1. What is the projected Compound Annual Growth Rate (CAGR) of the Controlled and Slow Release Fertilizers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Controlled and Slow Release Fertilizers

Controlled and Slow Release FertilizersControlled and Slow Release Fertilizers by Type (Organic Low-Solubility Fertilizers, Inorganic Low-Solubility Fertilizers, Coated & Encapsulated Fertilizers), by Application (Cereals & Grains, Fruits & Vegetables, Oil Seeds and Pulses, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

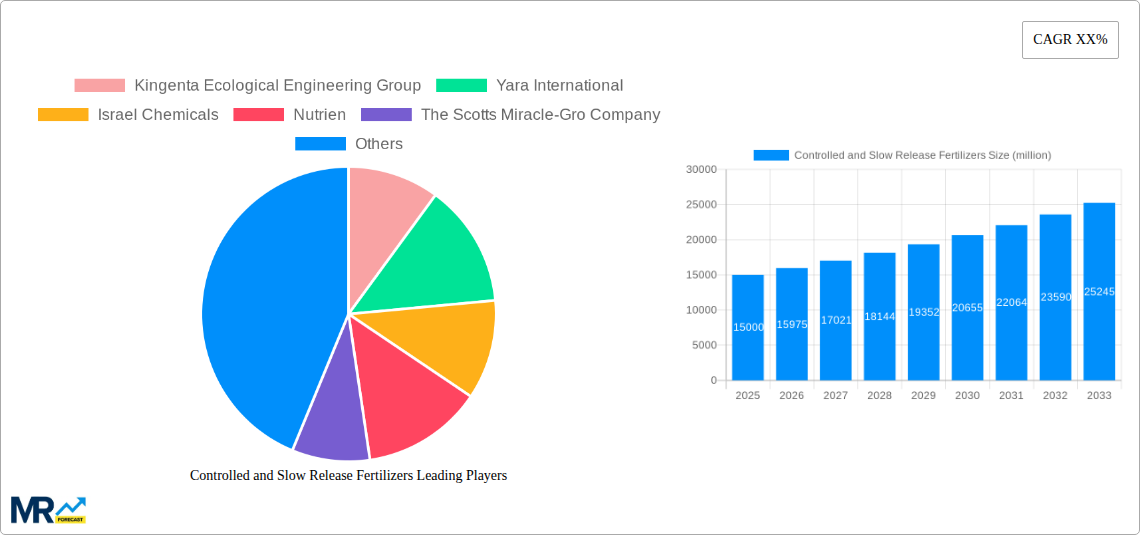

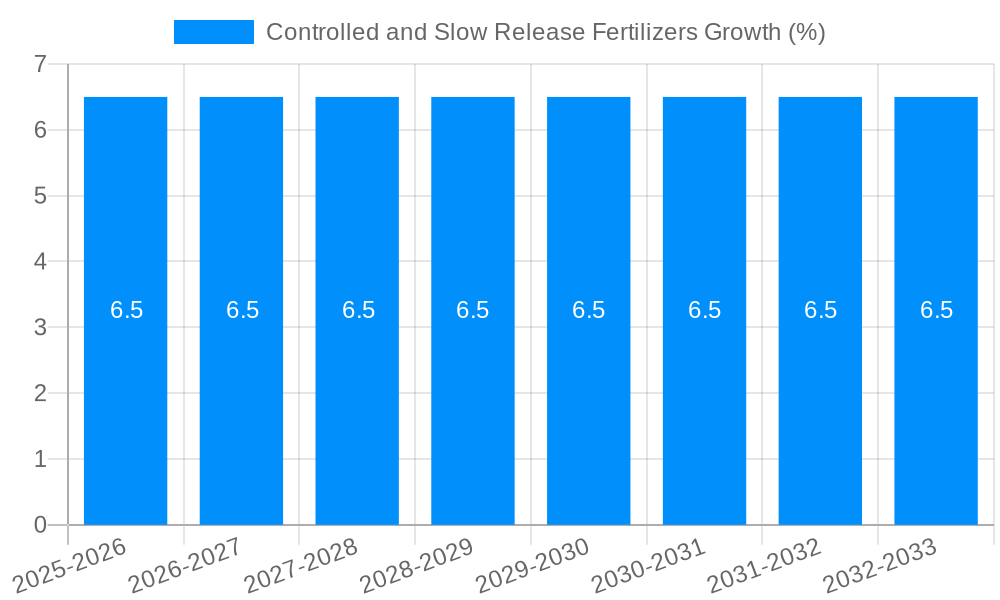

The global market for controlled and slow-release fertilizers is experiencing robust expansion, driven by an increasing demand for enhanced agricultural productivity and sustainable farming practices. With an estimated market size of approximately $15,000 million in 2025, this sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This upward trajectory is primarily fueled by the need to optimize nutrient delivery to crops, thereby minimizing environmental impact through reduced leaching and volatilization. Key drivers include a growing global population necessitating higher food production, the rising adoption of precision agriculture techniques, and government initiatives promoting nutrient use efficiency. The market is segmented into various types, including Organic Low-Solubility Fertilizers, Inorganic Low-Solubility Fertilizers, and Coated & Encapsulated Fertilizers, each catering to specific crop needs and soil conditions. Cereals & Grains and Fruits & Vegetables represent the largest application segments, reflecting their significant contribution to global food security and value chains.

