1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Rental Service?

The projected CAGR is approximately 6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Construction Machinery Rental Service

Construction Machinery Rental ServiceConstruction Machinery Rental Service by Type (Excavators, Bulldozers, Loaders, Cranes, Asphalt Pavers, Concrete Mixers, Dump Trucks, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global construction machinery rental market is experiencing substantial growth, propelled by a growing preference for rental solutions over direct ownership within the construction sector. This shift is attributed to project variability, high capital expenditure for machinery acquisition, and the operational advantages of accessing specialized equipment on demand. Key segments include excavators, bulldozers, and loaders. Technological advancements are enhancing equipment efficiency and safety, broadening user adoption. The proliferation of online rental platforms and optimized logistics are further accelerating market penetration. Despite potential short-term impacts from economic fluctuations, sustained global infrastructure development, particularly in rapidly urbanizing and industrializing emerging economies, ensures a robust long-term outlook. Leading companies are actively expanding fleets and service portfolios to meet escalating demand, fostering a competitive environment that drives innovation and cost-effectiveness for users.

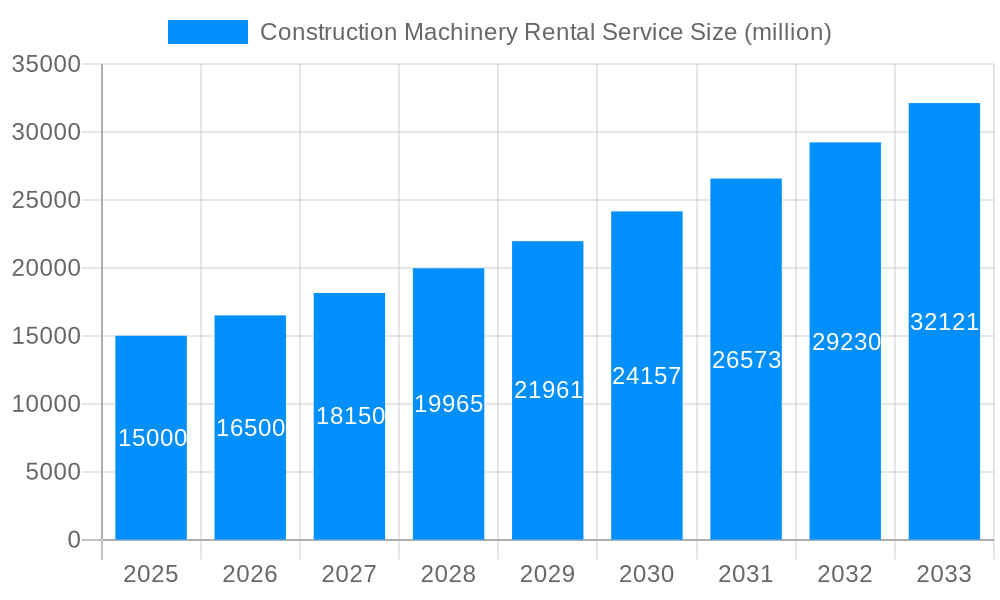

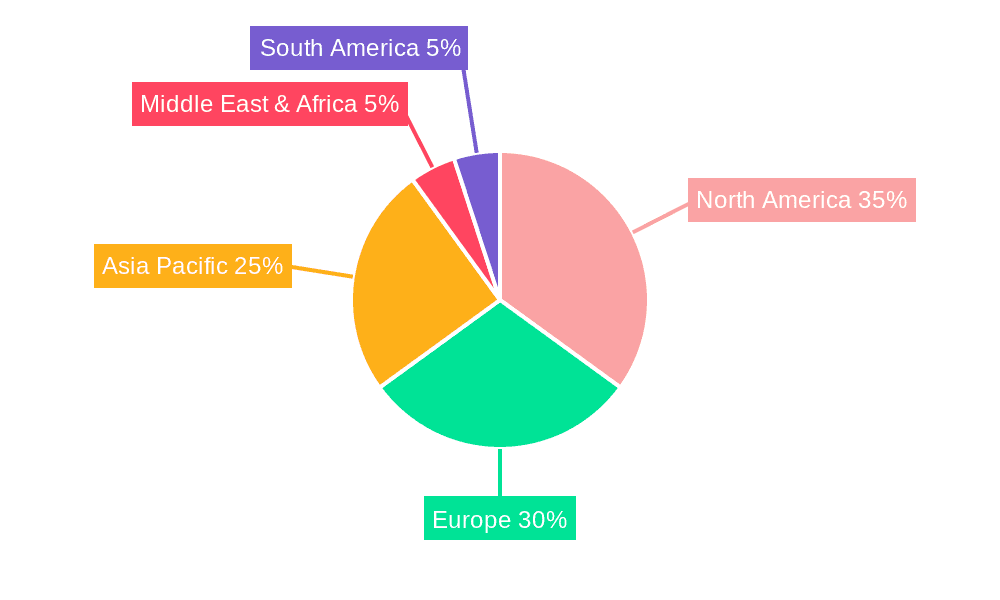

Regionally, North America and Europe currently dominate the market due to mature construction industries and high rental service adoption. However, the Asia-Pacific region is anticipated to witness significant expansion, driven by extensive infrastructure projects in China and India. The Middle East and Africa also present considerable potential, fueled by large-scale infrastructure initiatives. Future market dynamics will be shaped by equipment safety and environmental regulations, alongside commodity price volatility and global economic trends. The construction machinery rental market is projected to achieve a healthy Compound Annual Growth Rate (CAGR) of 6%, indicating consistent expansion and significant opportunities for both established and new market participants. The market size was valued at $126.15 billion in the base year 2024.

