1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic OEM/ODM?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cosmetic OEM/ODM

Cosmetic OEM/ODMCosmetic OEM/ODM by Type (/> Cosmetic OEM, Cosmetic ODM), by Application (/> Skincare, Makeup, Haircare, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

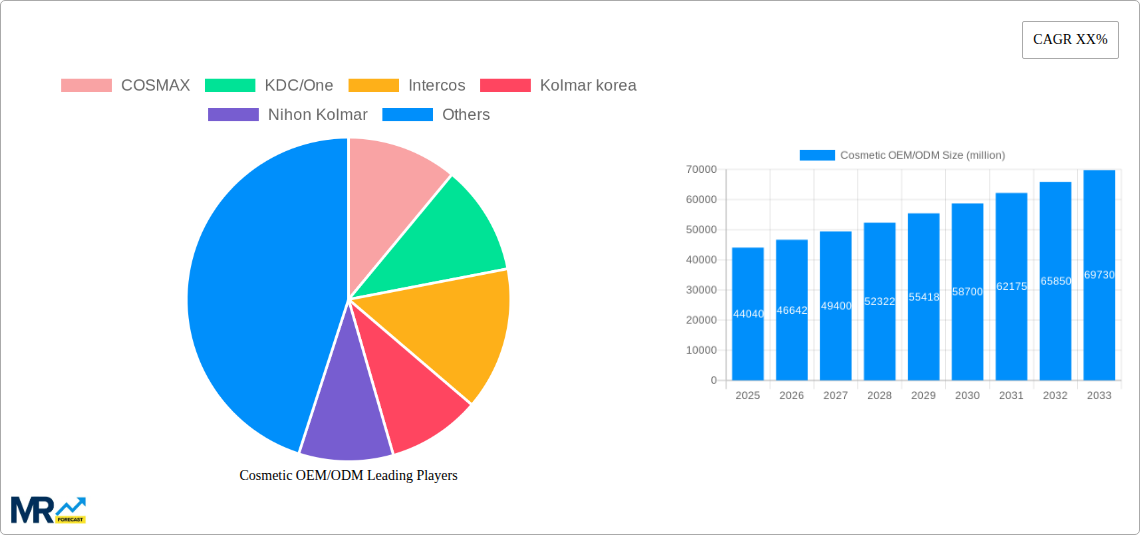

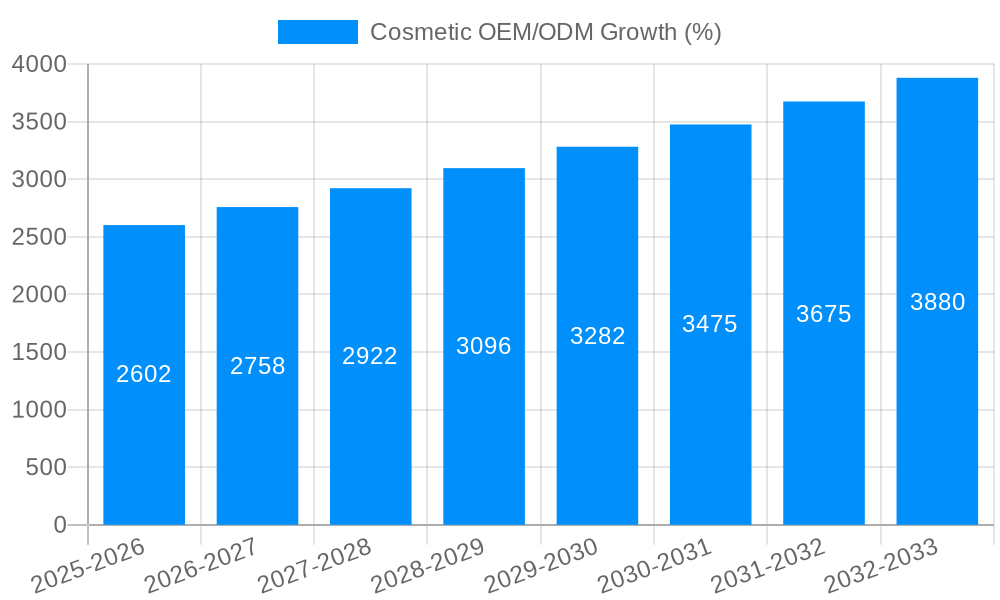

The global cosmetic OEM/ODM market, valued at $44,040 million in 2025, is poised for significant growth. While the provided CAGR is missing, a conservative estimate, considering the industry's consistent expansion fueled by increasing demand for personalized beauty products and the rise of indie beauty brands, would place it between 5% and 7% annually for the forecast period (2025-2033). Key drivers include the growing popularity of natural and organic cosmetics, the escalating demand for customized beauty solutions, and the increasing outsourcing of manufacturing by brands seeking cost efficiencies and operational agility. Emerging trends, such as the integration of advanced technologies like AI and machine learning in formulation and manufacturing, sustainability initiatives focused on eco-friendly packaging and sourcing, and the rising preference for personalized skincare regimens, further propel market expansion. However, challenges remain, including stringent regulatory compliance across different geographies, fluctuations in raw material prices, and the need for consistent quality control across diverse production lines. The competitive landscape is characterized by a mix of large multinational players and smaller niche companies, with both groups focusing on innovation and strategic partnerships to maintain their market share.

