1. What is the projected Compound Annual Growth Rate (CAGR) of the Conductive Polymer Tantalum Electrolytic Capacitors?

The projected CAGR is approximately 8.2%.

Conductive Polymer Tantalum Electrolytic Capacitors

Conductive Polymer Tantalum Electrolytic CapacitorsConductive Polymer Tantalum Electrolytic Capacitors by Type (Industrial Grade, Military Grade, World Conductive Polymer Tantalum Electrolytic Capacitors Production ), by Application (Consumer Electronics, Military and Aerospace, Automotive, Industrial Equipment, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

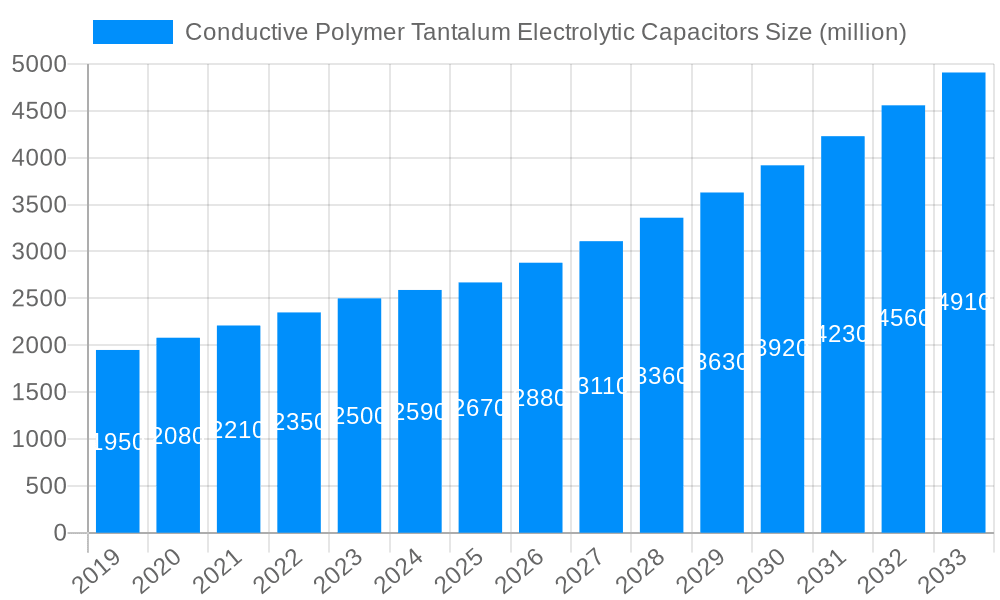

The global conductive polymer tantalum electrolytic capacitors market is experiencing robust expansion, projected to reach approximately USD 2.67 billion in 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 8.2% throughout the study period (2019-2033). The fundamental driver for this market surge lies in the escalating demand for advanced electronic components that offer superior performance, miniaturization, and reliability. Conductive polymer tantalum capacitors, with their low Equivalent Series Resistance (ESR), excellent high-frequency performance, and enhanced thermal stability, are increasingly becoming the preferred choice across a multitude of industries. The burgeoning consumer electronics sector, encompassing smartphones, wearables, and high-definition entertainment systems, is a significant contributor, as is the critical need for dependable components in military and aerospace applications, where failure is not an option. Furthermore, the automotive industry's rapid electrification and the integration of sophisticated electronic control units (ECUs) are also propelling market growth.

The market is characterized by several key trends, including the continuous innovation in materials science leading to improved conductive polymer formulations, enabling higher capacitance densities and voltage ratings. The increasing adoption of surface-mount technology (SMT) further emphasizes the need for compact and high-performance capacitors, aligning perfectly with the characteristics of conductive polymer tantalum electrolytic capacitors. While the market demonstrates strong growth potential, certain restraints could influence its trajectory. The inherent cost of tantalum, a critical raw material, can present a challenge, though advancements in recycling and material efficiency are mitigating this concern. Moreover, the development and adoption of alternative capacitor technologies, such as multilayer ceramic capacitors (MLCCs) with improved conductive properties, could pose competitive pressure. Nevertheless, the unique advantages offered by conductive polymer tantalum electrolytic capacitors, particularly in demanding applications, are expected to sustain their market dominance and drive significant value creation in the coming years.

This report delves deep into the burgeoning global market for Conductive Polymer Tantalum Electrolytic Capacitors, offering an exhaustive analysis from the Historical Period of 2019-2024 through to the Forecast Period of 2025-2033, with a keen focus on the Base Year and Estimated Year of 2025. The Study Period spanning 2019-2033 provides a comprehensive timeline for understanding market dynamics. We project the global market value to reach over ten billion USD by the end of the forecast period, fueled by continuous innovation and expanding applications.

