1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Face Cream Bottle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cosmetic Face Cream Bottle

Cosmetic Face Cream BottleCosmetic Face Cream Bottle by Application (Low Grade Face Cream Packaging, Medium Grade Face Cream Packaging, High Grade Face Cream Packaging, World Cosmetic Face Cream Bottle Production ), by Type (Capacity Below 50ml, Capacity 50-100ml, Capacity 100-150ml, World Cosmetic Face Cream Bottle Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

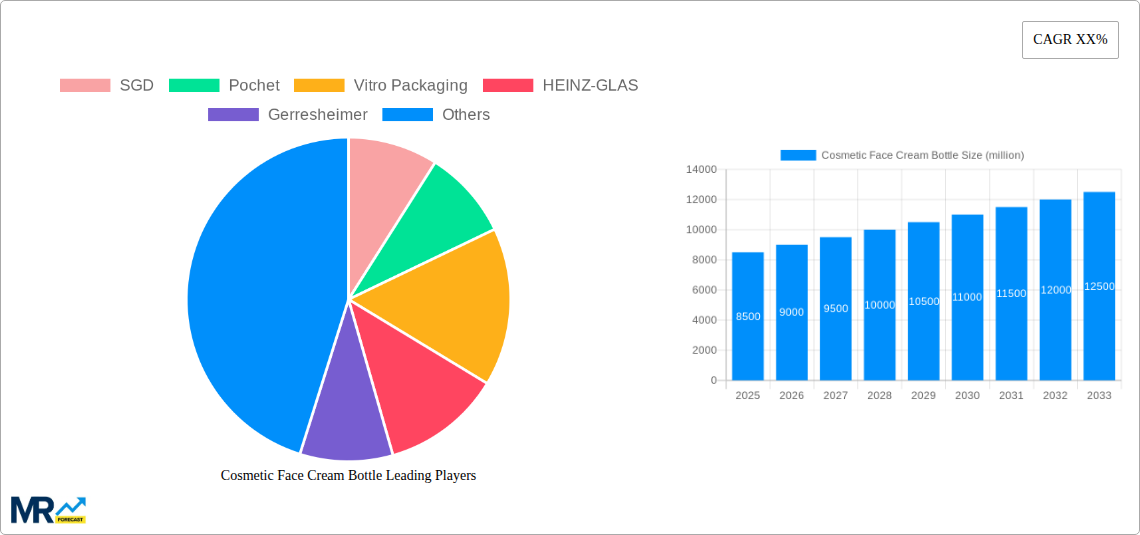

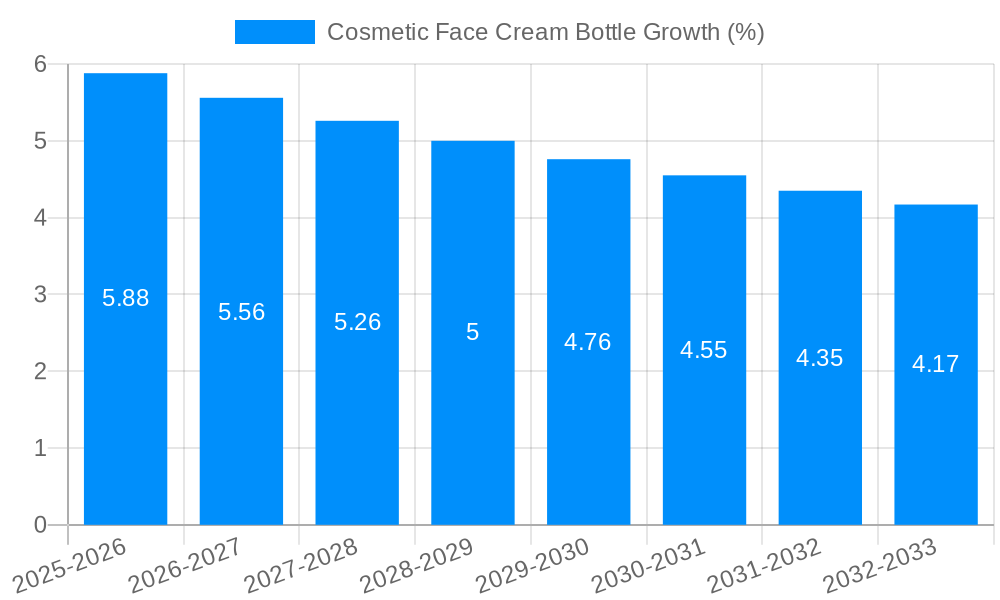

The global cosmetic face cream bottle market is poised for robust expansion, projected to reach an estimated USD 8,500 million by 2025 and subsequently grow to an anticipated USD 11,500 million by 2033. This significant market valuation is underpinned by a compound annual growth rate (CAGR) of approximately 5.5% between 2025 and 2033. A primary driver fueling this growth is the escalating consumer demand for premium and aesthetically pleasing skincare products, which necessitates high-quality, visually appealing packaging. The burgeoning beauty and personal care industry, especially the face cream segment, is witnessing increased innovation in product formulations, prompting manufacturers to invest in sophisticated packaging solutions that enhance product appeal and shelf presence. Furthermore, the growing emphasis on sustainability and eco-friendly packaging alternatives is also shaping market dynamics, with consumers increasingly favoring brands that adopt recyclable and biodegradable materials. This trend is pushing manufacturers to explore novel packaging designs and materials, creating new opportunities within the market.

