1. What is the projected Compound Annual Growth Rate (CAGR) of the Component Packaging and Testing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Component Packaging and Testing

Component Packaging and TestingComponent Packaging and Testing by Type (/> IDM, OSAT), by Application (/> Automobile, Communications, Consumer Electronics, UPS & Data Centers, Photovoltaic, Energy Storage and Wind Power, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

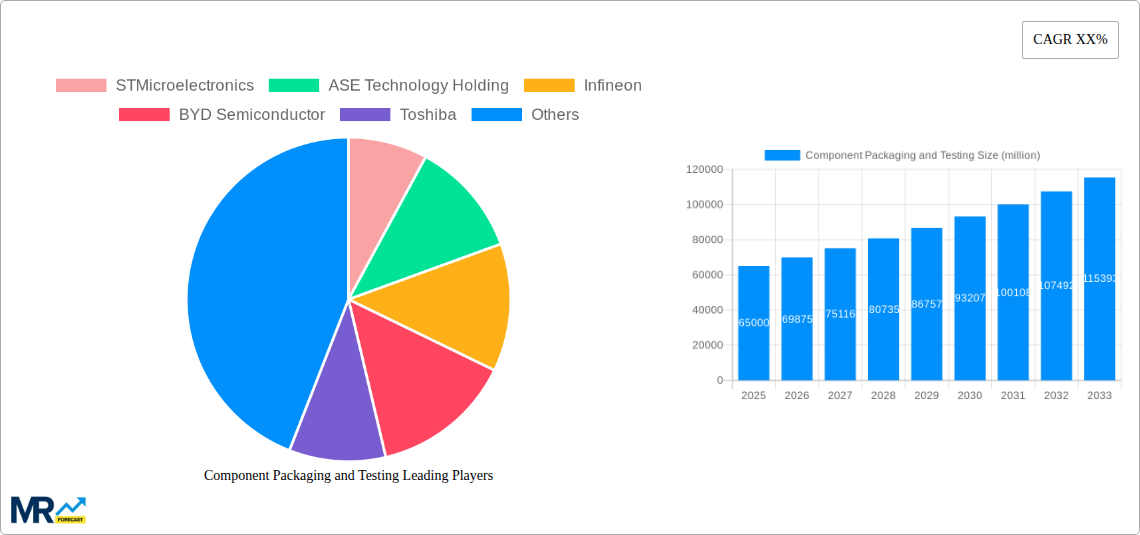

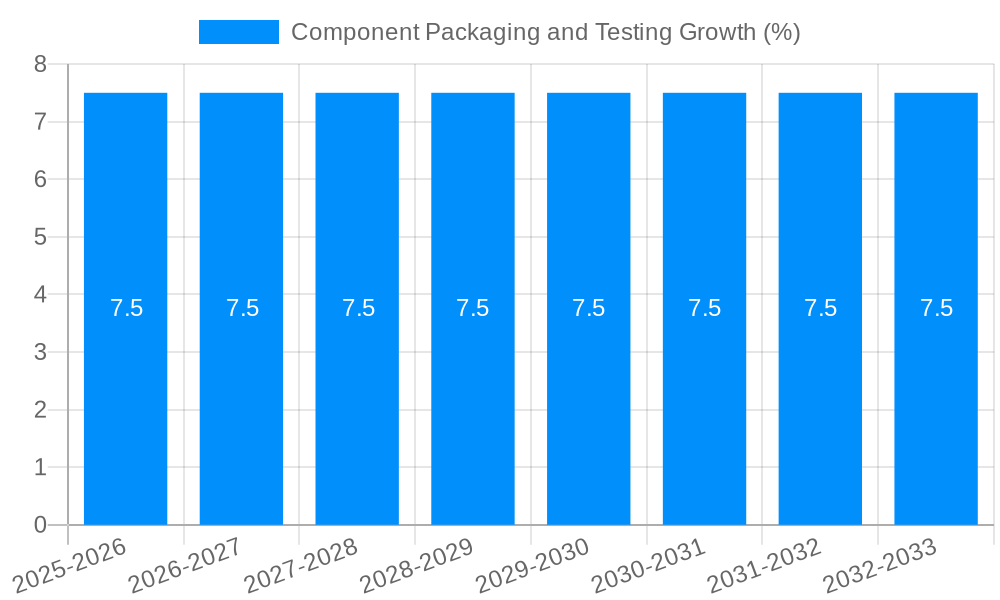

The global Component Packaging and Testing market is poised for substantial growth, with an estimated market size of approximately $65 billion in 2025, projected to expand at a robust Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This expansion is primarily fueled by the relentless demand for advanced semiconductor devices across a wide spectrum of industries. The burgeoning automotive sector, with its increasing integration of sophisticated electronics for autonomous driving, infotainment, and electric vehicle powertrains, is a significant growth engine. Similarly, the escalating adoption of 5G technology, the continued evolution of consumer electronics like smartphones and wearables, and the critical need for reliable power solutions in UPS & Data Centers are all contributing to the upward trajectory of this market. Furthermore, the growing emphasis on renewable energy sources, particularly photovoltaic and wind power systems, requires specialized and durable component packaging and testing to ensure long-term performance and safety, adding another layer to market expansion.

While the market demonstrates strong growth potential, certain challenges may temper its pace. The intricate and capital-intensive nature of advanced packaging technologies, coupled with the increasing complexity of testing protocols for cutting-edge semiconductors, presents significant investment hurdles. Supply chain disruptions, geopolitical uncertainties, and the constant pressure to reduce costs in a highly competitive landscape also act as restraining factors. Despite these challenges, innovation in areas such as wafer-level packaging (WLP), advanced interconnect technologies, and sophisticated testing methodologies will continue to drive the market forward. Key players like STMicroelectronics, ASE Technology Holding, Infineon, BYD Semiconductor, and Amkor are at the forefront, investing in research and development to meet the evolving needs of high-growth applications and maintain their competitive edge in this dynamic global market.

