1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Connected Vehicles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Connected Vehicles

Commercial Connected VehiclesCommercial Connected Vehicles by Type (LCVs, Others), by Application (Consumer, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

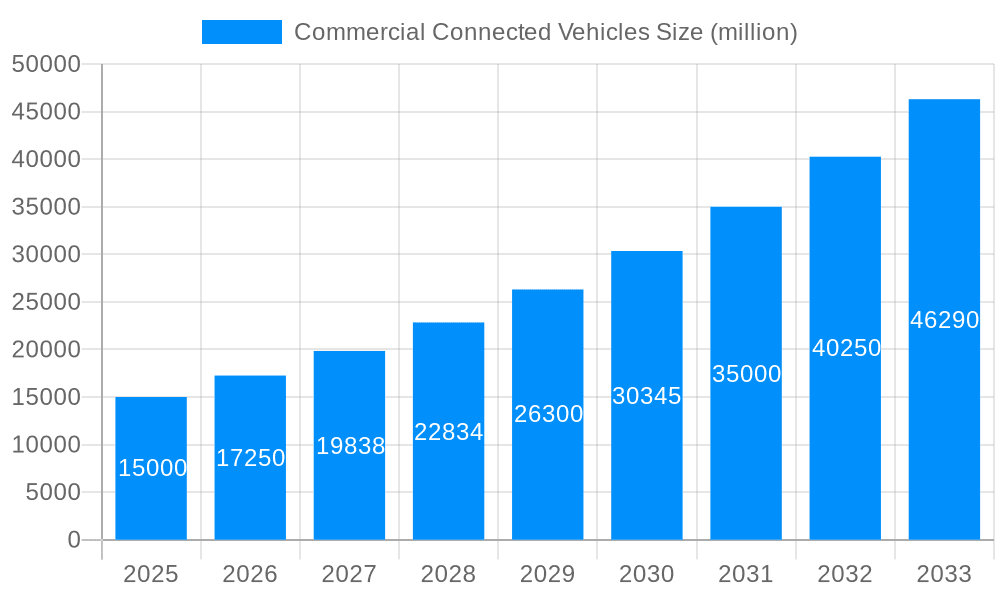

The commercial connected vehicle market is experiencing robust growth, driven by increasing demand for enhanced fleet management, improved driver safety, and optimized logistics. The integration of telematics, IoT sensors, and advanced analytics provides businesses with real-time data insights into vehicle performance, location, and driver behavior, leading to significant operational efficiencies and cost reductions. Factors such as stricter regulatory compliance requirements concerning safety and emission standards are further accelerating market adoption. We estimate the market size in 2025 to be approximately $15 billion, based on industry reports and observed growth trends in related sectors. A Compound Annual Growth Rate (CAGR) of 15% is projected for the forecast period (2025-2033), indicating a substantial market expansion. Key segments within the market include heavy-duty trucks, light commercial vehicles, and specialized fleets (e.g., construction, delivery). Competition is fierce, with established telematics providers, major telecom companies, and automotive technology firms vying for market share. The ongoing development and deployment of 5G technology will unlock new possibilities for data transmission and advanced connected vehicle services, further fueling market expansion.

