1. What is the projected Compound Annual Growth Rate (CAGR) of the Compact Vacuum Cleaner?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Compact Vacuum Cleaner

Compact Vacuum CleanerCompact Vacuum Cleaner by Type (With Bag, Bagless), by Application (Residential, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

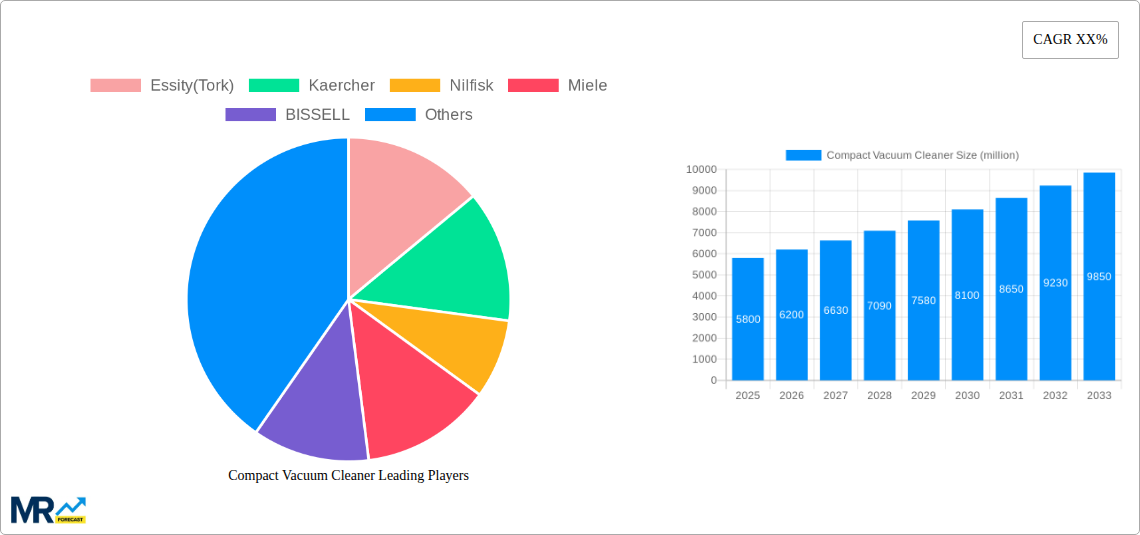

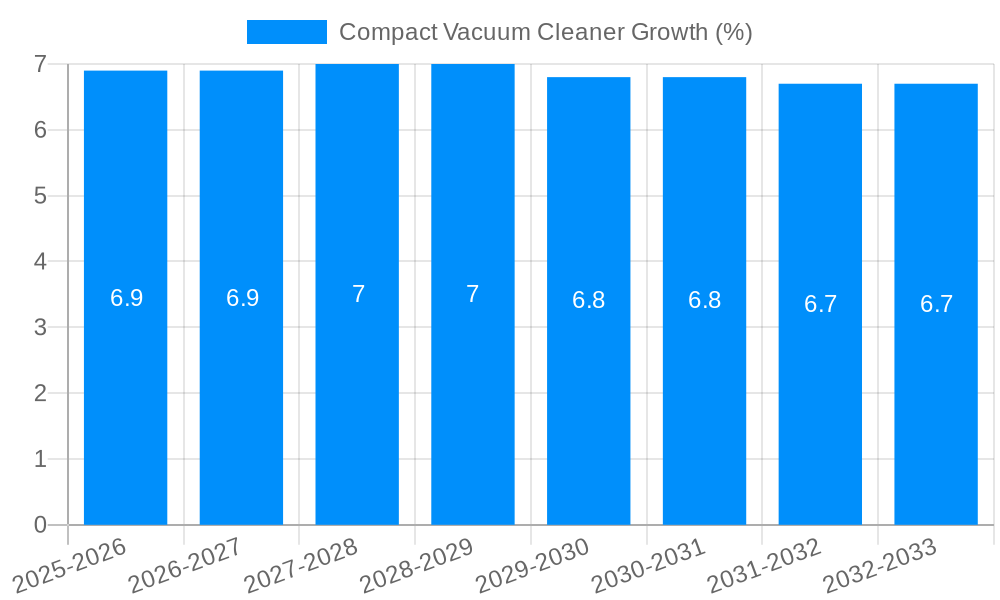

The global compact vacuum cleaner market is poised for significant expansion, projected to reach a substantial market size of approximately $5.8 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 7.5% anticipated throughout the forecast period of 2025-2033. This robust growth trajectory is fueled by a confluence of factors, including the increasing urbanization trend, leading to smaller living spaces where compact and efficient cleaning solutions are paramount. Furthermore, a growing awareness among consumers regarding hygiene and cleanliness, coupled with the rising disposable incomes in developing economies, is driving demand for sophisticated yet space-saving vacuum cleaners. The "With Bag" segment is expected to maintain a dominant share, driven by user preference for easier disposal and cleaner maintenance, although the "Bagless" segment is rapidly gaining traction due to its cost-effectiveness and environmental benefits.

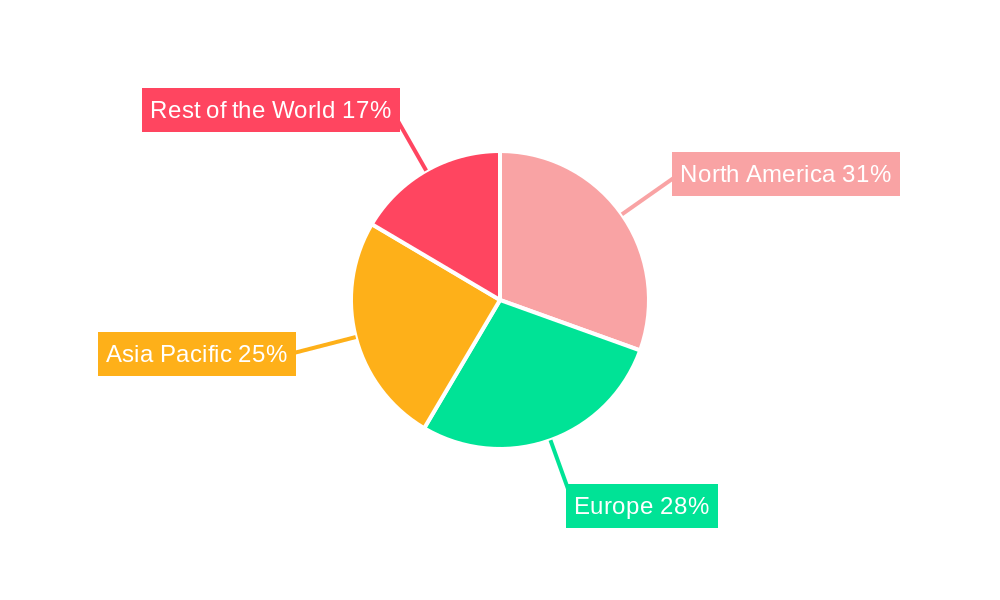

The market's expansion is further propelled by continuous technological advancements, with manufacturers introducing innovative features such as enhanced suction power, improved filtration systems (HEPA filters), and smart functionalities like app connectivity and voice control. The residential application segment will continue to be the primary revenue generator, catering to the everyday cleaning needs of households. However, the "Others" application segment, encompassing small commercial spaces, offices, and automotive detailing, is also witnessing notable growth. Key market restraints include intense price competition and the availability of lower-cost, albeit less efficient, alternatives. Despite these challenges, the market is expected to overcome these hurdles through product differentiation and strategic market penetration, with North America and Europe currently leading in terms of market share, while the Asia Pacific region shows the fastest growth potential due to its burgeoning middle class and increasing adoption of modern home appliances.

This report offers a comprehensive analysis of the global Compact Vacuum Cleaner market, providing in-depth insights into its trajectory from 2019 to 2033, with a base year of 2025 and detailed projections for the forecast period of 2025-2033, building upon the historical period of 2019-2024. The market is valued in the millions of units, presenting a detailed understanding of unit sales and growth patterns. The report meticulously examines key industry trends, driving forces, challenges, regional dominance, growth catalysts, and the competitive landscape, featuring leading manufacturers and significant technological and market developments.

