1. What is the projected Compound Annual Growth Rate (CAGR) of the Continuously Variable Transmission Oil?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Continuously Variable Transmission Oil

Continuously Variable Transmission OilContinuously Variable Transmission Oil by Type (GL-1~GL-3, GL-4, GL-5), by Application (Passenger Vehicle, Heavy-duty Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

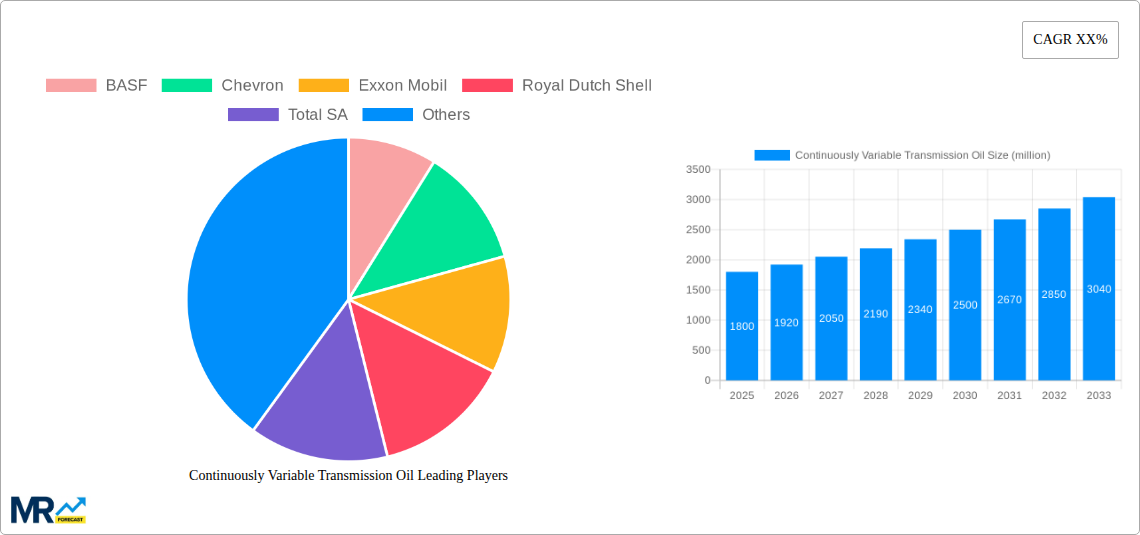

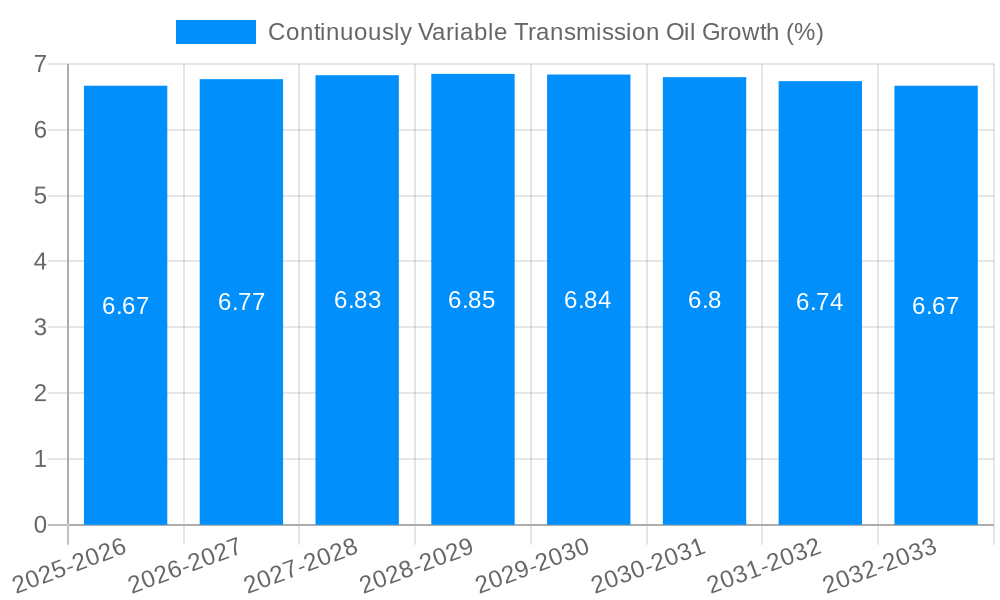

The global Continuously Variable Transmission (CVT) oil market is projected to experience robust growth, driven by the increasing adoption of CVTs in passenger vehicles worldwide. With an estimated market size of approximately USD 1,800 million in 2025, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This upward trajectory is primarily fueled by the inherent advantages of CVTs, such as improved fuel efficiency and a smoother driving experience, which are highly sought after by consumers and regulatory bodies alike. The demand for advanced CVT fluids that offer superior wear protection, thermal stability, and extended drain intervals is on the rise. These enhanced formulations are critical for the longevity and optimal performance of the increasingly sophisticated CVT systems found in modern vehicles, thereby supporting the market's expansion.