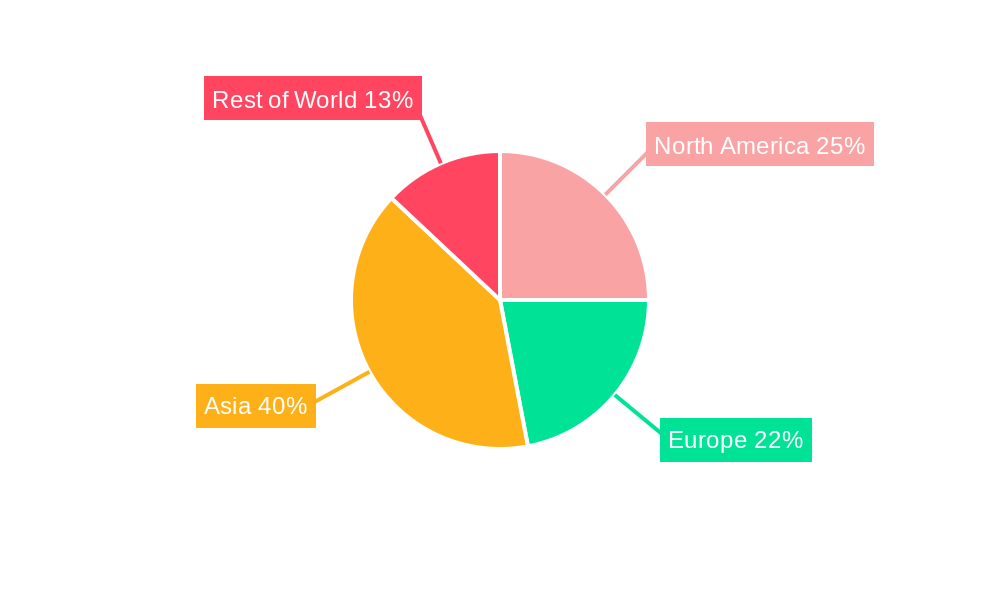

The market segmentation (unprovided) likely encompasses various product categories (skincare, makeup, haircare), service offerings (formulation, packaging, manufacturing), and geographical regions. Considering the listed companies, a strong presence is apparent across Asia, particularly in Korea and Japan, indicating these regions as major contributors to market growth. North America and Europe are also significant players, driven by robust consumer spending on cosmetics and a developed infrastructure supporting the industry. The forecast period (2025-2033) suggests continued expansion, although potential external factors, such as global economic conditions and shifts in consumer preferences, must be considered for accurate long-term projections. Market penetration strategies emphasizing innovation, quality, and sustainability will be crucial for companies seeking to thrive in this dynamic and competitive environment.

The global cosmetic OEM/ODM market is experiencing robust growth, driven by the increasing demand for personalized and customized beauty products. The market, valued at approximately 150 billion units in 2025, is projected to reach over 250 billion units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6%. This expansion is fueled by several key factors. Firstly, the burgeoning e-commerce sector empowers smaller brands to access a wider audience, increasing their reliance on OEM/ODMs for cost-effective production and flexible scaling. Secondly, the growing preference for natural and organic cosmetics necessitates specialized manufacturing capabilities and formulations, which OEM/ODMs are adept at providing. Thirdly, the rise of private label and store brands further intensifies demand for OEM/ODM services, as retailers seek to expand their product offerings and enhance profitability. The market demonstrates considerable diversity, with a range of services including formulation development, packaging solutions, and regulatory compliance support. Increased consumer awareness of ethical sourcing and sustainable practices is also impacting the market, pushing OEM/ODMs to adopt more environmentally friendly and socially responsible manufacturing processes. This trend is reflected in a growing demand for certifications and transparent supply chains, further influencing the evolution of the market landscape. Finally, technological advancements, such as AI-driven formulation development and automation in manufacturing, are streamlining production and improving efficiency, contributing to enhanced cost-effectiveness and quicker turnaround times. These combined trends ensure a continued upward trajectory for the cosmetic OEM/ODM market throughout the forecast period (2025-2033).

Several key factors are propelling the growth of the cosmetic OEM/ODM market. The rise of independent beauty brands and e-commerce platforms significantly contributes to this expansion. These smaller brands often lack the capital investment for large-scale manufacturing, making OEM/ODMs an essential partner for production and distribution. Furthermore, the increasing consumer demand for diverse and personalized cosmetic products necessitates flexibility in production, a strength that OEM/ODMs offer. The growing awareness of natural and organic ingredients and the demand for sustainable and ethically sourced products are also pushing the market forward. OEM/ODMs are well-positioned to adapt to these preferences, offering formulations with specific certifications and sustainable packaging solutions. In addition, cost optimization is a major factor driving this market. OEM/ODMs generally provide economies of scale, lowering manufacturing costs for brands, especially those operating on smaller budgets. Technological advancements in formulation development and manufacturing processes further enhance efficiency and reduce production times, contributing to overall cost savings and increased profitability for both OEM/ODMs and their clients. The expansion into new geographical markets, particularly in developing economies with rising disposable incomes, also fuels the growth, presenting immense untapped potential for expansion.

