1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Voluntary Carbon Offsetting Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Voluntary Carbon Offsetting Services

Commercial Voluntary Carbon Offsetting ServicesCommercial Voluntary Carbon Offsetting Services by Application (Environmental Protection, Invest and Manage Your Finances, Financial Derivatives, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

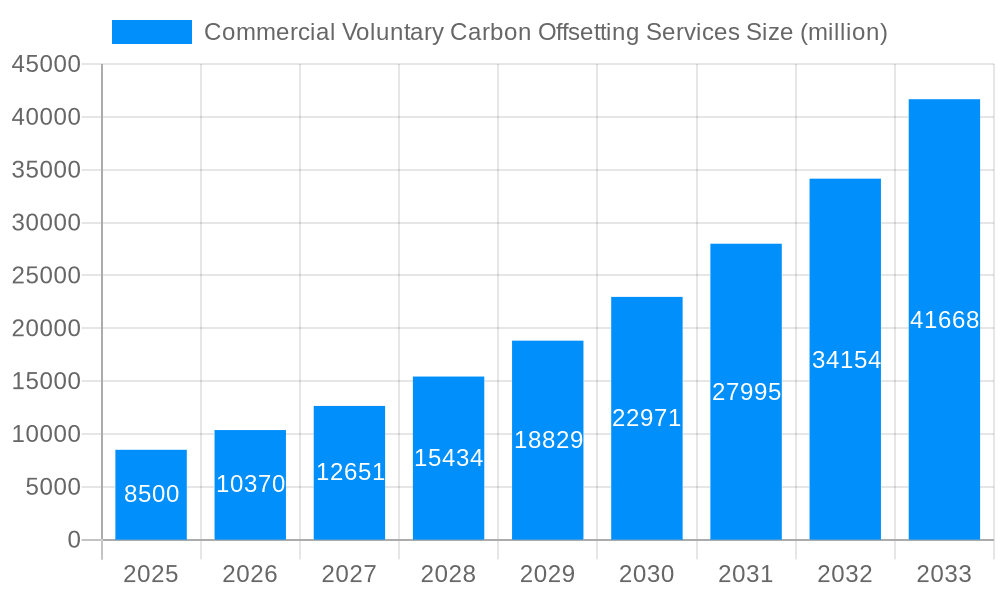

The commercial voluntary carbon offsetting services market is experiencing robust growth, driven by increasing corporate commitments to sustainability and net-zero targets. The market, estimated at $5 billion in 2025, is projected to expand significantly over the forecast period (2025-2033), fueled by a Compound Annual Growth Rate (CAGR) of approximately 15%. This growth is underpinned by several key factors. Firstly, growing regulatory pressure and investor scrutiny are pushing companies to actively reduce their carbon footprints and demonstrate their climate action efforts. Secondly, the rising awareness among consumers about climate change is prompting businesses to adopt more sustainable practices and offset their unavoidable emissions. Thirdly, the increasing availability of high-quality carbon offset projects, supported by technological advancements in monitoring, reporting, and verification (MRV), enhances market credibility and trust. Finally, the emergence of innovative financing mechanisms and partnerships between corporations, NGOs, and governments facilitates wider market access and participation.

However, the market also faces challenges. Price volatility in carbon credits, concerns about the additionality and permanence of offset projects, and a lack of standardized methodologies for measuring and verifying emissions reductions present hurdles to overcome. Furthermore, ensuring the integrity and transparency of the offsetting process is critical to maintaining public confidence and attracting further investment. The market is segmented by project type (renewable energy, reforestation, etc.), verification standards, and geographic region. Key players include established environmental consultancies, carbon project developers, financial institutions, and exchanges, all vying for a share of this expanding market. The continued growth of the market is largely contingent upon addressing these challenges and fostering greater transparency and standardization within the industry.

The commercial voluntary carbon offsetting services market is experiencing explosive growth, driven by increasing corporate awareness of climate change and a rising demand for credible ways to neutralize carbon footprints. The market, valued at $XXX million in 2025, is projected to reach $YYY million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a steady upward trajectory, with significant acceleration in recent years, fueled by both regulatory pressure and consumer pressure on businesses to demonstrate environmental responsibility. This growth is not uniform across all segments; we observe a clear preference for high-quality, verifiable offsets, leading to increased demand for projects with robust monitoring, reporting, and verification (MRV) frameworks. The market is also characterized by a shift towards more sophisticated offsetting strategies, incorporating both avoidance and removal projects, reflecting a growing understanding of the complexities of carbon accounting. Furthermore, the increasing availability of technology solutions, simplifying the process of identifying, purchasing, and managing offsets, is significantly contributing to market expansion. The influx of both established players and innovative startups further fuels competition and drives innovation, ultimately benefitting buyers by offering a wider range of options at potentially more competitive pricing. However, this increased activity also highlights the critical need for enhanced standardization and transparency to prevent greenwashing and ensure the environmental integrity of offset projects.

