulations with beneficial ingredients like prebiotics, probiotics, and specific fatty acids, also act as significant growth catalysts, addressing evolving parental concerns and infant health needs.

This comprehensive report offers an in-depth analysis of the global Cow's Milk Organic Infant Formula market, meticulously examining trends, driving forces, challenges, and growth catalysts. Covering a Study Period of 2019-2033 with a Base Year of 2025, it provides valuable insights into market dynamics and future projections. The report delves into the dominance of specific regions like North America and Europe, as well as key segments such as Dry Process Type and First Stage applications, underscoring their market leadership. It further highlights the significant impact of emerging economies in Asia-Pacific, particularly China, on global production. The report includes a detailed examination of industry developments and a comprehensive list of leading players, offering a holistic view of the competitive landscape. This detailed coverage equips stakeholders with the necessary intelligence to navigate and capitalize on opportunities within this burgeoning market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Abbott, HiPP, Holle, Bellamy, Topfer, The Hain Celestial Group, Nature One, Perrigo, Babybio, Gittis, Humana, Bimbosan, Ausnutria, Nutribio, HealthyTimes, Arla, Yeeper, Wyeth, Kendamil, Nestle, Feihe, JUNLEBAO, YILI, BIOSTIME, Biobim.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cow´s Milk Organic Infant Formula," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cow´s Milk Organic Infant Formula, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.