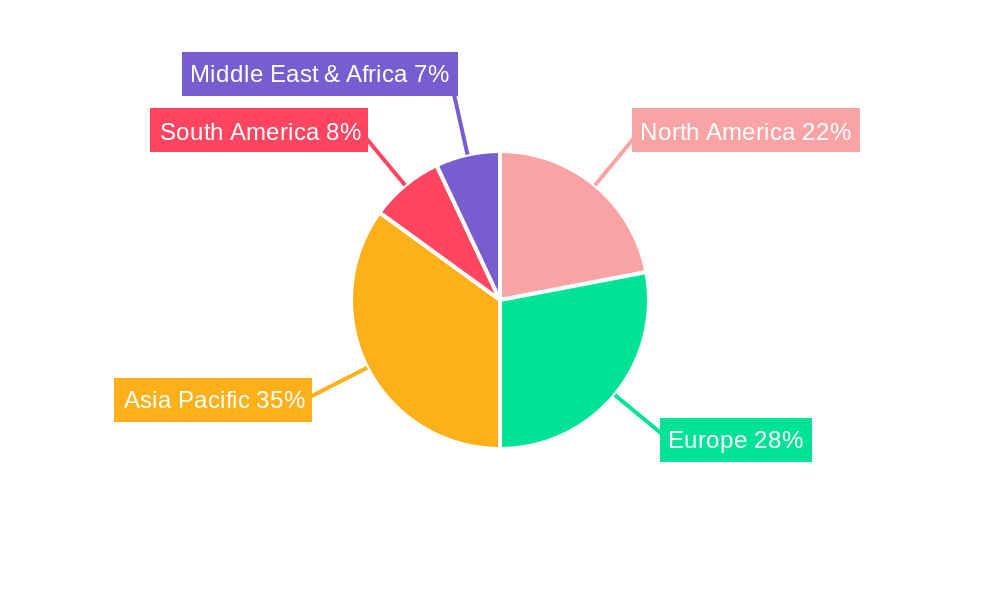

The market's segmentation by application reveals a substantial contribution from high-grade face cream packaging, indicating a strong consumer preference for luxury and premium skincare. This segment is expected to lead the market due to its association with enhanced product efficacy and aspirational brand positioning. The medium-grade face cream packaging segment also holds considerable weight, catering to a broad consumer base seeking a balance between quality and affordability. The low-grade face cream packaging segment, while smaller, is crucial for mass-market products and promotional offerings. In terms of capacity, bottles ranging from 50-100ml are anticipated to dominate, aligning with standard product sizes for face creams. However, growth in smaller capacities (below 50ml) is also expected due to the rising popularity of travel-sized and sample products. Geographically, the Asia Pacific region is emerging as a key growth engine, driven by a rapidly expanding middle class, increasing disposable incomes, and a strong preference for skincare routines.

This report provides an in-depth analysis of the global cosmetic face cream bottle market, encompassing production, applications, types, and industry developments. The study period spans from 2019 to 2033, with a base year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. The report delves into the intricate dynamics of this sector, utilizing millions of units as the primary metric for production and consumption.

