1. What is the projected Compound Annual Growth Rate (CAGR) of the Corded Contractor Table Saws for Woodworking?

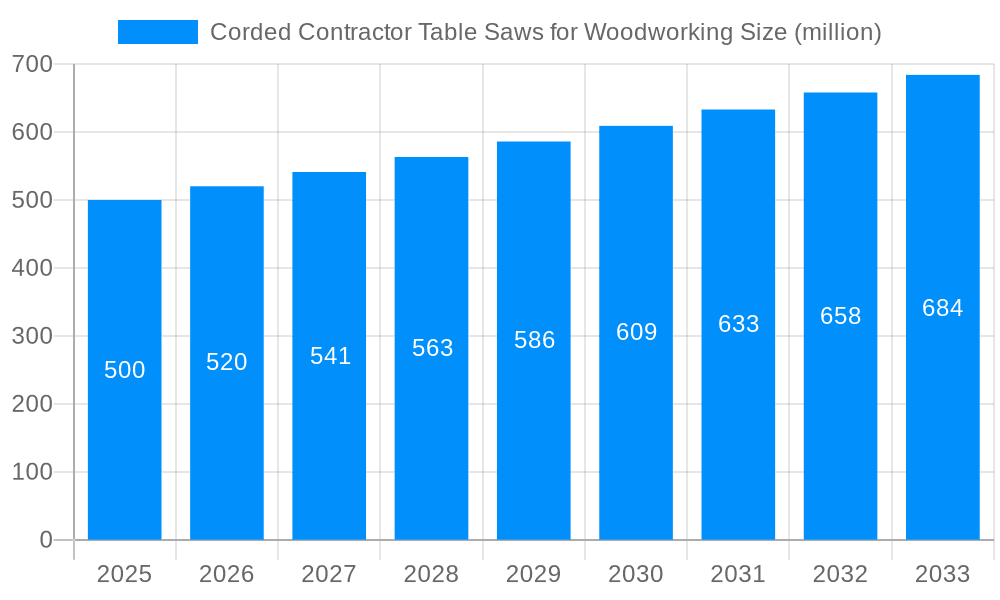

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Corded Contractor Table Saws for Woodworking

Corded Contractor Table Saws for WoodworkingCorded Contractor Table Saws for Woodworking by Type (Below 10Inch, 10-12Inch, Above 12Inch), by Application (Industrial, Household), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

