1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction and Industrial Equipment Rental?

The projected CAGR is approximately 6.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Construction and Industrial Equipment Rental

Construction and Industrial Equipment RentalConstruction and Industrial Equipment Rental by Type (Construction Equipment Rental 建筑和工业设备租赁, Industrial Equipment Rental), by Application (Personal Use, Commercial Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

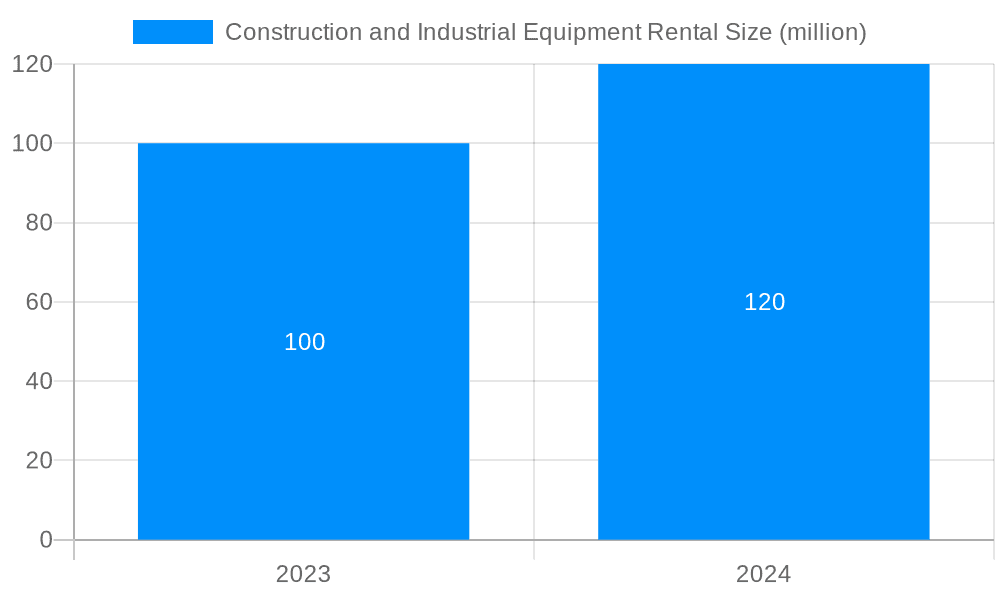

The global construction and industrial equipment rental market is projected to expand from $213.68 billion in 2025 to a substantial figure by 2033, driven by a Compound Annual Growth Rate (CAGR) of 6.1%. This growth is fueled by escalating demand for rental equipment across key sectors including construction, mining, and manufacturing, alongside the increasing adoption of rental solutions by businesses and individuals seeking cost-effective operational strategies.

