1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Glass Fiber Nonwoven?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Construction Glass Fiber Nonwoven

Construction Glass Fiber NonwovenConstruction Glass Fiber Nonwoven by Type (Airlay Glass Fiber Nonwoven, Wetlaid Glass Fiber Nonwoven, Other), by Application (Roofing Materials, Wallpapers, Floor, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

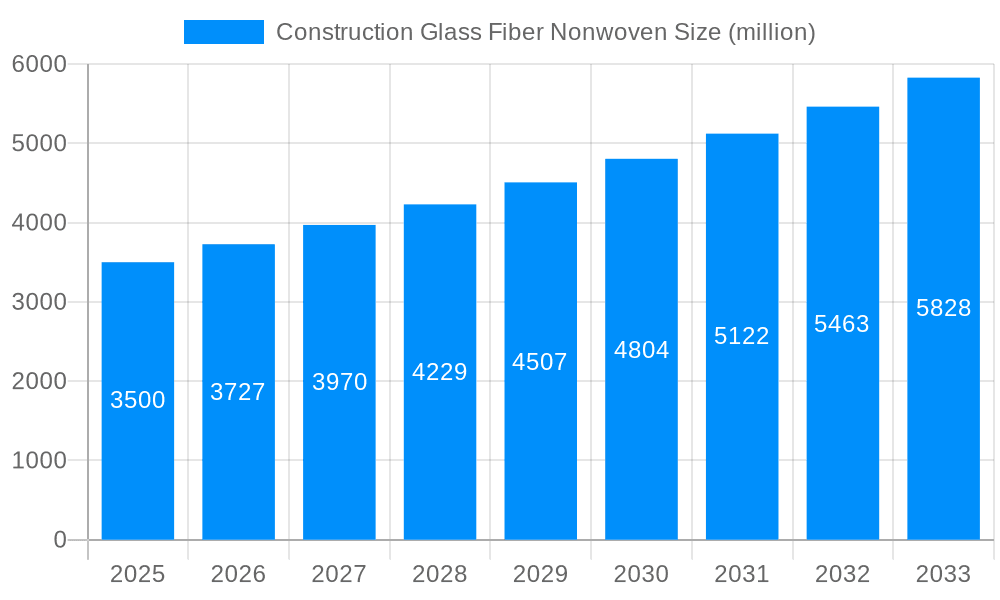

The construction glass fiber nonwoven market is experiencing robust growth, driven by the increasing demand for sustainable and high-performance building materials. The market's expansion is fueled by several factors, including the rising popularity of eco-friendly construction practices, stringent building codes emphasizing energy efficiency, and the need for durable, lightweight roofing and insulation solutions. The preference for aesthetically pleasing interior finishes, such as high-quality wallpapers and flooring, further contributes to market expansion. Airlay and wetlaid glass fiber nonwovens dominate the market, catering to diverse applications in roofing materials, wallpapers, and flooring, with a projected CAGR of 5% (estimated based on typical growth rates in similar construction materials markets). Key players like Owens Corning, Saint-Gobain, and Ahlstrom-Munksjö are leveraging their technological expertise and established distribution networks to maintain a strong market presence. However, the market faces certain restraints including fluctuating raw material prices, potential supply chain disruptions, and the competitive landscape with other insulation materials. Regional growth varies, with North America and Asia Pacific leading the market due to substantial construction activities and a high adoption rate of advanced building technologies. The forecast period from 2025-2033 presents significant opportunities for market expansion due to infrastructure development projects globally and increasing investment in green buildings.

Looking ahead, the construction glass fiber nonwoven market is poised for continued expansion, driven by technological advancements in fiber production, the development of innovative nonwoven structures, and an increasing focus on improving the thermal and acoustic performance of buildings. The market will witness increased consolidation through mergers and acquisitions as larger players seek to expand their product portfolios and market share. Furthermore, the growing adoption of sustainable manufacturing practices and the development of recycled fiber content will shape the market's future trajectory. The focus will shift towards customized solutions to address specific regional needs and preferences, leading to niche product development and greater market segmentation. The introduction of smart building technologies that incorporate nonwoven materials presents additional growth prospects. Geographical expansion, particularly in emerging economies with rapidly developing infrastructure, will be a key focus for market players.

The construction glass fiber nonwoven market is experiencing robust growth, driven by the increasing demand for lightweight, durable, and cost-effective building materials. The global market size, valued at an estimated XXX million units in 2025, is projected to witness significant expansion during the forecast period (2025-2033). This growth is fueled by several factors, including the burgeoning construction industry, particularly in developing economies, and the rising adoption of sustainable and energy-efficient building practices. The preference for nonwoven glass fiber materials in various applications, such as roofing, insulation, and flooring, is further boosting market expansion. Analysis of the historical period (2019-2024) reveals a consistent upward trend, indicating a sustained demand for these products. Key market insights reveal a strong preference for specific types of glass fiber nonwovens, like airlaid and wetlaid variants, depending on application requirements. The increasing awareness of the environmental benefits of using recycled materials in construction is also expected to positively influence the market's trajectory in the coming years. Furthermore, technological advancements in fiber production and processing techniques are continuously improving the performance and versatility of these nonwovens, opening up new opportunities in diverse construction applications. Competition among key players is stimulating innovation and price optimization, making glass fiber nonwovens an increasingly attractive choice for construction projects of varying scales. The market's future trajectory looks promising, with projected growth exceeding XXX million units by 2033.

