1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Half Rack?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Half Rack

Commercial Half RackCommercial Half Rack by Type (Below 350 Kg, 350 Kg to 450 Kg, Above 450 Kg, World Commercial Half Rack Production ), by Application (Gym, Stadium, Others, World Commercial Half Rack Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

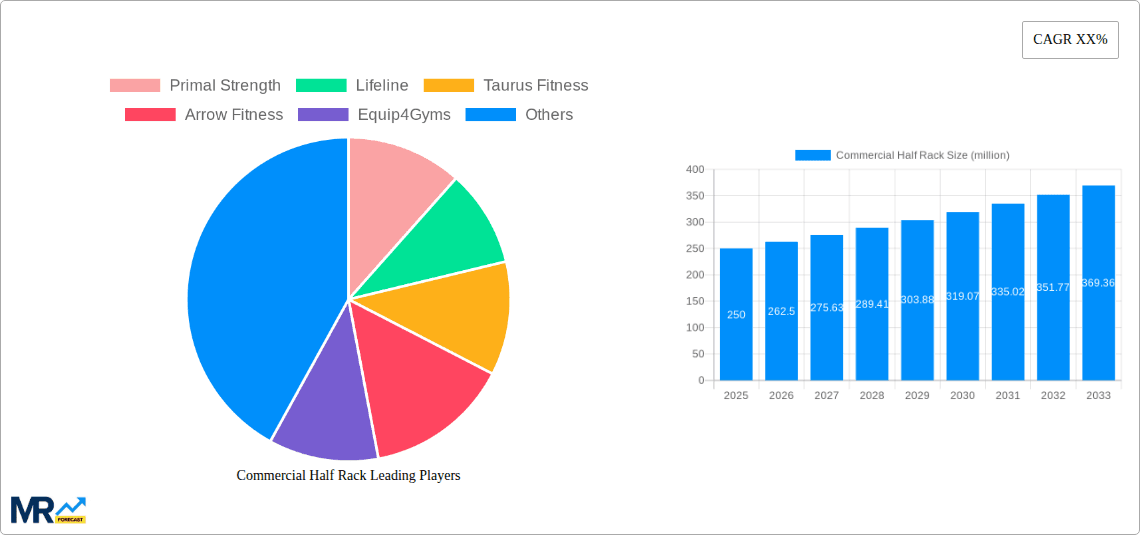

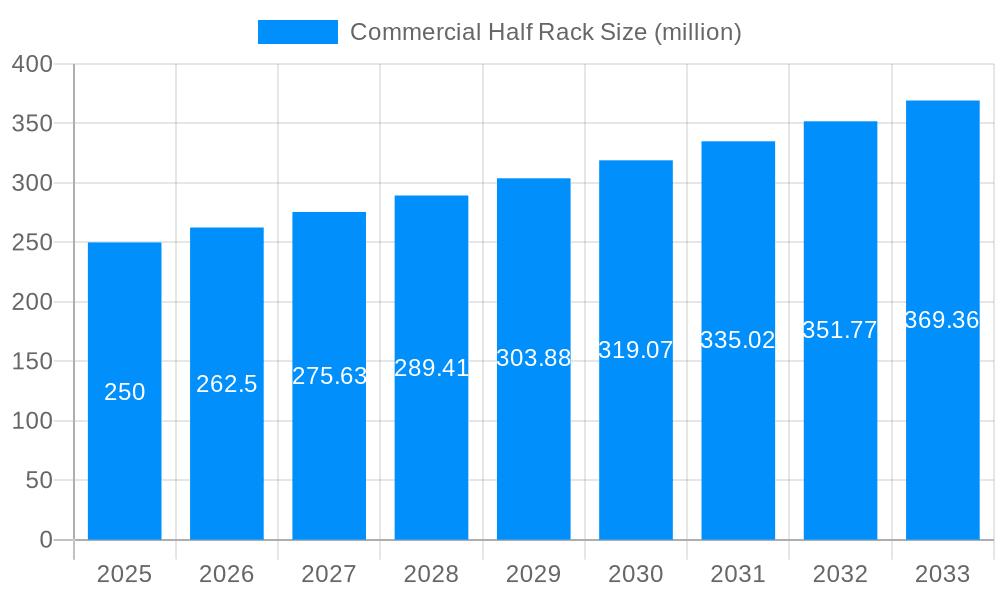

The global commercial half rack market is experiencing robust growth, driven by the increasing popularity of fitness and strength training, coupled with the expansion of commercial gyms and fitness studios worldwide. The market is segmented by weight capacity (below 350kg, 350-450kg, above 450kg) and application (gym, stadium, others), offering diverse options for various fitness settings. Key players like Primal Strength, Lifeline, and Taurus Fitness are driving innovation through the introduction of high-quality, durable, and feature-rich equipment, catering to both professional athletes and fitness enthusiasts. The North American and European markets currently hold significant market share, but Asia-Pacific is projected to witness substantial growth in the coming years due to rising disposable incomes and increased health consciousness. This growth is further fueled by trends such as the rise of boutique fitness studios, high-intensity interval training (HIIT), and functional fitness, all of which heavily utilize half racks. However, factors such as fluctuating raw material prices and potential supply chain disruptions pose challenges to market expansion. The forecast period of 2025-2033 suggests a positive outlook, with a projected Compound Annual Growth Rate (CAGR) indicating sustained market expansion. Competition is fierce, demanding continuous innovation and strategic marketing to capture a larger market share. The market's growth is intrinsically linked to broader economic conditions and consumer spending on fitness and wellness. Furthermore, technological advancements in materials science and manufacturing techniques continue to enhance product durability and performance, shaping market dynamics.

The market's segmentation offers opportunities for specialized product development and targeted marketing. For example, manufacturers are focusing on creating specialized half racks designed for specific workout styles or user needs, such as those optimized for CrossFit or powerlifting. This specialization leads to increased product differentiation and competitive advantage. Furthermore, the incorporation of smart technology, such as integrated fitness trackers and connectivity features, is becoming a key trend in the industry, adding value to the products and enhancing the overall user experience. Sustainability is also gaining traction, with manufacturers exploring eco-friendly materials and production processes to cater to the growing environmental consciousness of consumers. The evolving fitness landscape and evolving consumer preferences will continue to shape the market, requiring companies to adapt and innovate to maintain market competitiveness.

The global commercial half rack market, valued at approximately X million units in 2025, is poised for significant growth throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a steadily increasing demand, driven by several factors detailed below. The market is characterized by a diverse range of products catering to various weight capacities and application needs. While gyms remain the dominant application segment, the increasing popularity of fitness within stadiums and other specialized facilities is driving expansion into these niche markets. Key players like Primal Strength, Lifeline, and Body-Solid are actively competing through product innovation, focusing on durability, safety features, and versatility to appeal to a broad customer base. The market is also witnessing a trend toward specialized half racks designed for specific