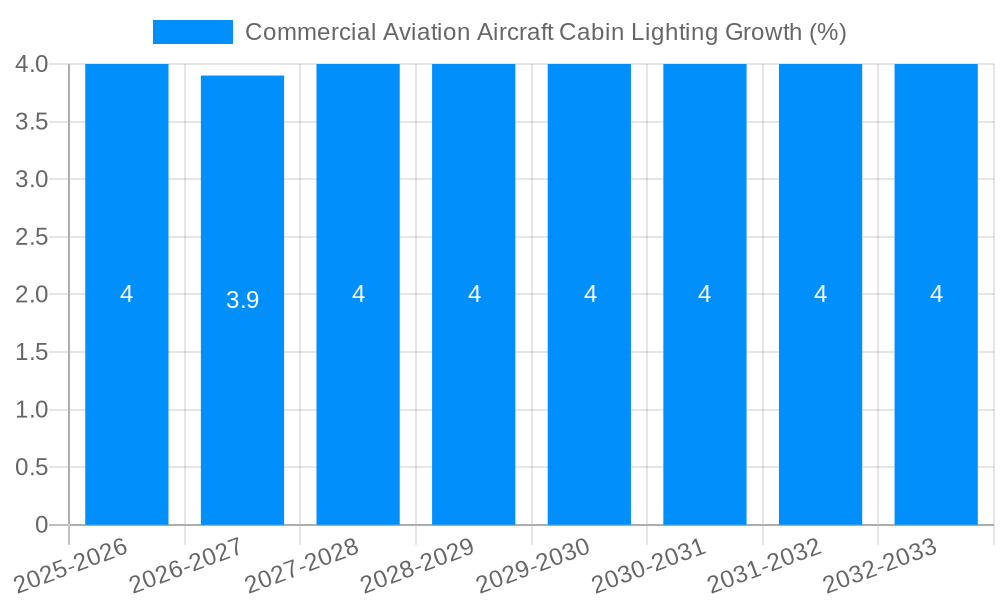

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aviation Aircraft Cabin Lighting?

The projected CAGR is approximately 4.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Aviation Aircraft Cabin Lighting

Commercial Aviation Aircraft Cabin LightingCommercial Aviation Aircraft Cabin Lighting by Type (Line-Fit, Retrofit), by Application (Very Light Aircraft, Wide Body Aircraft, Narrow Body Aircraft, Business General Aviation), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

