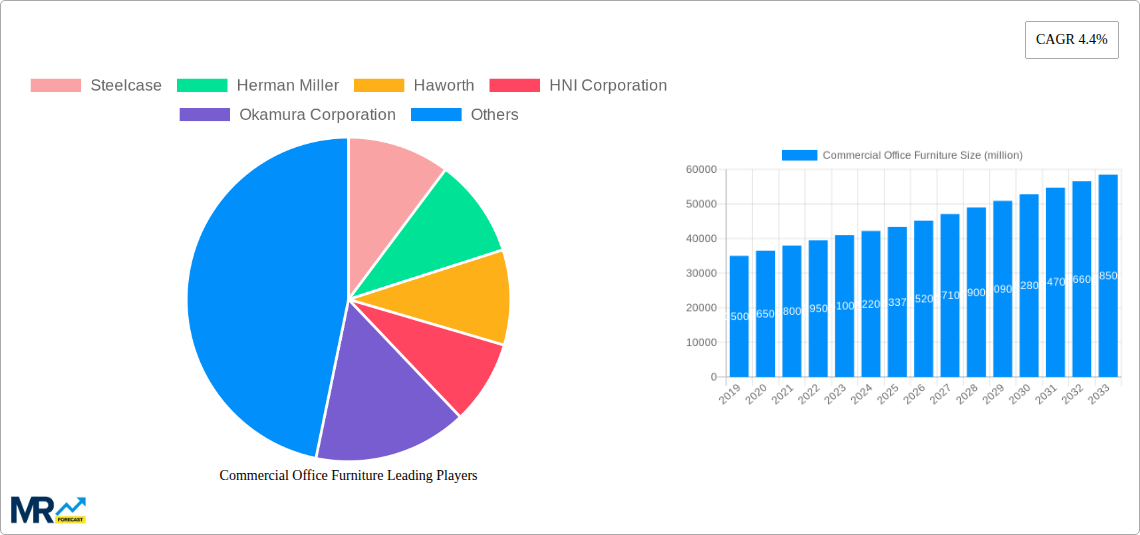

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Office Furniture?

The projected CAGR is approximately 4.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Office Furniture

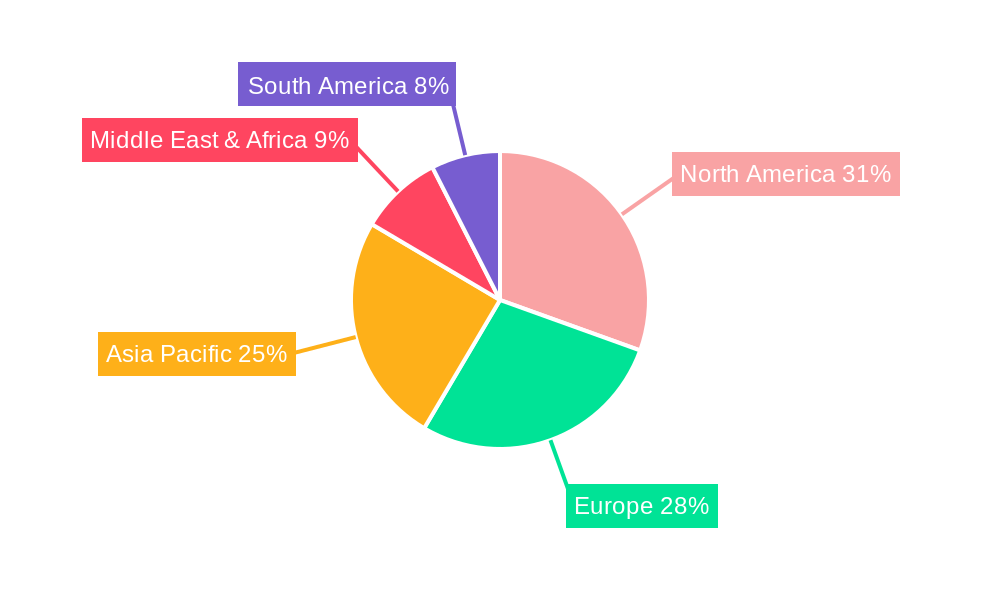

Commercial Office FurnitureCommercial Office Furniture by Type (Seating, Tables, Casegood, Other), by Application (School, Hospital, Hotels, Office Building, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

