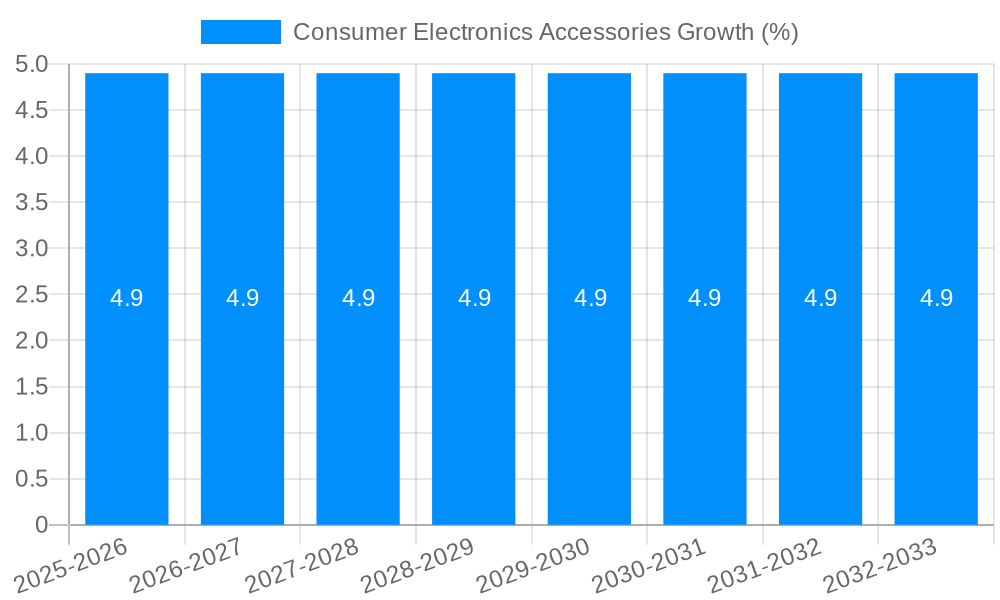

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Electronics Accessories?

The projected CAGR is approximately 4.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Consumer Electronics Accessories

Consumer Electronics AccessoriesConsumer Electronics Accessories by Type (Protect Shell, Protective Film, Charger and cable, Mobile Power Supply, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

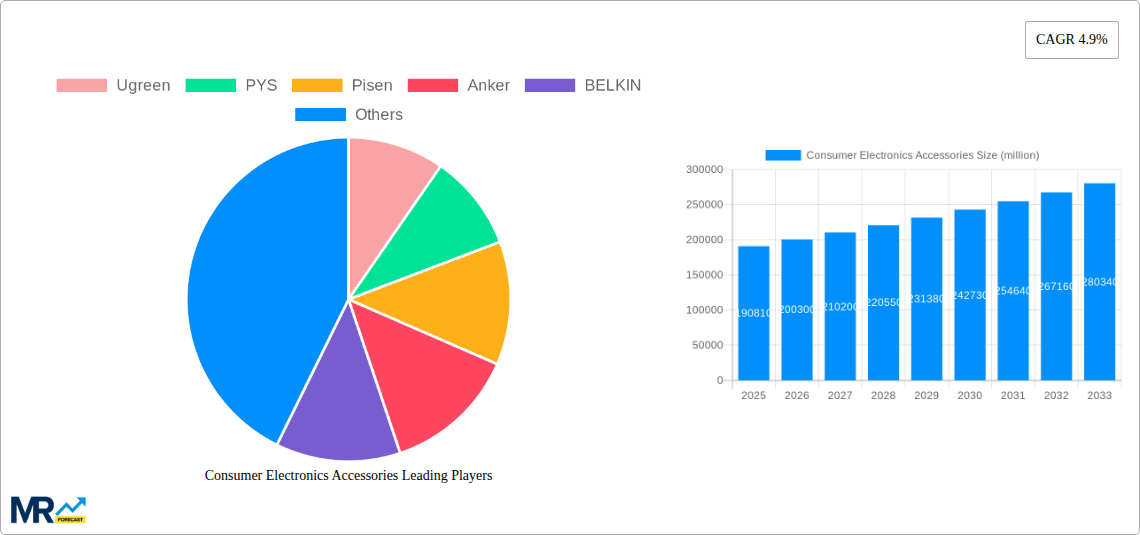

The global Consumer Electronics Accessories market is poised for robust growth, projected to reach $190,810 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.9% expected to sustain this upward trajectory through 2033. This significant market expansion is fueled by several key drivers, including the ever-increasing penetration of smartphones and other portable electronic devices, the rapid evolution of technology leading to frequent device upgrades, and a growing consumer demand for enhanced functionality and personalized experiences through accessories. The market is segmented into essential categories such as protect shells, protective films, chargers and cables, mobile power supplies, and other miscellaneous accessories, each catering to distinct consumer needs. The continuous innovation in product design, materials, and smart features within these segments will be critical in capturing market share and meeting evolving consumer preferences.