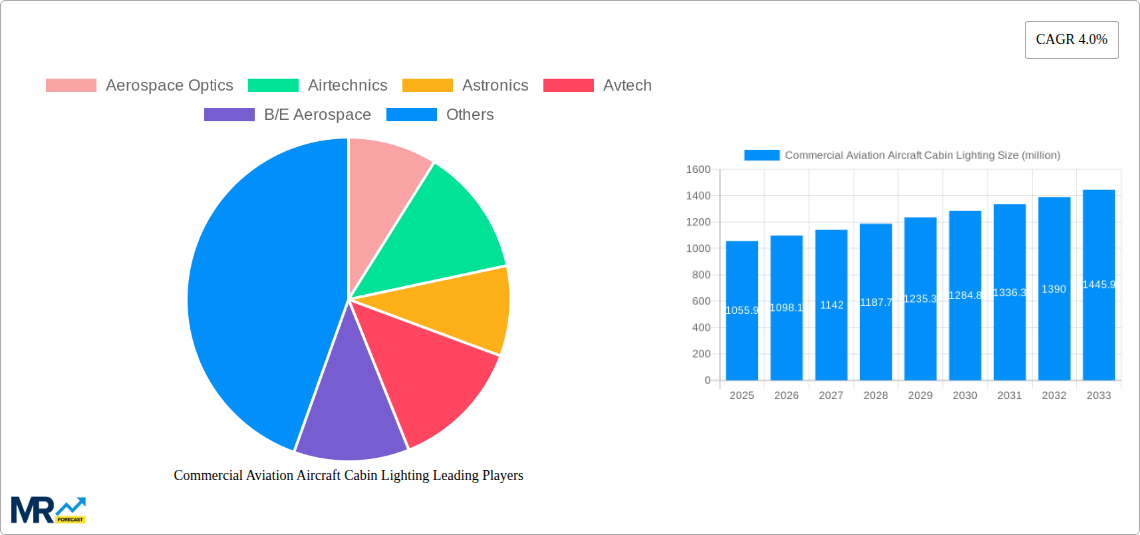

The global Commercial Aviation Aircraft Cabin Lighting market is poised for steady growth, projected to reach approximately $1055.9 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.0% expected from 2025 to 2033. This expansion is driven by several key factors, most notably the continuous evolution and demand for enhanced passenger comfort and in-flight experience. Airlines are increasingly investing in advanced cabin lighting solutions, including dynamic LED systems, mood lighting, and personalized illumination, to differentiate their services and attract discerning travelers. The retrofit segment, in particular, is a significant contributor, as airlines upgrade older fleets to meet new regulatory standards and passenger expectations. Furthermore, the growing demand for fuel-efficient and low-maintenance lighting technologies, such as LED, further fuels market expansion. The increasing passenger traffic and the ongoing expansion of global air travel are also fundamental drivers supporting this market's upward trajectory.

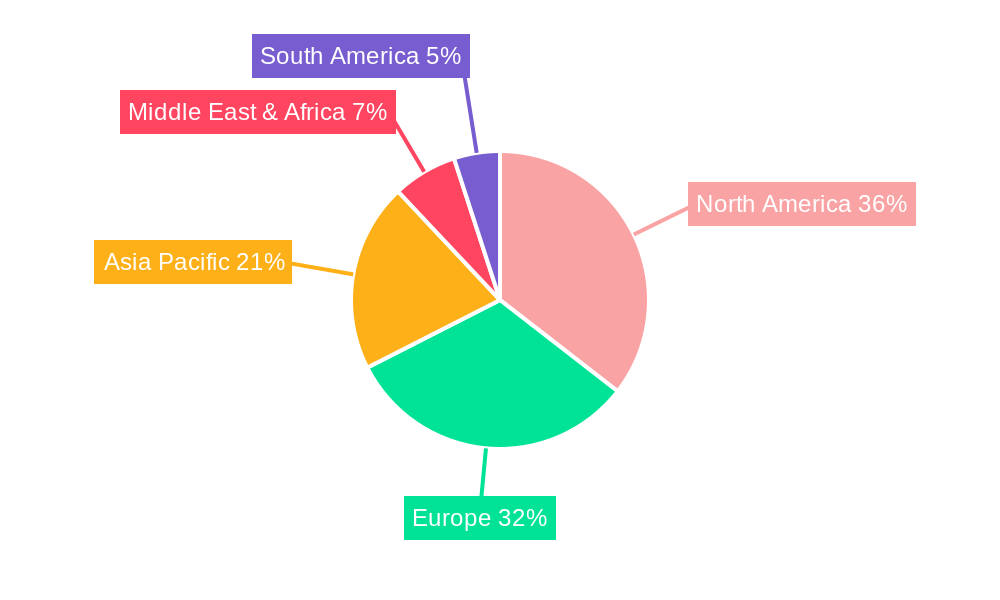

Technological advancements and a focus on sustainability are shaping the future of aircraft cabin lighting. The integration of smart lighting systems, offering features like circadian rhythm management and enhanced visual appeal, is becoming a key trend. The market is segmented into two primary types: Line-Fit and Retrofit, with both contributing to the overall growth. Applications span across Very Light Aircraft, Wide Body Aircraft, Narrow Body Aircraft, and Business General Aviation, each presenting unique opportunities for lighting manufacturers. Geographically, North America and Europe currently lead the market, driven by mature aviation industries and significant investments in fleet modernization. However, the Asia Pacific region, with its rapidly expanding aviation sector and increasing disposable incomes, is expected to witness the fastest growth in the forecast period. Key players are actively engaged in research and development, aiming to introduce innovative and energy-efficient lighting solutions to capitalize on these evolving market dynamics.

Here is a unique report description on Commercial Aviation Aircraft Cabin Lighting, incorporating your specified details:

This comprehensive report delves into the dynamic world of commercial aviation aircraft cabin lighting, offering an in-depth analysis of market trends, drivers, challenges, and future projections. Spanning a study period from 2019 to 2033, with a base year of 2025, this research provides invaluable insights for stakeholders navigating this evolving sector. The report meticulously examines historical data from 2019-2024 and forecasts market trajectories for the 2025-2033 period, offering a robust foundation for strategic decision-making.

The global commercial aviation aircraft cabin lighting market is a critical component of passenger comfort, aircraft aesthetics, and operational efficiency. As airlines continuously strive to enhance the passenger experience and reduce operational costs, the demand for advanced, energy-efficient, and aesthetically pleasing cabin lighting solutions continues to grow. This report quantifies the market size in millions of units, providing a clear picture of its scale and growth potential.