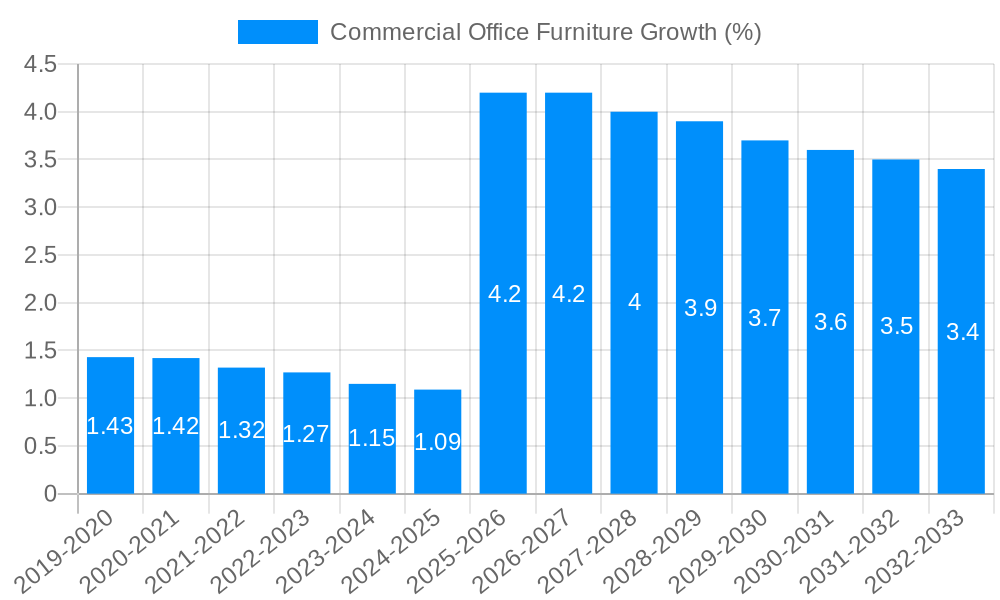

The global commercial office furniture market is poised for significant growth, projected to reach approximately $43,370 million by 2025. This expansion is driven by a dynamic interplay of evolving workplace designs, technological advancements, and a growing emphasis on employee well-being. Key drivers include the increasing adoption of hybrid work models, necessitating flexible and adaptable office layouts that cater to both collaborative and individual focused work. The demand for ergonomic and sustainable furniture solutions is also on the rise as companies prioritize creating healthier and more environmentally conscious work environments. Furthermore, the ongoing need for modernizing aging office infrastructures, coupled with corporate expansion and relocation initiatives, will continue to fuel market demand. The market's Compound Annual Growth Rate (CAGR) of 4.4% between 2019 and 2033 underscores a consistent upward trajectory, indicating a robust and sustained demand for commercial office furnishings.

The market is segmented by product type into Seating, Tables, Casegoods, and Other, with Seating and Casegoods likely representing the largest segments due to their fundamental role in office functionality. Applications span across Schools, Hospitals, Hotels, Office Buildings, and Other sectors, with Office Buildings being the dominant application due to the widespread need for functional and aesthetic workspaces. Geographically, North America and Europe have historically been leading markets, driven by established corporate presence and a strong focus on workplace innovation. However, the Asia Pacific region, particularly China and India, is emerging as a high-growth market, propelled by rapid economic development, increasing foreign investment, and a burgeoning corporate sector. Leading companies such as Steelcase, Herman Miller, and Haworth are at the forefront, continuously innovating to meet the changing demands for smart, sustainable, and user-centric office furniture solutions. Restraints such as rising raw material costs and supply chain disruptions could pose challenges, but are expected to be mitigated by technological advancements and strategic sourcing.

Here's a unique report description on Commercial Office Furniture, incorporating your specified elements:

The global commercial office furniture market is poised for a dynamic evolution, projected to witness a substantial expansion driven by evolving workplace paradigms and the relentless pursuit of employee well-being and productivity. XXX, a key indicator of market health, suggests a significant uptick in demand for adaptable, ergonomic, and aesthetically pleasing furniture solutions. The historical period (2019-2024) laid the groundwork for this transformation, characterized by a growing awareness of the link between office design and employee satisfaction. As we enter the base year of 2025, the market is already exhibiting a pronounced shift towards furniture that supports flexible work arrangements, including hybrid models and hot-desking. This necessitates modular, easily reconfigurable, and lightweight furniture that can cater to diverse user needs throughout the day. The forecast period (2025-2033) is anticipated to be shaped by a surge in investments in smart office technology integration, with furniture increasingly designed to incorporate power outlets, charging stations, and connectivity solutions seamlessly. Furthermore, a heightened focus on sustainability is driving demand for eco-friendly materials, recycled content, and durable products with extended lifecycles. The estimated year of 2025 will likely see a consolidation of these trends, with manufacturers prioritizing the development of furniture that not only enhances functionality but also contributes to a positive and inspiring work environment. The adoption of biophilic design principles, incorporating natural elements and colors, is also gaining traction, aiming to foster a sense of calm and reduce stress within the workspace. The report will delve into the intricate interplay of these trends, providing a comprehensive overview of the market's trajectory and the innovative solutions shaping the future of commercial offices.