This comprehensive report delves into the intricate world of component packaging and testing, a critical segment of the semiconductor industry. With a projected market value reaching millions of units annually and a dynamic trajectory spanning from 2019-2033, this analysis provides an in-depth look at market trends, driving forces, challenges, regional dominance, and future growth catalysts. The study leverages a base year of 2025 with an estimated year of 2025, supported by a robust forecast period from 2025-2033, building upon a detailed historical period of 2019-2024.

The component packaging and testing landscape is currently experiencing a significant evolution, driven by the insatiable demand for increasingly sophisticated and compact electronic devices. XXX, a key insight, highlights the accelerating shift towards advanced packaging technologies that integrate multiple functionalities within a single package, thereby reducing board space and enhancing performance. This trend is particularly pronounced in the automotive sector, where the proliferation of advanced driver-assistance systems (ADAS) and electric vehicle (EV) powertrains necessitates highly reliable and space-efficient power semiconductor packages. Similarly, the burgeoning communications industry, fueled by the rollout of 5G networks and the growth of the Internet of Things (IoT), is demanding innovative packaging solutions that can handle higher frequencies and increased data throughput. Consumer electronics, a perennial powerhouse, continues to push the boundaries of miniaturization and cost-effectiveness, further stimulating the adoption of advanced packaging. We are witnessing a substantial increase in the use of wafer-level packaging (WLP) techniques, including wafer-level chip-scale packaging (WLCSP), which offer significant advantages in terms of form factor, performance, and cost for high-volume applications. Furthermore, the report identifies a growing emphasis on heterogeneous integration, where different types of semiconductor dies are co-packaged to create highly specialized and powerful modules. This approach is becoming indispensable for applications like artificial intelligence (AI) processors, high-performance computing (HPC), and advanced sensor modules. The testing segment is not lagging behind; there's a noticeable drive towards more sophisticated and efficient testing methodologies to ensure the reliability and performance of these complex components. This includes the adoption of AI-driven testing solutions, in-line testing integrated into the manufacturing process, and advanced characterization techniques to detect even the most subtle defects. The market is also seeing a convergence of packaging and testing services, with integrated solutions becoming increasingly sought after by semiconductor manufacturers to streamline their supply chains and accelerate time-to-market. The overall trend points towards a market characterized by innovation, specialization, and a relentless pursuit of higher performance and greater integration.

