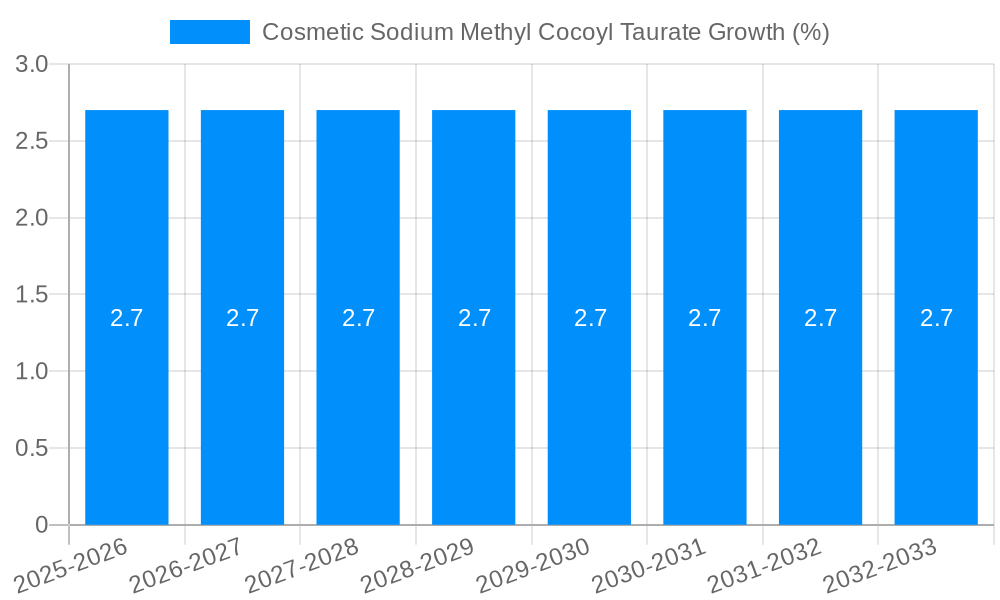

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Sodium Methyl Cocoyl Taurate?

The projected CAGR is approximately 2.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cosmetic Sodium Methyl Cocoyl Taurate

Cosmetic Sodium Methyl Cocoyl TaurateCosmetic Sodium Methyl Cocoyl Taurate by Type (Powder, Liquid/Paste), by Application (Shampoo, Facial Cleaner, Shower Gel, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

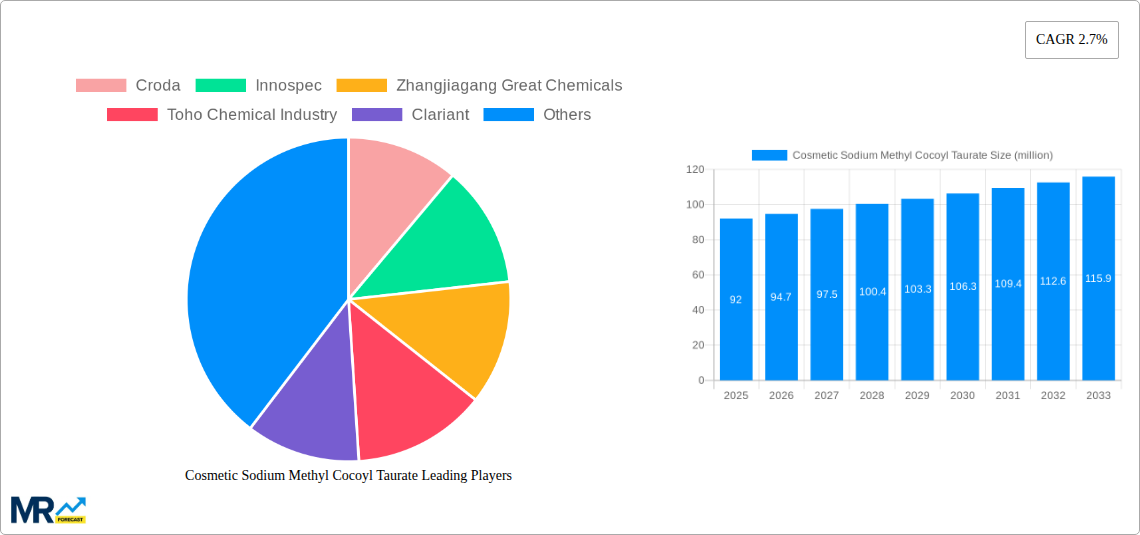

The global cosmetic sodium methyl cocoyl taurate market, valued at approximately $92 million in 2025, exhibits a steady Compound Annual Growth Rate (CAGR) of 2.7% from 2019 to 2033. This growth is fueled by the increasing demand for mild, naturally-derived surfactants in personal care products. Consumers are increasingly seeking eco-friendly and sustainable options, driving the adoption of sodium methyl cocoyl taurate, a biodegradable and gentle surfactant ideal for sensitive skin. The market's expansion is further propelled by the growing popularity of natural and organic cosmetics, as well as the rising awareness of the potential harmful effects of harsh chemical surfactants. Key players like Croda, Innospec, and Clariant are driving innovation and supply within the market, contributing to its continued growth. Market segmentation, while not explicitly provided, likely includes variations based on product form (liquid, powder), application (shampoo, body wash, facial cleansers), and geographic region. The consistent, albeit moderate, growth trajectory suggests a stable and predictable market with opportunities for further expansion through product differentiation and targeted marketing.