The competitive landscape for Consumer Electronics Accessories is dynamic and highly fragmented, featuring a mix of established global brands like Ugreen, Anker, BELKIN, and Huawei, alongside a multitude of regional players such as PYS, Pisen, ZMI, and Baseus. These companies are actively engaged in product differentiation, focusing on areas like fast charging technology, wireless solutions, durability, and aesthetic appeal. Emerging trends include the rise of eco-friendly and sustainable accessory options, the integration of AI and IoT capabilities into accessories, and the growing importance of premium and specialized accessories catering to niche markets. However, the market also faces certain restraints, such as the increasing commoditization of basic accessories leading to price pressures, concerns regarding product longevity and e-waste, and the potential for counterfeiting, which can impact brand reputation and consumer trust. Strategic investments in research and development, robust distribution networks, and effective marketing strategies will be crucial for companies to navigate these challenges and capitalize on the significant growth opportunities in the Consumer Electronics Accessories market.

This report offers an in-depth analysis of the global Consumer Electronics Accessories market, providing crucial insights for stakeholders navigating this dynamic sector. With a study period spanning from 2019 to 2033, including a historical analysis from 2019-2024 and a robust forecast from 2025-2033, this report leverages the Base Year of 2025 for its estimations. It delves into market trends, driving forces, challenges, regional dominance, growth catalysts, and the key players shaping the industry. The report’s comprehensive scope ensures a thorough understanding of market dynamics, enabling informed strategic decision-making and identification of lucrative opportunities within the vast and evolving landscape of consumer electronics peripherals.

XXX The consumer electronics accessories market is experiencing a transformative period characterized by rapid innovation, evolving consumer demands, and a growing emphasis on personalized and sustainable solutions. From 2019 to 2024, the market witnessed a steady expansion fueled by the ubiquity of smartphones and the increasing adoption of smart home devices. The Base Year of 2025 marks a pivotal point, with projections indicating continued robust growth through the Forecast Period of 2025-2033. Key trends revolve around the escalating demand for high-speed charging solutions, driven by larger battery capacities and the need for quick power-ups. Wireless charging technology, in particular, is gaining significant traction, moving beyond premium devices to become a mainstream expectation. The market is also seeing a surge in demand for durable and aesthetically pleasing protective accessories, with consumers seeking to safeguard their increasingly expensive electronic devices. This includes a rising preference for materials that offer enhanced protection without compromising on style or portability. Furthermore, the "connected lifestyle" trend is creating significant opportunities for accessories that enhance the functionality and interoperability of various consumer electronics, such as smartwatches, wireless earbuds, and portable speakers. The rise of the Internet of Things (IoT) ecosystem is directly translating into a greater need for complementary accessories that facilitate seamless integration and enhanced user experience across multiple devices. The "Other" category within the report, encompassing diverse accessories like power banks, data cables, and adapters, is expected to remain a significant contributor due to its essential nature. As devices become more specialized, the demand for tailored accessories that cater to specific functionalities and user needs will continue to grow. The market's trajectory from 2019 to 2033 highlights a persistent evolution, driven by technological advancements and changing consumer behaviors, solidifying the consumer electronics accessories market as a critical component of the broader consumer electronics industry.

The consumer electronics accessories market is being propelled by a confluence of powerful factors, fundamentally reshaping its landscape. A primary driver is the ever-increasing penetration of smartphones and wearable devices globally. As these core devices become more sophisticated and indispensable, the demand for complementary accessories that enhance their functionality, protection, and usability naturally escalates. The rapid pace of technological advancement also plays a crucial role. Innovations in battery technology, charging speeds, and connectivity standards necessitate the development of new and improved accessories, creating a continuous cycle of demand. For instance, the transition to USB-C and the widespread adoption of fast-charging protocols have fueled the growth of the charger and cable segment. Furthermore, the growing consumer emphasis on personalization and aesthetics is driving the demand for accessories that not only offer practical benefits but also reflect individual style and preferences. This is evident in the burgeoning market for custom-designed protective shells and premium charging solutions. The expansion of the Internet of Things (IoT) ecosystem is another significant propellant. As more devices become interconnected, the need for accessories that facilitate seamless integration and enhance the overall user experience across these devices is on the rise. This includes accessories for smart home devices, connected vehicles, and other IoT-enabled products, further broadening the market's scope and potential.

Despite the robust growth trajectory, the consumer electronics accessories market faces several significant challenges and restraints. A primary concern is the intense competition and market saturation, particularly within established segments like chargers and cables. The presence of numerous manufacturers, including both established brands and emerging players, leads to price wars and pressure on profit margins. This makes it challenging for smaller companies to gain significant market share. Another considerable restraint is the rapid obsolescence of technology. As consumer electronics devices evolve at an unprecedented pace, the accessories designed for older models can quickly become outdated, leading to inventory management issues and potential financial losses for manufacturers. The increasing complexity of product compatibility also poses a challenge. With a multitude of device models, operating systems, and charging standards, ensuring that accessories are compatible with a wide range of products can be a significant hurdle for manufacturers. Furthermore, the growing threat of counterfeit products erodes consumer trust and can damage the reputation of legitimate brands. These fake products often compromise on quality and safety, leading to potential device damage and user dissatisfaction. The economic sensitivity of discretionary spending also acts as a restraint. In times of economic downturn or uncertainty, consumers may postpone or reduce their spending on non-essential accessories, impacting overall market demand. Finally, the increasing regulatory scrutiny and environmental concerns regarding materials and manufacturing processes could introduce additional compliance costs and operational complexities for businesses.

