1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Grade Genetic Testing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Consumer Grade Genetic Testing

Consumer Grade Genetic TestingConsumer Grade Genetic Testing by Type (/> Diagnostic Screening, PGD, Relationship Testing), by Application (/> Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

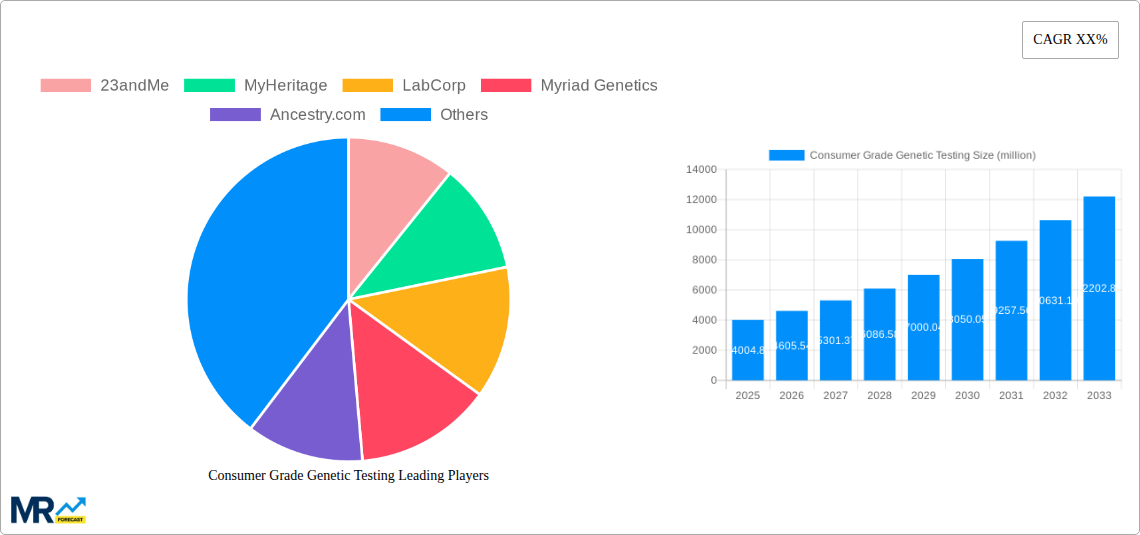

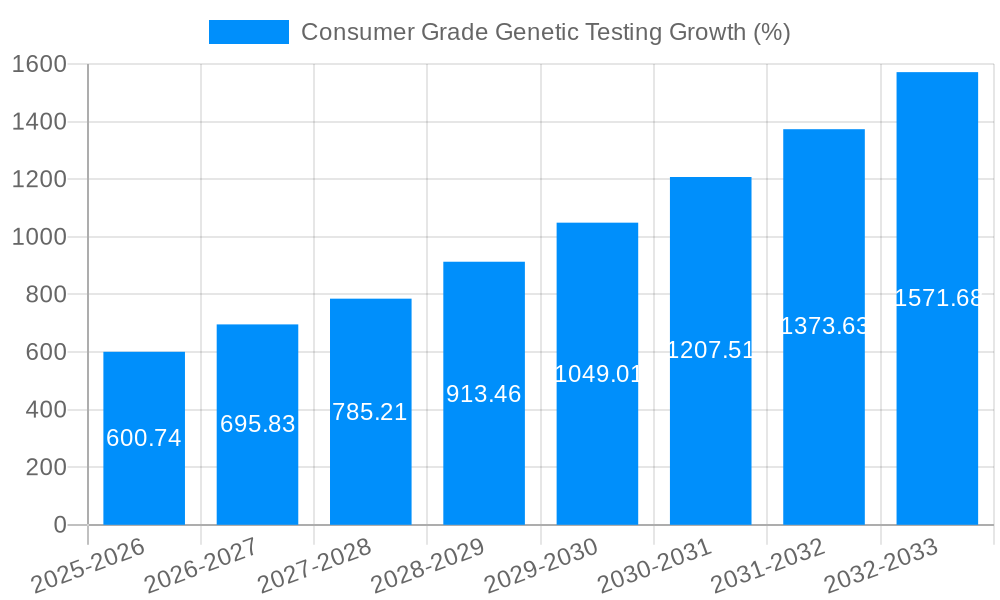

The consumer grade genetic testing market, valued at approximately $4004.8 million in 2025, is experiencing robust growth. While the precise Compound Annual Growth Rate (CAGR) isn't provided, considering the rapid technological advancements in genomics and increasing consumer awareness of personalized healthcare, a conservative estimate of 15% CAGR over the forecast period (2025-2033) is reasonable. This growth is fueled by several key drivers: the decreasing cost of genetic sequencing, the rising prevalence of chronic diseases prompting proactive health management, increasing direct-to-consumer (DTC) marketing of genetic tests, and a growing interest in ancestry tracing. Furthermore, the development of sophisticated genetic testing platforms and user-friendly interfaces is contributing to higher market penetration. However, challenges remain, including concerns surrounding data privacy and security, the accuracy and interpretation of complex genetic data, and the potential for genetic discrimination. The market segmentation likely involves tests categorized by purpose (ancestry, health risks, carrier screening, etc.), testing method (SNP genotyping, whole genome sequencing), and sales channel (online, retail, healthcare providers).

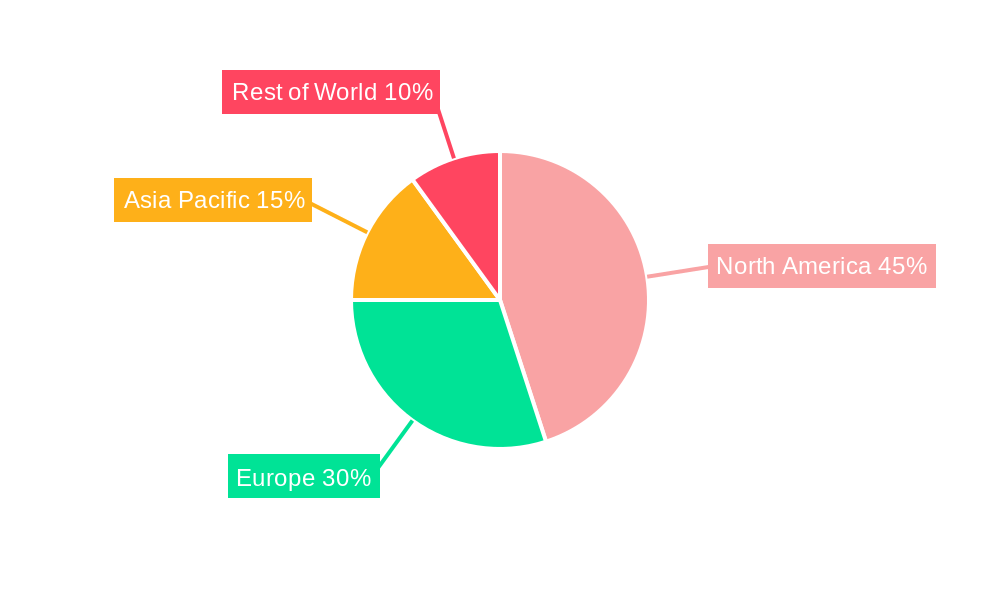

The competitive landscape is highly fragmented, with a mix of large established players like 23andMe, Ancestry.com, and LabCorp alongside smaller, specialized companies. The market is witnessing continuous innovation in terms of test offerings and analytical capabilities, driving further segmentation and creating opportunities for specialized companies to cater to niche segments. This is pushing established players to diversify their portfolios and invest in