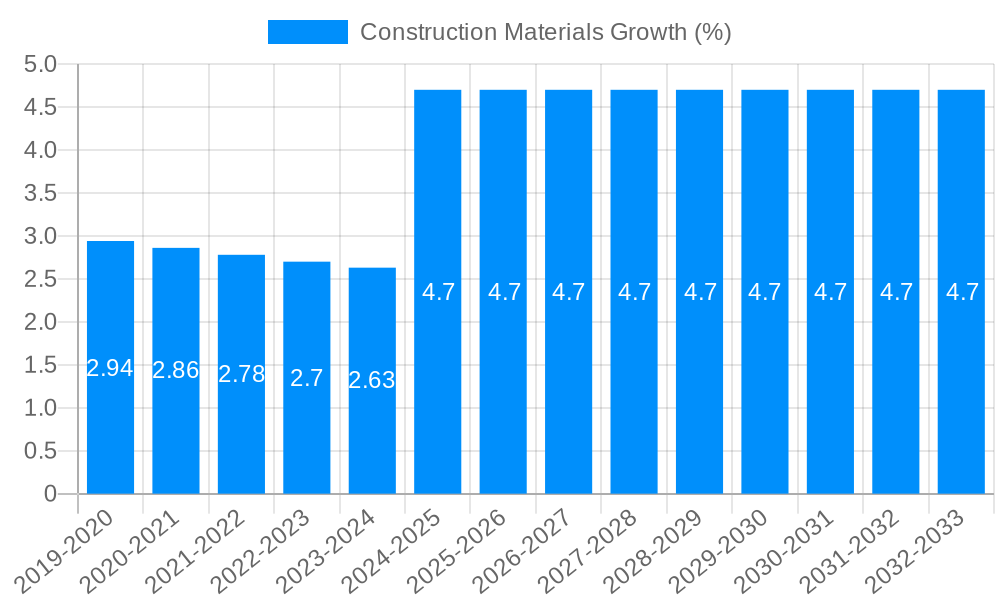

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Materials?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Construction Materials

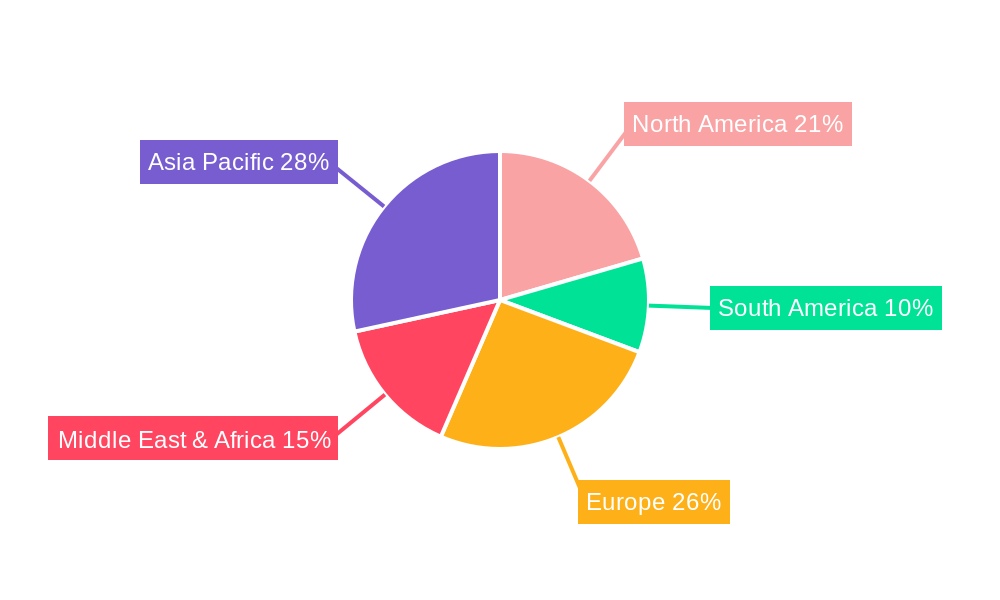

Construction MaterialsConstruction Materials by Type (Construction Aggregates, Concrete Bricks, Cement, Construction Metals, Others), by Application (Residential Sector, Industrial Sector, Commercial Sector), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