The commercial office furniture market is being propelled by a confluence of powerful forces, fundamentally reshaping how businesses approach their physical workspaces. A primary driver is the increasing emphasis on employee well-being and productivity. As organizations recognize the direct correlation between a comfortable and functional environment and employee output, investments in ergonomic seating, height-adjustable desks, and acoustically optimized furniture are soaring. The shift towards hybrid and remote work models, a phenomenon cemented during the historical period (2019-2024) and continuing into the estimated year of 2025, has also fueled demand for flexible and adaptable furniture solutions. Companies are seeking furniture that can easily be reconfigured to accommodate varying team sizes and work styles, facilitating both collaborative sessions and focused individual work. Furthermore, the rising awareness of sustainability and environmental responsibility is a significant catalyst. Businesses are increasingly prioritizing furniture made from recycled, recyclable, and sustainably sourced materials, aligning with their corporate social responsibility goals and appealing to a workforce that values eco-conscious brands. The rapid advancements in technology and smart office integration are also playing a crucial role. Furniture is no longer just a static piece; it's becoming an interactive element, incorporating built-in power, wireless charging, and connectivity features, creating a more seamless and efficient work experience.

Despite the robust growth prospects, the commercial office furniture market faces several significant challenges and restraints that could temper its expansion. A primary hurdle is the fluctuating economic landscape and global supply chain disruptions. The study period (2019-2033) has already witnessed periods of economic uncertainty and logistical complexities, impacting raw material availability, manufacturing costs, and delivery timelines. This volatility can lead to increased prices for furniture, potentially deterring some businesses from making significant investments. Another considerable restraint is the evolving nature of office utilization. While hybrid work is a driver, the long-term impact on overall office space requirements and the demand for traditional furniture sets remains a subject of ongoing observation. Companies may hesitate to commit to large-scale furniture procurements if they are still defining their optimal office footprint. Furthermore, rising raw material costs and inflationary pressures are a persistent concern. The prices of wood, metal, plastics, and textiles, all essential components of office furniture, are subject to market fluctuations, directly impacting manufacturing overhead and ultimately the retail price of the final product. The increasing competition from low-cost manufacturers, particularly in emerging markets, also presents a challenge for established players seeking to maintain premium pricing and market share. Finally, the rigidity of existing corporate procurement processes and long lead times for large projects can slow down the adoption of new furniture trends and innovative solutions.

The commercial office furniture market's dominance is characterized by a dual interplay of geographical influence and segment specialization.

Region/Country Dominance:

Segment Dominance (Application: Office Building):

The Office Building application segment is unequivocally the dominant force in the commercial office furniture market. This dominance stems from the sheer volume of commercial spaces dedicated to office work globally. The historical period (2019-2024) has seen a recalibration of office design, with a move away from traditional cubicle farms towards more open-plan, collaborative, and flexible layouts. This necessitates a wide array of furniture types within this segment:

The estimated year of 2025 and the subsequent forecast period (2025-2033) will witness this dominance of the Office Building segment continuing, propelled by a renewed focus on creating engaging and productive work environments that attract and retain talent. The integration of technology within furniture, the increasing demand for sustainable materials, and the growing adoption of flexible work policies will all further solidify the Office Building segment's position as the primary driver of the commercial office furniture market.

The commercial office furniture industry's growth is significantly catalyzed by several key factors. The enduring trend towards flexible and hybrid work models necessitates adaptable and modular furniture that can be easily reconfigured to support diverse working styles and space utilization. A growing emphasis on employee well-being and ergonomic design is driving demand for high-quality, health-conscious furniture that enhances comfort and productivity. Furthermore, the increasing corporate commitment to sustainability and environmental responsibility is spurring the adoption of eco-friendly materials and durable products with extended lifecycles. Finally, the ongoing digital transformation of workplaces, with the integration of technology into furniture, is creating new avenues for growth and innovation.

This comprehensive report delves into the global commercial office furniture market, offering an in-depth analysis of trends, drivers, challenges, and opportunities. The study encompasses a detailed examination of the market from the historical period of 2019-2024, with a base year in 2025 and an extensive forecast period spanning from 2025 to 2033. It provides granular insights into key market segments, including Seating, Tables, Casegood, and Other, across various applications such as Office Buildings, Schools, Hospitals, and Hotels. The report highlights the significant industry developments and strategic initiatives undertaken by leading players like Steelcase, Herman Miller, and Haworth. Furthermore, it offers a deep dive into regional market dynamics, identifying key areas and countries poised for dominant growth. This report is an invaluable resource for stakeholders seeking to understand the evolving landscape, capitalize on emerging opportunities, and navigate the complexities of the commercial office furniture industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.4%.

Key companies in the market include Steelcase, Herman Miller, Haworth, HNI Corporation, Okamura Corporation, Kokuyo, ITOKI, Global Furniture Group, Teknion, Knoll, Kimball, KI, Sedus Stoll, EFG, Bene AG, Martela, Kinnarps Holding, Nowy Styl, Ahrend, Henglin Chair Industry, Flokk, Fursys, Sunon, Uchida Yoko, Changjiang Furniture, USM Modular Furniture, .

The market segments include Type, Application.

The market size is estimated to be USD 43370 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Commercial Office Furniture," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Office Furniture, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.