The global market for Conductive Polymer Tantalum Electrolytic Capacitors is experiencing a profound transformation, driven by the relentless pursuit of miniaturization, enhanced performance, and superior reliability across a multitude of industries. From the Historical Period (2019-2024), we observed a steady upward trajectory, with the market value already reaching several billion dollars. The transition to higher capacitance densities and lower Equivalent Series Resistance (ESR) has become a paramount trend, enabling the development of more compact and efficient electronic devices. This is particularly evident in consumer electronics, where the demand for smaller form factors in smartphones, laptops, and wearables continues to escalate. Furthermore, the adoption of conductive polymer technology over traditionalMnO2 or wet electrolytic alternatives is accelerating due to its inherent advantages in surge current handling, stability over temperature and frequency, and significantly longer operational lifespans. The increasing complexity and power demands of modern electronic systems are pushing component manufacturers to develop capacitors with higher voltage ratings and improved thermal management capabilities. By 2025, the market is poised to witness a substantial surge in demand for these advanced components, with projections indicating a global market value approaching ten billion USD. This growth is further substantiated by an anticipated compound annual growth rate (CAGR) exceeding 8% during the Forecast Period (2025-2033). The integration of these capacitors into critical infrastructure within the automotive sector, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is a significant trend shaping the market landscape. Similarly, the stringent requirements of military and aerospace applications, demanding robust performance under extreme conditions, are driving innovation and market penetration. The evolving regulatory landscape, with a focus on energy efficiency and lead-free manufacturing, also plays a crucial role in shaping product development and market adoption. The increasing adoption of advanced packaging techniques and specialized materials will continue to redefine the capabilities and applications of these capacitors, ensuring their indispensable role in next-generation electronic designs.

The conductive polymer tantalum electrolytic capacitor market is experiencing robust growth, propelled by several key driving forces that underscore its strategic importance in modern electronics. The relentless demand for miniaturization, a defining characteristic of consumer electronics, is a primary catalyst. As devices become smaller and thinner, components with higher capacitance density and a reduced physical footprint are imperative. Conductive polymer technology excels in this regard, offering significantly higher volumetric efficiency compared to traditional tantalum electrolytic capacitors. This trend is further amplified by the explosive growth of the Internet of Things (IoT) ecosystem, which necessitates vast numbers of small, power-efficient sensors and connected devices. Secondly, the burgeoning automotive industry, particularly the rapid electrification of vehicles, is a significant growth engine. Electric vehicles (EVs) and advanced driver-assistance systems (ADAS) require high-performance, reliable capacitors for power management, filtering, and energy storage. Conductive polymer tantalum capacitors offer superior surge handling and stable performance under fluctuating temperatures, making them ideal for the demanding automotive environment. Moreover, the increasing prevalence of 5G technology and its associated infrastructure, which requires high-frequency filtering and stable power delivery, is also contributing to market expansion. The commitment of leading manufacturers to continuous research and development, focusing on improving capacitance, voltage ratings, and operational stability, is also a crucial driving force, ensuring that these capacitors remain at the forefront of technological advancement.

Despite the promising growth trajectory, the conductive polymer tantalum electrolytic capacitor market is not without its challenges and restraints. A significant hurdle remains the inherent cost of tantalum, a rare earth metal, which can make conductive polymer tantalum capacitors more expensive than alternative capacitor technologies, particularly in cost-sensitive applications. While advancements in material science are mitigating this to some extent, the price volatility of tantalum can impact market competitiveness. Furthermore, the stringent manufacturing processes and purity requirements for tantalum, coupled with environmental concerns related to mining and processing, can pose regulatory and supply chain challenges. Another restraint stems from the availability of high-performance alternatives. For certain applications, advanced ceramic capacitors or supercapacitors may offer comparable or even superior performance in terms of power density or extremely low ESR, potentially diverting some demand. While conductive polymer tantalum capacitors excel in surge handling and stability, designers must carefully consider these trade-offs when selecting components. Moreover, the specialized nature of conductive polymer technology can sometimes lead to a steeper learning curve for designers less familiar with its nuances, potentially slowing adoption in some segments. Ensuring long-term reliability in extreme temperature and humidity conditions, though generally excellent, remains an ongoing area of focus for manufacturers, especially in highly demanding industrial and military applications. Overcoming these challenges will be crucial for unlocking the full market potential of conductive polymer tantalum electrolytic capacitors.

