1. What is the projected Compound Annual Growth Rate (CAGR) of the Conference Room Webcams?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Conference Room Webcams

Conference Room WebcamsConference Room Webcams by Type (10x Optical Zoom Below, 10-20x Optical Zoom, 20-30x Optical Zoom, 30x Optical Zoom Above), by Application (Corporate Enterprises, Education, Media & Entertainment, Healthcare, Government & Defense, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

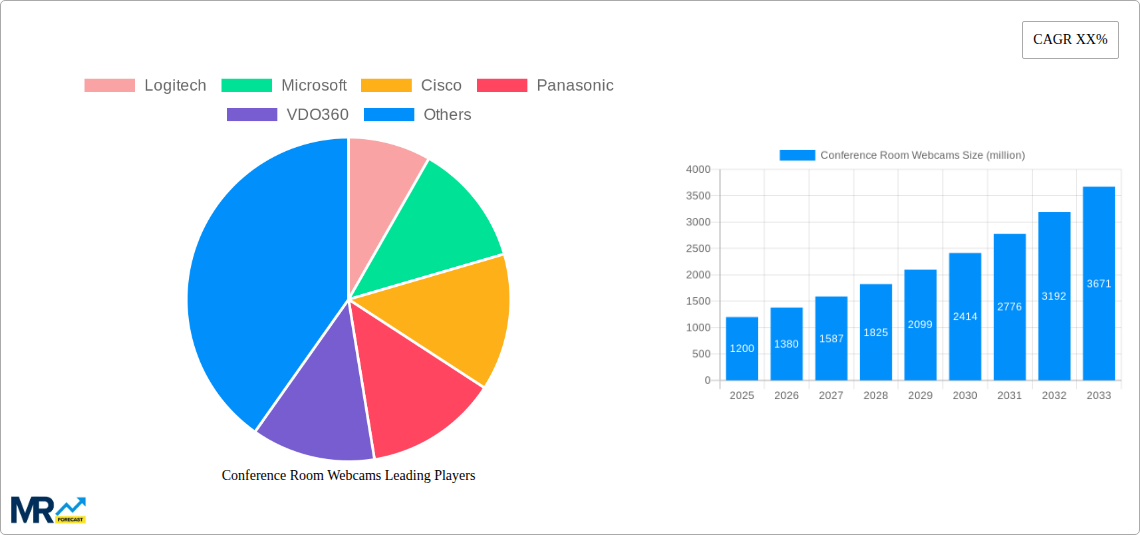

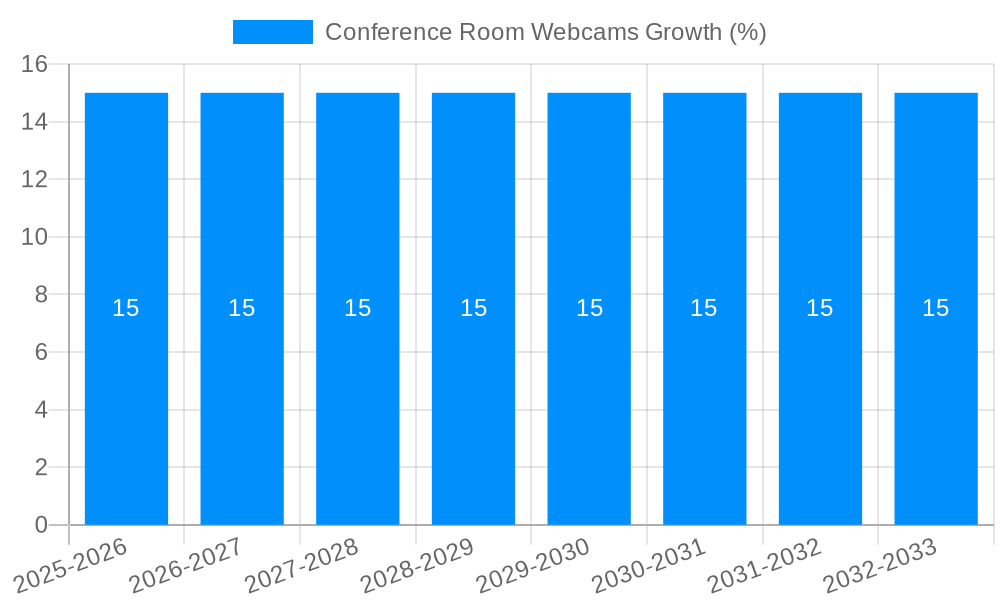

The global Conference Room Webcams market is poised for significant expansion, projected to reach approximately $1,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% anticipated over the forecast period (2025-2033). This substantial growth is primarily fueled by the escalating adoption of hybrid and remote work models, necessitating advanced communication solutions for seamless collaboration. The increasing demand from corporate enterprises for enhanced virtual meetings, coupled with the growing integration of high-definition video conferencing in educational institutions for remote learning and in the media & entertainment sector for content creation, are key drivers. Furthermore, the healthcare industry's reliance on telemedicine and remote consultations, and the government and defense sectors' need for secure and reliable communication, are also contributing to market momentum. The evolution towards webcams with higher optical zoom capabilities, particularly in the 20-30x and 30x optical zoom above segments, reflects the industry's push for clearer visuals and greater flexibility in larger meeting spaces.