Several factors are propelling the rapid growth of the commercial voluntary carbon offsetting services market. Firstly, heightened corporate social responsibility (CSR) initiatives are pushing companies to actively reduce their environmental impact, with carbon neutrality becoming a significant strategic goal for many. Secondly, growing consumer awareness and pressure are influencing purchasing decisions, favouring environmentally conscious brands and businesses. This consumer-driven demand is pushing companies to implement robust carbon reduction strategies, including the purchase of carbon offsets. Governmental regulations and policies, while not always directly mandating offsetting, are indirectly driving adoption by setting ambitious emissions reduction targets and incentivizing sustainable practices. The development and refinement of robust methodologies for measuring, reporting, and verifying (MRV) carbon offsets are also improving market confidence and facilitating wider adoption. Finally, technological advancements, including blockchain-based tracking systems and data analytics tools, are enhancing transparency and streamlining the offsetting process, making it more accessible and efficient for businesses of all sizes. The increased availability of readily accessible offset purchasing platforms further simplifies market entry and participation.

Despite the significant growth, the commercial voluntary carbon offsetting services market faces several challenges. The lack of standardized methodologies and verification processes across different offset projects creates uncertainty and can lead to inconsistencies in the quality and credibility of offsets. This concern contributes to skepticism and potential accusations of "greenwashing," which undermines market confidence. The complexity of carbon accounting and the difficulty in accurately measuring and verifying emissions reductions across diverse project types present significant hurdles, particularly for smaller businesses. Furthermore, the risk of double-counting offsets, where the same emission reduction is claimed by multiple entities, is a significant concern needing robust oversight and transparency. The geographical distribution of offset projects can also present challenges, particularly in ensuring proper monitoring and verification of remote or inaccessible locations. Finally, the price volatility of carbon credits and the potential for market manipulation can hinder broader adoption, especially for businesses with limited financial resources. Addressing these challenges requires the development of robust standards, improved transparency, and strengthened governance mechanisms within the market.

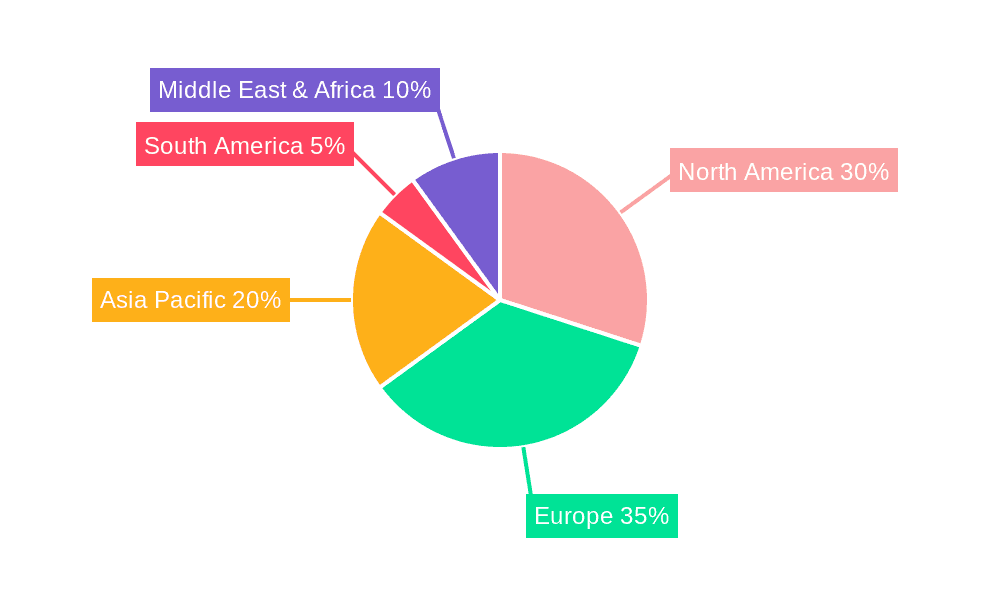

North America: This region is expected to dominate the market due to stringent environmental regulations, a high concentration of large corporations with ambitious sustainability goals, and a developed carbon market infrastructure. The US, in particular, with its significant corporate presence and focus on ESG (Environmental, Social, and Governance) investing, will be a major driver of growth.

Europe: The EU's ambitious climate targets and the implementation of the EU Emissions Trading System (ETS) will further stimulate demand for voluntary carbon offsets, particularly among businesses aiming to exceed regulatory requirements and enhance their sustainability image.

Asia-Pacific: Rapid industrialization and economic growth in countries like China and India are leading to significant greenhouse gas emissions. While initially lagging behind North America and Europe, this region is witnessing increasing awareness and adoption of voluntary carbon offsetting as companies seek to manage their carbon footprint and meet investor expectations.

