1. What is the projected Compound Annual Growth Rate (CAGR) of the Compact Disc?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Compact Disc

Compact DiscCompact Disc by Application (Commercial use, Family use, World Compact Disc Production ), by Type (CD-ROM, Recordable CD, ReWriteable CD, Video CD, Others, World Compact Disc Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

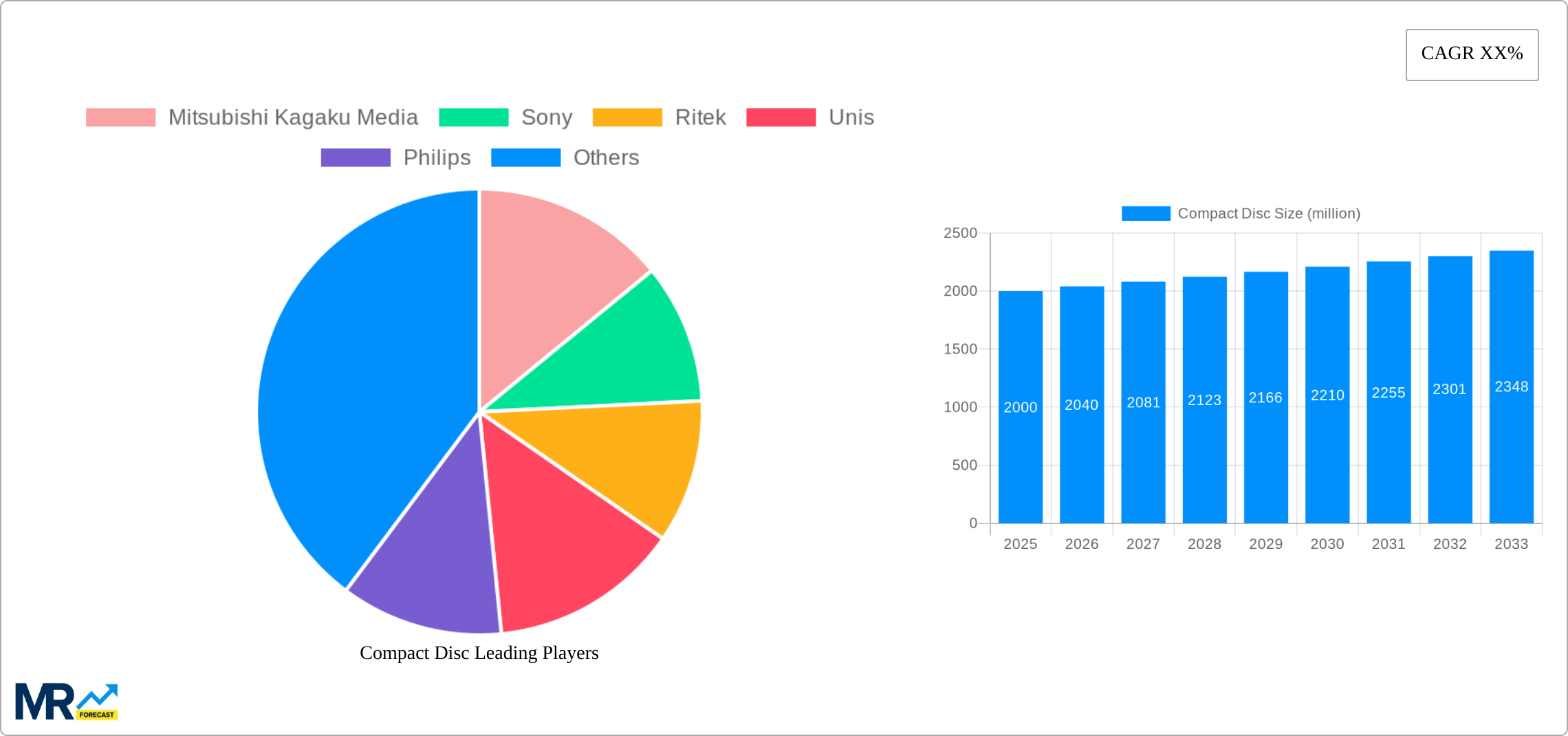

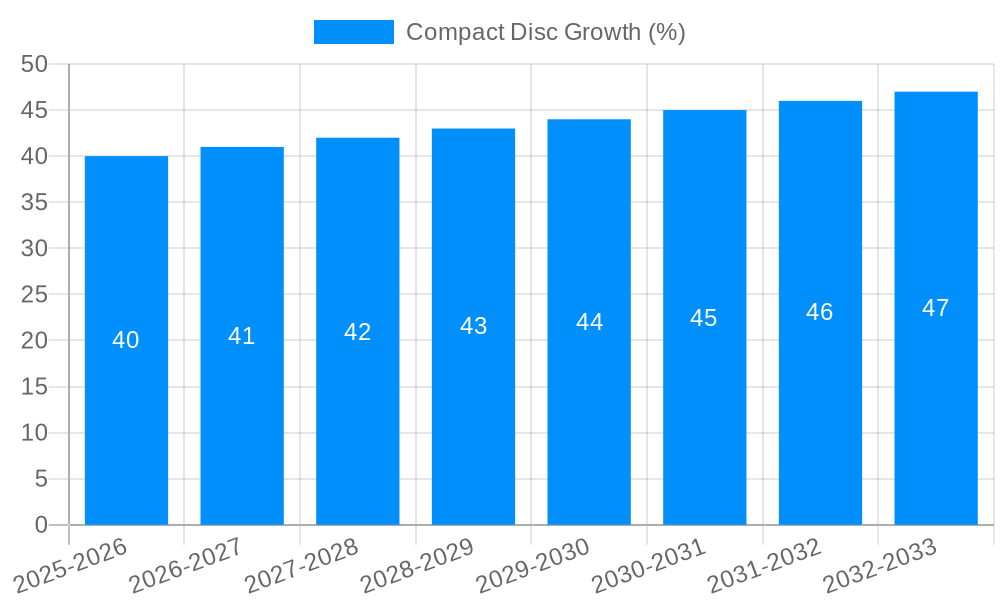

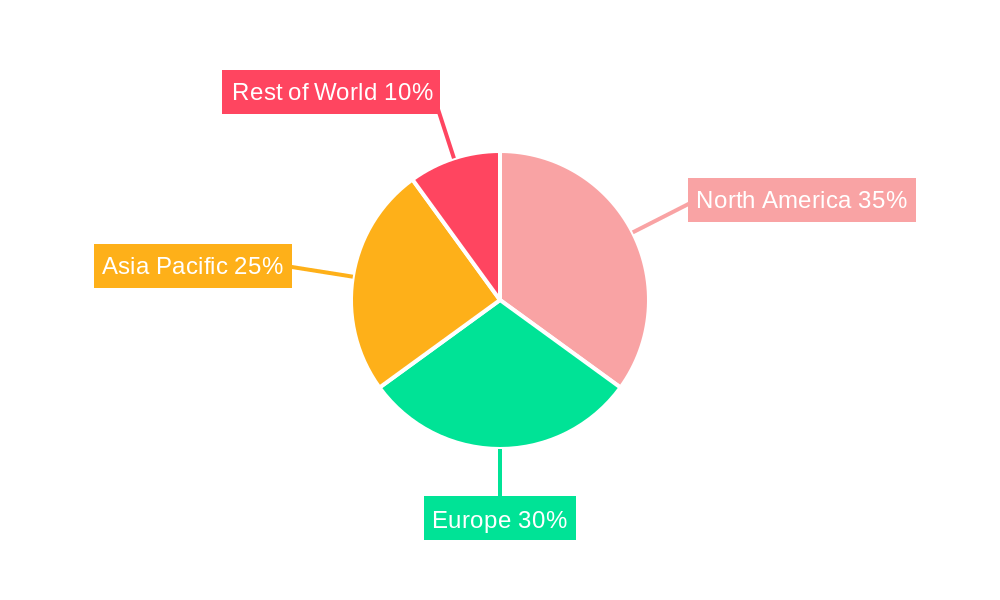

The global compact disc (CD) market, while experiencing a decline in recent years due to the rise of digital music streaming and downloads, maintains a niche presence driven by specific applications. The market size in 2025 is estimated at $2 billion, reflecting a steady, albeit modest, Compound Annual Growth Rate (CAGR) of 2% from 2019 to 2024. This growth is primarily fueled by the continued demand for archiving purposes, particularly within commercial sectors for data storage and some segments of the music industry, such as collectors and audiophiles who value the physical quality of CDs. Furthermore, the use of CDs in educational settings, particularly for software distribution in areas with limited internet access, contributes to market stability. The market is segmented by application (commercial, family), and type (CD-ROM, recordable CD, rewritable CD, video CD, others). Key players such as Mitsubishi Kagaku Media, Sony, Ritek, and others compete in this market, focusing on specialized manufacturing techniques and distribution channels to cater to the remaining demand. Geographic distribution shows a higher market concentration in North America and Europe, reflecting established markets with a higher proportion of consumers who may have pre-existing CD collections and players or who require CDs for specific archiving needs. However, emerging markets in Asia-Pacific exhibit modest growth, primarily driven by specific commercial applications.