The global market for component packaging and testing is a multi-million unit industry, with projections indicating sustained growth driven by several interconnected factors. The relentless miniaturization of electronic devices across all application segments, from smartphones to advanced medical equipment, necessitates packaging solutions that offer higher integration density and reduced physical footprints. This has led to the widespread adoption of advanced packaging technologies such as wafer-level packaging (WLP), chiplet integration, and 2.5D/3D packaging, which are critical for maximizing functionality within limited space. Furthermore, the exponential growth of data generation and processing, particularly in the realms of Artificial Intelligence (AI), High-Performance Computing (HPC), and 5G telecommunications, demands components capable of handling immense computational power and data throughput. Advanced packaging plays a pivotal role in enabling these capabilities by allowing for the integration of multiple dies and specialized functionalities, thereby improving performance and reducing latency. The increasing sophistication of the automotive sector, with its rapid adoption of autonomous driving features, electric powertrains, and in-car connectivity, is another significant growth driver. These applications require highly reliable, high-power, and compact semiconductor components, placing a premium on advanced packaging and rigorous testing to ensure safety and performance. Similarly, the burgeoning demand for renewable energy solutions, such as solar power and energy storage systems, along with the expansion of data centers to support cloud computing and digital services, are further fueling the need for specialized and robust component packaging and testing. The ongoing digital transformation across various industries is creating a continuous demand for semiconductors, and by extension, for their efficient packaging and comprehensive testing to ensure optimal functionality and longevity.

The component packaging and testing market is experiencing robust growth, propelled by a confluence of powerful technological and market dynamics. The relentless advancement of semiconductor technology, with ever-shrinking transistor sizes and increasing chip complexity, directly fuels the need for sophisticated packaging solutions that can house these advanced dies effectively. This includes technologies that enable higher integration density, improved thermal management, and enhanced electrical performance. The burgeoning demand for connected devices, driven by the Internet of Things (IoT), 5G networks, and the proliferation of smart applications, is a significant catalyst. These applications require miniaturized, high-performance, and energy-efficient components, pushing the boundaries of packaging innovation. The automotive industry's rapid electrification and pursuit of autonomous driving capabilities are creating substantial demand for specialized power semiconductors and sensor modules, all of which require advanced packaging and stringent testing to ensure reliability and safety. Furthermore, the accelerating adoption of Artificial Intelligence (AI) and Machine Learning (ML) across various sectors, from cloud computing to edge devices, necessitates the development of specialized processors and memory architectures, often enabled by advanced packaging techniques that allow for the integration of multiple functional blocks. The ongoing digital transformation across all industries, leading to increased reliance on data processing and cloud infrastructure, further amplifies the need for high-performance computing components and, consequently, their packaging and testing.

Despite the robust growth, the component packaging and testing sector faces several significant challenges and restraints that could potentially temper its expansion. The escalating complexity of advanced packaging technologies, while enabling higher performance, also leads to increased manufacturing costs and longer development cycles. This can create a barrier to entry for smaller players and put pressure on profit margins for established companies. The stringent reliability and performance requirements for critical applications like automotive and aerospace industries necessitate highly rigorous and time-consuming testing protocols, adding to the overall cost and complexity of the supply chain. Furthermore, the semiconductor industry is inherently capital-intensive, and the continuous need for investment in advanced equipment and research and development to keep pace with technological advancements can be a significant financial burden. Supply chain disruptions, as witnessed in recent years due to geopolitical factors, natural disasters, and unforeseen demand fluctuations, can lead to material shortages, extended lead times, and increased costs for both packaging materials and testing services. The global shortage of skilled labor in specialized areas like semiconductor manufacturing, packaging engineering, and testing expertise also poses a significant challenge, potentially hindering production capacity and innovation. Moreover, increasing environmental regulations and the growing emphasis on sustainability are pushing manufacturers to adopt more eco-friendly materials and processes, which can require substantial investment in research and new manufacturing methodologies. Finally, intellectual property protection and the constant threat of counterfeiting in the complex semiconductor supply chain present ongoing concerns that require robust solutions.