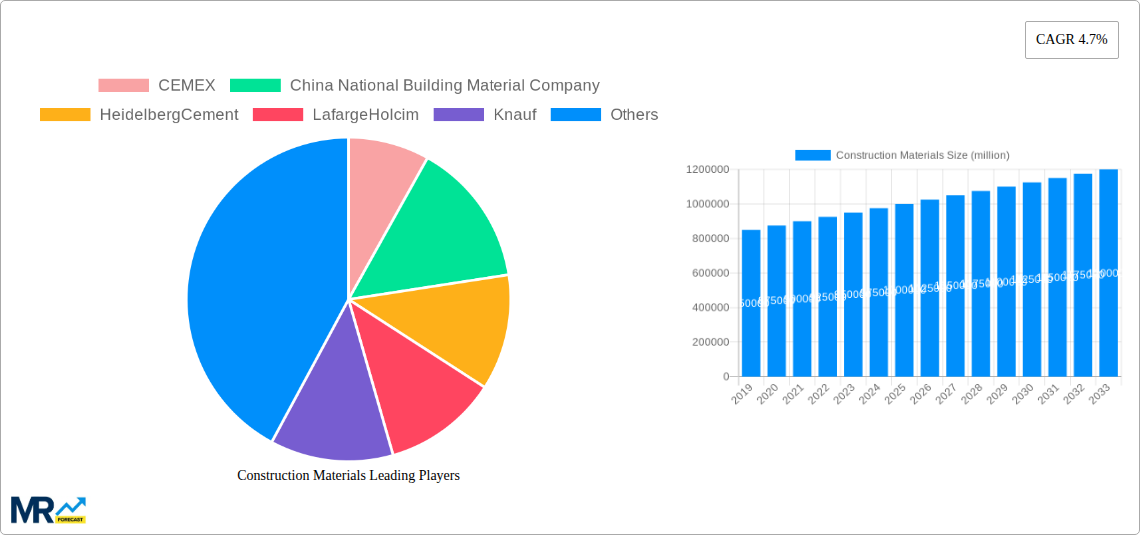

The global construction materials market is poised for robust growth, projected to reach an estimated USD 1093.13 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This significant market expansion is underpinned by a confluence of factors, with infrastructure development initiatives worldwide serving as a primary driver. Governments are increasingly investing in upgrading and expanding transportation networks, public utilities, and urban infrastructure, directly fueling demand for a wide array of construction materials. Furthermore, the ongoing urbanization trend, particularly in emerging economies, necessitates the construction of new residential, commercial, and industrial facilities, thereby bolstering the market. Technological advancements in material science, leading to the development of more sustainable, durable, and energy-efficient construction materials, are also contributing to market penetration. Innovations such as advanced composites, recycled materials, and smart building components are gaining traction, aligning with global sustainability goals and attracting environmentally conscious developers.

The market's growth trajectory is further supported by sustained demand from the residential sector, driven by population growth and rising disposable incomes, leading to increased housing construction and renovation. The industrial sector is also a key contributor, with expansion and modernization of manufacturing facilities and industrial parks requiring substantial material inputs. Moreover, the commercial sector, encompassing retail spaces, offices, and hospitality venues, continues to exhibit growth, particularly in developing regions. While the market demonstrates strong growth potential, certain restraints, such as fluctuating raw material prices and stringent environmental regulations, may present challenges. However, the overarching trend towards sustainable construction practices and the increasing adoption of green building materials are expected to mitigate these challenges and unlock new avenues for growth. Key players are actively engaged in research and development, strategic partnerships, and mergers and acquisitions to enhance their market position and cater to evolving customer needs.

This report provides an in-depth analysis of the global construction materials market, encompassing a comprehensive study from the historical period of 2019-2024, with a base year of 2025. The research extends through a robust forecast period of 2025-2033, offering invaluable insights into future market trajectories. The report meticulously examines key segments including Construction Aggregates, Concrete Bricks, Cement, Construction Metals, and Others, alongside their applications across the Residential, Industrial, and Commercial sectors. Leveraging advanced analytical methodologies, this report aims to equip stakeholders with strategic intelligence for navigating the evolving landscape of construction materials. With an estimated market value reaching into the billions, this report is crucial for understanding the dynamics of this foundational industry.