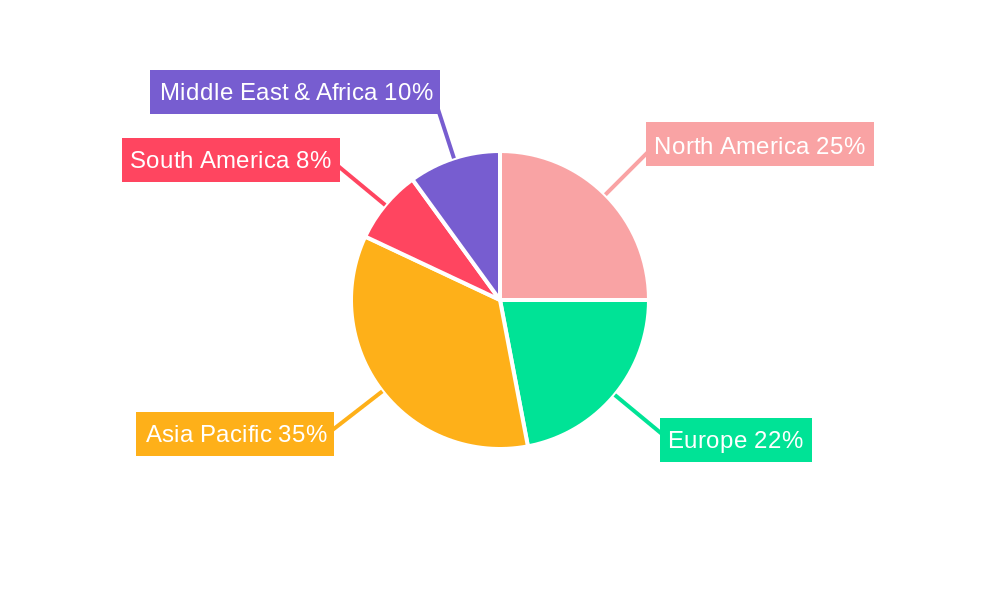

The market is segmented by type into GL-1 to GL-3, GL-4, and GL-5, with GL-4 and GL-5 fluids likely dominating due to their advanced performance characteristics suitable for a wider range of CVT applications. In terms of application, passenger vehicles are the primary demand driver, accounting for the largest share. However, the growing use of CVTs in heavy-duty vehicles also presents a significant growth avenue. Geographically, the Asia Pacific region, led by China and Japan, is expected to be the largest and fastest-growing market, owing to its dominant position in automotive manufacturing and the widespread adoption of CVTs. North America and Europe also represent substantial markets, influenced by stringent fuel economy regulations and a strong preference for technologically advanced vehicles. Key players like BASF, Chevron, Exxon Mobil, and Royal Dutch Shell are actively investing in research and development to introduce innovative CVT oil formulations that meet evolving industry standards and consumer expectations.

The global Continuously Variable Transmission (CVT) oil market is poised for substantial expansion, projecting a compound annual growth rate (CAGR) of over 5% from a market size of approximately 1,800 million units in 2024 to an estimated 2,800 million units by 2033. This robust growth trajectory is underpinned by several interconnected trends that are reshaping the automotive landscape and the demand for specialized lubricants. At its core, the increasing adoption of Continuously Variable Transmissions (CVTs) in passenger vehicles, driven by their inherent fuel efficiency advantages and smoother driving experience, is the primary catalyst. As manufacturers prioritize reducing CO2 emissions and enhancing fuel economy to meet stringent regulatory standards, CVTs are becoming a mainstream technology, particularly in compact and mid-size car segments. This surge in CVT deployment directly translates to a higher demand for high-performance CVT fluids, which are critical for optimal transmission operation, longevity, and efficiency.

Furthermore, advancements in lubricant technology are playing a pivotal role. The evolution of base oils and additive packages has led to the development of CVT oils with enhanced thermal stability, superior wear protection, and improved friction management capabilities. These advanced formulations are essential to handle the unique operational demands of CVTs, which often involve continuous slippage and high operating temperatures. The market is also witnessing a growing preference for synthetic and semi-synthetic CVT oils over conventional mineral oils, owing to their superior performance characteristics and extended drain intervals. This shift towards premium lubricants is further boosted by the increasing sophistication of vehicle designs and the rising consumer expectations for reliability and performance. The report will meticulously analyze these evolving trends, providing granular insights into their impact on market segmentation, regional dynamics, and the competitive landscape. The interplay between technological innovation, regulatory pressures, and consumer preferences will be thoroughly examined to offer a comprehensive understanding of the forces shaping the future of the CVT oil market.

