1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Diagnostic Kits?

The projected CAGR is approximately XX%.

COVID-19 Diagnostic Kits

COVID-19 Diagnostic KitsCOVID-19 Diagnostic Kits by Type (Molecular Detection, Antigen Detection, Antibody Detection, World COVID-19 Diagnostic Kits Production ), by Application (Hospital, Laboratory, Home, World COVID-19 Diagnostic Kits Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

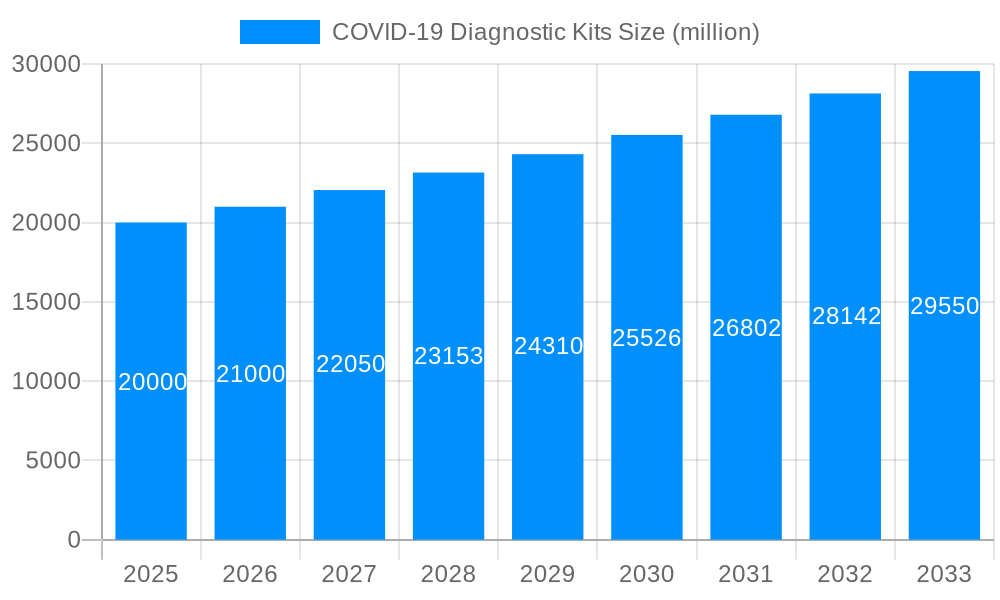

The COVID-19 pandemic spurred unprecedented growth in the diagnostic kits market, creating a multi-billion dollar industry. While the initial surge in demand has subsided, the market continues to evolve, driven by ongoing surveillance, variant tracking, and the need for rapid, accurate testing. The market, estimated at $15 billion in 2025, is projected to experience a compound annual growth rate (CAGR) of 5% through 2033, reaching an estimated $23 billion. This sustained growth is fueled by several factors. The increasing prevalence of infectious diseases beyond COVID-19 necessitates robust diagnostic capabilities, driving demand for technologically advanced kits. Furthermore, advancements in molecular detection, antigen detection, and antibody detection technologies, resulting in improved accuracy, speed, and ease of use, are contributing to market expansion. The diverse application segments, encompassing hospitals, laboratories, and increasingly, home testing, further fuel market diversification and growth. While some market restraint could arise from pricing pressures and the entry of numerous players, the continued need for pandemic preparedness and the emergence of new infectious diseases ensures a relatively stable and growing market outlook.