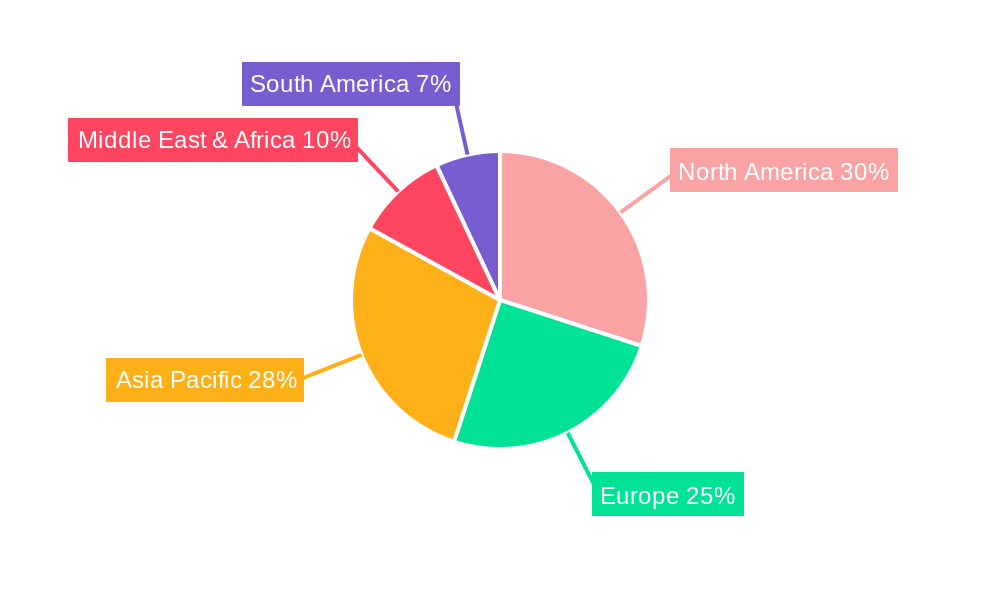

The market's trajectory is further shaped by emerging trends such as the integration of AI-powered features like automatic framing, speaker tracking, and noise cancellation, enhancing the user experience. The proliferation of cloud-based conferencing platforms also necessitates compatible, high-performance webcams. However, certain restraints, including the initial cost of advanced conferencing equipment for smaller businesses and potential concerns regarding data privacy and security, could temper the growth rate in specific segments. Despite these challenges, the market is characterized by intense competition among leading players like Logitech, Microsoft, and Cisco, who are continuously innovating to offer feature-rich and cost-effective solutions. The Asia Pacific region is expected to witness the fastest growth due to rapid digitalization and increasing investments in collaborative technologies, while North America and Europe will continue to hold significant market share owing to established remote work infrastructures.

The global conference room webcam market is experiencing a significant upward trajectory, projected to reach over US$4,000 million by the end of the study period in 2033. This impressive growth is fueled by an escalating demand for enhanced remote and hybrid collaboration solutions across diverse industries. The historical period of 2019-2024 witnessed the foundational growth, accelerated by the unforeseen shift towards remote work, solidifying the need for robust communication tools. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion. Looking ahead to the forecast period of 2025-2033, this report will dissect the intricate web of technological advancements, evolving user preferences, and strategic market dynamics that are shaping this burgeoning sector.

Key market insights reveal a strong emphasis on improving video and audio quality, with manufacturers investing heavily in higher resolution sensors, advanced optics, and sophisticated noise-cancellation technologies. The integration of AI-powered features, such as auto-framing, speaker tracking, and intelligent background blurring, is becoming a standard expectation, transforming static video calls into more dynamic and engaging interactions. Furthermore, the market is seeing a clear trend towards user-friendly, plug-and-play devices that simplify setup and operation for seamless integration into existing conference room infrastructures. The increasing adoption of 4K resolution and higher zoom capabilities (specifically the 30x Optical Zoom Above segment) is also a defining characteristic of current trends, catering to larger meeting spaces and the need for greater clarity and detail. The report will explore how these evolving technological landscapes are directly influencing market segmentation and driving innovation.

The relentless march of digital transformation, coupled with the profound impact of the COVID-19 pandemic, has irrevocably altered the landscape of workplace communication, acting as primary drivers for the conference room webcam market. The widespread adoption of hybrid work models has necessitated the creation of equitable and effective collaboration environments for both in-office and remote participants. This has, in turn, spurred significant investment in high-quality audio-visual equipment. Businesses are no longer viewing conference room webcams as mere peripherals but as essential components of their operational infrastructure, crucial for maintaining productivity, fostering team cohesion, and enabling global connectivity. The growing realization that superior video conferencing solutions directly translate to improved decision-making and enhanced business outcomes further propels this market forward.