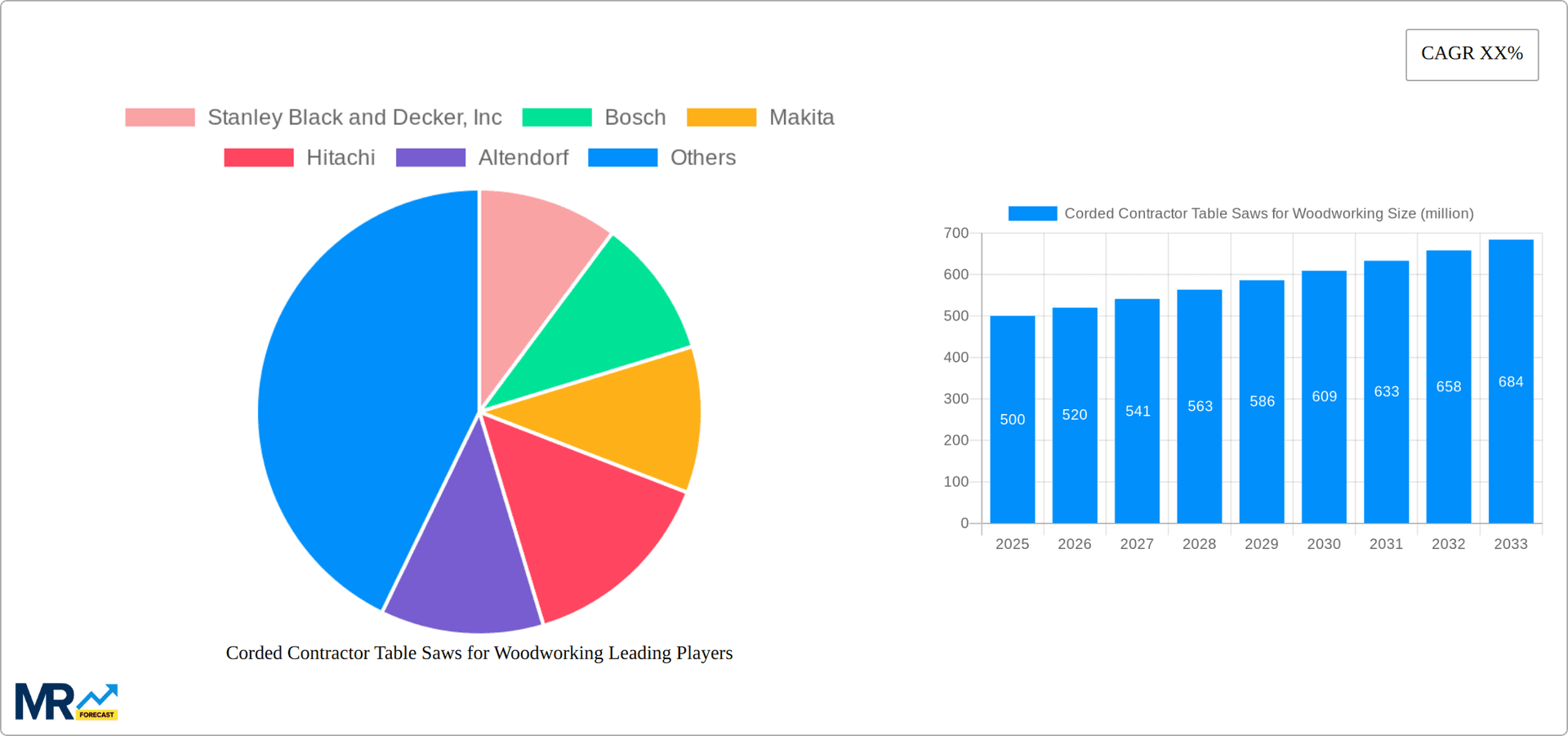

The global corded contractor table saw market, a vital segment of the power tool industry, is poised for robust expansion. Driven by sustained demand for professional-grade woodworking equipment and escalating construction activities worldwide, the market is projected to reach $2.5 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. This upward trajectory is primarily attributed to contractors' continued preference for corded tools, valuing their unwavering power and reliability over cordless alternatives in high-demand applications. The growing appeal of DIY woodworking and home renovation projects further bolsters consumer demand. However, market expansion is tempered by the increasing adoption of cordless technology, rising material costs, and intensified competition from manufacturers offering diverse product lines. Market segmentation highlights significant demand for high-performance models equipped with advanced safety features, influencing sales across various manufacturers. Leading brands such as Stanley Black & Decker, Bosch, and Makita dominate through established distribution networks and strong brand equity, while emerging players differentiate through innovation and competitive pricing. Geographically, North America and Europe represent key markets, underpinned by mature construction sectors and a high propensity for professional woodworking tool adoption.

The future vitality of the corded contractor table saw market relies on manufacturers' agility in responding to evolving consumer needs. Innovations such as advanced safety technologies, exemplified by SawStop's blade-braking system, alongside enhanced customization and improved energy efficiency to address environmental considerations, will be critical. Strategic pricing and robust distribution partnerships will be instrumental in capturing market share. While the proliferation of cordless technology presents a notable challenge, the inherent power and reliability of corded saws guarantee their continued relevance in professional woodworking, especially in specialized applications demanding high torque and prolonged, uninterrupted operation. The long-term outlook remains optimistic, forecasting consistent, moderate growth fueled by the persistent requirements of the professional woodworking sector.

The global corded contractor table saw market for woodworking experienced robust growth during the historical period (2019-2024), exceeding 20 million units sold annually by 2024. This growth is projected to continue, albeit at a more moderated pace, throughout the forecast period (2025-2033), driven by several factors detailed below. The estimated market size in 2025 is pegged at approximately 22 million units, indicating a steady increase in demand. While cordless models are gaining traction, corded contractor table saws remain the workhorse for many professionals and serious DIY enthusiasts due to their superior power and consistent performance. This segment benefits from strong brand loyalty and a well-established distribution network. Key trends impacting the market include increasing adoption of safety features (like riving knives and blade guards), a push towards greater portability and maneuverability in certain models, and the ongoing demand for enhanced precision and cutting capacity. The market has also seen a rise in specialized table saws catering to niche woodworking applications, contributing to overall market expansion. The preference for durability and longevity, especially among professional contractors, continues to favor corded models due to their proven reliability. Finally, the relatively lower initial cost compared to some high-end cordless alternatives sustains the significant market share of corded contractor table saws. This report analyzes these trends in detail, providing comprehensive insights into the market dynamics and future prospects across various regions and segments.

Several key factors are driving the growth of the corded contractor table saw market. Firstly, the sustained demand from the construction and woodworking industries remains a significant engine of growth. Large-scale infrastructure projects and the ongoing popularity of DIY and home renovation contribute to consistent demand for reliable and powerful cutting tools. Secondly, the affordability of corded models compared to their cordless counterparts makes them attractive to budget-conscious consumers, both professional and amateur. Thirdly, the superior power and cutting performance offered by corded saws are crucial for professionals undertaking demanding projects, leading to continued preference for this technology. The well-established distribution networks and readily available replacement parts also contribute to sustained demand. Moreover, continuous product innovation, leading to improvements in safety features, ease of use, and overall cutting precision, further fuels market growth. Finally, ongoing economic growth in developing nations, where the construction and woodworking sectors are rapidly expanding, opens up significant new market opportunities for corded contractor table saws.

Despite the positive growth trajectory, the corded contractor table saw market faces several challenges. The increasing popularity of cordless table saws presents a significant competitive threat. Cordless models offer greater portability and freedom of movement, appealing to users working in confined spaces or on mobile projects. The higher initial cost of cordless saws, however, continues to favour corded models. Another constraint is the growing emphasis on safety regulations and the need for manufacturers to continuously improve the safety features of their products to meet these evolving standards. Additionally, fluctuating prices of raw materials, such as steel and other components used in table saw manufacturing, can impact the overall profitability and pricing of the product. Furthermore, growing concerns about environmental impact and energy consumption associated with corded tools could influence consumer choices in favor of more eco-friendly alternatives. Finally, technological advancements in other wood cutting methods, like CNC routers, might pose a long-term challenge for traditional table saws, although these alternative technologies typically target different market segments and application needs.

