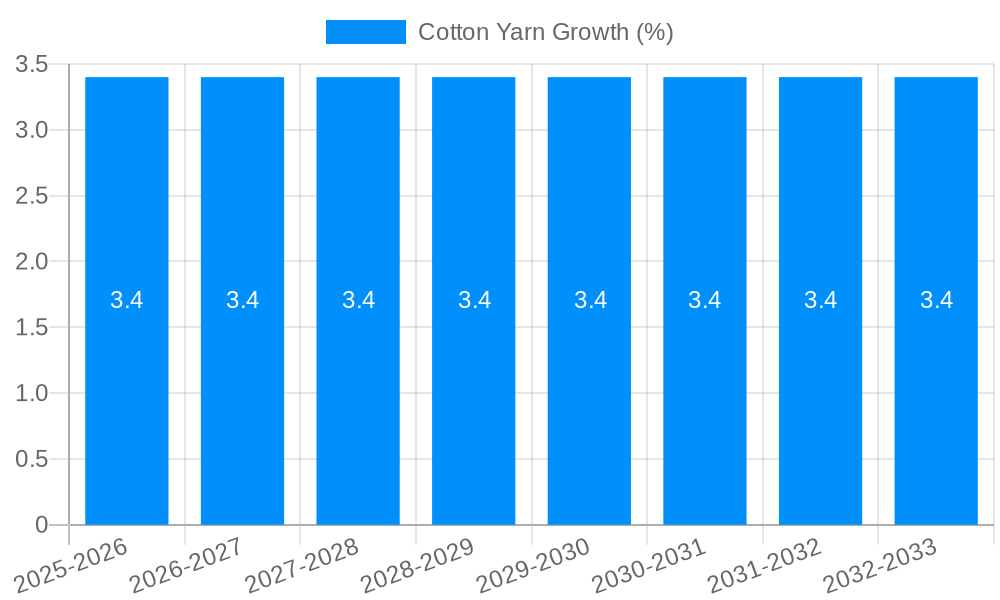

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cotton Yarn?

The projected CAGR is approximately 3.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cotton Yarn

Cotton YarnCotton Yarn by Type (Carded Yarn, Combed Yarn, Others), by Application (Apparel, Home Textiles, Industrial Textiles, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

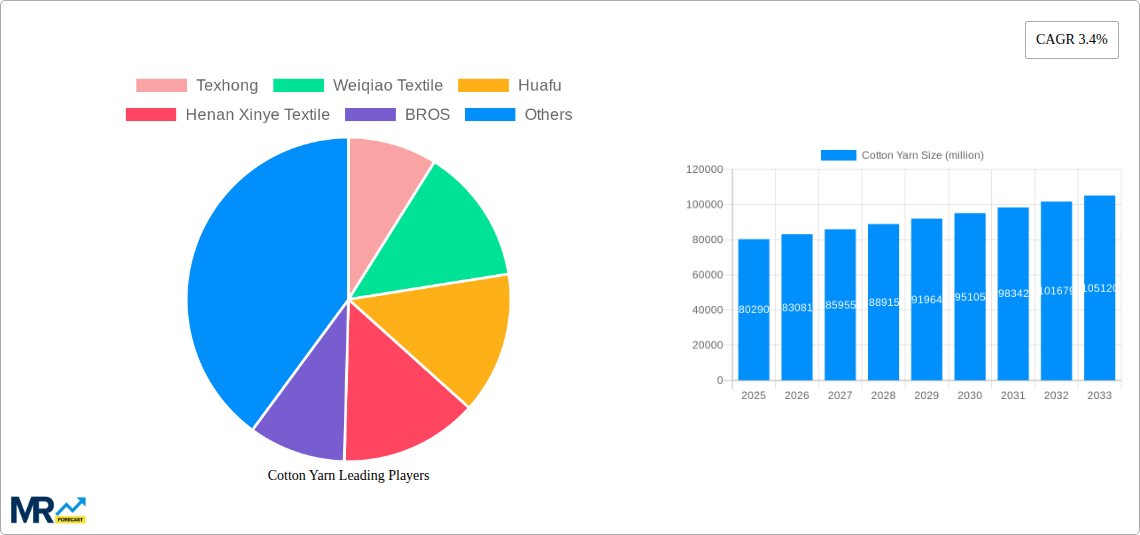

The global cotton yarn market is projected for robust growth, with an estimated market size of approximately USD 80,290 million in 2025, driven by sustained demand across diverse applications and evolving consumer preferences. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 3.4% anticipated from 2025 to 2033. Key growth drivers include the expanding textile industry, particularly in apparel and home textiles, which continues to be a cornerstone of global consumer spending. Furthermore, technological advancements in spinning technologies are leading to higher quality and more specialized cotton yarn products, catering to niche markets and premium segments. The increasing emphasis on sustainable and ethically sourced materials also presents a significant opportunity, as consumers and brands alike prioritize eco-friendly alternatives. The market's resilience is further bolstered by the versatility of cotton yarn, making it indispensable in a wide array of end-use industries.