Moreover, the increasing globalization of businesses and the rise of remote teams are creating a persistent demand for advanced communication tools that can bridge geographical divides. Educational institutions are also recognizing the value of immersive virtual learning experiences, leading to increased adoption of webcams in classrooms and lecture halls. The entertainment industry is leveraging these devices for remote production and virtual event broadcasting, adding another significant layer of demand. These multifaceted applications, spanning across critical sectors, collectively create a powerful impetus for sustained market growth and innovation in the conference room webcam domain.

Despite the robust growth trajectory, the conference room webcam market is not without its challenges and restraints. A significant hurdle lies in the perceived high initial investment costs associated with enterprise-grade solutions, especially for small and medium-sized businesses (SMBs). While the long-term benefits are evident, the upfront expenditure can be a deterrent for some organizations, prompting them to opt for more budget-friendly, albeit less sophisticated, alternatives. Another key challenge revolves around integration complexities and compatibility issues. Ensuring seamless integration with existing video conferencing platforms, network infrastructures, and other IT equipment can be a technically demanding process, requiring skilled IT personnel and potentially incurring additional costs for specialized support.

Furthermore, concerns regarding data privacy and security remain a critical consideration for many organizations. The transmission of sensitive business information through video conferencing platforms necessitates robust security protocols and encryption, and any perceived vulnerabilities can lead to hesitancy in adoption. The rapid pace of technological evolution also presents a challenge; businesses must constantly evaluate and update their equipment to remain competitive, which can lead to obsolescence concerns and recurring investment cycles. Finally, the availability of a wide array of product options, each with varying features and price points, can create decision fatigue for buyers, making it difficult to identify the most suitable solution for their specific needs.

The global conference room webcam market is characterized by dynamic regional and segment-specific growth patterns. North America, driven by a mature business ecosystem and a high propensity for adopting advanced technologies, is expected to continue its dominance throughout the study period, contributing an estimated US$1,800 million by 2025. The region's robust presence of major corporations, coupled with a strong emphasis on hybrid work models and technological innovation, positions it as a leading market. The United States, in particular, accounts for a substantial portion of this market share, with companies actively investing in upgrading their collaboration infrastructure to support distributed workforces and enhance remote communication efficiency. The extensive adoption of video conferencing solutions in corporate enterprises and the burgeoning media and entertainment sector further solidify North America's leading position.

Across various segments, the Corporate Enterprises application segment is projected to be the largest revenue contributor, estimated to reach over US$2,500 million by 2025. This dominance is attributed to the critical need for seamless communication and collaboration within large organizations, enabling efficient internal meetings, client interactions, and project management across geographically dispersed teams. The increasing implementation of sophisticated video conferencing systems in boardrooms, huddle rooms, and general meeting spaces within corporate settings underscores this trend.

Within the Type segmentation, the 30x Optical Zoom Above segment is anticipated to witness significant growth. This is driven by the requirement for enhanced clarity and broader coverage in larger conference rooms, where participants may be situated at a considerable distance from the camera. The ability to capture sharp, detailed visuals from afar is crucial for effective remote participation, particularly in executive boardrooms and large auditoriums. The continuous advancements in optical zoom technology, coupled with the increasing demand for high-definition video quality, are fueling the expansion of this segment, making it a key area of focus for market players.

The Education and Healthcare segments are also poised for substantial growth, albeit from a smaller base. The increasing integration of remote learning tools and telemedicine services necessitates advanced video conferencing capabilities. Government and Defense sectors are also significant adopters, prioritizing secure and reliable communication solutions.

Several key catalysts are fueling the robust growth of the conference room webcam industry. The escalating adoption of hybrid and remote work models globally has created an indispensable demand for effective collaboration tools. Furthermore, significant technological advancements, including the integration of AI-powered features and the widespread availability of 4K and higher resolution cameras, are enhancing user experience and driving adoption. The increasing focus on immersive and engaging virtual meetings, coupled with government initiatives supporting digital infrastructure development, are further bolstering market expansion.

This comprehensive report offers an in-depth analysis of the global conference room webcam market, providing crucial insights for stakeholders. It meticulously details market trends, driving forces, and challenges, painting a clear picture of the current landscape and future trajectory. The report segments the market by type and application, identifying key regions and countries poised for significant growth. Furthermore, it highlights crucial growth catalysts and profiles leading market players. The extensive analysis, spanning from the historical period of 2019-2024 to the forecast period of 2025-2033, with a base year of 2025, equips businesses with the essential data and strategic understanding to navigate this dynamic and rapidly evolving industry, potentially impacting investment decisions worth millions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Logitech, Microsoft, Cisco, Panasonic, VDO360, HuddleCamHD, Hp, Razer, Philips, AVer, Ausdom, Lumens, Xcellon, Owl Labs, Avaya, Bose Corporation, Adesso Inc, Huddly, Jabra, MEE audio, MuxLab, Kandao Technology, Aoni, Dell, Elecom, Hikvision, Yealink, Sanwa Supply, ValueHD, Lenovo, IVCOO, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Conference Room Webcams," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Conference Room Webcams, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.