Dominant Regions and Countries:

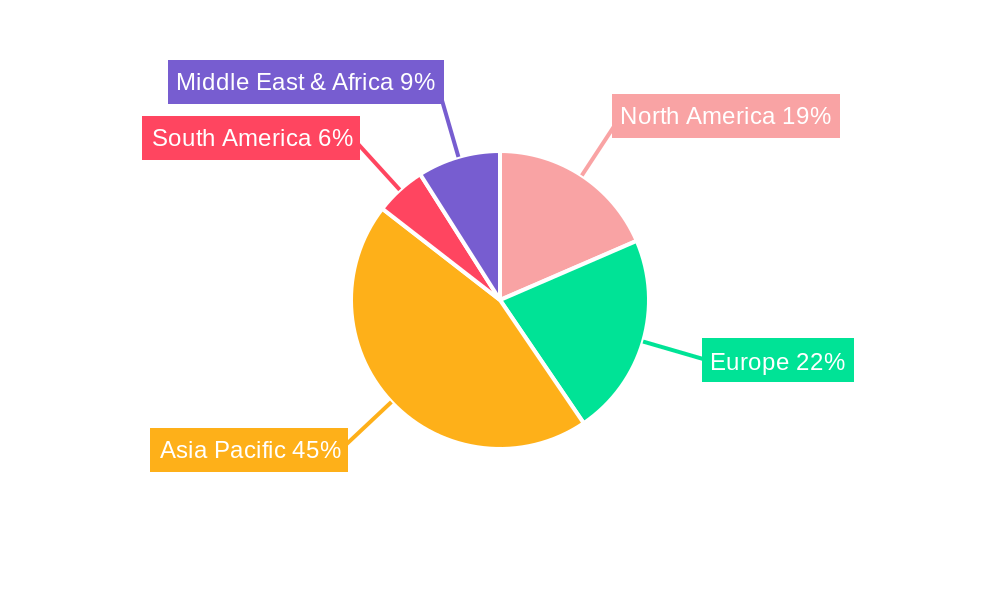

The global component packaging and testing market is significantly shaped by the concentration of semiconductor manufacturing hubs and the strategic importance of key geographic locations. Asia Pacific stands out as the undisputed leader, driven by its established semiconductor manufacturing ecosystem and the presence of major Original Semiconductor Assembly and Test (OSAT) providers. Within Asia Pacific, Taiwan and South Korea are pivotal, housing world-leading companies in advanced packaging technologies and boasting significant OSAT capacity. The region benefits from a robust supply chain, a highly skilled workforce, and strong government support for the semiconductor industry, enabling the high-volume production of packaged components. China is rapidly emerging as a dominant force, with substantial investments in domestic semiconductor manufacturing, including packaging and testing capabilities. Driven by national initiatives to achieve semiconductor self-sufficiency, Chinese companies are expanding their operations and technological prowess, positioning the country for significant market share growth in the coming years. The sheer volume of semiconductor production and assembly occurring in this region, catering to both domestic consumption and global export markets, solidifies its leading position.

The United States holds a significant position, particularly in terms of research and development, advanced packaging innovation, and the presence of major Integrated Device Manufacturers (IDMs) that have their own in-house packaging and testing facilities. While its OSAT capacity might be less concentrated than in Asia, the US plays a crucial role in driving technological advancements and setting industry standards, especially for high-end applications. Europe is also a key player, with a growing focus on specialized semiconductor manufacturing and advanced packaging solutions, particularly in areas like automotive and industrial electronics. The region is investing heavily in domestic semiconductor capabilities to reduce reliance on external supply chains and foster innovation in critical sectors.

Dominant Segments:

Within the dynamic landscape of component packaging and testing, several segments are poised for substantial growth and market dominance.