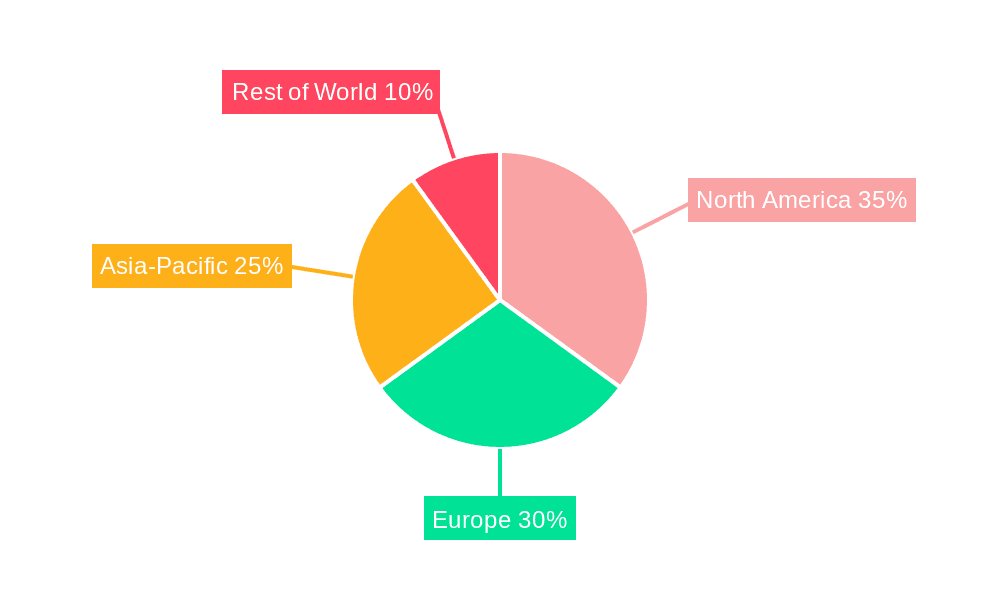

Challenges remain, including concerns around data security and privacy, the high initial investment costs associated with implementing connected vehicle technology, and the need for robust infrastructure to support widespread connectivity. However, these challenges are being actively addressed through technological advancements and the development of secure, scalable solutions. The market is witnessing a shift towards cloud-based solutions and software-as-a-service (SaaS) models, offering businesses greater flexibility and reducing upfront capital expenditure. Geographical growth will vary, with North America and Europe anticipated to maintain strong positions due to established infrastructure and high adoption rates. However, emerging economies in Asia-Pacific and Latin America are poised for significant growth as infrastructure improves and the adoption of connected vehicle technologies accelerates. The continued development of autonomous driving technologies will further reshape the landscape of the commercial connected vehicle market in the coming years.

The global commercial connected vehicles market is experiencing explosive growth, projected to reach tens of millions of units by 2033. The study period, spanning 2019-2033, reveals a significant shift towards connectivity in commercial fleets, driven by a confluence of technological advancements, regulatory pressures, and the increasing need for operational efficiency. The estimated market size in 2025, our base year, already signifies a substantial penetration of connected technologies within the commercial vehicle sector. The forecast period, 2025-2033, indicates continued robust expansion, propelled by factors like the increasing adoption of telematics, the rise of 5G networks, and the burgeoning demand for data-driven insights in logistics and transportation. Analysis of the historical period (2019-2024) underscores the accelerating adoption rate, setting the stage for even more significant growth in the coming years. This growth is not uniform across all vehicle types or regions, with certain segments and geographical areas exhibiting considerably faster adoption rates than others. The market is witnessing the emergence of new business models, with connectivity services becoming an integral part of the overall value proposition for commercial vehicles. This trend extends beyond mere tracking and monitoring; it encompasses predictive maintenance, optimized routing, improved driver safety, and enhanced fleet management capabilities. The market is also seeing increasing integration of connected vehicle data with other business systems, enabling more comprehensive data analytics and business intelligence applications. Ultimately, the trend points towards a future where connected commercial vehicles are seamlessly integrated into a broader ecosystem of smart transportation and logistics networks.

Several key factors are driving the rapid expansion of the commercial connected vehicles market. Firstly, the relentless pursuit of operational efficiency is a major catalyst. Connectivity offers real-time visibility into vehicle location, performance, and driver behavior, allowing fleet managers to optimize routes, reduce fuel consumption, minimize downtime, and improve overall productivity. Secondly, advancements in telematics technology, particularly the proliferation of affordable and robust GPS tracking devices and cellular connectivity, have significantly lowered the barrier to entry for adopting connected vehicle solutions. The rise of 5G networks further accelerates this trend by enabling faster data transmission and supporting the deployment of more sophisticated connected vehicle applications. Thirdly, increasing regulatory pressure regarding vehicle safety and emissions standards is pushing businesses to adopt technologies that enhance safety and improve environmental performance. Connected vehicles play a vital role in meeting these requirements, enabling features like driver monitoring systems, advanced driver-assistance systems (ADAS), and remote diagnostics. Finally, the increasing availability of data analytics platforms and the growing expertise in utilizing this data to extract actionable insights are further fueling market growth. This allows for improved decision-making related to fleet management, maintenance scheduling, and route optimization, ultimately leading to significant cost savings and efficiency gains.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of commercial connected vehicles. One major hurdle is the high initial investment cost associated with equipping vehicles with telematics devices and integrating them into existing fleet management systems. This can be particularly challenging for smaller businesses with limited capital. Furthermore, concerns about data security and privacy are growing as the amount of data collected from connected vehicles increases. Robust security measures and transparent data governance policies are crucial to address these concerns and build trust among stakeholders. The complexity of integrating connected vehicle data with existing enterprise systems can also pose a significant challenge, requiring significant IT infrastructure investments and expertise. Differences in telematics standards and protocols across different vehicle manufacturers and service providers can also create interoperability issues, hindering seamless data exchange and integration. Finally, the reliability of cellular network coverage, particularly in remote areas, remains a concern for many fleet operators. Addressing these challenges requires collaborative efforts among technology providers, fleet operators, and regulatory bodies to develop standardized protocols, enhance data security measures, and ensure reliable connectivity infrastructure.