XXX The global Compact Vacuum Cleaner market is experiencing a transformative phase, driven by evolving consumer lifestyles and an increasing emphasis on efficient and space-saving home appliances. The proliferation of smaller living spaces in urban centers worldwide has significantly amplified the demand for compact and lightweight vacuum cleaners that offer powerful performance without compromising on storage convenience. This trend is further accelerated by a growing awareness of indoor air quality and a desire for healthier living environments, leading consumers to seek out vacuum cleaners with advanced filtration systems, including HEPA filters, that effectively capture allergens and fine dust particles. The Bagless segment is projected to maintain its dominance, accounting for over 60 million units by 2025, owing to its cost-effectiveness and reduced environmental impact compared to bagged alternatives. However, a niche but growing segment of consumers still prefers With Bag models, especially those with severe allergies, seeking the convenience of easy disposal and enhanced hygiene, expected to contribute over 15 million units in the same year. The Residential application segment continues to be the primary revenue driver, projected to exceed 85 million units in sales by 2025, reflecting widespread adoption in households across developed and developing economies. Innovations in design and functionality are also paramount, with manufacturers increasingly focusing on cordless operation, smart features like app connectivity and voice control, and multi-functional capabilities such as integrated mopping or steam cleaning. These advancements are not only enhancing user experience but also broadening the appeal of compact vacuum cleaners beyond traditional cleaning tasks. The report anticipates a steady compound annual growth rate (CAGR) of approximately 4.5% for the compact vacuum cleaner market throughout the forecast period, underscoring its robust and sustained expansion. The market's evolution is also influenced by a growing eco-consciousness, leading to a demand for energy-efficient models and those constructed from recycled materials. This holistic approach to product development and consumer preference paints a picture of a dynamic and forward-looking market.

The compact vacuum cleaner market is being propelled by a confluence of powerful forces, primarily stemming from evolving consumer needs and technological advancements. The pervasive trend of urbanization and the resultant shrinking living spaces globally have made compact, easy-to-store, and maneuverable cleaning solutions highly desirable. Consumers are actively seeking appliances that offer maximum functionality with minimal spatial footprint, a need perfectly met by the compact vacuum cleaner. Furthermore, a heightened awareness regarding health and hygiene, particularly post-pandemic, has spurred demand for efficient dust and allergen removal. Advanced filtration systems, such as HEPA filters, integrated into these compact devices are becoming a critical selling point, attracting health-conscious consumers. The increasing disposable income in emerging economies, coupled with a rising middle class, is also a significant driver, enabling a larger segment of the population to invest in modern home appliances like compact vacuum cleaners. The continuous innovation by manufacturers, focusing on cordless technology, enhanced suction power, lighter weights, and user-friendly designs, is also playing a crucial role in attracting new customers and retaining existing ones. The diversification of product offerings to cater to specific cleaning needs, from pet owners to those with hardwood floors, further broadens the market appeal. The e-commerce boom has also facilitated wider accessibility to these products, allowing consumers to easily research, compare, and purchase their preferred models, thereby accelerating market growth.

Despite the promising growth trajectory, the compact vacuum cleaner market faces several challenges and restraints that could temper its expansion. One of the primary hurdles is the intense competition within the market, characterized by a plethora of brands offering similar products at varying price points. This saturation can lead to price wars, impacting profit margins for manufacturers. Another significant restraint is the relatively higher initial cost associated with advanced features like cordless operation, powerful lithium-ion batteries, and sophisticated filtration systems, which can deter price-sensitive consumers, particularly in developing economies. The perceived durability and longevity of some compact vacuum cleaners, especially those in the lower price segments, can also be a concern for consumers, leading to a preference for more robust, albeit larger, traditional vacuum cleaners. Furthermore, the rapid pace of technological obsolescence, with newer models incorporating advanced features, can create a reluctance among consumers to invest in current models, fearing they will be outdated quickly. The availability and cost of replacement parts, such as batteries and filters, can also be a deterrent for some users, especially for less established brands. Lastly, the increasing popularity of alternative cleaning methods, such as robotic vacuum cleaners and steam mops, while often complementary, can also be viewed as competing solutions for specific cleaning tasks, potentially limiting the market share of traditional compact vacuums.

The global Compact Vacuum Cleaner market is poised for significant growth, with the Bagless segment expected to be the dominant force throughout the forecast period. This dominance is rooted in a combination of economic, environmental, and convenience factors that resonate strongly with a broad consumer base. By 2025, the Bagless segment is projected to capture over 60% of the market share, translating to an estimated sale of over 60 million units globally.

