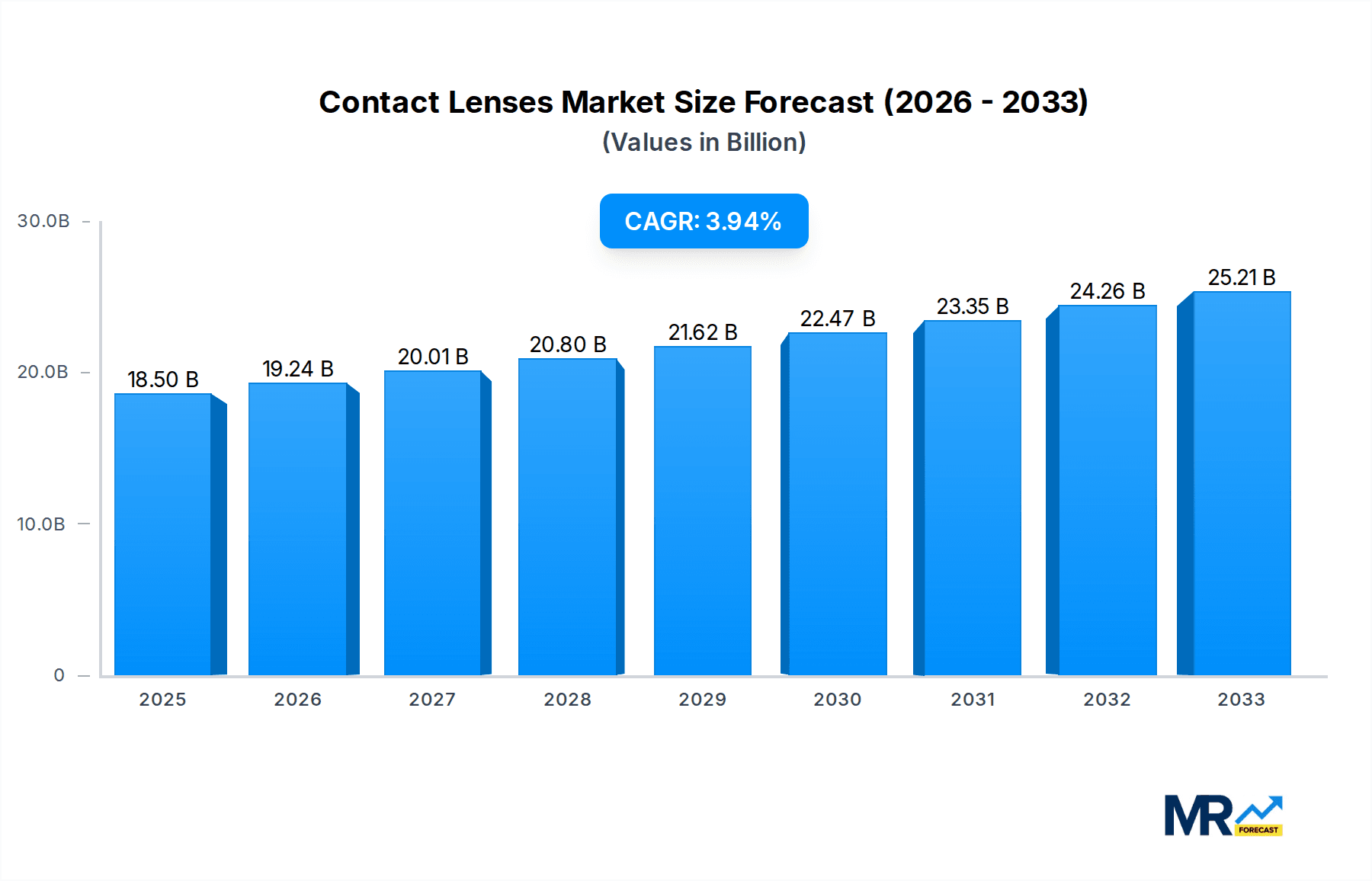

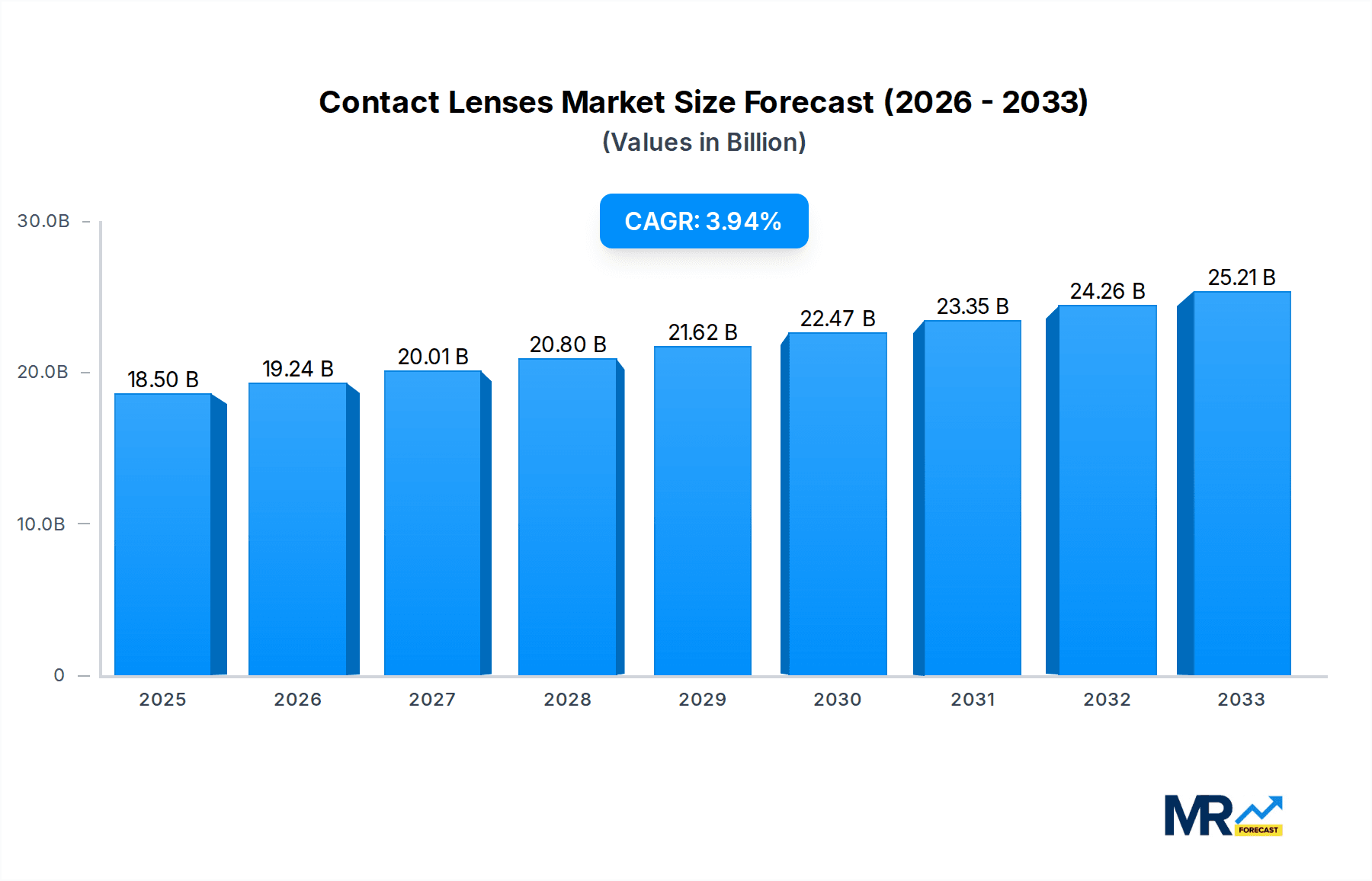

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contact Lenses?

The projected CAGR is approximately 4.0%.