advanced technologies. The geographical distribution of the market is likely skewed towards developed regions (North America and Europe) initially, with emerging markets in Asia and Latin America expected to show significant growth over the long term, driven by rising disposable incomes and increased healthcare awareness. This expansion will be contingent on improved infrastructure and regulatory frameworks in these regions.

The consumer grade genetic testing market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by decreasing costs, increased accessibility, and growing consumer interest in personalized healthcare and ancestry, the market witnessed significant expansion during the historical period (2019-2024). The estimated market value in 2025 is in the millions, reflecting a substantial increase from previous years. This upward trajectory is expected to continue throughout the forecast period (2025-2033), fueled by technological advancements, improved data analysis capabilities, and the expansion of direct-to-consumer (DTC) testing options. Key market insights reveal a shift towards more comprehensive testing panels, incorporating analyses beyond ancestry and basic health traits, including pharmacogenomics and carrier screening. Furthermore, the market is seeing an increase in the development of user-friendly platforms and mobile applications to make results more accessible and understandable to consumers. The growing integration of genetic testing into preventative healthcare initiatives is further driving market expansion, as individuals increasingly use these tests to inform lifestyle choices and proactively manage their health risks. This trend is particularly pronounced in developed regions with higher disposable incomes and access to advanced healthcare technologies. While concerns about data privacy and the ethical implications of genetic testing persist, these are being addressed through increased regulatory scrutiny and improved industry standards. The overall market landscape reflects a dynamic interplay between technological advancements, consumer demand, and regulatory oversight, paving the way for continued expansion in the years to come.