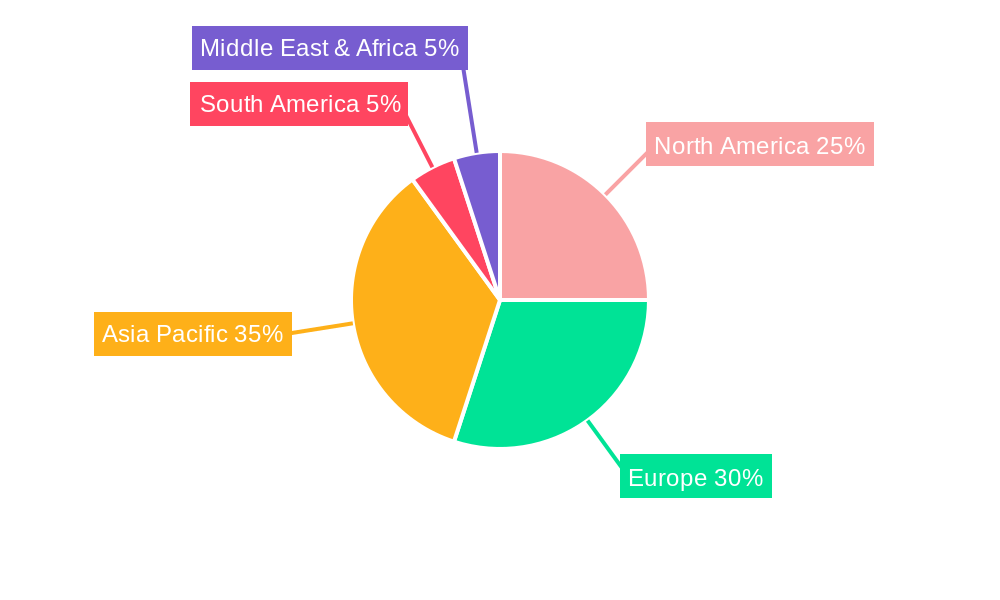

Further analysis reveals that the adoption of coated and encapsulated fertilizers is gaining momentum due to their ability to precisely control nutrient release over extended periods, aligning with plant growth stages. This technological advancement is a significant trend, enabling farmers to achieve better yields with fewer applications, leading to cost savings and reduced environmental footprints. While the market benefits from these strong growth factors, certain restraints, such as the higher initial cost of advanced formulations compared to conventional fertilizers and a lack of awareness in some developing regions, could temper the pace of widespread adoption. Nevertheless, leading companies like Yara International, Nutrien, and Kingenta Ecological Engineering Group are actively investing in research and development to innovate and expand their product portfolios, particularly in regions like Asia Pacific and Europe where adoption rates are already high and demand for sustainable solutions is escalating. North America also presents a substantial market, driven by technological advancements and a focus on sustainable agricultural practices.

The global market for controlled and slow release fertilizers is experiencing a significant upswing, driven by a confluence of factors including increasing agricultural productivity demands, heightened environmental consciousness, and advancements in fertilizer technology. During the Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, and a Forecast Period spanning from 2025-2033, the market has demonstrated robust growth. The Historical Period of 2019-2024 laid the foundation for this expansion, witnessing a growing adoption of these specialized fertilizers due to their superior efficiency and reduced environmental impact compared to conventional alternatives. XXX, a key market insight, indicates a projected market valuation reaching USD 25,000 million by 2033, a substantial increase from its estimated USD 18,000 million in 2025. This growth is intrinsically linked to the escalating need for sustainable agricultural practices that optimize nutrient delivery to crops while minimizing losses through leaching and volatilization. As global food demand continues to rise, expected to cater to a population exceeding 9,000 million in the coming decades, farmers are increasingly turning to controlled and slow release fertilizers as a cornerstone of precision agriculture. These fertilizers offer a significant advantage by releasing nutrients gradually over an extended period, matching crop uptake patterns and reducing the frequency of application, thereby lowering labor costs and fuel consumption. Furthermore, the growing awareness of the detrimental effects of nutrient runoff on water bodies and greenhouse gas emissions associated with conventional fertilizer production and use is acting as a potent catalyst for the adoption of these advanced formulations. Innovations in coating technologies, such as polymer coatings and biodegradable materials, have further enhanced the performance and environmental profile of these fertilizers, making them more accessible and effective across a wider range of crops and soil types. The market is also witnessing a diversification in product offerings, with manufacturers developing tailored solutions for specific crop needs and climatic conditions, further fueling market penetration and growth.