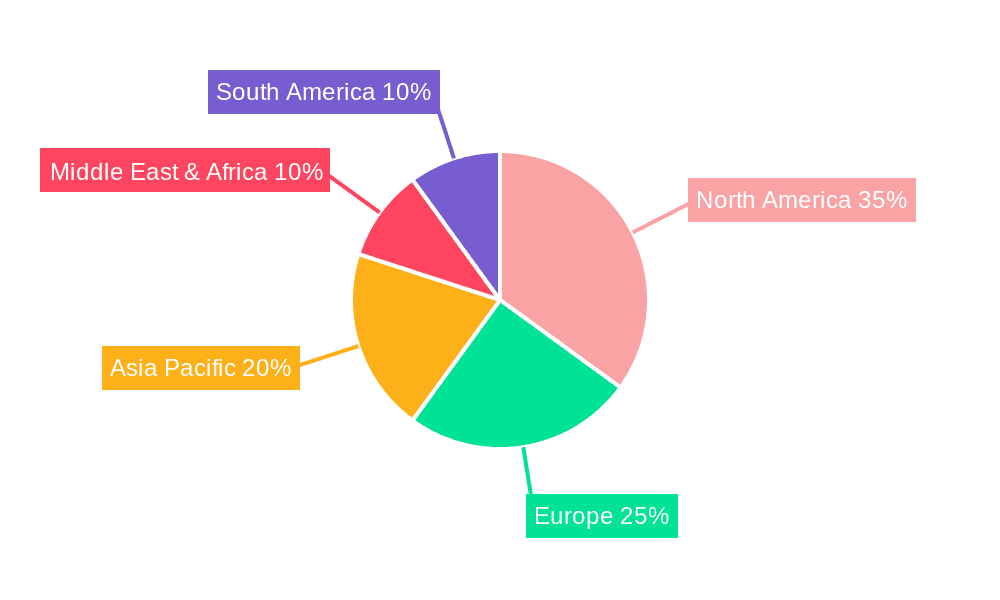

Key players like Abbott, Roche, and Quidel, alongside numerous smaller companies, are actively involved in innovation and competition within this space. Geographical market segmentation reveals North America and Europe as leading regions, reflecting higher healthcare spending and technological adoption rates. However, Asia-Pacific is expected to show significant growth due to rising healthcare infrastructure development and increasing awareness of infectious disease prevention. The shift towards point-of-care testing and the development of user-friendly home diagnostic kits are significant trends reshaping the competitive landscape. This implies a move away from centralized testing facilities to decentralized solutions for quicker results and improved accessibility, especially in remote areas or resource-limited settings. Maintaining consistent regulatory compliance and ensuring accurate testing remain critical for continued market success.

The COVID-19 pandemic triggered an unprecedented surge in demand for diagnostic kits, propelling the market to a value exceeding tens of billions of dollars within the first two years. The global production of COVID-19 diagnostic kits skyrocketed, reaching several hundred million units annually at its peak. This explosive growth was driven by the urgent need for rapid and accurate testing to contain the virus's spread. The market initially saw a dominance of molecular diagnostic tests (PCR), offering high accuracy but with limitations in speed and accessibility. Antigen rapid tests emerged as a vital complement, providing quicker results though with slightly lower sensitivity. Antibody tests played a crucial role in understanding the spread of infection and immunity levels within populations. However, as the pandemic evolved and vaccination programs progressed, demand shifted. While the overall market size has contracted from its peak, significant residual demand persists, particularly for variants of concern monitoring, surveillance programs, and ongoing needs within healthcare settings. The market is now consolidating, with a focus on improved test accuracy, reduced costs, and integrated solutions combining multiple testing modalities. This evolution reflects a transition from emergency response to a more sustainable approach incorporating COVID-19 testing into routine healthcare practices, anticipating future outbreaks and evolving healthcare needs. The long-term forecast projects a multi-million unit annual market, driven by ongoing surveillance and preparedness for future pandemics. This substantial annual production volume, even in a post-pandemic context, showcases the lasting significance of the COVID-19 diagnostic kits market. Furthermore, the technological advancements spurred by the pandemic's initial demand continue to shape the industry, resulting in more sophisticated, user-friendly, and cost-effective testing options. This has led to the increased adoption of home testing kits, a segment expected to show continued growth, driven by public preference for convenient and readily accessible testing options.

The remarkable growth in the COVID-19 diagnostic kits market is primarily fueled by the global pandemic's persistent threat. The imperative to rapidly identify infected individuals to contain the spread of the virus was the initial primary driver. Government initiatives worldwide, including large-scale testing programs and public health initiatives, significantly boosted demand. The development of various testing modalities, including rapid antigen tests and molecular tests, catered to diverse needs and settings, further fueling market expansion. The continuous emergence of new variants necessitates ongoing surveillance and testing, sustaining market demand even as overall infection rates decline. Furthermore, the development of point-of-care testing (POCT) devices has broadened accessibility, enabling faster diagnosis in diverse settings, including hospitals, clinics, and even homes. The increased awareness of the importance of early diagnosis and preventative measures among individuals has created a robust market for at-home testing kits. Finally, continuous research and development efforts focused on improving test sensitivity, specificity, and cost-effectiveness further contribute to the market's sustained growth trajectory, alongside the ongoing need for pandemic preparedness and the potential for future outbreaks.

