1. What is the projected Compound Annual Growth Rate (CAGR) of the Corrosion Monitoring?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Corrosion Monitoring

Corrosion MonitoringCorrosion Monitoring by Type (/> Ultrasonic Monitoring, Radiographic Monitoring, Guided wave Monitoring, Electromagnetic Monitoring, Destructive Monitoring, Others), by Application (/> Chemical, Oil and Gas, Power Generation, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

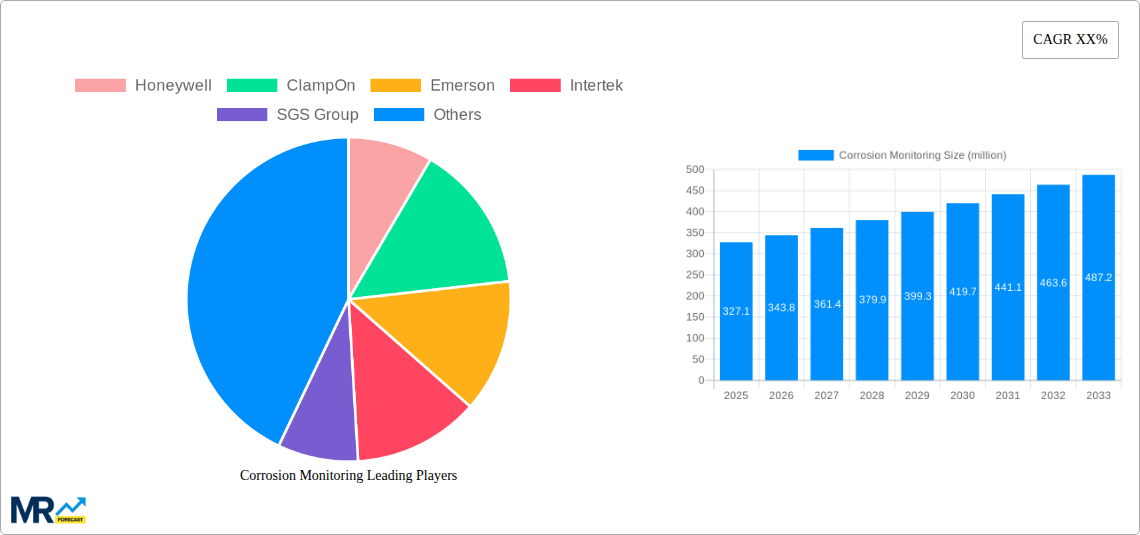

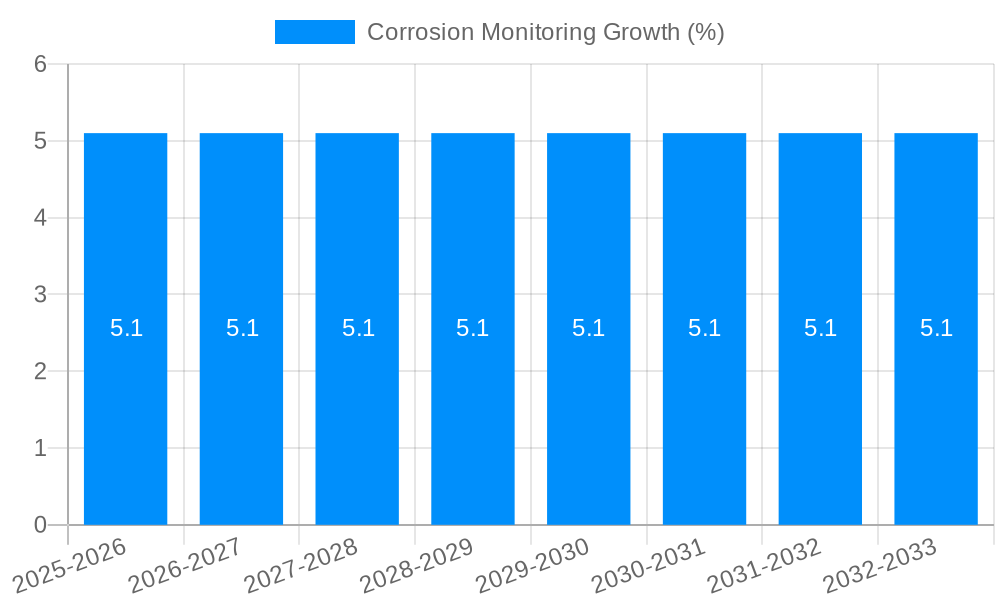

The global Corrosion Monitoring market is poised for significant expansion, projected to reach an estimated USD 475.2 million by 2033, driven by a compound annual growth rate (CAGR) of approximately 5.2% from its base year of 2025. This robust growth is fundamentally fueled by the increasing demand for asset integrity management and the imperative to prevent costly failures across critical industries. The Oil and Gas sector, a cornerstone of the corrosion monitoring landscape, continues to be a primary driver, with aging infrastructure and stringent safety regulations necessitating advanced monitoring solutions. Similarly, the Power Generation industry’s reliance on continuous operations and the need to extend the lifespan of vital equipment are propelling market adoption. Emerging applications in the chemical sector, focusing on enhanced process safety and product purity, also contribute to this upward trajectory. The inherent value of proactive corrosion management – mitigating environmental damage, ensuring regulatory compliance, and safeguarding human safety – underpins the market's consistent expansion.