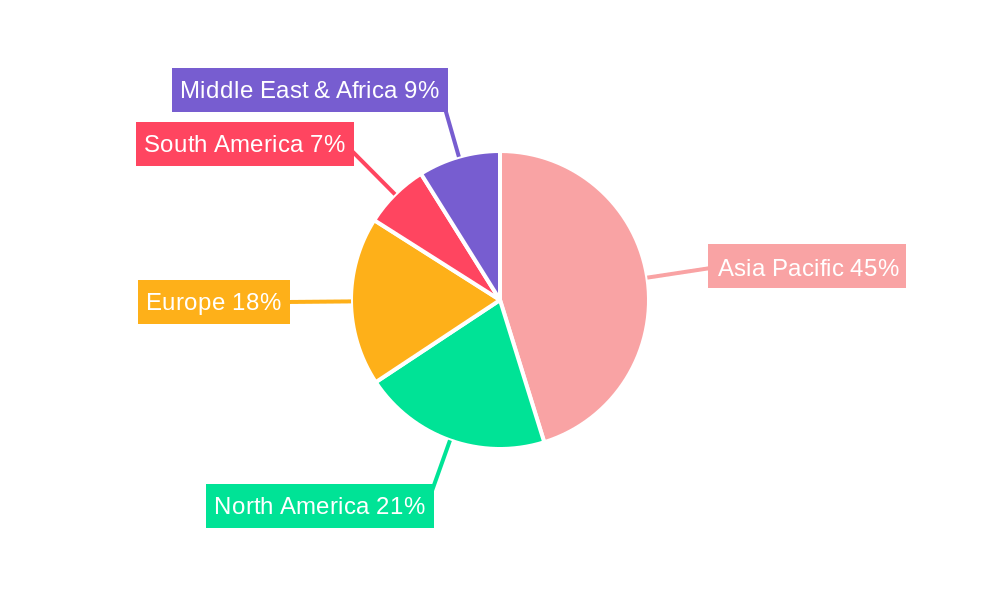

The market segmentation reveals a dynamic landscape. Carded yarn, a staple for many applications due to its cost-effectiveness, will continue to hold a significant share. However, combed yarn is expected to witness substantial growth as demand for premium apparel and high-quality home textiles escalates. Industrial textiles, though a smaller segment, also contributes to the overall market expansion, driven by specialized applications in areas like technical textiles. Geographically, the Asia Pacific region, led by China and India, is poised to remain the dominant force, owing to its extensive manufacturing capabilities and a burgeoning domestic consumer base. Emerging markets in South America and Africa also present significant untapped potential, with increasing industrialization and rising disposable incomes. Despite the positive outlook, challenges such as fluctuating raw material prices and increasing competition from synthetic fibers necessitate strategic innovation and supply chain optimization among market players to maintain healthy growth.

This report offers an in-depth examination of the global cotton yarn market, providing critical insights and forecasts from 2019 to 2033. Leveraging 2025 as the base and estimated year, and focusing on the forecast period of 2025-2033, the analysis builds upon a robust historical understanding of the market from 2019 to 2024. The report delves into market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments, with a specific focus on the Carded Yarn segment within the Apparel application.

The global cotton yarn market is poised for steady, yet nuanced, growth over the study period (2019-2033), with the base year of 2025 serving as a pivotal point for current market dynamics and future projections. A key insight from our analysis indicates a sustained demand driven by the perennial popularity of cotton fiber in consumer goods, particularly in apparel and home textiles. However, the market is witnessing a subtle but significant shift in consumer preferences and manufacturing practices. For instance, there's an increasing emphasis on sustainable and ethically sourced cotton, which is influencing procurement decisions for yarn manufacturers and, consequently, the types of yarn being produced. This trend is not merely a niche interest but is steadily integrating into mainstream market demands, pushing for greater transparency in the supply chain.