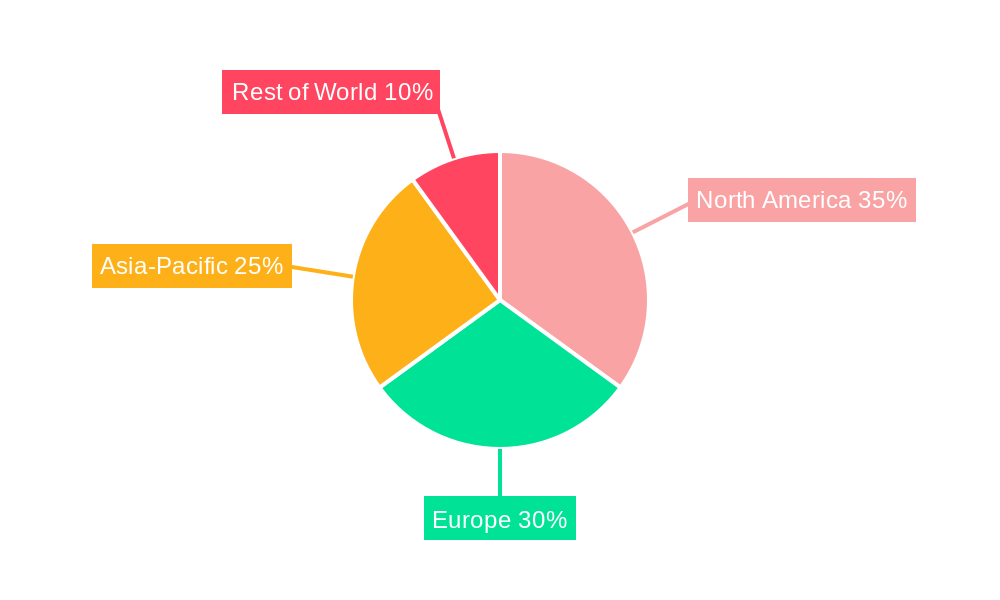

The forecast period of 2025-2033 suggests continued market expansion, with projected growth driven by ongoing consumer preference shifts towards naturally-derived ingredients. While geographical data is missing, regional variations likely exist based on differing consumer preferences, regulatory landscapes, and economic conditions. North America and Europe are anticipated to hold significant market shares due to established personal care industries and high consumer awareness of sustainable products. Emerging markets in Asia-Pacific are also likely to contribute substantially to market growth, driven by expanding middle classes and increasing disposable income. However, potential restraints could include fluctuations in raw material prices and competition from synthetic alternatives, necessitating ongoing innovation and efficient supply chain management by market players.

The global cosmetic sodium methyl cocoyl taurate market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by increasing consumer demand for mild, naturally-derived, and sustainable cosmetic ingredients, the market has demonstrated consistent expansion throughout the historical period (2019-2024). The estimated market value for 2025 positions it for significant further growth during the forecast period (2025-2033). Key market insights reveal a strong preference for sodium methyl cocoyl taurate in personal care products due to its excellent cleansing and foaming properties, coupled with its mild nature, making it suitable for sensitive skin. This trend is further fueled by the rising awareness of the potential harm caused by harsh surfactants found in many conventional cosmetic products. The growing popularity of natural and organic cosmetics, along with increasing regulatory scrutiny on chemical ingredients, is also contributing to the market's expansion. Manufacturers are actively incorporating sodium methyl cocoyl taurate into a broader range of products, including shampoos, body washes, facial cleansers, and baby products. The market is witnessing innovation in formulations, with manufacturers exploring new ways to enhance the efficacy and performance of sodium methyl cocoyl taurate-based products. This includes exploring combinations with other natural ingredients to achieve synergistic effects and improving product texture and sensory experience. Furthermore, the increasing focus on sustainable and ethically sourced ingredients is driving demand for sodium methyl cocoyl taurate produced using environmentally friendly methods. The market's future trajectory indicates continued growth, driven by these sustained trends and the ongoing search for gentler, safer, and more sustainable alternatives in the cosmetic industry. The competition among manufacturers is also intensifying, leading to ongoing product innovation and price competitiveness, further benefiting consumers.