Despite the significant growth potential, the cosmetic OEM/ODM market faces several challenges. Maintaining consistent quality across large-scale production can be demanding, especially with the increasing complexity of formulations and diverse ingredient sourcing. Competition within the industry is fierce, with established players and new entrants vying for market share. Maintaining price competitiveness while ensuring high-quality standards requires strategic management and operational efficiency. The constantly evolving regulatory landscape, with varying regulations across different regions and countries, presents a challenge for compliance and necessitates continuous adaptation. Ensuring supply chain stability and sourcing raw materials sustainably and ethically can be challenging, especially with fluctuating global markets and increasing environmental concerns. Furthermore, technological advancements, while offering advantages, also require significant investments in infrastructure and expertise, potentially limiting entry for smaller players. Finally, intellectual property protection is crucial, and maintaining confidentiality for client formulations and product designs is a constant concern. Overcoming these obstacles effectively is essential for successful navigation of the market.

Asia-Pacific: This region is projected to dominate the market, fueled by rapid economic growth, a burgeoning middle class, and increasing consumer spending on cosmetics. Countries like China, South Korea, and Japan are key drivers of this growth. The preference for personalized and natural beauty products in this region significantly contributes to the demand for OEM/ODM services. The rising popularity of K-beauty and J-beauty trends further bolsters market expansion. The high population density coupled with increased disposable incomes makes this region exceptionally lucrative.

North America: While possessing a mature market, North America continues to exhibit robust growth due to the increasing demand for customized products and the expansion of the organic and natural beauty segments. The focus on sustainability and ethical sourcing is also a key driver of growth in this region.

Europe: The European market is characterized by stringent regulatory standards and a strong focus on product safety and sustainability. This leads to a high demand for OEM/ODMs with robust quality control systems and compliance expertise. The region's diverse consumer preferences require adaptability and a broad product portfolio from OEM/ODMs.

Skincare Segment: This segment is anticipated to maintain its dominance due to the rising consumer awareness of skincare routines and the growing availability of specialized skincare products addressing diverse needs. The expanding market for natural and organic skincare further drives this segment’s growth.

Hair Care Segment: This segment's growth is supported by increased consumer spending on hair care products and the expanding market for personalized hair care solutions catering to specific hair types and needs.

The combined forces of regional economic development, shifting consumer preferences, and regulatory considerations shape the competitive landscape of the cosmetic OEM/ODM market, making Asia-Pacific, and specifically the skincare segment, the most significant growth areas in the foreseeable future.

Several factors are accelerating growth within the cosmetic OEM/ODM industry. The increasing demand for customized and personalized beauty products, driven by the rise of individual brands and e-commerce, fuels significant expansion. The ongoing trend toward natural and organic ingredients, alongside the growing emphasis on sustainable and ethical manufacturing practices, continues to shape industry innovation and create new opportunities for specialized OEM/ODM providers. Technological advancements, including automation and AI-driven formulation development, are enhancing efficiency and reducing production costs. Finally, the expansion of the market into emerging economies with rising disposable incomes further contributes to the overall growth trajectory of the sector.

The cosmetic OEM/ODM market is poised for significant expansion over the next decade. The convergence of several factors, such as the growing demand for personalized beauty products, the rise of e-commerce, the increasing preference for natural and organic cosmetics, and ongoing technological advancements, indicates continued market growth. This report provides a comprehensive analysis of market trends, driving forces, challenges, key players, and regional dynamics, offering a valuable resource for stakeholders seeking to navigate this dynamic and rapidly evolving market. The report's data-driven insights offer strategic recommendations for businesses looking to capitalize on the opportunities within the cosmetic OEM/ODM sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include COSMAX, KDC/One, Intercos, Kolmar korea, Nihon Kolmar, Cosmo Beauty, Mana Products, Cosmecca, PICASO Cosmetic, Nox Bellow Cosmetics, Toyo Beauty, Chromavis, Arizona Natural Resources, Opal Cosmetics, Ancorotti Cosmetics, A&H International Cosmetics, BioTruly, Bawei Biotechnology, B.Kolor, Easycare Group, ESTATE CHEMICAL, Ridgepole, Foshan wanying cosmetics, Ya Pure Cosmetics, ANTE ( Suzhou) cosmetics, Jiangsu Meiaisi Cosmetics, Life-Beauty, Homar.

The market segments include Type, Application.

The market size is estimated to be USD 44040 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Cosmetic OEM/ODM," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cosmetic OEM/ODM, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.