training methodologies, further segmenting the market and creating opportunities for niche players. The preference for higher weight capacity models (above 450 kg) indicates a growing demand for robust equipment capable of handling intense training regimes. Competitive pricing strategies, coupled with advancements in materials and manufacturing techniques, are contributing to the market's overall growth. Furthermore, the increasing emphasis on functional fitness and personalized workout programs is bolstering the demand for versatile equipment like commercial half racks, which can support a wide array of exercises. This trend is likely to continue, particularly in developed countries with a growing health-conscious population and substantial investments in fitness infrastructure. The market shows a notable preference for certain regions, primarily driven by factors such as fitness culture, economic growth, and government initiatives promoting health and wellness. This geographic disparity provides opportunities for expansion in less penetrated regions. Overall, the market presents a robust and dynamic landscape with substantial growth potential in the coming years.

The burgeoning fitness industry, fueled by an increasing awareness of health and wellness globally, forms the bedrock of this market's growth. The rising disposable incomes in many developing nations, alongside a growing preference for intense and functional fitness training, directly translates to higher demand for durable and versatile equipment like commercial half racks. Gyms and fitness centers, seeking to attract and retain clients, are constantly upgrading their facilities with top-of-the-line equipment. This continuous demand for upgrades within established fitness businesses is a significant driver. Moreover, advancements in material science have led to the creation of lighter, stronger, and more user-friendly half racks. These improvements are impacting both performance and aesthetics, making them more appealing to fitness enthusiasts and commercial establishments alike. Furthermore, the expansion of boutique fitness studios and specialized training facilities is generating consistent demand. These facilities often prioritize equipment quality and versatility, further boosting the market's trajectory. Finally, the increasing adoption of group fitness classes and personal training sessions involving free weights makes the half rack an essential piece of equipment, solidifying its role in modern fitness environments.

Despite the positive market trends, several challenges hinder the growth of the commercial half rack market. High initial investment costs can be a barrier to entry for smaller fitness centers or startups with limited budgets. This price sensitivity often restricts their ability to invest in premium equipment. Fluctuations in raw material prices, particularly steel, directly impact the manufacturing cost of half racks, leading to price instability and potentially affecting profit margins. Competition within the industry is intense, with numerous established and emerging players vying for market share. This competitive landscape requires companies to continuously innovate and differentiate their products to maintain their position. Transportation and logistics costs can significantly add to the overall price, especially for heavier models shipped internationally. This can impact the competitiveness of certain brands, particularly in regions with high transportation expenses. Additionally, the increasing demand for customization and specialized features presents a challenge in terms of production efficiency and potentially increased costs. Meeting the diverse needs of individual customers requires flexible manufacturing processes and potentially longer lead times. Finally, concerns related to product safety and durability are paramount. Any incidents or negative reviews regarding safety can significantly damage a brand's reputation and negatively impact sales.