The global cosmetic face cream bottle market is experiencing a dynamic evolution, driven by a confluence of consumer preferences, technological advancements, and evolving market strategies. XXX The increasing demand for premium and sophisticated skincare products is directly translating into a heightened need for equally premium packaging solutions. Consumers are increasingly associating the quality and efficacy of a face cream with the elegance and functionality of its container. This trend is particularly evident in the High Grade Face Cream Packaging segment, where brands are investing heavily in innovative designs, exotic materials, and intricate finishing techniques to create a tactile and visual experience that reflects the luxury of the product within. The rise of personalized and niche beauty brands also contributes to this trend, as these smaller players often differentiate themselves through unique and eye-catching packaging that stands out on crowded retail shelves.

Furthermore, the pervasive influence of social media and the visual nature of product discovery are placing a greater emphasis on aesthetically pleasing packaging. Influencers and consumers alike are more likely to showcase and recommend products with visually appealing bottles, creating a feedback loop that encourages manufacturers to prioritize design innovation. This has led to a surge in demand for custom-designed bottles, unique color palettes, and sophisticated embellishments such as embossing, debossing, and metallic finishes. The capacity of these bottles also plays a role in emerging trends, with a noticeable shift towards both smaller, travel-friendly sizes (Capacity Below 50ml) for on-the-go application and larger, more economical formats for consumers seeking value. However, the middle ground, particularly the Capacity 50-100ml range, continues to hold significant market share, catering to the everyday needs of a broad consumer base. Sustainability is no longer a niche concern but a mainstream expectation. Brands are actively seeking packaging solutions that minimize environmental impact, leading to increased adoption of recycled materials, lighter-weight designs, and refillable options. This push for eco-consciousness is reshaping manufacturing processes and material sourcing, influencing the entire value chain of cosmetic face cream bottle production. The market is witnessing a growing interest in glass bottles due to their perceived premium feel, recyclability, and inertness, while also seeing innovation in advanced plastics that offer comparable aesthetics and performance with a lighter footprint. The interplay between these material choices and design aspirations will continue to shape the landscape of cosmetic face cream bottle trends in the coming years.

The cosmetic face cream bottle market is being propelled by a robust set of driving forces, fundamentally rooted in the expanding global beauty industry and evolving consumer behaviors. The relentless growth of the skincare segment, fueled by an aging global population and increasing disposable incomes in emerging economies, forms the bedrock of this expansion. As more individuals prioritize self-care and invest in anti-aging and dermatological solutions, the demand for effective and attractively packaged face creams escalates proportionally. Furthermore, a significant catalyst is the intensifying competition among cosmetic brands. In a crowded marketplace, packaging serves as a crucial differentiator, allowing brands to communicate their value proposition, target audience, and product identity effectively. This competitive pressure spurs innovation in design, materials, and functionality, pushing manufacturers to develop bottles that are not only aesthetically pleasing but also user-friendly and brand-aligned.

The burgeoning e-commerce channel also plays a pivotal role. With the rise of online shopping for beauty products, the physical appeal of a bottle becomes even more critical in capturing consumer attention amidst digital storefronts. Brands are therefore investing in visually striking packaging that translates well in online imagery and can withstand the rigors of shipping, thus influencing the demand for specific bottle types and materials. Moreover, the growing awareness and demand for sustainable and eco-friendly products are shaping purchasing decisions. Consumers are increasingly scrutinizing the environmental footprint of their beauty products, prompting manufacturers to explore recyclable, biodegradable, and minimalist packaging options. This shift towards sustainability is not just a trend but a fundamental change in consumer expectations, compelling brands to adopt greener packaging solutions and driving innovation in this area. The ongoing research and development in materials science are also contributing, leading to the creation of novel, lightweight, and more durable packaging alternatives that can offer both aesthetic appeal and functional benefits.

Despite the robust growth trajectories, the cosmetic face cream bottle market is not without its significant challenges and restraints. One of the most prominent hurdles is the escalating cost of raw materials, particularly glass and specialized plastics. Fluctuations in the prices of these essential components directly impact the production costs for bottle manufacturers, potentially leading to higher retail prices for consumers or squeezing profit margins for brands and producers. The global supply chain disruptions, exacerbated by geopolitical events and logistical complexities, further contribute to material sourcing challenges and price volatility, making consistent production planning a complex undertaking.