Furthermore, the market is experiencing a bifurcation in its product landscape. While conventional cotton yarn remains dominant due to its affordability and widespread availability, there's a discernible uptick in the demand for premium and specialized cotton yarns. This includes organic cotton yarns, recycled cotton yarns, and yarns with enhanced properties such as antimicrobial or moisture-wicking capabilities, catering to more discerning consumers and specialized applications. The forecast period (2025-2033) is expected to see this premium segment gain more traction, albeit from a smaller base. Geographically, Asia-Pacific, particularly China and India, continues to be the epicenter of cotton yarn production and consumption, a trend that is likely to persist. However, we are also observing nascent but promising growth in other regions, driven by localized textile industries and a growing emphasis on domestic production. The average annual growth rate is projected to be moderate, reflecting the maturity of some segments and the ongoing challenges in raw material sourcing and price volatility. Understanding these intricate trends is crucial for stakeholders aiming to navigate the evolving cotton yarn landscape effectively. The market's trajectory is not a monolithic surge but a series of interconnected shifts, demanding strategic adaptation and foresight.

The cotton yarn market's trajectory is predominantly propelled by the enduring and widespread appeal of cotton as a natural fiber. Its inherent qualities – breathability, softness, comfort, and hypoallergenic properties – make it the preferred choice for a vast array of consumer applications, with apparel leading the charge. The sheer volume of the global apparel industry, consistently driven by fashion trends, population growth, and evolving consumer lifestyles, creates a perpetual demand for cotton yarn. This intrinsic demand is further amplified by the growing emphasis on sustainable and ethical sourcing. Consumers are increasingly conscious of the environmental and social impact of their purchases, leading to a rise in demand for organic, recycled, and BCI (Better Cotton Initiative) certified cotton yarns. This push towards sustainability not only drives demand for specific yarn types but also incentivizes innovation in yarn production processes, aiming for reduced water usage, chemical inputs, and waste.

Moreover, the robust growth in home textiles, encompassing bedding, towels, upholstery, and other household items, also significantly contributes to the market's momentum. The increasing disposable incomes in developing economies and the constant desire for home décor upgrades translate into sustained demand for cotton-based products. The industrial textiles sector, while smaller in comparison, also plays a role, with cotton yarns finding applications in specialized areas. Furthermore, technological advancements in spinning and processing technologies are contributing to improved yarn quality, efficiency, and the development of new yarn functionalities, thereby broadening the scope of applications and attracting new market segments. The combined effect of these factors creates a dynamic and resilient market for cotton yarn.

Despite the robust demand, the cotton yarn market faces several significant challenges and restraints that can temper its growth trajectory. The most prominent and persistent challenge is the inherent volatility of cotton prices. Cotton is an agricultural commodity, making its prices susceptible to a multitude of factors, including weather patterns, crop yields, geopolitical events, government policies, and global demand-supply imbalances. This price fluctuation directly impacts the profitability of yarn manufacturers, making it difficult to maintain stable pricing and consistent margins. Furthermore, the increasing competition from synthetic fibers, such as polyester and nylon, presents another significant restraint. While cotton offers distinct advantages, synthetics often provide superior durability, wrinkle resistance, and lower cost, making them attractive alternatives in certain applications, particularly in industrial textiles and some segments of apparel.

The environmental concerns associated with conventional cotton cultivation, such as high water consumption and pesticide usage, are also a growing restraint. While the industry is moving towards more sustainable practices, the transition requires significant investment and can be a slow process. This can lead to reputational risks and regulatory pressures, potentially impacting market access for products not meeting sustainability standards. Additionally, the labor-intensive nature of cotton farming and processing, coupled with rising labor costs in some regions, can further escalate production expenses. Geopolitical instability and trade protectionism in key cotton-producing or consuming nations can disrupt supply chains and create market uncertainties. Finally, the availability of raw material, especially in certain regions, can be a limiting factor, influenced by factors like land availability and the success of agricultural practices. These challenges necessitate proactive strategies and continuous adaptation from market players.

Key Region/Country: Asia-Pacific, particularly China and India, is projected to continue its dominance in the global cotton yarn market throughout the forecast period (2025-2033).

Dominant Segment: The Carded Yarn segment within the Apparel application is expected to lead the market.