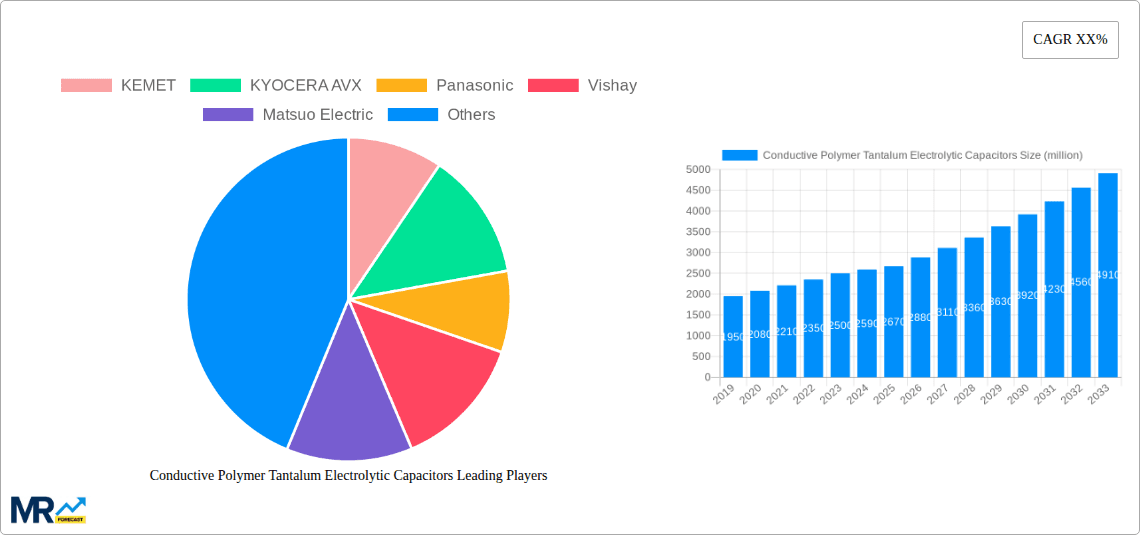

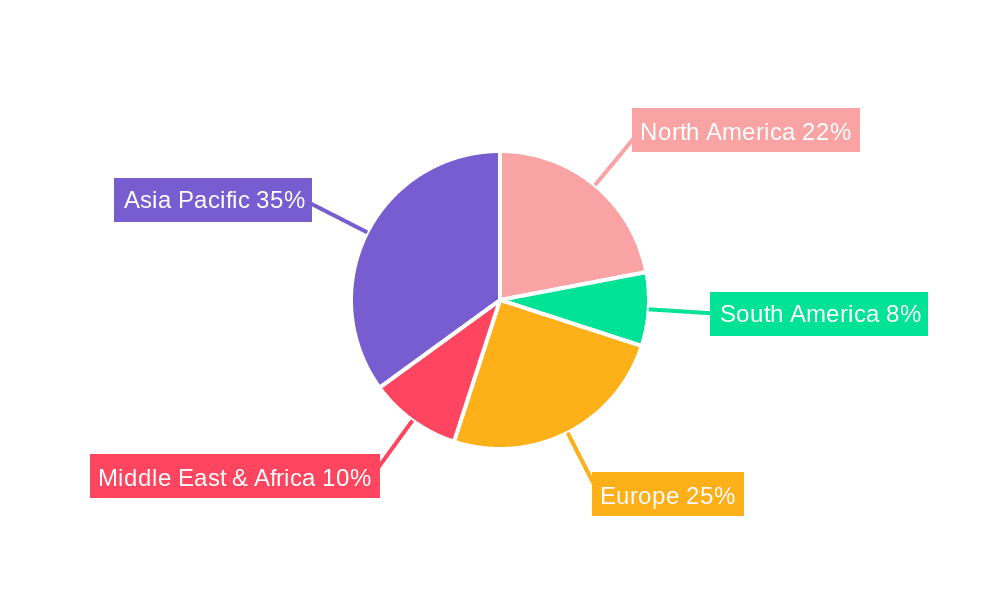

The global Conductive Polymer Tantalum Electrolytic Capacitors market is characterized by a dynamic interplay of regional strengths and segment dominance. However, Asia Pacific is poised to emerge as the leading region, driven by its robust manufacturing capabilities, burgeoning electronics industry, and significant investments in research and development. Countries like China are not only major consumers but also increasingly significant producers, with companies like Zhuzhou Hongda Electronics, Sunlord, Hunan Xiangyee Electronic Technology, and Jiangsu Zhenhua Xinyun Electronics contributing significantly to the global supply. The presence of extensive supply chains and a highly skilled workforce in this region further solidifies its leadership.