Another significant restraint is the increasing stringency of environmental regulations and the growing consumer demand for sustainable packaging. While this also acts as a driver for innovation, meeting these evolving standards often requires substantial investment in new technologies, manufacturing processes, and material research. For smaller manufacturers or brands with limited budgets, adapting to these stricter eco-friendly mandates can be financially burdensome and technically demanding. The disposal and recycling infrastructure for cosmetic packaging also presents a challenge in certain regions. Even with the use of recyclable materials, the absence of widespread and efficient recycling systems can undermine sustainability efforts and contribute to environmental pollution, thereby posing a reputational risk for brands.

Furthermore, the rapid pace of innovation in cosmetic formulations and product claims necessitates equally agile packaging development. Brands are constantly seeking new ways to protect sensitive ingredients, enhance product efficacy, and provide unique application experiences, which requires specialized bottle designs and dispensing mechanisms. The development and mass production of such customized solutions can be time-consuming and expensive, creating a lag between product innovation and packaging readiness. Lastly, counterfeiting and product diversion remain persistent concerns in the beauty industry. Manufacturers and brands must invest in anti-counterfeiting measures within their packaging, adding to the complexity and cost of production, and potentially limiting design freedoms in the pursuit of enhanced security.

The global cosmetic face cream bottle market is characterized by regional dominance and segment specialization, with Asia Pacific emerging as a powerhouse, largely driven by the robust growth of Medium Grade Face Cream Packaging and the substantial production within the Capacity 50-100ml segment.

Asia Pacific:

North America & Europe:

Emerging Markets:

The interplay between these regions and segments creates a dynamic global market. While Asia Pacific leads in sheer volume and the medium-grade, 50-100ml capacity segment due to its vast consumer base and manufacturing prowess, North America and Europe continue to drive innovation and demand for premium, high-grade packaging solutions.

Several key factors are acting as potent growth catalysts for the cosmetic face cream bottle industry. The ever-expanding global beauty and personal care market, particularly the robust growth in the skincare segment, directly translates into increased demand for face cream bottles. Moreover, the rising disposable incomes in emerging economies are empowering a larger consumer base to invest in premium and specialized skincare products, further boosting consumption. The relentless drive for product differentiation and brand identity in a highly competitive market compels cosmetic companies to invest in innovative and aesthetically appealing packaging, spurring design advancements. Furthermore, the growing consumer preference for sustainable and eco-friendly packaging is not only a challenge but also a significant growth catalyst, pushing manufacturers to develop and adopt novel, greener materials and designs.

This report offers a truly comprehensive overview of the cosmetic face cream bottle market, delving into every facet of its intricate ecosystem. From granular analysis of production volumes in millions of units across various capacities (Below 50ml, 50-100ml, 100-150ml) to a detailed breakdown of application segments (Low Grade, Medium Grade, High Grade Face Cream Packaging), the report leaves no stone unturned. It meticulously examines the driving forces behind market expansion, such as evolving consumer preferences and industry competition, while also critically assessing the challenges and restraints, including rising material costs and stringent regulations. Furthermore, the report highlights key regions and segments poised for dominance, providing actionable insights for market participants. The inclusion of significant industry developments and a thorough list of leading players ensures a holistic understanding of the current landscape and future trajectory. This comprehensive coverage empowers stakeholders with the data-driven intelligence necessary for strategic decision-making and profitable growth in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SGD, Pochet, Vitro Packaging, HEINZ-GLAS, Gerresheimer, Piramal Glass, Zignago Vetro, Bormioli Luigi, Stolzle Glass, Pragati Glass, T.Y.CHU&CO, Guangdong Huaxing Glass, Yuyao Qitai Cosmetic packaging, Shaoxing Meiquan Plastics, Zhejiang Wansheng Cosmetic Packaging, Guangzhou Lexin Glass Products, Shaoxing Shangyu Mingyuan Cosmetics Packing, Zhan Yu Enterprise, Guangzhou Sunwin Cosmetics Packaging, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cosmetic Face Cream Bottle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cosmetic Face Cream Bottle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.