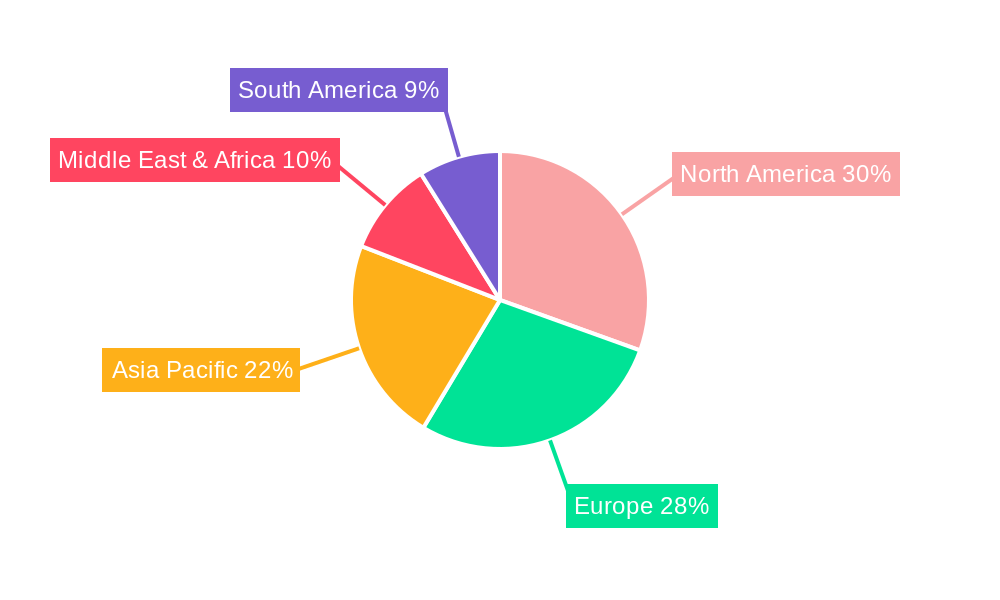

The market's evolution is further shaped by a dynamic interplay of technological advancements and prevailing industry trends. Ultrasonic Monitoring and Guided Wave Monitoring are emerging as frontrunners, offering non-destructive and highly accurate insights into corrosion progression, thereby reducing downtime and maintenance costs. Conversely, while Destructive Monitoring methods still hold relevance for specific applications requiring detailed analysis, their adoption is gradually being eclipsed by more efficient, real-time solutions. Key market restraints include the initial capital investment required for sophisticated monitoring systems and the need for skilled personnel to interpret complex data. However, the long-term cost savings and enhanced operational efficiency derived from effective corrosion monitoring are increasingly outweighing these initial hurdles. Geographically, North America and Europe currently dominate the market due to their established industrial base and advanced technological adoption. However, the Asia Pacific region, driven by rapid industrialization in countries like China and India and a growing focus on infrastructure development and asset preservation, presents the most significant growth opportunity in the coming years.