The restraining factors for the CD market include the continued dominance of digital music streaming services, cost-effectiveness of digital formats, and the decreasing production of CD players. While the overall market size is relatively small compared to other media formats, its persistence highlights the niche needs it continues to fulfill. Future growth will likely depend on innovative applications of CD technology, perhaps incorporating it within specialized archival or data security systems, rather than relying on continued reliance on its traditional use cases. The forecast period of 2025-2033 suggests a gradual, consistent market trajectory, with projected annual growth largely mirroring past trends. While a dramatic resurgence is unlikely, the CD market shows signs of stabilized survival within a clearly defined, though shrinking, niche.

The compact disc (CD) market, while significantly diminished from its peak in the late 20th century, continues to exhibit a surprising resilience, particularly within niche segments. While the overall production volume has declined dramatically over the past decade, the study period (2019-2033) reveals a complex picture. The historical period (2019-2024) saw a consistent drop in production, primarily driven by the rise of digital music streaming and download services. However, a certain level of demand persists, fueled by specific applications and a dedicated collector base. The estimated year (2025) and the forecast period (2025-2033) suggest a stabilization, though not a resurgence, in production numbers. This stabilization can be attributed to a few factors: the continued use of CDs in certain commercial applications (archival storage, distribution of software in some sectors), the persistent appeal of physical media among audiophiles and collectors seeking superior audio quality, and the relatively low cost of production for basic CD-ROMs. While millions of units are still produced annually, the market's overall value is significantly less than its peak years, reflecting a shift towards digital formats. The future of the CD market is unlikely to see significant growth but a slow decline is also unlikely, leaving it in a state of stable, albeit reduced, production for the foreseeable future. The continued existence of manufacturing facilities, even if at reduced capacity, indicates a sustained market presence despite digital media dominance.

Several factors contribute to the continued, albeit diminished, demand for compact discs. Firstly, the inherent durability and reliability of CDs, especially compared to flash memory, make them a viable option for long-term archival storage of data in certain commercial settings. Some industries prefer the physical security and longevity of CDs for crucial data, mitigating the risks associated with digital storage failure. Secondly, a dedicated collector's market actively maintains a demand for physical music, particularly among audiophiles who value the perceived superior audio quality offered by CDs over compressed digital formats. This niche market, while not massive, contributes significantly to the overall production figures. Thirdly, the relatively low production cost for basic CD-ROMs makes them a cost-effective solution for certain software and data distribution channels, especially in regions with limited high-speed internet access. Finally, the familiar and straightforward nature of CDs remains accessible, particularly for older demographics less familiar with digital technologies. While the overarching trend favors digital media, these factors combine to create a steady, albeit small, demand for compact discs within specified niches.

The primary challenge facing the compact disc industry is the overwhelming dominance of digital music streaming and download services. The convenience and vast selection offered by these platforms have significantly eroded the market share of physical media. The cost of physical storage and distribution is also a significant barrier, as shipping and manufacturing costs eat into profit margins. Further technological advancements in digital storage formats also pose a threat, with higher capacity and more durable alternatives continuing to emerge. Competition from USB drives and other forms of digital storage, even in commercial applications, is increasingly stiff. The declining availability of CD players in new electronic devices is another factor contributing to the reduced demand. Finally, the lack of significant innovation within the CD format itself makes it less attractive compared to constantly evolving digital technologies. These combined factors create a challenging environment for the CD industry, placing pressure on producers to maintain production efficiencies and target very specific market niches to remain viable.

While precise market share data fluctuates yearly, certain regions and segments are noticeably more prominent within the Compact Disc market than others.

In summary, although the overall CD market is shrinking, the commercial segment and specifically the CD-ROM remains a more resistant sector within a continually shrinking market, particularly in regions with less robust digital infrastructure. The continued, albeit limited, production and distribution demonstrates a level of continued relevance for specific sectors, indicating a potential stabilization rather than a complete market collapse.

The CD market's future growth, while modest, can be influenced by several factors. Targeted marketing towards collectors and audiophiles who value high-fidelity audio can help sustain demand. Focusing on specialized commercial applications where data security and long-term archiving are paramount could also unlock new opportunities. Finally, exploring potential partnerships with industries that require a cost-effective and readily available data storage and distribution solution, particularly in developing countries, could offer growth avenues.

The compact disc market, while significantly diminished, shows signs of stabilization within specific niches. Focusing on targeted markets (commercial applications, collectors), leveraging the inherent advantages of CDs (durability, cost-effectiveness in specific scenarios), and implementing efficient production strategies are key to the continued viability of this sector. The industry needs to adapt to the digital age by identifying and catering to very specific needs in order to sustain its presence within the overall media market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mitsubishi Kagaku Media, Sony, Ritek, Unis, Philips, Maxcell, Newsmy, Benq, Deli, Panasonic, Sanwa Denshi, Moser Baer, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Compact Disc," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Compact Disc, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.