OSAT (Outsourced Semiconductor Assembly and Test): The OSAT segment is a primary driver of the market. Companies specializing in assembly and testing services cater to a vast array of semiconductor manufacturers, offering economies of scale, specialized expertise, and advanced technologies. The growing trend of fabless semiconductor companies outsourcing their packaging and testing needs to OSAT providers solidifies this segment's importance. The continuous innovation in packaging technologies like wafer-level packaging (WLP), fan-out wafer-level packaging (FOWLP), and 2.5D/3D integration, which require specialized equipment and expertise, further propels the growth of OSAT providers.

Application: Automobile: The automotive industry is rapidly transforming, driven by electrification, autonomous driving, advanced driver-assistance systems (ADAS), and in-car infotainment. This surge in semiconductor content within vehicles demands highly reliable, high-performance, and compact packaging solutions for power management ICs, sensors, processors, and communication chips. The stringent safety and reliability standards in the automotive sector necessitate advanced testing protocols and robust packaging to withstand harsh operating environments. This application segment represents a significant and growing market for component packaging and testing services.

Application: Communications: The ongoing evolution of wireless communication technologies, from 5G to future 6G deployments, along with the ever-expanding Internet of Things (IoT) ecosystem, creates a continuous demand for high-frequency, high-speed, and power-efficient semiconductor components. Advanced packaging techniques are crucial for enabling smaller form factors and improved performance in smartphones, base stations, networking equipment, and a myriad of IoT devices. The testing of these components to meet stringent performance and reliability standards is equally vital.

Application: UPS & Data Centers: The exponential growth of cloud computing, big data analytics, and artificial intelligence (AI) is driving an unprecedented demand for high-performance computing (HPC) solutions and robust data center infrastructure. This translates into a significant need for advanced packaging and testing of processors, memory, and other critical components that power these data centers and uninterruptible power supply (UPS) systems. The focus here is on high density, high speed, and exceptional reliability to ensure continuous operation and efficient data processing.

Several key factors are acting as potent growth catalysts for the component packaging and testing industry. The relentless drive towards miniaturization and higher integration density across all electronic devices, fueled by consumer demand for smaller, more powerful gadgets, necessitates advanced packaging solutions. The rapid expansion of the 5G network infrastructure and the proliferation of IoT devices are creating a massive demand for specialized, high-performance semiconductor components that rely heavily on sophisticated packaging and rigorous testing. Furthermore, the automotive industry's aggressive push towards electrification and autonomous driving features is a major growth engine, requiring highly reliable and compact power management and sensor ICs. The burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) in various applications, from cloud computing to edge devices, demands advanced packaging techniques to integrate complex processors and memory, thereby boosting performance and efficiency.

This report offers an all-encompassing examination of the component packaging and testing market, providing critical insights for stakeholders across the semiconductor value chain. It dissects market dynamics, identifying key trends and their implications for various segments and applications. The analysis delves into the fundamental driving forces propelling market growth, such as the relentless demand for miniaturization, the expansion of 5G and IoT, and the rapid evolution of the automotive and data center sectors. Conversely, it critically assesses the challenges and restraints that could impede market expansion, including escalating costs, supply chain vulnerabilities, and the need for specialized talent. The report meticulously identifies dominant regions and countries, highlighting the strategic importance of Asia Pacific, particularly Taiwan, South Korea, and China, in shaping the global market landscape. Furthermore, it pinpoints key segments like OSAT, automotive, communications, and UPS & Data Centers that are set to experience substantial growth. The report also identifies specific growth catalysts that are poised to accelerate the industry's trajectory and provides a comprehensive list of leading global players. Finally, it details significant developments and historical trends, offering a forward-looking perspective with projections extending through 2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include STMicroelectronics, ASE Technology Holding, Infineon, BYD Semiconductor, Toshiba, Powertech Technology, Sanan Optoelectronics, Littelfuse (IXYS), China Resources Microelectronics Limited, Hangzhou Silan Microelectronics, Jilin Sino-Microelectronics Co., Ltd, Nexperia, Renesas Electronics, Texas Instruments, Amkor, UTAC, Carsem, Foshan Blue Rocket Electronics Co Ltd, Tianshui Huatian Technology Co., Ltd., China Wafer Level CSP Co Ltd, King Yuan ELECTRONICS CO., LTD..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Component Packaging and Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Component Packaging and Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.