This report offers an in-depth analysis of the global Corrosion Monitoring market, providing a granular view of its evolution from the historical period of 2019-2024, through the base and estimated year of 2025, and projecting its trajectory through the forecast period of 2025-2033. With an estimated market value in the hundreds of millions of dollars, this research delves into the intricate dynamics shaping the industry, including technological advancements, regulatory landscapes, and the ever-increasing demand for asset integrity management across critical sectors. Our comprehensive coverage aims to equip stakeholders with actionable insights to navigate this complex and vital market.

The global corrosion monitoring market is experiencing robust growth, driven by an increasing awareness of the economic and safety implications of material degradation. Throughout the study period of 2019-2033, significant trends are emerging, reshaping how industries approach the prevention and mitigation of corrosion. The historical period of 2019-2024 saw a foundational build-up of IoT integration and cloud-based analytics, leading to more proactive maintenance strategies rather than reactive repairs. This shift is projected to accelerate, with the base year of 2025 marking a pivotal point where predictive maintenance, powered by advanced AI and machine learning algorithms, becomes increasingly mainstream. The forecast period of 2025-2033 is expected to witness a surge in the adoption of non-intrusive monitoring techniques, such as ultrasonic and guided wave monitoring, offering significant advantages in terms of cost-effectiveness, minimal downtime, and enhanced safety during inspection processes.

Furthermore, the market is trending towards integrated solutions, where corrosion monitoring systems are seamlessly embedded within broader asset management platforms. This convergence allows for real-time data aggregation from various sources, providing a holistic view of asset health and enabling more informed decision-making. The growing complexity of industrial infrastructure, particularly in the oil and gas and chemical sectors, necessitates sophisticated monitoring to prevent catastrophic failures and environmental incidents. Consequently, the demand for intelligent sensors and advanced data analytics platforms capable of processing vast amounts of real-time data will continue to rise. Regulatory pressures, focused on environmental protection and worker safety, are also playing a crucial role in driving the adoption of advanced corrosion monitoring technologies. The market is moving beyond simple detection to sophisticated prediction and prevention, with a clear emphasis on extending asset lifespan and minimizing operational disruptions. The estimated market value, reaching into the hundreds of millions of dollars, reflects the critical importance of these trends in safeguarding industrial assets and ensuring operational continuity.

Several key drivers are propelling the global corrosion monitoring market forward, underpinning its steady expansion over the study period of 2019-2033. Foremost among these is the ever-present economic imperative to mitigate the substantial financial losses associated with corrosion. Industry estimates suggest that corrosion costs industries billions of dollars annually in repair, replacement, and downtime. As such, proactive corrosion monitoring, identified as a critical component of asset integrity management, offers a significant return on investment by preventing costly failures and extending the lifespan of valuable assets. This economic pressure is particularly acute in capital-intensive sectors like oil and gas, chemical processing, and power generation, where even minor leaks or structural weaknesses can lead to catastrophic consequences and immense financial repercussions.

Secondly, stringent environmental regulations and an increasing global focus on sustainability are playing a pivotal role. Governments and international bodies are implementing stricter guidelines to prevent environmental pollution and ensure public safety. Corrosion is a primary culprit behind leaks and spills in pipelines, storage tanks, and other critical infrastructure, posing serious environmental risks. Consequently, industries are compelled to invest in advanced corrosion monitoring technologies to comply with these regulations and avoid hefty fines, legal liabilities, and reputational damage. The growing emphasis on preventing environmental disasters and ensuring safe operations further amplifies the demand for reliable and effective corrosion monitoring solutions, contributing to the market's robust growth and estimated value in the hundreds of millions of dollars.