Contact Lenses

Contact LensesContact Lenses by Application (Spherical, Toric, Multifocal, Cosmetic), by Type (Rigid Contact Lenses, Hybrid Contact Lenses, Soft Contact Lenses), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global contact lens market is poised for robust expansion, projected to reach an estimated $18,500 million by 2025. This growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.0% throughout the forecast period of 2019-2033. The increasing prevalence of refractive errors, coupled with a growing aesthetic consciousness and the demand for convenient vision correction solutions, are primary drivers propelling this market forward. Advancements in material science and lens technology are leading to the development of more comfortable, breathable, and functionally superior lenses, including multifocal and toric designs catering to diverse visual needs. The soft contact lens segment, particularly daily disposable lenses, continues to dominate due to their convenience and reduced risk of complications, while innovations in rigid gas permeable (RGP) and hybrid lenses are expanding their applications for complex vision correction.

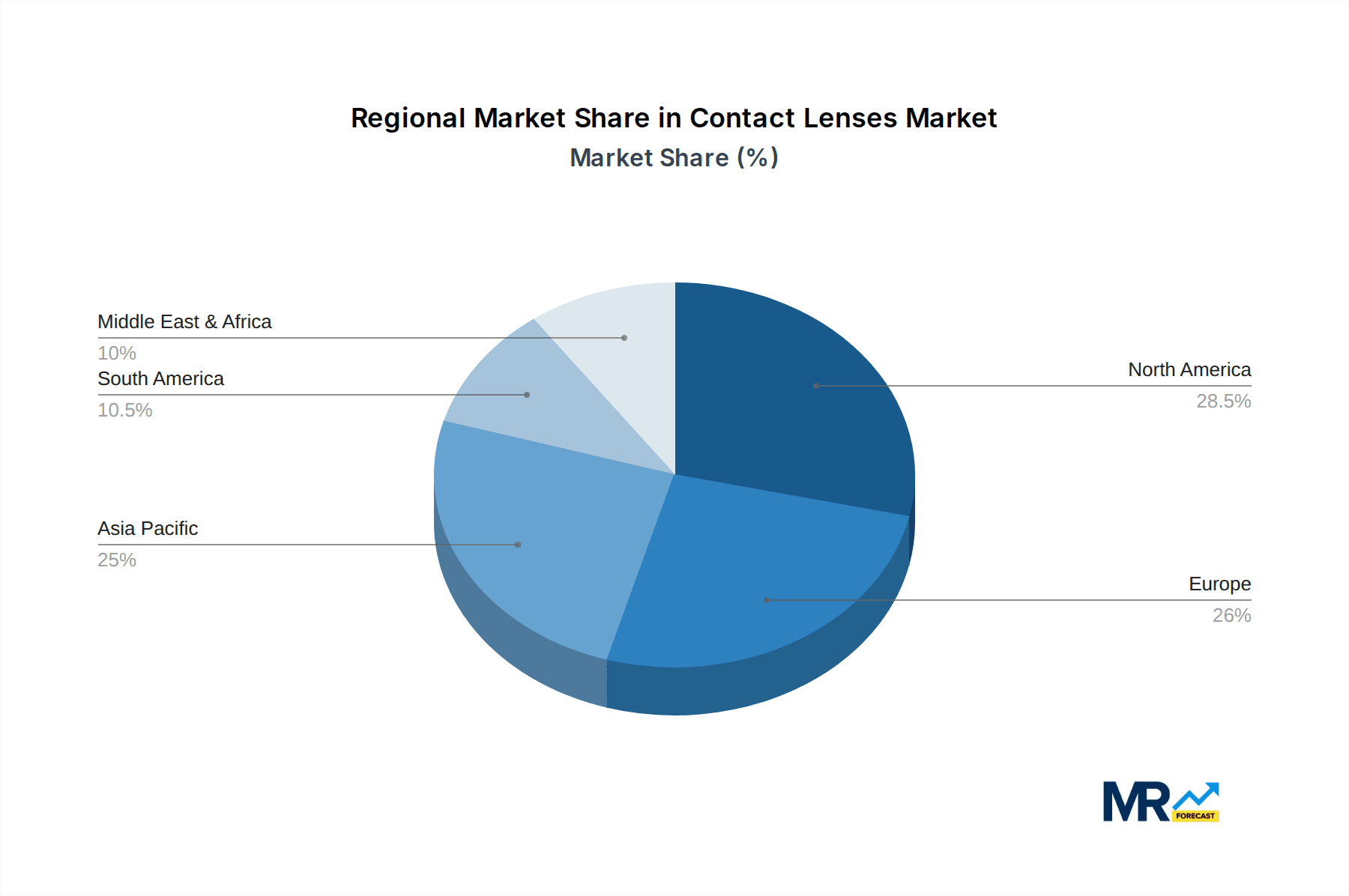

The market is further energized by emerging trends such as the rise of cosmetic contact lenses, offering aesthetic enhancements alongside vision correction, and the increasing adoption of smart contact lenses with integrated digital functionalities. However, potential restraints include the high cost of advanced lens technologies, the risk of eye infections associated with improper lens care, and the growing popularity of refractive surgeries as an alternative permanent solution. Geographically, the Asia Pacific region is expected to witness the fastest growth, driven by a burgeoning middle class, increasing disposable incomes, and a rising awareness of eye health. North America and Europe currently represent significant market shares, supported by well-established healthcare infrastructures and a high prevalence of vision impairments. Key players like Johnson & Johnson Vision Care, Novartis, and CooperVision are actively engaged in research and development, strategic acquisitions, and product launches to maintain their competitive edge in this dynamic market.

The global contact lenses market, projected to reach a staggering XXX million in value by 2033, is undergoing a significant transformation driven by an increasing awareness of eye health, the aesthetic appeal of cosmetic lenses, and advancements in material science. The study period, spanning from 2019 to 2033, with a base year of 2025, has witnessed a consistent upward trajectory. During the historical period (2019-2024), the market laid a robust foundation, primarily fueled by the demand for vision correction. As we move into the forecast period (2025-2033), the market's expansion is expected to accelerate, propelled by several key trends. A significant shift towards multifocal contact lenses is being observed, catering to the growing presbyopia population, which is a direct consequence of an aging global demographic. Furthermore, the burgeoning demand for cosmetic contact lenses, offering a vibrant palette of colors and enhancement options, is attracting