The Asia-Pacific region, spearheaded by China and India, will remain the undisputed powerhouse of the global cotton yarn market. This dominance is rooted in a confluence of factors that have historically positioned these nations as the world's textile manufacturing hubs. China, with its advanced manufacturing infrastructure, extensive production capacity, and significant domestic demand, coupled with its role as a major exporter of finished textile products, will continue to be a critical player. The presence of giant players like Texhong, Weiqiao Textile, Huafu, and Henan Xinye Textile underscores this regional strength. These companies benefit from economies of scale, access to skilled labor, and supportive government policies that foster industrial growth. India, another colossal player, leverages its vast cotton cultivation base, a strong domestic textile industry, and a growing export market. Companies such as Vardhman Group, Nahar Spinning, Alok, Trident Group, and KPR Mill Limited are integral to India's market share, capitalizing on the availability of raw materials and a skilled workforce. The sheer volume of yarn produced and consumed within this region, driven by both internal demand for clothing and home textiles, and their pivotal role in global supply chains, solidifies Asia-Pacific's leadership. Furthermore, the competitive cost structures in these countries, despite rising labor costs, continue to make them attractive sourcing destinations for global textile brands. The established ecosystem of raw material suppliers, spinners, weavers, and garment manufacturers creates a self-sustaining cycle of growth. While other regions may see incremental growth, the sheer scale and established infrastructure of Asia-Pacific will ensure its sustained dominance.

Within this dominant region, the Carded Yarn segment, particularly when applied to Apparel, is anticipated to be the leading force. Carded yarn, characterized by its slightly coarser texture and lower cost compared to combed yarn, is the workhorse of the textile industry for everyday wear. The vast majority of apparel manufactured globally, from t-shirts and casual wear to denims and basic knitwear, utilizes carded cotton yarn due to its affordability, durability, and good comfort properties. The sheer volume of basic apparel production, which forms the backbone of the fashion industry, directly translates into a higher demand for carded yarn. While combed yarn offers superior softness and a smoother finish, its higher cost often restricts its use to premium apparel segments or specific niche applications. For mass-market apparel, the cost-effectiveness and reliable performance of carded yarn make it the preferred choice. Companies that are proficient in producing high-volume, cost-efficient carded yarn for the apparel sector, such as Weiqiao Textile and Huamao, will continue to thrive. The demand for basic cotton garments is consistently high across all demographics and income levels, making the apparel application of carded yarn a perennial market leader. This segment's dominance is further reinforced by the global demand for everyday clothing, which is less susceptible to the fashion whims that might influence demand for more specialized yarn types. The accessibility and widespread use of carded yarn in everyday clothing ensure its continuous and substantial market share.

Several factors are poised to act as significant growth catalysts for the cotton yarn industry. The increasing global population, coupled with rising disposable incomes in emerging economies, will continue to fuel demand for cotton-based apparel and home textiles. The growing consumer preference for natural and sustainable fibers, driven by environmental consciousness, will boost the demand for organic and recycled cotton yarns. Innovations in spinning technology are leading to improved yarn quality, strength, and functionality, opening up new application possibilities and enhancing competitiveness against synthetic alternatives. Finally, the expanding e-commerce landscape is making textile products more accessible globally, thereby stimulating consumption and indirectly driving yarn demand.

This comprehensive report provides an unparalleled deep dive into the global cotton yarn market, offering a granular understanding of its intricate workings and future potential. From meticulously analyzing historical data (2019-2024) to projecting future trends (2025-2033) based on a carefully considered 2025 base year, the report equips stakeholders with actionable intelligence. It dissects the market's driving forces, the challenges that temper its growth, and pinpoints the key regions and dominant segments, with a specific emphasis on the vital Carded Yarn for Apparel market. Furthermore, it identifies crucial growth catalysts and provides a detailed overview of leading industry players. The report's strength lies in its forward-looking perspective, presenting significant developments and offering a holistic view of the market dynamics, thereby enabling informed strategic decision-making for all participants in the cotton yarn value chain.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.4%.

Key companies in the market include Texhong, Weiqiao Textile, Huafu, Henan Xinye Textile, BROS, China Resources, Huamao, Lutai Textile, Guanxing, Hengfeng, Shandong Ruyi, Huafang, Sanyang, Dasheng, Lianfa, Vardhman Group, Nahar Spinning, Alok, Trident Group, KPR Mill Limited, Nitin Spinners, Aarti International, Spentex, Daewoo, Bitratex Industries, Nishat Mills, Fortex, Parkdale, .

The market segments include Type, Application.

The market size is estimated to be USD 80290 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cotton Yarn," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cotton Yarn, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.