The commercial aviation aircraft cabin lighting market is undergoing a significant transformation, driven by a confluence of passenger expectations, technological advancements, and regulatory considerations. A key trend is the pervasive adoption of LED technology. This shift away from older, less efficient lighting systems like incandescent and fluorescent bulbs is not merely an aesthetic choice; it is fundamentally about energy savings. LEDs consume considerably less power, translating into substantial fuel cost reductions for airlines, a crucial metric in an industry constantly seeking to optimize its bottom line. Furthermore, LEDs offer a far greater degree of color control and dimming capabilities, enabling airlines to create a diverse range of ambiances, from vibrant during boarding to calming during long-haul flights. This ability to dynamically adjust cabin lighting contributes directly to an improved passenger experience, influencing mood and potentially reducing jet lag.

Another prominent trend is the increasing demand for smart cabin lighting solutions. This encompasses systems that can be integrated with other cabin management systems, allowing for automated adjustments based on flight phase, time of day, or even passenger preferences. Features such as dynamic window lighting that mimics natural daylight cycles, personalized reading lights with adjustable intensity and color temperature, and ambient mood lighting that changes throughout the flight are becoming increasingly sought after. The emphasis on health and well-being is also shaping lighting trends, with a growing interest in circadian rhythm lighting systems designed to help passengers adapt to different time zones and minimize the effects of jet lag. Beyond passenger comfort, there's a parallel trend towards lighting solutions that enhance operational efficiency. This includes features like fault-detection systems within the lighting network, which can alert maintenance crews to issues before they become critical, minimizing downtime. The integration of lightweight materials and modular designs is also a significant trend, contributing to overall aircraft weight reduction and simplifying maintenance and replacement processes. The aesthetic appeal of cabin interiors is no longer an afterthought but a strategic differentiator for airlines, and lighting plays a pivotal role in achieving this, with customizable color palettes and dynamic illumination patterns becoming standard offerings. The market is also seeing a rise in demand for customizable lighting solutions, allowing airlines to differentiate their cabin offerings and create unique brand experiences.

Several powerful forces are collectively propelling the commercial aviation aircraft cabin lighting market forward. Foremost among these is the escalating demand for enhanced passenger experience. In an increasingly competitive airline industry, cabin ambiance and comfort are becoming key differentiators. Airlines recognize that sophisticated and adaptable cabin lighting can significantly influence passenger satisfaction, leading to increased loyalty and positive word-of-mouth. This drive for improved passenger journeys directly fuels investment in advanced lighting technologies that offer a greater range of customization and dynamic control.

Secondly, increasing airline focus on operational efficiency and cost reduction is a major catalyst. The inherent energy efficiency of LED lighting, coupled with its longer lifespan compared to traditional bulbs, translates into significant savings on electricity consumption and reduced maintenance costs. As fuel prices remain a critical factor in airline economics, any technology that contributes to fuel efficiency, even indirectly through weight reduction and lower power draw, receives considerable attention. Furthermore, the development of lighter and more durable lighting components contributes to overall aircraft weight reduction, further optimizing fuel burn.

The relentless pace of technological innovation is also a primary driver. Advancements in LED technology, miniaturization of components, and the development of intelligent control systems are continuously opening up new possibilities for cabin lighting design and functionality. This includes the integration of lighting with cabin management systems, enabling features like personalized lighting controls and automated adjustments based on flight phases or time of day. The growing importance of sustainability and environmental regulations also plays a role, encouraging the adoption of energy-efficient lighting solutions. Regulatory bodies and environmental advocates are increasingly pushing for greener aviation practices, and energy-saving lighting is a tangible step in that direction. Finally, the continuous growth in global air travel, particularly in emerging economies, creates a sustained demand for new aircraft and, consequently, for cabin interior components, including lighting systems.

Despite the robust growth drivers, the commercial aviation aircraft cabin lighting market faces several significant challenges and restraints that can impede its expansion. A primary concern is the high initial cost of advanced lighting systems. While LED technology offers long-term savings, the upfront investment in sophisticated systems, including controllers, wiring harnesses, and specialized fixtures, can be substantial, particularly for airlines operating on tight margins. This can make it challenging for smaller carriers or those in price-sensitive markets to adopt the latest innovations.

Furthermore, the stringent certification and regulatory requirements in the aviation industry pose a significant hurdle. Any new lighting component or system must undergo rigorous testing and certification processes to ensure compliance with safety, flammability, and electromagnetic interference (EMI) standards. This lengthy and complex certification process can delay product development and market entry, increasing costs for manufacturers and potentially slowing down the adoption of new technologies.