The proliferation of Continuously Variable Transmission (CVT) oil is primarily propelled by the global imperative to enhance fuel efficiency and reduce vehicular emissions. As environmental regulations become increasingly stringent, particularly in major automotive markets, manufacturers are actively integrating CVTs into their vehicle lineups. CVTs, by their nature, allow engines to operate within their most efficient RPM range for a broader spectrum of vehicle speeds, thereby significantly improving fuel economy compared to traditional automatic or manual transmissions. This inherent advantage makes them a favored choice for passenger vehicles, and to a lesser extent, for certain heavy-duty applications where optimized operational efficiency is paramount. The widespread adoption of these fuel-saving transmissions, therefore, directly translates to a surging demand for specialized CVT oils, which are engineered to meet the unique frictional, thermal, and anti-wear requirements of these intricate powertrains.

Beyond fuel efficiency, the driving experience offered by CVTs also contributes to their growing popularity. The seamless acceleration and smooth gear transitions provided by CVTs are highly appreciated by consumers, leading to increased market acceptance and demand. This positive consumer perception encourages automakers to further invest in CVT technology and, consequently, in the development and supply of high-quality CVT fluids. The continuous refinement of CVT technology, aimed at improving performance, durability, and compatibility with a wider range of vehicle types, further fuels the demand for compatible and advanced CVT oils. As CVTs evolve, so too must the lubricants that serve them, creating a symbiotic relationship that drives innovation and market growth for CVT oil manufacturers.

Despite the promising growth trajectory, the Continuously Variable Transmission (CVT) oil market encounters several significant challenges and restraints that could temper its expansion. A primary concern is the high cost of specialized CVT oils compared to conventional transmission fluids. The complex formulations, which often involve advanced additive packages and high-quality base stocks, contribute to a higher price point. This can be a deterrent for price-sensitive consumers, especially in emerging markets, potentially hindering the widespread adoption of premium CVT fluids. Furthermore, the technical complexity and evolving nature of CVT technology itself present a challenge for lubricant manufacturers. As CVT designs continue to evolve and new variations emerge, there is a constant need for research and development to ensure that CVT oils are compatible and perform optimally across a diverse range of transmission systems. This necessitates continuous investment in R&D, which can be resource-intensive.

Another considerable restraint is the lack of standardization in CVT fluid specifications. Unlike traditional automatic transmission fluids with established industry standards, CVT fluid specifications can vary significantly between different Original Equipment Manufacturers (OEMs) and even between different CVT models from the same manufacturer. This fragmentation can lead to confusion among consumers and workshops, making it challenging to identify the correct CVT oil for a specific vehicle. Consequently, there's a risk of using incompatible fluids, which can lead to premature transmission wear, performance issues, and costly repairs. The growing preference for electric vehicles (EVs) also poses a long-term challenge. While EVs do not utilize traditional transmissions, their increasing market share could eventually reduce the overall demand for internal combustion engine (ICE) related lubricants, including CVT oils.

The global Continuously Variable Transmission (CVT) oil market is poised for significant dominance by specific regions and segments, driven by a confluence of factors including vehicle production, technological adoption, and regulatory landscapes.

Dominant Segments:

Application: Passenger Vehicle: This segment is unequivocally the most dominant force in the CVT oil market.

Type: GL-4: While GL-5 is prevalent in many conventional transmissions, the GL-4 segment is expected to hold a considerable share within the CVT oil market, especially for older or less performance-intensive CVT applications.

Dominant Regions:

Asia-Pacific: This region is projected to be the largest and fastest-growing market for CVT oils.

North America: This region represents another significant market for CVT oils, driven by stringent fuel economy regulations and consumer demand for fuel-efficient vehicles.

The growth of the Continuously Variable Transmission (CVT) oil industry is primarily fueled by the increasing adoption of CVTs in passenger vehicles, driven by their superior fuel efficiency and smoother driving experience. This trend is further amplified by global regulatory pressures to reduce emissions and enhance fuel economy, compelling automakers to integrate CVTs across a wider range of models. Advancements in lubricant technology, leading to more sophisticated and high-performance CVT fluids with enhanced thermal stability and wear protection, also act as a significant growth catalyst, enabling longer drain intervals and improved transmission longevity.

This report offers an exhaustive analysis of the Continuously Variable Transmission (CVT) oil market, meticulously forecasting its trajectory from 2019 to 2033. The study provides in-depth insights into market drivers such as the escalating adoption of fuel-efficient CVTs in passenger vehicles and the impact of stringent emission regulations. It also delves into the challenges, including the high cost of specialized fluids and the lack of standardization. Crucially, the report identifies key regions, particularly Asia-Pacific and North America, and dominant segments like passenger vehicles, which are expected to lead market growth. It will also detail the competitive landscape, highlighting the strategies and innovations of leading players like BASF, Chevron, and Exxon Mobil.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BASF, Chevron, Exxon Mobil, Royal Dutch Shell, Total SA, British Petroleum, Fuchs Petrolub, Lubrizol, Lukoil, Petroliam Nasional Berhad, Amsoil, Pennzoil, Valvoline, PetroChina, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Continuously Variable Transmission Oil," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Continuously Variable Transmission Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.