The global construction materials market is poised for dynamic evolution throughout the study period (2019-2033), with significant shifts anticipated around the base year of 2025. XXX The prevailing trend indicates a burgeoning demand driven by urbanization and infrastructure development initiatives, particularly in emerging economies. Construction aggregates continue to form the bedrock of the market, accounting for a substantial portion of the overall volume and value, with projections suggesting sustained growth as megaprojects and general construction activities pick up pace. Cement, a fundamental component in most construction projects, will witness steady demand, though its growth trajectory might be influenced by the increasing adoption of alternative binders and sustainable practices aimed at reducing its carbon footprint. The construction metals segment is expected to experience robust expansion, propelled by large-scale industrial projects, infrastructure upgrades, and the increasing use of steel and aluminum in modern architectural designs for their strength and recyclability. Concrete bricks, while traditional, will continue to hold a significant market share, particularly in residential and smaller-scale commercial constructions, with a growing emphasis on pre-fabricated and modular building solutions. The "Others" segment, encompassing a wide array of specialized materials such as insulation, roofing, flooring, and advanced composites, is anticipated to exhibit the highest compound annual growth rate. This surge is attributed to an increasing focus on energy efficiency, durability, aesthetics, and specialized performance requirements in modern construction, leading to a greater adoption of innovative and value-added materials. The residential sector, benefiting from population growth and rising disposable incomes, will remain a primary consumer of construction materials. However, the industrial and commercial sectors are expected to witness more pronounced growth in specific material demands, especially in developing regions undertaking significant industrial expansion and the development of sophisticated commercial infrastructure. For instance, the increasing emphasis on green building certifications and sustainable construction practices is driving innovation and demand for eco-friendly materials, a trend that is projected to gain considerable momentum beyond 2025. The integration of smart materials and advanced manufacturing techniques is also set to redefine the construction materials landscape, offering enhanced performance, reduced waste, and improved construction efficiency.

The construction materials market is experiencing a powerful surge fueled by a confluence of robust economic factors and evolving societal needs. Foremost among these is the relentless pace of global urbanization, particularly in developing nations. As populations increasingly migrate to cities in pursuit of better opportunities, the demand for housing, commercial spaces, and essential infrastructure like roads, bridges, and public utilities escalates dramatically. This burgeoning urban landscape directly translates into a sustained and growing need for fundamental construction materials such as cement, aggregates, and metals. Furthermore, governments worldwide are recognizing the critical role of infrastructure development in economic growth and connectivity. Ambitious national and regional infrastructure projects, encompassing transportation networks, energy facilities, and water management systems, are being launched and accelerated, injecting significant demand into the construction materials sector. The increasing emphasis on sustainability and environmental consciousness is also acting as a potent driver. Growing awareness of climate change and resource depletion is pushing for the adoption of greener building practices and materials. This includes a rising preference for recycled content, low-carbon cement alternatives, and materials that enhance energy efficiency in buildings. The commercial sector, driven by investments in retail spaces, offices, and hospitality, is also contributing to market expansion, as businesses seek to build and renovate facilities to meet evolving consumer and workforce demands. This multifaceted demand, stemming from essential human needs and strategic economic planning, underpins the optimistic outlook for the construction materials market.

Despite the robust growth drivers, the construction materials market is not without its hurdles. A significant challenge revolves around the inherent volatility in raw material prices. Fluctuations in the cost of key inputs like iron ore for steel, petroleum for asphalt, and energy for cement production can directly impact the profitability of manufacturers and the overall cost of construction projects. Geopolitical instability and supply chain disruptions, as witnessed in recent years, can exacerbate these price swings and lead to material shortages, delaying project timelines and increasing expenditure. Environmental regulations, while crucial for sustainable development, can also pose a challenge. Stricter emission standards for cement production or requirements for the use of recycled materials can necessitate significant investments in new technologies and processes for manufacturers, potentially increasing operational costs in the short term. Furthermore, the construction industry is often characterized by cyclicality, with demand for materials being closely tied to the overall health of the economy. Economic downturns or recessions can lead to a sharp decline in construction activity, consequently impacting the demand for construction materials. The labor-intensive nature of the construction industry also presents a restraint. A shortage of skilled labor can lead to project delays and increased labor costs, indirectly affecting the demand and application of certain materials. Finally, the significant capital investment required for setting up and modernizing manufacturing facilities for construction materials can act as a barrier to entry for new players and a constraint for existing ones seeking to scale up operations or adopt advanced technologies.