Several key factors are accelerating the growth of the consumer grade genetic testing market. The dramatic reduction in the cost of sequencing technology is a major driver, making genetic testing increasingly accessible to a wider population. This affordability is coupled with the rise of direct-to-consumer (DTC) testing companies offering convenient and user-friendly online platforms, eliminating the need for physician referrals. Consumer awareness of the benefits of personalized medicine and preventative healthcare is also significantly contributing to market growth. Individuals are becoming increasingly proactive in managing their health, and genetic testing provides valuable insights into predispositions to certain diseases, allowing for early interventions and lifestyle adjustments. The growing interest in ancestry research and genealogical exploration is another crucial driver, attracting a large segment of consumers seeking to uncover their family history and ethnic origins. Furthermore, advancements in data analytics and interpretation techniques are improving the accuracy and comprehensiveness of genetic test results, enhancing their value and attracting more users. The increasing integration of genetic data into electronic health records (EHRs) and personalized medicine initiatives is further strengthening the market, facilitating seamless access to genetic information by healthcare professionals for better diagnosis and treatment.

Despite its remarkable growth, the consumer grade genetic testing market faces several challenges and restraints. Concerns regarding data privacy and security remain significant, with consumers worried about the potential misuse of their sensitive genetic information. This is compounded by the lack of standardized regulations and protocols across different jurisdictions, leading to inconsistencies in data protection measures. The interpretation of genetic test results can also be complex and require specialized knowledge, posing a risk of misinterpretation and anxiety for consumers without adequate genetic counseling. The potential for genetic discrimination in employment, insurance, and other areas remains a considerable concern, despite legislative efforts to mitigate this risk. Moreover, the accuracy and reliability of some DTC genetic tests have been questioned, with concerns about the validity of certain interpretations and the potential for false positives or negatives. These issues necessitate stricter quality control measures and greater transparency regarding the limitations of the tests. The lack of comprehensive genetic counseling services, particularly in underserved communities, hinders the accessibility and proper utilization of genetic testing results. This necessitates increased investment in genetic literacy initiatives and accessible counseling resources. Finally, the ever-evolving nature of genetic research and the constant updating of knowledge require ongoing efforts to ensure that the interpretation of genetic data remains current and accurate.

The North American market, specifically the United States, is currently dominating the consumer grade genetic testing market, owing to high disposable incomes, advanced healthcare infrastructure, and a strong culture of proactive healthcare management. However, rapid growth is anticipated in other regions, including Europe and Asia-Pacific, as these markets mature and access to technology and affordability improve.

Dominant Segments:

The market is seeing the emergence of combination tests offering ancestry information alongside health and wellness insights, capitalizing on the growing overlap in consumer interest between these segments. Future growth will depend on technological innovation, improved data analysis, robust regulatory environments and public trust.

Several factors are catalyzing growth in the consumer grade genetic testing industry. Technological advancements continue to reduce testing costs while simultaneously enhancing accuracy and the scope of information obtainable. Growing consumer awareness of the benefits of personalized medicine and preventive healthcare is driving demand. The increasing integration of genetic data into electronic health records (EHRs) is facilitating better healthcare decision-making. Finally, the expansion of direct-to-consumer testing options is making genetic testing more accessible and convenient.

This report provides a comprehensive analysis of the consumer grade genetic testing market, encompassing historical data, current market dynamics, and future projections. It identifies key trends, driving forces, challenges, and growth catalysts, and profiles leading players in the industry. The report offers valuable insights for investors, industry participants, and researchers seeking a thorough understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include 23andMe, MyHeritage, LabCorp, Myriad Genetics, Ancestry.com, Quest Diagnostics, Gene By Gene, DNA Diagnostics Center, Invitae, IntelliGenetics, Ambry Genetics, Living DNA, EasyDNA, Pathway Genomics, Centrillion Technology, Xcode, Color Genomics, Anglia DNA Services, African Ancestry, Canadian DNA Services, DNA Family Check, Alpha Biolaboratories, Test Me DNA, 23 Mofang, Genetic Health, DNA Services of America, Shuwen Health Sciences, Mapmygenome, Full Genomes, .

The market segments include Type, Application.

The market size is estimated to be USD 4004.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Consumer Grade Genetic Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Consumer Grade Genetic Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.