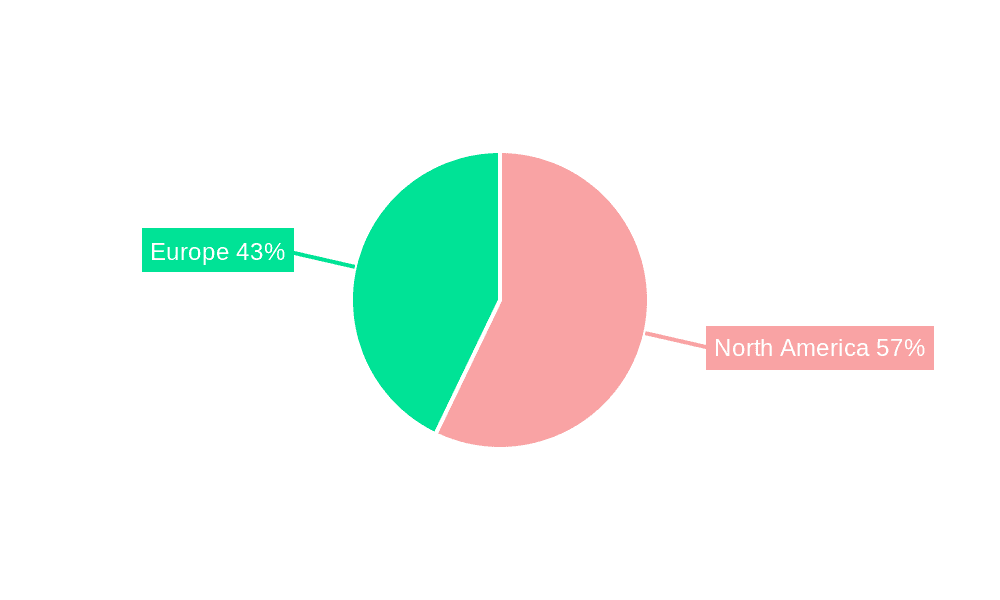

North America currently leads the construction and industrial equipment rental market, with Europe and Asia Pacific following. The United States represents the dominant force within North America, contributing significantly to regional revenue. The market's expansion in North America is underpinned by robust demand from diverse end-use industries. Europe holds the second-largest market share, propelled by the thriving construction sector. Asia Pacific is identified as the fastest-growing region, experiencing increased demand for equipment rentals from its expanding industrial and construction landscapes.

The construction and industrial equipment rental market has demonstrated significant expansion, evidenced by a market size of $25.16 billion in 2023, with projections reaching $47.64 billion by 2032, at a CAGR of 9.4% (2023-2032). This upward trend is predominantly influenced by the rising demand for rental services, driven by a burgeoning construction industry, extensive infrastructure development initiatives, and a growing preference for flexible and economical rental options over outright equipment purchase.

The construction and industrial equipment rental market is primarily driven by the following key factors:

Soaring Construction Industry: The exponential growth of the construction industry has significantly contributed to the escalating demand for construction equipment rentals. The expansion of commercial and residential construction projects, as well as large-scale infrastructure initiatives, has led to a surge in the need for diverse types of heavy equipment.

Favorable Government Policies: Governments worldwide are actively implementing favorable policies and initiatives to encourage sustainable construction practices. This includes promoting the adoption of modern and efficient construction equipment, which further stimulates the rental market's growth.

Rental Cost-Effectiveness: Rental solutions provide a cost-effective alternative to purchasing expensive construction and industrial equipment. It eliminates hefty upfront investments, reduces storage and maintenance expenses, and allows businesses to access specialized equipment as needed.

Despite the thriving market, the construction and industrial equipment rental industry grapples with certain challenges and restraints:

Operator Availability: Skilled and experienced equipment operators are crucial for effective equipment utilization. However, the shortage of qualified operators can hinder rental businesses from meeting the growing demand, particularly for specialized or complex equipment.

Environmental Regulations: Stringent environmental regulations governing equipment emissions and noise levels can pose challenges to rental companies. They must invest in eco-friendly solutions and ensure compliance with regulatory standards, which can increase operational costs.

Seasonality: Certain construction and industrial activities are seasonal, leading to fluctuations in equipment rental demand throughout the year. This can impact the profitability of rental businesses during off-peak periods.

Regionally, North America is expected to dominate the global construction and industrial equipment rental market with a 35% share, driven by the strong construction industry, particularly in the United States. The growing adoption of advanced technologies and a favorable regulatory environment further contribute to the region's dominance.

The construction equipment rental segment is projected to hold the largest market share of over 60% throughout the forecast period. The consistent demand for various construction equipment, including excavators, cranes, bulldozers, and backhoes, for infrastructure projects and commercial construction, will continue to fuel the growth of this segment.

Several growth catalysts are poised to drive the construction and industrial equipment rental market in the coming years:

Technological Advancements: The integration of IoT (Internet of Things) and telematics systems into construction equipment enhances efficiency, productivity, and safety. This technological transformation is revolutionizing the rental industry and improving customer service.

Emerging Rental Models: Flexible rental models, such as subscription-based rental and long-term contracts, are gaining popularity. These models offer cost-effective solutions for customers, ensuring access to the latest equipment while minimizing downtime.

Environmental Sustainability: The construction and industrial equipment rental industry is increasingly focusing on reducing carbon emissions and promoting environmental sustainability. The adoption of electric and hybrid equipment, as well as initiatives to minimize waste and optimize resource utilization, will shape the future of the market.

The construction and industrial equipment rental sector has witnessed several noteworthy developments in recent years:

Consolidation and Mergers: The market has observed a trend towards consolidation, with larger companies acquiring smaller rental businesses to expand their presence and enhance their competitive advantage.

Digitization and Automation: Digital technologies are transforming the industry, enabling online booking, remote monitoring, and predictive maintenance. This digitization enhances customer experience and streamlines operations.