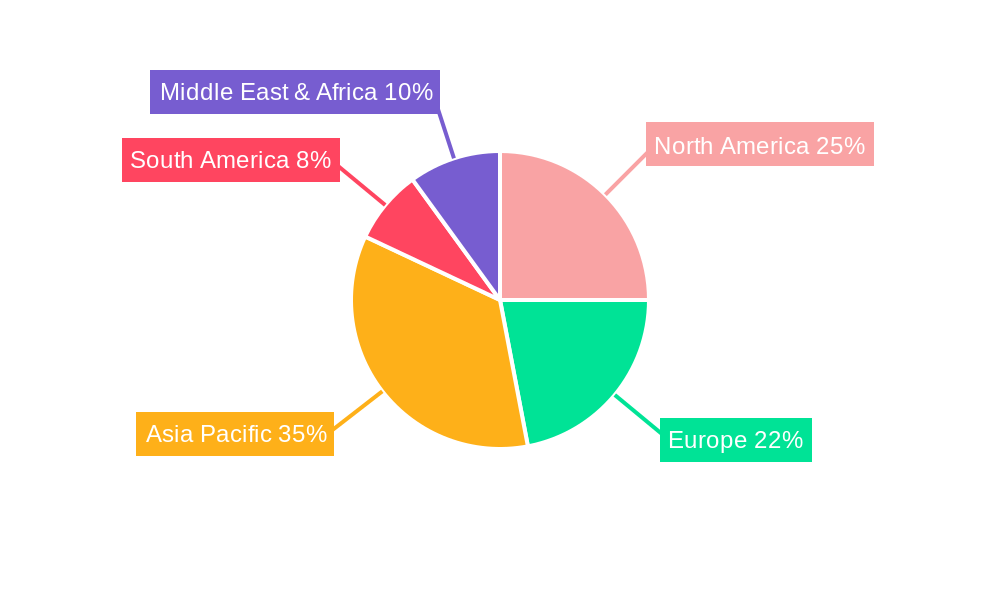

The consumer electronics accessories market is characterized by distinct regional dynamics and segment dominance, with Asia Pacific and the Charger and Cable segment poised for significant leadership.

Asia Pacific Region: This region, encompassing countries like China, South Korea, Japan, and India, is projected to be the largest and fastest-growing market for consumer electronics accessories through the forecast period of 2025-2033. Several factors contribute to this dominance:

Charger and Cable Segment: Within the various types of consumer electronics accessories, the Charger and Cable segment is expected to continue its reign as the dominant force throughout the study period (2019-2033).

Other regions like North America and Europe will also exhibit significant growth, driven by high disposable incomes and a mature consumer electronics market, but Asia Pacific's sheer scale of production and consumption, coupled with the fundamental necessity of the Charger and Cable segment, positions them as the primary drivers of market dominance.

Several key factors are acting as powerful catalysts for growth in the consumer electronics accessories industry. The continuous evolution of consumer electronics devices with enhanced functionalities and larger battery capacities necessitates corresponding advancements in charging solutions and protective gear. Furthermore, the proliferation of the Internet of Things (IoT) ecosystem is creating new avenues for accessory development, enabling seamless connectivity and enhanced user experiences across multiple devices. The increasing consumer demand for personalization and aesthetic appeal is driving innovation in the design and materials of accessories. Finally, the expanding reach of e-commerce platforms is making a wider variety of accessories accessible to a global consumer base, significantly boosting sales volumes.

This comprehensive report on Consumer Electronics Accessories provides an exhaustive analysis of the market from 2019 to 2033, with a sharp focus on the Base Year of 2025 and the subsequent Forecast Period of 2025-2033. It delves into the intricate dynamics shaping the industry, offering invaluable market insights, identifying key growth drivers, and highlighting potential challenges. The report's in-depth regional analysis, particularly focusing on the dominance of Asia Pacific and the Charger and Cable segment, alongside a detailed examination of leading players and significant market developments, equips stakeholders with the knowledge necessary to navigate this evolving landscape and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.9%.

Key companies in the market include Ugreen, PYS, Pisen, Anker, BELKIN, DNS, ZMI, Baseus, CE-Link, Hank, NATIVE UNION, BULL, Shenzhen JAME, Huawei, Nien Yi, OPPO, Satechi, VIVO, Stiger, OPSO, Snowkids, IWALK, ESR, Joyroom, ORICO, .

The market segments include Type.

The market size is estimated to be USD 190810 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Consumer Electronics Accessories," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Consumer Electronics Accessories, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.