Several factors are contributing to the impressive growth of the construction glass fiber nonwoven market. Firstly, the global construction industry's expansion, particularly in rapidly developing economies across Asia and the Middle East, necessitates a substantial increase in building materials. Glass fiber nonwovens are gaining traction due to their lightweight nature, enabling easier transportation and handling, and their superior durability and strength compared to traditional materials. Secondly, the increasing focus on energy efficiency and sustainability in construction is a major driver. Glass fiber nonwovens excel in thermal and acoustic insulation, making them crucial for creating eco-friendly and energy-saving buildings. The growing adoption of green building codes and regulations further strengthens the demand. Thirdly, cost-effectiveness plays a vital role. Compared to other insulation and reinforcement materials, glass fiber nonwovens offer a competitive price point, making them a viable option for both residential and commercial projects. Finally, advancements in manufacturing processes have improved the quality and performance of glass fiber nonwovens, leading to enhanced properties like improved resistance to moisture, fire, and chemicals, thus further expanding their application potential.

Despite the positive growth outlook, the construction glass fiber nonwoven market faces some challenges. Fluctuations in raw material prices, primarily glass fibers and binding agents, can significantly impact production costs and profitability. The market is susceptible to global economic downturns, as construction activities are often among the first to be affected during economic recessions. Moreover, stringent environmental regulations regarding the disposal and recycling of glass fiber waste can present operational hurdles for manufacturers. Competition from substitute materials, such as mineral wool and polyurethane foams, also poses a threat. These alternatives might offer specific advantages in certain applications, forcing manufacturers of glass fiber nonwovens to constantly innovate and improve their product offerings. Lastly, variations in regional regulations and building codes can influence market penetration in different geographical areas, requiring manufacturers to adapt their products to meet local standards and requirements. Effectively navigating these challenges requires a strategic approach involving cost optimization, sustainable practices, and continuous product improvement.

The roofing materials segment is poised to dominate the construction glass fiber nonwoven market due to its widespread use as an underlayment in roofing systems. This segment's significant market share is driven by the increasing demand for durable and weather-resistant roofing solutions. Glass fiber nonwovens offer excellent protection against moisture, wind, and UV damage, making them a preferred choice for various roofing applications.

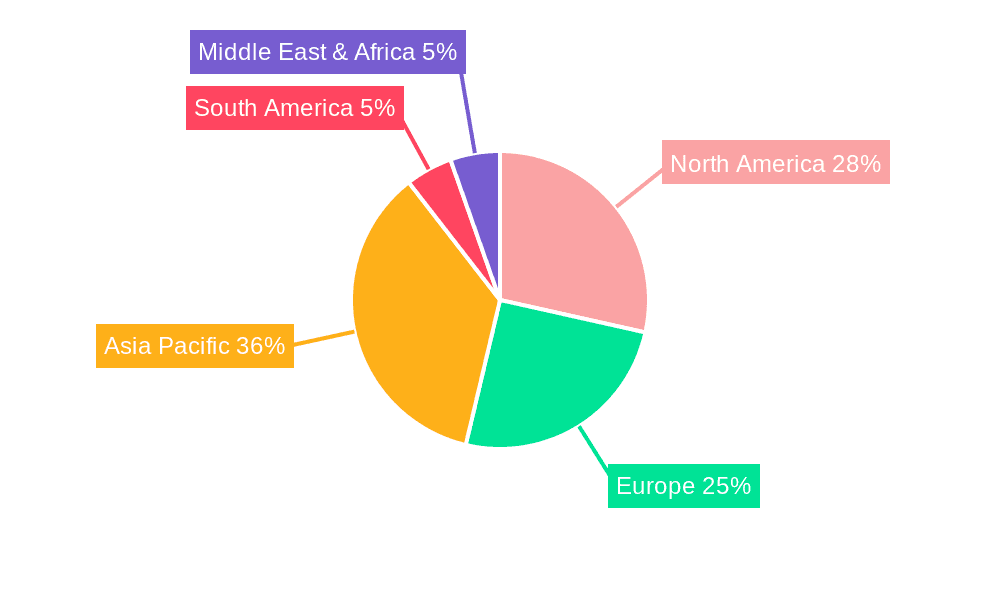

Asia-Pacific: This region is expected to dominate the market due to its rapidly expanding construction sector, particularly in countries like China, India, and Japan. The region's robust economic growth and increasing urbanization are driving demand for efficient and cost-effective building materials like glass fiber nonwovens.