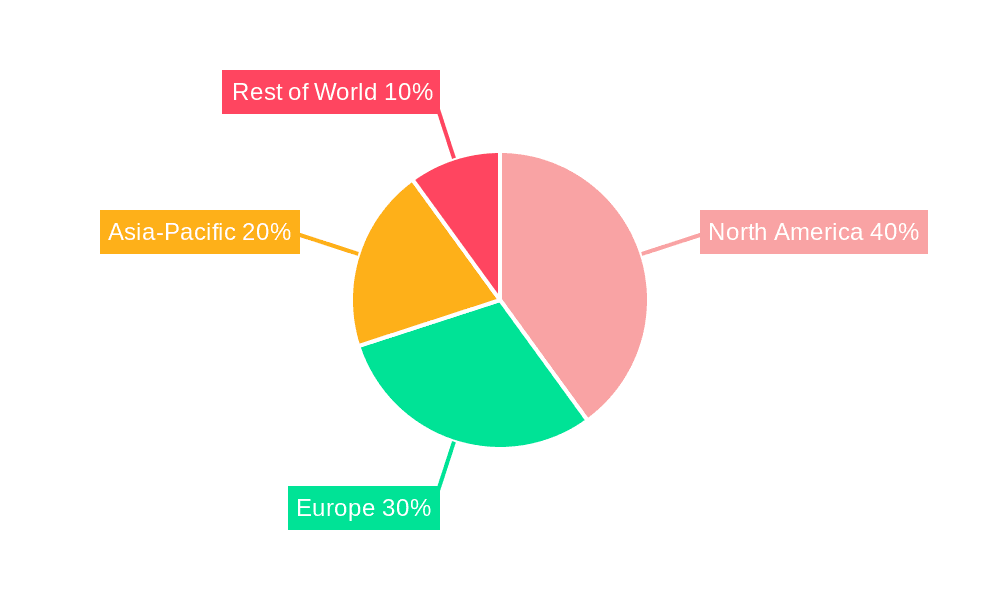

North America: This region is expected to dominate the market due to a large construction sector, a high prevalence of DIY projects, and a robust demand for professional-grade woodworking tools. The established presence of major manufacturers and a developed distribution network also contribute to this region's dominance.

Europe: The European market demonstrates substantial growth potential, driven by consistent demand from the construction and renovation industries across several countries. However, the market is characterized by a mix of both large-scale industrial users and individual DIY enthusiasts, impacting the types of saws in demand.

Asia-Pacific: Rapid urbanization and infrastructure development in several Asian countries are propelling significant growth in the corded table saw market. This region's growth is driven by both professional and industrial sectors, although it may lag slightly behind North America and Europe in terms of overall market size due to various economic and infrastructural factors.

Professional Segment: Contractors and professional woodworkers comprise a key segment, demanding high power, durability, and accuracy, thus driving the demand for high-end corded table saws. This segment shows a high degree of brand loyalty and a consistent willingness to invest in quality tools.

DIY Enthusiast Segment: The growing DIY culture and home renovation projects fuel demand in the amateur segment. This segment often balances affordability with functionality and may favor models offering a blend of price and performance.

The dominance of North America is expected to persist throughout the forecast period, followed by Europe and Asia-Pacific. However, the growth rates in the latter two regions might outpace North America, potentially narrowing the market share differences in the coming years. The professional segment will likely retain its significant share, while the DIY segment will show steady growth, albeit at a potentially lower rate compared to the professional sector.

The corded contractor table saw market is experiencing growth due to the enduring demand from construction and woodworking professionals, coupled with the rising popularity of DIY projects among consumers. Continuous innovation leading to safer, more efficient, and user-friendly models further catalyzes market expansion. The relatively lower cost compared to cordless models maintains its competitive edge, particularly among budget-conscious buyers. Finally, growing infrastructure development in emerging economies presents significant untapped market potential.

This report provides a detailed analysis of the corded contractor table saw market, encompassing market size estimations, growth projections, and key trend identification. It offers invaluable insights for manufacturers, distributors, and investors seeking to understand the dynamics of this important sector within the broader woodworking tools industry. The report includes granular data on market segments, regional breakdowns, competitive landscapes, and future growth forecasts for the study period of 2019-2033.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Stanley Black and Decker, Inc, Bosch, Makita, Hitachi, Altendorf, TTI, Felder Group USA, General International, Nanxing, Powermatic, SCM Group, JET Tool, Rexon Industrial Corp., Ltd., SawStop, LLC, Otto Martin Maschinenbau, Cedima, .

The market segments include Type, Application.

The market size is estimated to be USD 2.5 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Corded Contractor Table Saws for Woodworking," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Corded Contractor Table Saws for Woodworking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.