Dominating Segments:

Dominating Segment: Construction Aggregates

Construction aggregates, encompassing sand, gravel, crushed stone, and recycled aggregates, are projected to continue their reign as the most dominant segment within the global construction materials market. Their pervasive use as a fundamental component in concrete, asphalt, road bases, and various other construction applications makes them indispensable. The sheer volume consumed across diverse projects, from small-scale residential developments to monumental infrastructure undertakings, solidifies their leading position. The study period, particularly from the base year of 2025 onwards, will witness sustained demand for aggregates driven by aggressive infrastructure development in emerging economies and the ongoing need for maintenance and upgrades in developed nations. The growing acceptance and utilization of recycled aggregates, stemming from environmental regulations and the desire for cost-effective solutions, will further bolster this segment's growth. Projects such as highway expansions, bridge construction, airport development, and the creation of new urban centers will perpetually require vast quantities of aggregates, ensuring their continued market leadership. The forecast period (2025-2033) will likely see an acceleration in aggregate consumption in regions undertaking large-scale public works and smart city initiatives, where the quality and consistency of aggregates are paramount.

Dominating Application Sector: Residential Sector

The residential sector is anticipated to remain a powerhouse in driving the demand for construction materials. As global populations continue to expand, the fundamental need for shelter will persistently fuel new residential construction. This demand is particularly acute in developing countries experiencing rapid urbanization and a growing middle class with increased disposable income, enabling them to invest in homeownership. Even in mature markets, there is a continuous need for housing, driven by factors such as household formation, renovations, and the replacement of aging housing stock. The residential sector's reliance on a broad spectrum of construction materials, including cement for foundations and structural elements, aggregates for concrete, bricks for walls, metals for reinforcement and fixtures, and a wide array of finishing materials like roofing, flooring, and insulation, ensures its significant contribution to the overall market value. The forecast period is expected to witness a growing emphasis on sustainable and energy-efficient housing solutions. This will translate into increased demand for materials that contribute to better insulation, water efficiency, and reduced environmental impact, further cementing the residential sector's importance.

Dominating Region: Asia-Pacific

The Asia-Pacific region is poised to dominate the global construction materials market throughout the study period (2019-2033), with its influence expected to be particularly pronounced from the base year of 2025 onwards. This dominance is underpinned by a potent combination of rapid economic growth, large and growing populations, and substantial government investments in infrastructure development. Countries like China, India, and Southeast Asian nations are experiencing unprecedented urbanization rates, leading to a massive demand for new housing, commercial complexes, and industrial facilities. Government-led initiatives focused on developing robust transportation networks, including high-speed rail, highways, and airports, further amplify the need for construction materials. The sheer scale of these projects, coupled with the ongoing need for urban renewal and infrastructure modernization, positions Asia-Pacific as the primary consumer of construction aggregates, cement, construction metals, and other building components. The region's burgeoning manufacturing sector also necessitates the construction of new factories and industrial parks, contributing significantly to material demand. Furthermore, rising disposable incomes are fueling demand for improved residential properties, creating a sustained need for building materials in the residential sector. The pace of construction activity in Asia-Pacific is projected to outstrip other regions, making it the focal point for market growth and strategic investment in the construction materials industry.

Several key factors are acting as powerful growth catalysts for the construction materials industry. The ongoing wave of urbanization, particularly in emerging economies, is a primary driver, creating an insatiable demand for new residential, commercial, and infrastructure developments. Significant government investments in infrastructure projects globally, aimed at improving connectivity and facilitating economic growth, are directly translating into increased consumption of foundational materials. The growing global emphasis on sustainability and green building practices is spurring innovation and demand for eco-friendly materials, recycled content, and energy-efficient solutions. Furthermore, technological advancements in material science and manufacturing are enabling the development of more durable, cost-effective, and specialized construction materials, opening up new application areas and market opportunities.

This comprehensive report offers an unparalleled deep dive into the construction materials market, meticulously analyzing trends, drivers, challenges, and future projections across a study period of 2019-2033. It provides granular insights into various market segments, including Construction Aggregates, Cement, Construction Metals, and more, along with their applications in the Residential, Industrial, and Commercial sectors. The report's detailed examination of key regions and dominant segments, supported by extensive data and expert analysis, equips stakeholders with a strategic roadmap. The inclusion of leading players and significant developments further enhances its value, offering a complete picture of the industry's current state and future trajectory. This report is an indispensable resource for investors, manufacturers, policymakers, and industry professionals seeking to understand and capitalize on the opportunities within the dynamic global construction materials market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include CEMEX, China National Building Material Company, HeidelbergCement, LafargeHolcim, Knauf, Saint Gobain, BaoWu, ArcelorMittal, USG, CSR, Nippon, Etex, Boral, Arauco, AWI, Kronospan, BNBM, .

The market segments include Type, Application.

The market size is estimated to be USD 1093130 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Construction Materials," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Construction Materials, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.