The surge in demand for controlled and slow release fertilizers is primarily propelled by the escalating global population, which necessitates higher agricultural yields to ensure food security. With an estimated population of over 8,000 million currently and projected to grow significantly, the pressure on agricultural land and resources is immense. Controlled and slow release fertilizers address this challenge by maximizing nutrient use efficiency, allowing crops to absorb essential nutrients over their growth cycle, thereby boosting yields. This efficiency translates to less fertilizer being required per unit of produce, making it an economically viable and environmentally responsible choice for farmers. Moreover, a growing global emphasis on sustainable agriculture and environmental stewardship is a powerful driver. Concerns about the environmental impact of conventional fertilizers, including nutrient runoff leading to eutrophication of water bodies and the contribution of nitrous oxide emissions to climate change, are pushing regulatory bodies and consumers towards more eco-friendly solutions. Controlled and slow release fertilizers significantly reduce nutrient losses, minimizing these environmental footprints. The continuous innovation and development of new coating technologies and formulations by leading manufacturers are also instrumental in propelling the market. These advancements have led to more precise nutrient release profiles, improved product longevity, and enhanced biodegradability, making these fertilizers more attractive and cost-effective for a broader spectrum of agricultural applications. The increasing adoption of precision agriculture techniques, which leverage data and technology to optimize farming practices, further complements the use of controlled and slow release fertilizers by enabling precise application based on crop needs and soil conditions, further cementing their position as a critical component of modern, sustainable farming systems.

Despite the promising growth trajectory, the controlled and slow release fertilizers market faces several challenges that temper its full potential. A significant restraint is the higher initial cost associated with these fertilizers compared to their conventional counterparts. While the long-term benefits of increased yield and reduced application frequency can offset this initial investment, the upfront expenditure can be a deterrent for many smallholder farmers, particularly in developing economies where capital availability is limited. Another critical challenge lies in the lack of awareness and technical expertise regarding the optimal use of these specialized fertilizers. Farmers often require extensive training and guidance on selecting the right product for their specific crop, soil type, and environmental conditions to achieve maximum efficacy. Misapplication can lead to suboptimal results, diminishing the perceived value of these advanced formulations. Furthermore, the complexity of manufacturing processes and the reliance on specialized raw materials for coating and encapsulation can pose supply chain challenges and contribute to production costs. Variations in weather patterns and soil conditions can also unpredictably influence the release rates of some controlled and slow release fertilizers, creating uncertainty for farmers and potentially impacting crop performance. Regulatory hurdles in certain regions, related to product registration and environmental impact assessments, can also introduce delays and add to the market entry costs for manufacturers. Addressing these challenges through education, demonstration programs, and the development of more cost-effective and adaptable formulations will be crucial for unlocking the full market potential of controlled and slow release fertilizers.

The global controlled and slow release fertilizers market exhibits distinct regional dominance and segment penetration, with several key players vying for market share.

Region/Country Dominance:

Segment Dominance:

The interplay between these regions and segments creates a dynamic market landscape, with continuous innovation and strategic investments shaping the future of controlled and slow release fertilizers.

Several key factors are acting as growth catalysts for the controlled and slow release fertilizers industry. The escalating global population, projected to reach over 9,000 million by 2033, necessitates increased food production, driving the demand for efficient nutrient management solutions. Growing environmental concerns and stricter regulations regarding nutrient runoff and greenhouse gas emissions are pushing farmers towards sustainable fertilizer alternatives. The continuous technological advancements in coating and encapsulation techniques are leading to more precise and effective nutrient release, enhancing their appeal. Furthermore, government initiatives promoting sustainable agriculture and precision farming practices are creating a favorable market environment.

This comprehensive report delves into the intricate dynamics of the global controlled and slow release fertilizers market, providing a thorough analysis of trends, drivers, and challenges. It meticulously examines key market insights, including projections for market size, growth rates, and segmentation. The report offers in-depth coverage of leading companies and their strategic initiatives, alongside an exploration of significant industry developments. With a study period spanning from 2019 to 2033, it provides historical context, a detailed analysis of the base and estimated year 2025, and a robust forecast for the period 2025-2033, equipping stakeholders with invaluable information for strategic decision-making in this evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kingenta Ecological Engineering Group, Yara International, Israel Chemicals, Nutrien, The Scotts Miracle-Gro Company, Sociedad Quimica Y Minera, Haifa Chemicals, Compo, Aglukon Spezialduenger, Tessenderlo Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Controlled and Slow Release Fertilizers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Controlled and Slow Release Fertilizers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.