The commercial connected vehicles market exhibits diverse growth patterns across regions and segments. North America and Europe are currently leading the market due to advanced infrastructure, stringent regulations, and early adoption of telematics technologies. However, the Asia-Pacific region is projected to experience the fastest growth in the coming years, driven by rapid economic development, expanding logistics sectors, and increasing government support for smart transportation initiatives.

Segments:

In summary, while North America and Europe maintain a significant market share, the Asia-Pacific region's rapid growth makes it a critical area for market expansion, particularly within the heavy-duty truck and light-duty vehicle segments.

The integration of artificial intelligence (AI) and machine learning (ML) into connected vehicle platforms is a powerful catalyst. These technologies enable predictive maintenance, optimized routing, and enhanced driver safety features, significantly improving operational efficiency and reducing costs. Furthermore, the growing adoption of 5G networks is unlocking the potential for new applications that require high bandwidth and low latency, such as real-time video streaming and advanced driver-assistance systems. Finally, increasing government regulations aimed at enhancing vehicle safety and reducing emissions are pushing businesses to adopt connected vehicle technologies, accelerating market growth.

This report provides a comprehensive analysis of the commercial connected vehicles market, encompassing market size estimations, growth forecasts, and key trend identification across various segments and geographies. It identifies leading players, analyzes driving forces and challenges, and outlines significant developments shaping the industry's future. The report is an invaluable resource for businesses, investors, and policymakers seeking a thorough understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

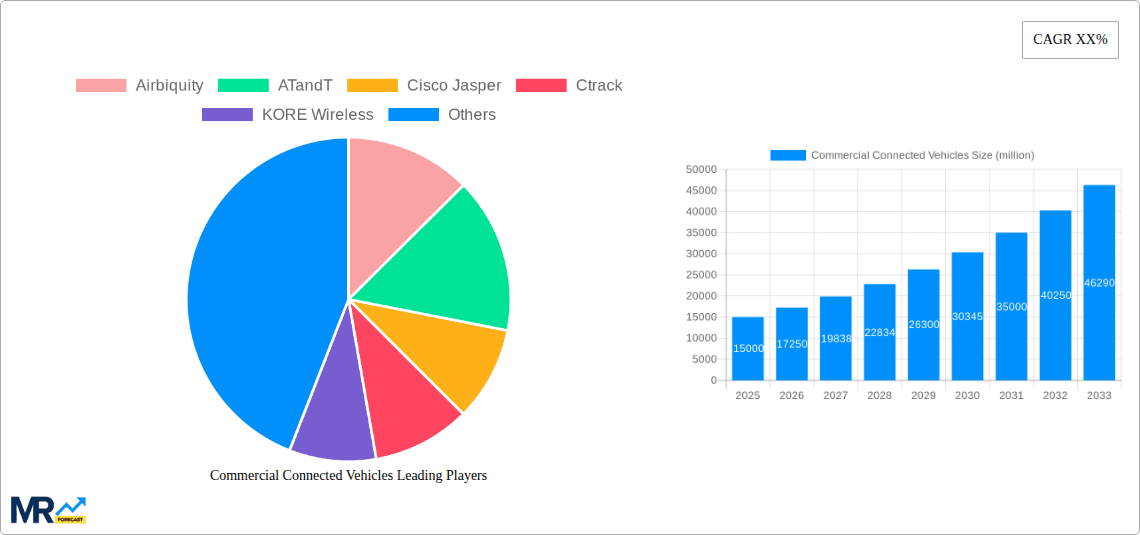

Key companies in the market include Airbiquity, ATandT, Cisco Jasper, Ctrack, KORE Wireless, Mojio, MiX Telematics, Octo Telematics, Tech Mahindra, Verizon, Vodafone, WirelessCar, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Commercial Connected Vehicles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Connected Vehicles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.