Within the application segments, Industrial Equipment is projected to be a key segment to dominate the market. This dominance is fueled by the increasing automation and digitalization of manufacturing processes, the growing demand for reliable power management solutions in heavy machinery, and the stringent requirements of specialized industrial applications such as medical devices, test and measurement equipment, and power supplies. The emphasis on long-term reliability, stability over a wide temperature range, and high surge current capability – all hallmarks of conductive polymer tantalum capacitors – makes them indispensable in this sector. For instance, a single piece of industrial equipment might require several capacitors, and the sheer volume of industrial installations globally translates into substantial demand. The trend towards Industry 4.0 and the proliferation of smart factories further accentuates the need for high-performance components that can withstand harsh operating environments.

Another significant contributor to market dominance will be the Automotive segment, especially with the accelerated adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). EVs require sophisticated power electronics for battery management systems, inverters, and charging infrastructure, where the stability and high ripple current handling of conductive polymer tantalum capacitors are crucial. ADAS systems, with their complex sensor arrays and processing units, also necessitate reliable filtering and decoupling solutions. By 2025, the automotive sector alone is expected to account for a substantial portion of the market share, with projections indicating a value exceeding two billion USD within this segment. The increasing integration of infotainment systems and the growing demand for enhanced safety features further bolster this trend.

The Military and Aerospace segment, while smaller in volume compared to industrial or automotive, represents a high-value market due to the critical nature of its applications and the stringent reliability and performance standards. Companies like KEMET and KYOCERA AVX are key players in this segment, supplying highly specialized capacitors that meet rigorous military specifications. The long lifecycles and mission-critical functions in this sector ensure a steady demand for high-quality, durable components. The ongoing investments in defense modernization and space exploration projects globally will continue to drive demand for these premium capacitors. While Consumer Electronics remains a massive market by volume, the competitive pricing and the availability of various capacitor technologies mean that its dominance in terms of value for conductive polymer tantalum capacitors will be somewhat tempered by the higher-value segments of industrial and automotive applications.

Several key growth catalysts are propelling the conductive polymer tantalum electrolytic capacitors industry forward. The accelerating trend towards electrification in the automotive sector, particularly for EVs and hybrid vehicles, creates a massive demand for high-performance capacitors in power management and energy storage systems. The continuous miniaturization of electronic devices across consumer electronics, medical equipment, and IoT applications is driving the need for capacitors with higher volumetric efficiency and superior performance characteristics, which conductive polymer technology readily provides. Furthermore, increasing investments in advanced infrastructure, including 5G deployment and renewable energy solutions, are creating new avenues for capacitor integration. The ongoing advancements in material science and manufacturing processes are leading to improved capacitance densities, lower ESR, and enhanced reliability, making these capacitors more attractive for a wider range of applications.

This comprehensive report offers an in-depth exploration of the global Conductive Polymer Tantalum Electrolytic Capacitors market. Our analysis spans from the Historical Period of 2019-2024, providing context for current market conditions, through to the Forecast Period of 2025-2033, offering strategic insights into future growth trajectories. The report delves into key market trends, identifying the critical technological advancements and application shifts that are shaping the industry. We meticulously examine the driving forces behind market expansion, highlighting factors such as the relentless pursuit of miniaturization, the burgeoning demand from the automotive sector, and the growing adoption of advanced electronics. Simultaneously, the report addresses the inherent challenges and restraints, including cost considerations and the availability of alternative technologies, providing a balanced perspective. A significant portion of the report is dedicated to identifying and analyzing the key regions and segments poised for dominance, offering valuable intelligence for market participants. Furthermore, it illuminates the critical growth catalysts that are fueling industry expansion and provides an exhaustive overview of the leading players in the market. The report also chronicles significant developments and technological advancements, offering a forward-looking view of the sector's evolution. With a projected market value exceeding ten billion USD by the end of the forecast period, this report provides indispensable information for stakeholders seeking to navigate and capitalize on the opportunities within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include KEMET, KYOCERA AVX, Panasonic, Vishay, Matsuo Electric, Zhuzhou Hongda Electronics, Sunlord, Hunan Xiangyee Electronic Technology, Jiangsu Zhenhua Xinyun Electronics.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Conductive Polymer Tantalum Electrolytic Capacitors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Conductive Polymer Tantalum Electrolytic Capacitors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.