a younger, trend-conscious consumer base. This segment, while historically niche, is rapidly gaining traction and contributing substantially to overall market growth. Innovations in silicone hydrogel materials have also revolutionized the industry, offering enhanced breathability and comfort, thereby extending wear time and improving wearer satisfaction. This has led to a greater acceptance of daily disposable lenses, a segment poised for significant expansion due to convenience and reduced risk of infections. The integration of smart lens technology, though still in its nascent stages, holds immense potential for future growth, promising functionalities beyond simple vision correction. The increasing prevalence of digital devices and subsequent eye strain is also indirectly boosting the market, as consumers seek comfortable and effective solutions for prolonged screen use. Companies like Johnson & Johnson Vision Care, Novartis, and CooperVision are at the forefront of these innovations, consistently investing in research and development to meet the evolving needs of consumers and eye care professionals. The market's resilience, even in the face of economic fluctuations, underscores the essential nature of vision correction and the growing desire for aesthetic enhancement.

The contact lenses market is experiencing robust growth, propelled by a confluence of powerful driving forces. A fundamental driver is the escalating global prevalence of refractive errors, including myopia, hyperopia, and astigmatism. As populations expand and lifestyles increasingly involve prolonged digital screen time, the incidence of these vision impairments continues to rise, creating a sustained demand for effective correction solutions. Contact lenses, offering a convenient and aesthetically pleasing alternative to traditional eyeglasses, are increasingly favored by a wide demographic. Beyond functional correction, the surge in cosmetic contact lenses represents another significant growth engine. These lenses, offering a spectrum of colors and enhancements, cater to a growing desire for self-expression and aesthetic modification, particularly among younger generations. This trend is transforming contact lenses from purely medical devices into fashion accessories. Technological advancements in material science and lens design are also playing a crucial role. The development of advanced silicone hydrogel materials has significantly improved oxygen permeability, leading to enhanced comfort, reduced dryness, and the potential for extended wear, including overnight wear for some individuals. This innovation has boosted wearer compliance and satisfaction. Furthermore, the increasing adoption of daily disposable lenses, driven by convenience and hygiene benefits, is a substantial market contributor. The aging global population, with a growing incidence of presbyopia, is a critical factor boosting the demand for multifocal contact lenses. These lenses offer a solution for age-related farsightedness, allowing individuals to see clearly at various distances. The proactive approach to eye health and a greater understanding of the benefits of regular eye check-ups contribute to early diagnosis and prescription of contact lenses.