Sustainability Initiatives: Rental companies are undertaking initiatives to reduce their environmental impact. This includes investing in emission-reducing equipment, implementing waste management programs, and promoting sustainable practices.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

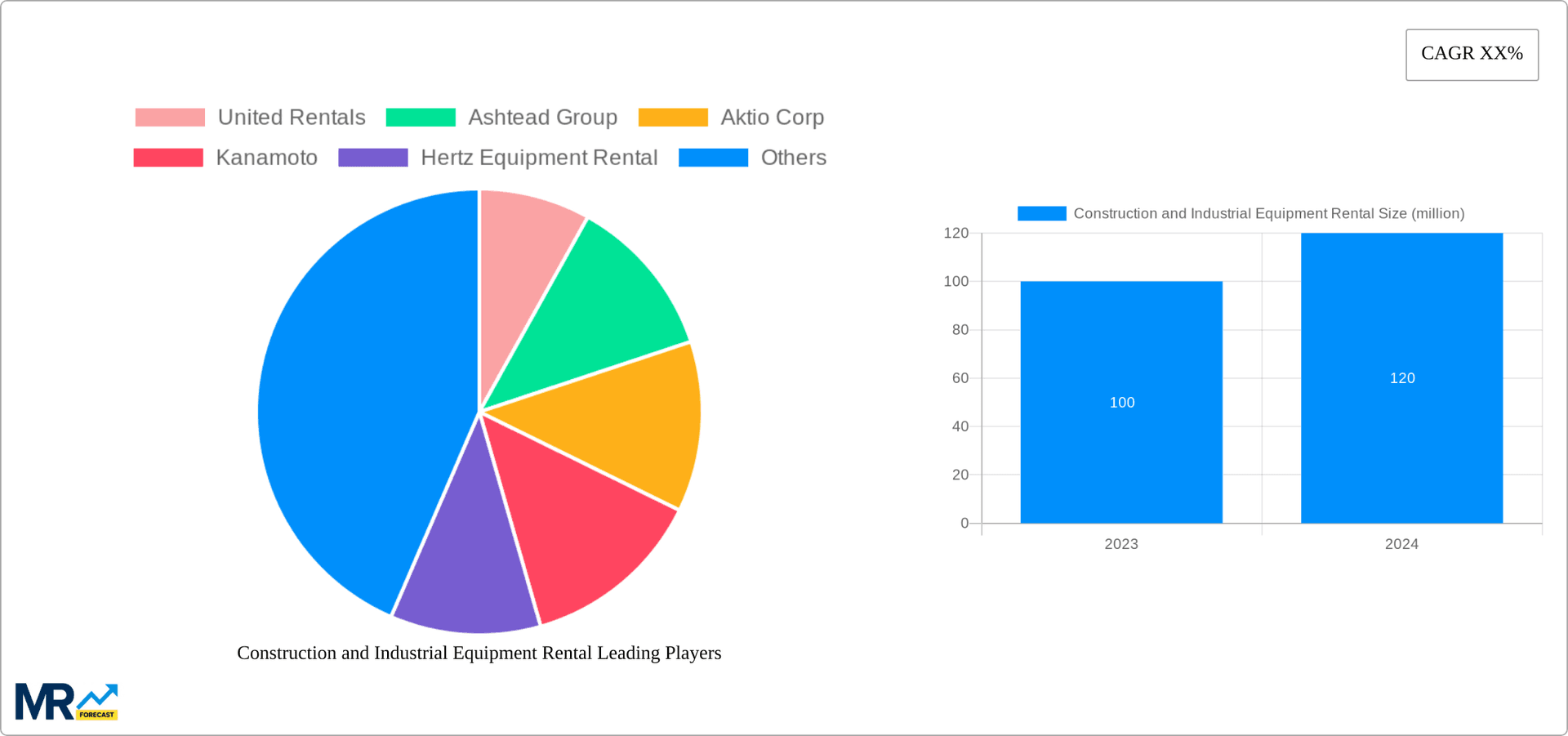

Key companies in the market include United Rentals, Ashtead Group, Aktio Corp, Kanamoto, Hertz Equipment Rental, Loxam Group, Blueline Rent, Ahern Rentals, Nishio Rent, Aggreko, Maxim Crane Works, Shaanxi Construction Machinery.

The market segments include Type, Application.

The market size is estimated to be USD 213.68 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Construction and Industrial Equipment Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Construction and Industrial Equipment Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.