Segments:

Renewable Energy Projects: This segment is expected to maintain significant market share driven by the growing demand for renewable energy sources and the increasing availability of high-quality, verifiable projects in this area. The decreasing cost of renewable energy technologies also makes this segment increasingly attractive.

Forestry and Land Use: This sector offers significant potential for carbon sequestration, particularly through reforestation and afforestation projects. However, rigorous monitoring and verification are crucial to mitigate risks associated with inaccurate reporting and land-use change.

Energy Efficiency Projects: These projects, focusing on improved energy efficiency in buildings, industrial processes, and transportation, are becoming increasingly popular due to their immediate impact on reducing greenhouse gas emissions. The verifiable nature of these improvements makes them especially attractive to companies seeking robust carbon offset solutions.

The continued growth in all these segments will depend heavily on the establishment of clear standards, robust verification mechanisms, and increased transparency throughout the carbon offsetting market. Addressing concerns related to additionality (ensuring the offset project wouldn't have happened without the carbon offset purchase) and permanence (ensuring the carbon reduction is long-lasting) is vital to maintain market integrity and encourage further investment.

Several factors are accelerating the growth of the commercial voluntary carbon offsetting services industry. Increasing corporate sustainability commitments, driven by both internal goals and external stakeholder pressure, are a primary catalyst. Coupled with stricter environmental regulations and growing consumer demand for environmentally responsible products and services, this pressure is fostering wider adoption of carbon offsetting programs. Technological advancements, particularly in monitoring, reporting, and verification (MRV) systems, provide greater transparency and accountability, thereby increasing market confidence and reducing risks associated with offset investments. Finally, a growing number of credible and high-quality offset projects, spanning diverse sectors like renewable energy and forestry, are further expanding the market and providing companies with more options to choose from.

This report provides a comprehensive analysis of the commercial voluntary carbon offsetting services market, covering historical trends, current market dynamics, and future projections. It offers detailed insights into key market drivers, challenges, and growth opportunities, allowing businesses and investors to make informed decisions. The report includes profiles of leading market players, segment-wise analysis, and regional market breakdowns, providing a comprehensive overview of this rapidly evolving sector. The analysis is supported by robust data and market intelligence, making it a valuable resource for anyone involved in or interested in the voluntary carbon market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

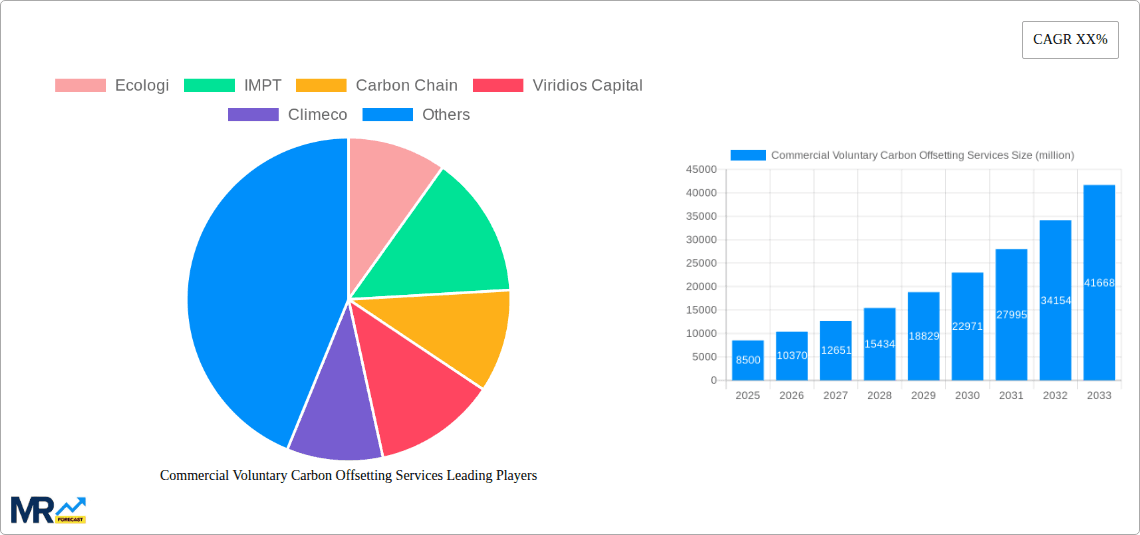

Key companies in the market include Ecologi, IMPT, Carbon Chain, Viridios Capital, Climeco, CHOOOSE, Carbonclick, Climate Impact Partners, CarbonBetter, HSBC, BAIN & COMPANY, ENGIE Impact, Chicago Mercantile Exchange (CME), Beijing Environment Exchange, Deloitte, Ecoact, Pwc.

The market segments include Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commercial Voluntary Carbon Offsetting Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Voluntary Carbon Offsetting Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.