Despite the significant growth, the COVID-19 diagnostic kits market faces several challenges. Fluctuations in demand due to changing infection rates pose a risk to manufacturers, impacting production planning and resource allocation. Regulatory hurdles and variations in approval processes across different regions can impede market penetration and create complexities for manufacturers navigating global markets. The need for continuous technological advancements and adaptation to new viral variants represent significant ongoing costs and resource demands. Competition is fierce, with numerous players vying for market share, pressuring profit margins and demanding aggressive innovation. Maintaining supply chain stability remains a concern, especially given the complex logistics involved in producing and distributing testing kits globally. Finally, ensuring equitable access to testing, particularly in low-resource settings, presents a significant societal and ethical challenge. The need to balance cost-effectiveness with accuracy and reliability remains a continuous challenge in test development and market competitiveness. Addressing these challenges is essential to fostering a sustainable and ethically responsible COVID-19 diagnostic kits market.

The North American and European markets have historically been dominant, driven by high healthcare expenditure, robust healthcare infrastructure, and early adoption of advanced diagnostic technologies. However, the Asia-Pacific region, particularly China and India, showed significant growth during the pandemic, largely due to their vast populations.

By Type: Molecular detection (PCR) tests initially dominated due to their high accuracy, but antigen tests gained significant traction due to their speed and ease of use. The market is now showing a blend of both types, with a gradual shift towards more sophisticated and affordable molecular tests. Antibody tests, though initially crucial in epidemiological studies, experienced a decrease in demand following widespread vaccination.

By Application: The hospital and laboratory settings remain dominant due to the need for accurate and reliable results in clinical settings. However, the significant increase in home testing kits adoption represents a considerable and growing market segment, driven by the convenience and accessibility.

In summary: While North America and Europe retain a significant market share based on established healthcare infrastructure and higher purchasing power, the Asia-Pacific region's substantial growth showcases a shifting global landscape in COVID-19 testing. The dominance of the segment continues to evolve from PCR-based molecular tests to a balanced approach incorporating rapid antigen tests and the growing segment of convenient and accessible home-based testing solutions. The future may lean towards point-of-care testing, which offers convenience and faster results.

Several factors are poised to fuel continued growth in the COVID-19 diagnostic kits market. Advancements in technology will lead to more accurate, affordable, and faster tests. The increasing prevalence of chronic diseases and the growing elderly population will drive increased demand for regular health checks, incorporating rapid diagnostic tests. Government investments in public health infrastructure and initiatives promoting proactive health monitoring will also stimulate growth. The development of multiplexed tests capable of detecting various pathogens simultaneously will represent an important technological advancement and increase market efficiency. Finally, increasing awareness among consumers about the importance of early diagnosis and self-testing further reinforces the market's upward trajectory.

This report offers a comprehensive overview of the COVID-19 diagnostic kits market, detailing trends, drivers, challenges, and key players. The market analysis includes detailed segmentations by type, application, and region, projecting the market's growth trajectory through 2033. The report provides valuable insights for stakeholders, including manufacturers, investors, and healthcare professionals, offering strategic guidance within this dynamic and constantly evolving market landscape. The report includes a substantial number of units in the millions and showcases a clear understanding of the market’s shifts and transformations.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Abbott, Access Bio, ACON Laboratories, Alveo Technologies, Applied BioCode, ARISTA Biotech, BD, Biocartis, BioFire Diagnostics, BioMedomics, Cepheid, Co-Diagnostics, Cue Health, Diasorin, Ellume, Grifols, Hologic, Andon Health, Lepu Medical, Lucira Health, Orient Gene, Quidel, Roche, Shenzhen YHLO Biotech, Guangzhou Wondfo Biotech.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "COVID-19 Diagnostic Kits," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the COVID-19 Diagnostic Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.