North America: The market in North America is also expected to witness considerable growth, fueled by the increasing focus on energy-efficient buildings and the rising demand for sustainable construction practices. This region is characterized by the presence of several established players in the glass fiber nonwoven industry.

Europe: While the European market is relatively mature, it still exhibits substantial growth potential driven by renovation projects and the stringent energy efficiency regulations in place.

Wetlaid Glass Fiber Nonwoven: This type of nonwoven offers superior strength and dimensional stability compared to airlaid variants, making it particularly suitable for applications requiring high performance, such as reinforcement in roofing and flooring systems. The higher production costs associated with wetlaid manufacturing are offset by its performance advantages in these demanding applications. The higher cost is compensated by its greater durability and longevity which translates to cost savings in the long term.

Other Applications: This segment encompasses a diverse range of uses, including insulation in walls and ceilings, as well as various niche applications in composite materials and filtration systems, contributing to the overall market's diversified growth. Innovative product development is continually expanding this segment.

The combination of robust growth in the Asia-Pacific region, driven by construction activity, and the high demand for wetlaid glass fiber nonwovens in roofing and other demanding applications points towards these factors as the most dominant influences shaping market trends. The interplay between geographical growth and product type makes accurate forecasting crucial.

The construction glass fiber nonwoven industry is experiencing accelerated growth fueled by the convergence of several factors. The rising global demand for sustainable and energy-efficient construction solutions significantly drives the demand for superior insulation materials, like glass fiber nonwovens. Simultaneously, advancements in manufacturing processes lead to cost reductions and enhanced product performance, attracting both residential and commercial construction sectors. These synergistic trends are key catalysts accelerating market expansion and cementing the position of glass fiber nonwovens as a vital component in modern construction.

This report provides a comprehensive analysis of the construction glass fiber nonwoven market, encompassing historical data (2019-2024), current market estimations (2025), and future projections (2025-2033). The detailed insights provided cover market size, segmentation by type and application, key regional markets, major players, and significant industry developments. This in-depth study equips stakeholders with a clear understanding of market trends and opportunities, enabling informed decision-making for strategic investments and business planning within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

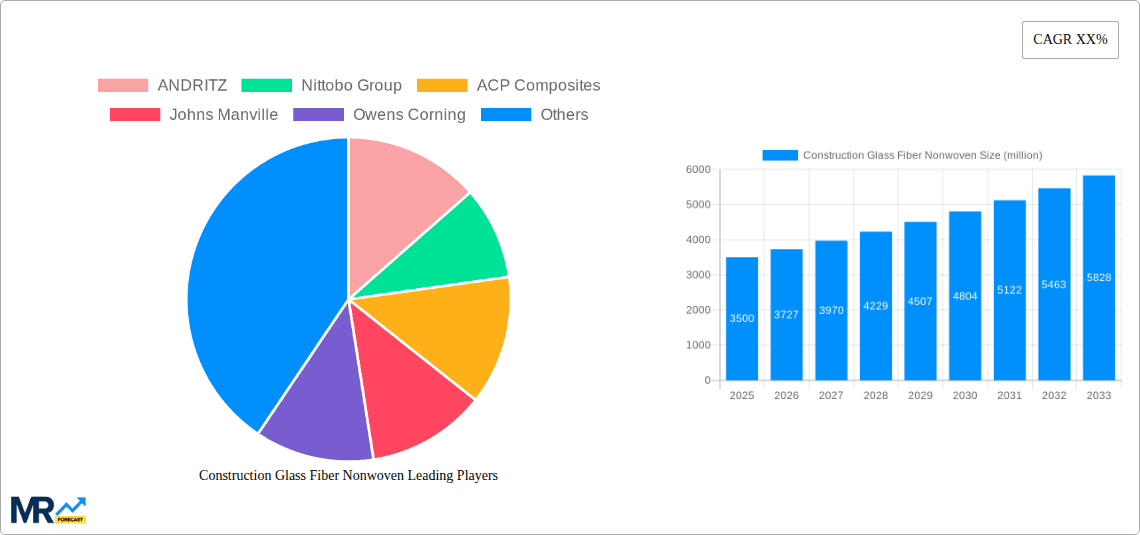

Key companies in the market include ANDRITZ, Nittobo Group, ACP Composites, Johns Manville, Owens Corning, Ahlstrom-Munksjö, NSG, Hokuetsu Corporation, Jiangsu Changhai Composite, Lydall, Chongqing Zaisheng Technology, Shaanxi HuaTek Fiberglass Material, Saint-Gobain, Sinoma Jinjing Fiberglass, Oji F-Tex Co., Ltd..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Construction Glass Fiber Nonwoven," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Construction Glass Fiber Nonwoven, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.