Segment Domination: The "Above 450 Kg" weight capacity segment is projected to experience the highest growth rate during the forecast period. This is primarily driven by the rising popularity of high-intensity training methodologies among professional athletes and serious fitness enthusiasts. These individuals require robust and durable equipment capable of withstanding heavy loads, leading to greater demand within this segment. The larger weight capacity models are generally seen as a better long-term investment for commercial establishments due to their increased durability and suitability for a wider range of exercises and users.

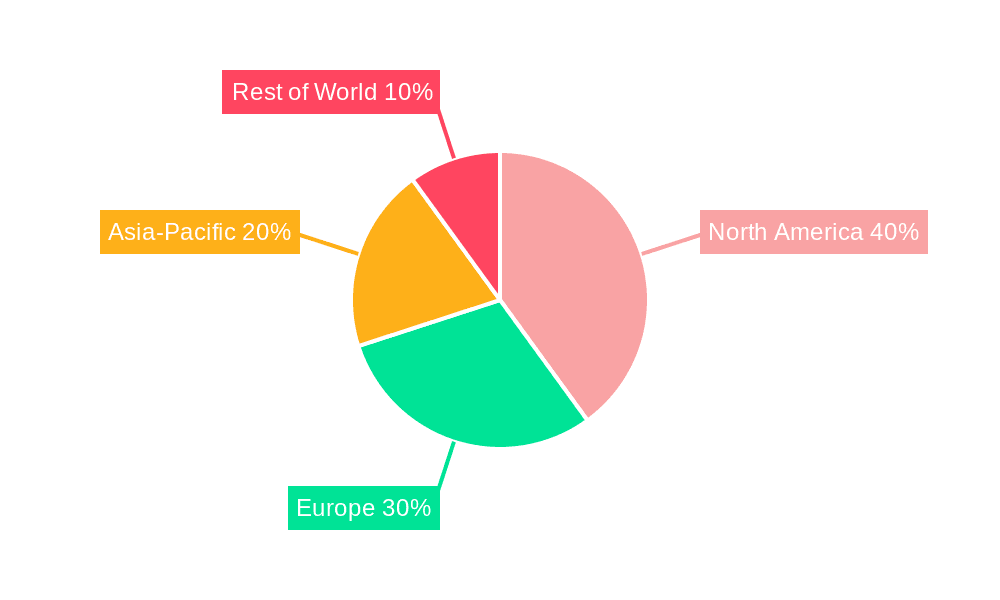

North America: The North American market is expected to remain dominant owing to the high per capita spending on fitness and wellness products, coupled with a well-established fitness infrastructure. The strong emphasis on personal training and boutique fitness studios further enhances the demand for high-quality, durable equipment such as commercial half racks.

Europe: This region shows strong growth potential, driven by the rising popularity of functional fitness and high-intensity interval training (HIIT). Moreover, an increasing focus on health and wellness within various countries is promoting investments in fitness infrastructure.

Asia-Pacific: While currently a smaller market compared to North America and Europe, this region is experiencing rapid expansion fueled by an expanding middle class and a growing awareness of health and fitness. Governments in many countries are actively promoting health and wellness initiatives, creating a supportive environment for market expansion.

Application Segment: The "Gym" application segment clearly dominates, encompassing a vast majority of the total market. This is due to the ubiquitous nature of commercial gyms and fitness centers in most regions. The "Stadium" segment, although currently smaller, demonstrates significant growth potential as athletic training facilities within stadiums and sports complexes are increasingly investing in sophisticated strength and conditioning equipment.

Several factors are poised to further accelerate the market's growth. The introduction of innovative designs incorporating advanced materials and technologies is enhancing durability and user experience. Growing awareness of the importance of strength training in overall health and fitness is driving demand among a wider population. Furthermore, the rise of online fitness platforms and social media influencers is promoting the popularity of strength training and thus the need for high-quality equipment like commercial half racks. Government initiatives supporting health and wellness are also creating a supportive market environment.

This report provides a comprehensive overview of the commercial half rack market, offering in-depth analysis of market trends, growth drivers, challenges, and key players. It provides valuable insights into market segmentation, regional performance, and future growth projections, enabling businesses to make well-informed strategic decisions. The report also includes detailed profiles of leading market participants, their competitive strategies, and recent developments, offering a complete picture of the market landscape. This information empowers businesses to understand the dynamics of the market and plan for future growth opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Primal Strength, Lifeline, Taurus Fitness, Arrow Fitness, Equip4Gyms, Catch Fitness, Body-Solid, Precor, Revolution Fitness, Hit Fitness, Armortech, Cyberfit Gym Equipment, York Barbell, Inspire Fitness, Origin Fitness, Reeplex, Pivot Fitness, Verve Fitness.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Commercial Half Rack," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Half Rack, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.