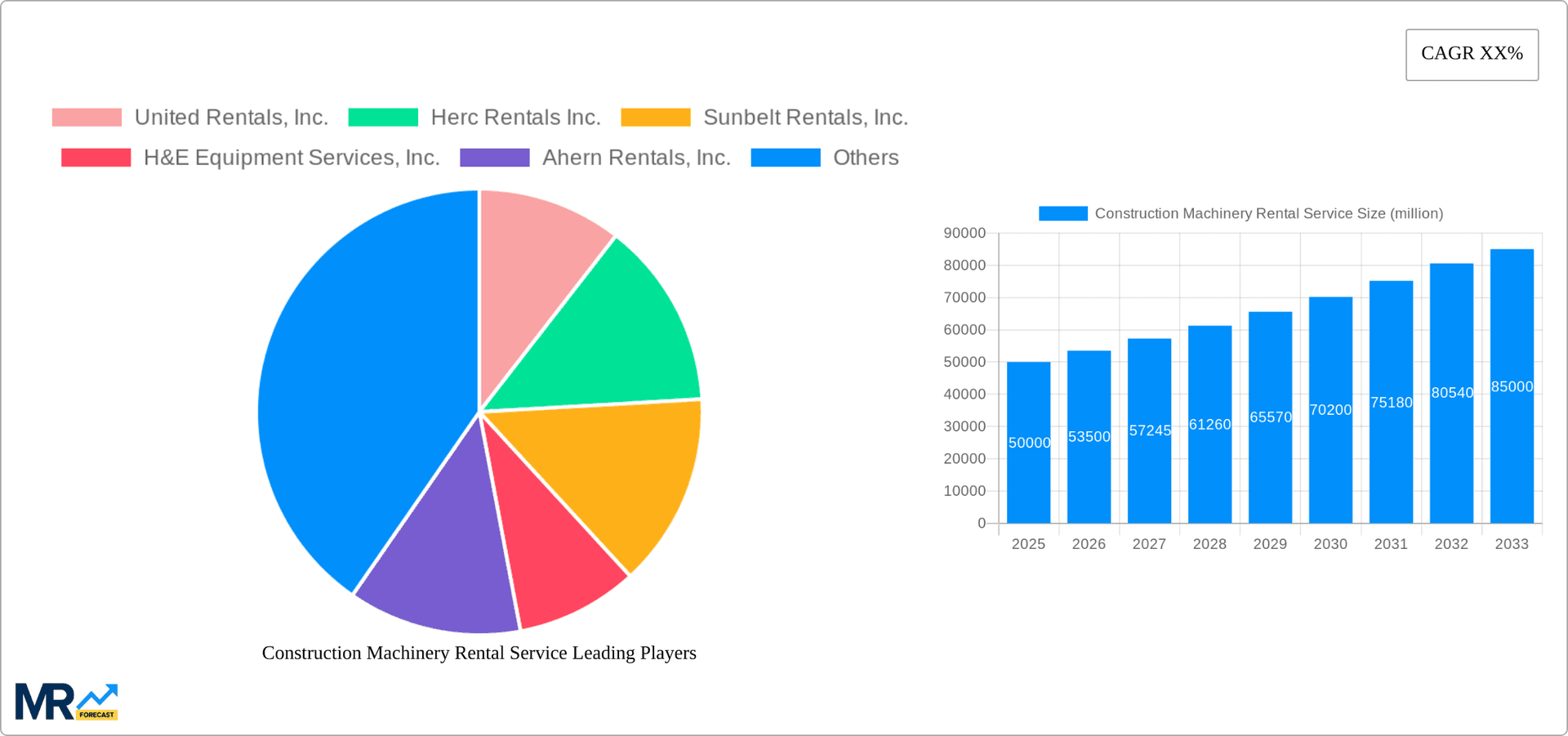

The global construction machinery rental service market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The market's expansion is fueled by several interconnected factors, including the increasing preference for rental services over outright purchases among construction companies of all sizes. This preference stems from the flexibility, cost-effectiveness, and reduced risk associated with renting. Smaller firms benefit from avoiding significant capital expenditure, while larger companies can optimize their equipment fleets based on project demands, avoiding underutilization and storage costs. The historical period (2019-2024) witnessed consistent growth, with the base year (2025) showing strong performance. The forecast period (2025-2033) anticipates further expansion, driven by factors such as burgeoning infrastructure development globally, particularly in emerging economies experiencing rapid urbanization and industrialization. This growth is not uniform across all segments; certain types of machinery, such as excavators and cranes, are experiencing higher demand due to their versatility across numerous construction projects. Moreover, technological advancements in construction machinery, including automation and improved efficiency, are enhancing the appeal of rental services by offering access to cutting-edge equipment without the long-term financial commitment. The competitive landscape is dynamic, with major players such as United Rentals, Inc., and Herc Rentals Inc. vying for market share through strategic acquisitions, expansion into new markets, and investment in technological upgrades. The market is characterized by consolidation, with larger companies absorbing smaller competitors to achieve economies of scale and expand their service portfolios. This evolution of the rental market is redefining construction methodologies, influencing procurement strategies, and promoting sustainable practices within the industry. The market's trajectory signifies a transformative shift in how construction projects are executed, with rental services playing a central and increasingly important role.

Several key factors are driving the remarkable growth of the construction machinery rental service market. Firstly, the rising cost of purchasing new equipment poses a significant barrier for many construction companies, especially smaller firms. Renting provides a more financially viable option, allowing them to access the necessary machinery without the substantial upfront investment. Secondly, the fluctuating nature of construction projects necessitates flexibility in equipment acquisition. Rental services offer this flexibility, enabling companies to scale their equipment needs up or down based on project demands, minimizing the risk of owning underutilized assets. Thirdly, technological advancements are making rental even more attractive. Modern machinery often incorporates sophisticated technologies that require specialized maintenance and upgrades. Rental companies manage these aspects, eliminating the burden on construction firms. This factor is especially compelling for companies that lack the internal expertise or resources for advanced equipment maintenance. Finally, increasing government investments in infrastructure projects globally are creating a strong demand for construction machinery, leading to greater reliance on rental services to fulfill these demands swiftly and cost-effectively. This confluence of economic, technological, and infrastructural drivers guarantees the continued expansion of this critical sector within the construction industry for the foreseeable future.