Despite the promising growth trajectory, the corrosion monitoring market is not without its challenges and restraints that influence its development throughout the study period of 2019-2033. A significant hurdle remains the initial capital investment required for implementing advanced corrosion monitoring systems. While the long-term benefits of these technologies are undeniable, the upfront costs associated with sophisticated sensors, data acquisition hardware, and software platforms can be a deterrent, especially for small and medium-sized enterprises (SMEs) or industries operating with tight budgets. This can lead to a fragmented adoption rate, with larger corporations readily investing while smaller entities lag behind.

Another critical challenge is the availability of skilled personnel capable of operating, maintaining, and interpreting the data generated by these advanced systems. The evolving nature of corrosion monitoring technologies, incorporating AI, machine learning, and complex data analytics, demands a specialized workforce with expertise in both engineering and data science. A shortage of such professionals can hinder the effective deployment and utilization of these solutions, limiting their full potential. Furthermore, the integration of new monitoring systems with existing legacy infrastructure often presents technical complexities and compatibility issues. Ensuring seamless data flow and interoperability between diverse systems can be a time-consuming and resource-intensive process, acting as a restraint on widespread adoption and contributing to the estimated market value, which, while substantial, could be even higher with these challenges addressed.

The global Corrosion Monitoring market is poised for significant regional and segmental dominance, with specific areas and technological approaches set to lead the expansion throughout the study period of 2019-2033.

Dominant Region:

Dominant Segment (Type):

Dominant Segment (Application):

While North America and the Oil and Gas sector are projected to lead, it is important to note the significant contributions and growth potential of other regions like Europe and Asia-Pacific, and other application segments such as Chemical and Power Generation, which are also experiencing substantial demand for effective corrosion monitoring solutions.

Several key factors are acting as significant growth catalysts for the corrosion monitoring industry, propelling its expansion and innovation throughout the study period. The increasing focus on asset integrity management (AIM) across all industrial sectors is a primary driver. Companies are shifting from reactive maintenance to proactive strategies to prevent failures, extend asset life, and ensure operational safety. This shift directly translates into a higher demand for sophisticated corrosion monitoring solutions. Furthermore, advancements in Internet of Things (IoT) technology are enabling the development of smart sensors that can continuously collect real-time data on corrosion rates and conditions, feeding into cloud-based platforms for analysis. This real-time data empowers predictive maintenance, allowing for timely interventions before critical damage occurs.

The global Corrosion Monitoring market is characterized by the presence of a number of key players who are instrumental in driving innovation and market growth. These companies offer a wide range of solutions encompassing various monitoring types and catering to diverse industry needs.

The corrosion monitoring sector has witnessed several pivotal developments that have reshaped its landscape and driven market evolution. These advancements, spanning technological breakthroughs, strategic partnerships, and evolving industry standards, have been crucial in enhancing the effectiveness and accessibility of corrosion management solutions.

This report provides a holistic view of the Corrosion Monitoring market, meticulously examining its dynamics from the historical period of 2019-2024, through the base and estimated year of 2025, and projecting its growth and evolution throughout the forecast period of 2025-2033. With an estimated market value reaching into the hundreds of millions of dollars, this comprehensive analysis delves into the intricate interplay of technological advancements, regulatory frameworks, and the persistent need for robust asset integrity management. Our objective is to furnish stakeholders with actionable intelligence, enabling them to effectively navigate this critical and ever-evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Honeywell, ClampOn, Emerson, Intertek, SGS Group, Applied Corrosion Monitoring, Buckleys (UVRAL), ChemTreat, Korosi Specindo, Circul-Aire, Cosasco, Huguenot Laboratories, Icorr Technologies, Pyramid Technical Services, Rysco Corrosion Services, BAC Corrosion Control, Aquarius Technologies, Alabama Specialty Products, .

The market segments include Type, Application.

The market size is estimated to be USD 301.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Corrosion Monitoring," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Corrosion Monitoring, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.