Several factors are propelling the growth of the cosmetic sodium methyl cocoyl taurate market. The rising consumer preference for mild and gentle cleansing agents is a key driver. Consumers, particularly those with sensitive skin, are actively seeking out products that are less likely to cause irritation or dryness. Sodium methyl cocoyl taurate, with its exceptional mildness profile, perfectly fits this demand. Simultaneously, the growing awareness of the negative environmental impact of harsh chemicals in cosmetics is pushing consumers towards more sustainable alternatives. Sodium methyl cocoyl taurate is often derived from renewable resources, making it an attractive option for environmentally conscious consumers. The increasing demand for natural and organic cosmetic products further strengthens this trend. Manufacturers are responding by incorporating sodium methyl cocoyl taurate into their formulations to align with consumer preferences for products free of harsh chemicals and synthetic ingredients. Moreover, stringent regulations regarding the use of certain chemicals in cosmetics in various regions are also contributing to the market's growth. Regulatory bodies are increasingly scrutinizing the safety and environmental impact of cosmetic ingredients, leading to a shift towards milder and more sustainable alternatives, such as sodium methyl cocoyl taurate. This regulatory landscape fuels innovation and encourages the development of safer and environmentally friendly cosmetic products.

Despite the positive market outlook, several challenges and restraints hinder the growth of the cosmetic sodium methyl cocoyl taurate market. One key challenge is the price competitiveness from other, potentially less sustainable, surfactants. While sodium methyl cocoyl taurate offers superior mildness and sustainability, its cost can be higher than that of some conventional surfactants. This price difference can be a barrier for some manufacturers, particularly those operating on tight budgets. Another restraint is the potential for variability in the quality of the raw materials used in the production of sodium methyl cocoyl taurate. Maintaining consistent quality and purity is crucial for ensuring the efficacy and safety of the final cosmetic product. Variations in the source of coconut oil, a key component in the production process, can affect the quality of the finished product, leading to inconsistent performance and potentially causing issues with product formulation. Additionally, the increasing demand for sodium methyl cocoyl taurate could lead to supply chain constraints, especially if production capacity does not keep pace with market growth. Ensuring a stable and reliable supply chain is vital for meeting the increasing market demands and preventing disruptions. Finally, keeping abreast of evolving consumer preferences and regulatory changes necessitates continuous innovation and adaptation within the industry.

The North American and European regions are expected to dominate the cosmetic sodium methyl cocoyl taurate market throughout the forecast period, driven by high consumer awareness of natural and organic cosmetics, stringent regulations, and strong demand for mild cleansing products. Asia-Pacific is also anticipated to experience significant growth, fuelled by rising disposable incomes, growing awareness of personal care, and a burgeoning middle class.

Segments: The market is segmented by product type (shampoo, body wash, facial cleanser, etc.) and application (personal care, baby care, etc.). The personal care segment currently holds the largest market share due to its wide-ranging applications in various products. However, the baby care segment shows promising growth potential due to the increasing preference for mild and hypoallergenic products for infants.

The market's dominance is primarily driven by the high demand for gentle and sustainable ingredients in developed markets, combined with the increasing popularity of natural and organic cosmetics. This is complemented by strong regulatory frameworks promoting safer and more eco-conscious cosmetic products. The Asia-Pacific region exhibits strong growth potential due to its burgeoning middle class, rising disposable income, and growing awareness of personal care and wellness.

The cosmetic sodium methyl cocoyl taurate industry is experiencing significant growth propelled by several key factors: the rising consumer preference for mild and natural cosmetic ingredients, the increasing demand for sustainable and eco-friendly products, and stricter regulations on the use of harsh chemicals in cosmetics. These factors are driving innovation in product formulations and increasing the adoption of sodium methyl cocoyl taurate across various cosmetic applications.

This report provides a comprehensive analysis of the global cosmetic sodium methyl cocoyl taurate market, covering market trends, driving forces, challenges, key players, and significant developments. The report utilizes a robust methodology incorporating market data, industry insights, and expert interviews to provide accurate and reliable projections for market growth. It offers valuable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors, enabling them to make informed strategic decisions and capitalize on emerging opportunities in this dynamic market. The report’s detailed segmentation and regional analysis offers a clear understanding of the various factors influencing market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.7%.

Key companies in the market include Croda, Innospec, Zhangjiagang Great Chemicals, Toho Chemical Industry, Clariant, Taiwan NJC, Galaxy, Zschimmer & Schwarz, Huzhou Ouli Biotechnology, Shanghai Oli Enterprises, Solvay, .

The market segments include Type, Application.

The market size is estimated to be USD 92 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cosmetic Sodium Methyl Cocoyl Taurate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cosmetic Sodium Methyl Cocoyl Taurate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.