Despite the promising growth trajectory, several challenges and restraints could impede the progress of the construction machinery rental service market. Economic downturns and fluctuations in construction activity directly impact demand, creating uncertainty for rental companies. The cyclical nature of the construction industry necessitates careful financial planning and risk management. Furthermore, the high cost of maintenance and repair of machinery represents a significant operational expense for rental providers, potentially affecting profit margins. Competition within the sector is fierce, with established players vying for market share and smaller companies striving to carve out niches. Maintaining a competitive edge requires constant innovation, technological upgrades, and efficient logistics management. Another significant challenge is managing equipment wear and tear, ensuring the availability of machines in optimal condition. Lastly, regulatory compliance and safety standards are crucial considerations, with potential penalties for non-compliance. These factors necessitate strategic management and adaptation within the industry to overcome these challenges and ensure sustainable growth amidst economic and market volatility.

The excavator segment is poised to dominate the construction machinery rental market throughout the forecast period. Excavation is a fundamental aspect of almost every construction project, from infrastructure development to building construction. This consistent and widespread demand makes excavators a highly sought-after rental item.

The dominance of excavators stems from their versatility. They are essential for tasks like earthmoving, trenching, demolition, and foundation preparation, making them indispensable across various construction phases. The high rental demand translates to significant revenue generation for rental companies, ensuring the sector’s ongoing prominence. Continued infrastructure investment globally, coupled with the persistent need for efficient earthmoving solutions, solidifies the excavator segment's position as a market leader within the construction machinery rental service industry.

The construction machinery rental service industry's growth is propelled by a confluence of factors. Increased government spending on infrastructure projects worldwide fuels demand. The rising popularity of rental over purchasing, due to cost-effectiveness and flexibility, further accelerates market growth. Technological advancements, such as automation and improved machine efficiency, enhance rental appeal. Lastly, the industry's consolidation, with larger players acquiring smaller ones, leads to improved service offerings and economies of scale. These catalysts collectively ensure the market's sustained expansion.

This report provides a comprehensive overview of the construction machinery rental service market, detailing its current trends, driving forces, challenges, key players, and future growth prospects. The analysis covers various machine types and key geographical regions, offering a granular understanding of this dynamic sector. The forecast period extends to 2033, providing valuable insights for investors, industry participants, and stakeholders seeking to navigate this evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include United Rentals, Inc., Herc Rentals Inc., Sunbelt Rentals, Inc., H&E Equipment Services, Inc., Ahern Rentals, Inc., BlueLine Rental, LLC, Neff Rental, LLC, The Home Depot Rental, Rental One, A-Plant, Laxyo Energy Ltd., .

The market segments include Type.

The market size is estimated to be USD 126.15 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Construction Machinery Rental Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Construction Machinery Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.