Dominance of the Bagless Segment: The appeal of bagless vacuum cleaners lies in their cost-effectiveness over the long term. Eliminating the need for recurring purchases of disposable bags significantly reduces the overall ownership cost, a crucial factor for budget-conscious consumers. Furthermore, the environmental consciousness among consumers is on the rise, and the bagless design aligns with sustainability goals by reducing waste generated from disposable bags. Users can simply empty the dustbin directly into the trash, contributing to a more eco-friendly cleaning routine. The convenience of being able to visually monitor the dustbin's fullness and empty it at any time, without needing to stock up on replacement bags, further enhances its popularity. Leading players like Kaercher, Nilfisk, and BISSELL have heavily invested in and promoted their bagless technologies, offering innovative dustbin emptying mechanisms and advanced cyclone technology for superior suction and filtration. The market for bagless compact vacuum cleaners is expected to grow at a CAGR of approximately 5.2% from 2025 to 2033.

North America: A Leading Region: North America, particularly the United States, is anticipated to be a key region for compact vacuum cleaner consumption. This leadership is driven by several factors. Firstly, the high rate of homeownership and a strong inclination towards maintaining clean and hygienic living spaces contribute to a consistent demand for cleaning appliances. Secondly, the widespread adoption of advanced technologies and a preference for convenience in daily chores make North American consumers receptive to innovative compact vacuum cleaner features, such as cordless functionality, smart connectivity, and multi-stage filtration. The presence of major manufacturers like BISSELL, BLACK + DECKER, and Dirt Devil, which have a strong brand presence and distribution networks in the region, further bolsters the market. The average household in North America is also increasingly influenced by trends in smaller living spaces, especially in major urban centers, creating a greater need for space-saving appliances. The market size in North America is estimated to reach over 35 million units by 2025, with a projected growth rate of around 4.8% during the forecast period.

Residential Application: The Primary Market: The Residential application segment is, and will continue to be, the largest consumer of compact vacuum cleaners. This is a direct reflection of their primary utility in maintaining household cleanliness. From small apartments to larger family homes, the need for efficient, portable, and effective cleaning solutions for everyday messes is universal. The growing number of single-person households and smaller families further amplifies the demand for compact models that are easy to handle and store. Manufacturers are continuously innovating within this segment, introducing models with specialized attachments for different floor types, upholstery, and even pet hair removal. The sheer volume of households globally ensures that the residential segment will remain the bedrock of the compact vacuum cleaner market. By 2025, the residential segment is expected to account for over 85 million units in sales worldwide, with an anticipated CAGR of approximately 4.4% from 2025 to 2033. Companies like Miele, known for its premium quality, and Rowenta, offering a balance of performance and affordability, have a strong foothold in the residential sector.

Several factors are acting as significant growth catalysts for the compact vacuum cleaner industry. The escalating trend of urbanization and the resultant smaller living spaces globally are creating an unprecedented demand for space-saving appliances. Technological advancements, particularly in battery technology and motor efficiency, are enabling the development of more powerful, lighter, and longer-lasting cordless compact vacuum cleaners. This enhances user convenience and expands their appeal beyond traditional corded models. Furthermore, a growing consumer awareness regarding health and hygiene, coupled with a desire for better indoor air quality, is driving the demand for vacuum cleaners equipped with advanced filtration systems like HEPA filters.

This report offers an unparalleled depth of analysis into the Compact Vacuum Cleaner market. Beyond market sizing and segmentation, it delves into the intricate dynamics of consumer behavior, purchasing patterns, and brand perceptions. It provides granular data on the adoption rates of different technologies, such as cordless versus corded, bagged versus bagless, and the increasing integration of smart features. The report also critically examines the impact of sustainability initiatives and regulatory landscapes on product development and market trends. Furthermore, it offers strategic insights for market participants, including market entry strategies, product differentiation tactics, and competitive positioning, ensuring a holistic understanding of the market's present state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Essity(Tork), Kaercher, Nilfisk, Miele, BISSELL, Linea 2000(DOMO), Princess, Midea Group(eureka), Cleva(Vacmaster), Dirt Devil, BLACK + DECKER, Lectrolux, Rowenta, Numatic, Beldray, FLEX, Vytronix, Dustybin, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Compact Vacuum Cleaner," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Compact Vacuum Cleaner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.