Despite its promising growth trajectory, the contact lenses market is not without its hurdles. A primary challenge lies in the management of eye infections and related complications. Improper hygiene, overuse, and the use of non-prescribed lenses can lead to serious eye health issues, necessitating stringent adherence to care regimens and regular professional consultations. This inherent risk can deter some potential users and necessitates significant consumer education initiatives. Another restraint is the high cost associated with some advanced contact lens technologies and specialized lenses, such as toric and multifocal variants, which can limit accessibility for price-sensitive consumers, particularly in emerging economies. The competitive landscape, while fostering innovation, also presents challenges. The presence of numerous global and regional players, including giants like Johnson & Johnson Vision Care and CooperVision, intensifies price competition and demands continuous investment in product differentiation and marketing. Stringent regulatory frameworks governing the approval and distribution of medical devices, including contact lenses, can also pose a challenge, leading to lengthy product development cycles and market entry barriers. Furthermore, the market faces a degree of inertia from individuals who are accustomed to wearing eyeglasses and are hesitant to switch to contact lenses due to perceived complexity of use or concerns about insertion and removal. The availability of sophisticated prescription eyeglasses that incorporate advanced features and designs also offers a competitive alternative. Ensuring proper fit and addressing issues like dry eyes, which can be exacerbated by certain lens types or environmental factors, remain ongoing challenges for both manufacturers and eye care professionals.

The contact lenses market is poised for significant dominance by specific regions and segments, driven by a blend of demographic, economic, and technological factors.

Key Regions/Countries to Dominate:

Dominant Segment: Soft Contact Lenses

The Soft Contact Lenses segment is anticipated to continue its reign as the dominant force within the contact lenses market. This dominance stems from several key advantages and widespread adoption:

While other segments like Rigid Contact Lenses and Hybrid Contact Lenses cater to specific niche requirements, their overall market share remains considerably smaller than that of soft contact lenses, solidifying its position as the undisputed leader.

The contact lenses industry is fueled by several potent growth catalysts. The escalating global prevalence of refractive errors, driven by increased screen time and an aging population, creates a fundamental and expanding demand for vision correction. The surging popularity of cosmetic contact lenses, driven by fashion trends and a desire for aesthetic enhancement, is attracting new consumer segments and boosting sales. Innovations in materials, such as advanced silicone hydrogels, have significantly improved comfort, breathability, and wearer satisfaction, encouraging wider adoption and longer wear times. The convenience and hygiene benefits of daily disposable lenses are a major driver, appealing to busy lifestyles and health-conscious individuals. Furthermore, a growing awareness of eye health and the benefits of regular eye examinations contribute to earlier diagnosis and prescription of contact lenses, thereby expanding the addressable market.

This comprehensive report on the contact lenses market delves into the intricate dynamics shaping its trajectory from 2019 to 2033. It meticulously analyzes the market's valuation, projected to reach XXX million by 2033, with 2025 serving as the base year for detailed estimations. The report examines the key trends, driving forces such as the rising incidence of refractive errors and the booming cosmetic lens segment, and the significant challenges including infection risks and cost barriers. It provides an in-depth exploration of dominant regions and segments, with a particular focus on the leading role of Soft Contact Lenses and the projected growth of North America and the Asia Pacific. Furthermore, the report highlights critical growth catalysts and profiles the leading industry players. Essential for stakeholders seeking to understand market nuances and future opportunities, this report offers a holistic view of the global contact lenses landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.0% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.0%.

Key companies in the market include Johnson &Johnson Vision Care, Novartis, CooperVision, Bausch + Lomb, St.Shine Optical, Menicon, Hydron, Weicon, moody, NEO Vision, Clearlab, Oculus, Camax, Seed, Hoya Corp, T-Garden.

The market segments include Application, Type.

The market size is estimated to be USD 18500 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Contact Lenses," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Contact Lenses, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.