The long lifecycle of aircraft also presents a restraint. Aircraft are typically in service for 20-30 years, meaning that even when new aircraft are being delivered with state-of-the-art lighting, a vast fleet of older aircraft with less advanced systems will remain in operation for an extended period. The retrofit market is growing, but the economics of retrofitting older aircraft with new lighting systems need to be carefully considered by airlines, especially if the return on investment is not clearly defined.

Additionally, technical complexity and integration challenges can be a restraint. Integrating advanced lighting systems with existing aircraft electrical and cabin management systems requires specialized expertise and can lead to compatibility issues. Ensuring seamless operation and reliability across a diverse range of aircraft models and configurations adds another layer of complexity. Finally, supply chain disruptions and raw material price volatility, as experienced in recent years, can impact the availability and cost of components, posing a challenge to manufacturers and potentially affecting the overall market growth.

The commercial aviation aircraft cabin lighting market is characterized by a few key regions and segments that are poised for significant dominance. The North America region, encompassing the United States and Canada, is a major powerhouse in this market. This dominance stems from several factors, including the presence of major aircraft manufacturers like Boeing, a substantial number of airlines operating extensive fleets, and a strong emphasis on passenger experience and technological innovation within the aviation sector. The region exhibits a high adoption rate of advanced lighting technologies, driven by the need for airlines to differentiate themselves in a competitive landscape. The demand for both line-fit installations on new aircraft and retrofit solutions for existing fleets is substantial, reflecting the continuous modernization of cabin interiors.

In terms of segments, the Wide Body Aircraft segment is projected to be a key dominator. These aircraft, designed for long-haul international routes, are where airlines invest most heavily in premium cabin features, including sophisticated lighting systems. Passengers on these flights are often willing to pay a premium for enhanced comfort and a more enjoyable travel experience, making advanced cabin lighting a critical component of the offering. The ability to implement dynamic mood lighting, personalized reading lights, and circadian rhythm lighting systems is particularly impactful in wide-body cabins, where flight durations are extended. The market for line-fit installations on new wide-body aircraft is robust, driven by ongoing fleet renewal and expansion by major carriers. The retrofit market for wide-body aircraft is also significant, as airlines seek to upgrade older aircraft to remain competitive and meet evolving passenger expectations.

The Narrow Body Aircraft segment also presents a substantial and growing market. While perhaps not receiving the same level of investment per cabin as wide-bodies, the sheer volume of narrow-body aircraft in operation globally, especially for short to medium-haul routes, makes this segment a critical driver of market growth. Airlines are increasingly recognizing the value of even basic yet efficient LED lighting in these aircraft to improve the overall passenger experience and reduce operating costs. The demand for line-fit solutions in this segment is consistently high due to the large number of new narrow-body aircraft being delivered annually. The retrofit market is also crucial, as airlines look to upgrade their older narrow-body fleets to comply with modern standards and enhance passenger appeal.

The Business General Aviation segment, while smaller in terms of unit volume compared to commercial passenger aircraft, is characterized by a very high demand for bespoke and premium lighting solutions. These aircraft are often customized to the specific needs and preferences of their owners, leading to a greater emphasis on luxury, comfort, and advanced technological integration. Lighting in this segment often goes beyond functional illumination to become an integral part of the cabin's design aesthetic, incorporating intricate dimming capabilities, color tuning, and even integration with entertainment and communication systems. The retrofit market in business aviation is particularly active, as owners frequently upgrade their aircraft to incorporate the latest in cabin technology and luxury. The application of lighting in this segment often involves highly specialized, low-volume, high-value solutions.

Several key growth catalysts are fueling the expansion of the commercial aviation aircraft cabin lighting industry. The relentless pursuit of an enhanced passenger experience is paramount, with airlines leveraging advanced lighting to create more comfortable, engaging, and visually appealing cabin environments. This is directly driving demand for sophisticated LED systems with dynamic color and intensity control. Furthermore, the increasing emphasis on fuel efficiency and reduced operating costs for airlines is a significant catalyst. The energy-saving properties of LED lighting, coupled with its longer lifespan, contribute directly to reduced power consumption and lower maintenance expenses. The continuous technological advancements in LED technology, control systems, and integration capabilities are opening up new possibilities and driving the adoption of next-generation lighting solutions.

This comprehensive report offers an all-encompassing view of the commercial aviation aircraft cabin lighting market. It meticulously analyzes current market dynamics and projects future trajectories through 2033, utilizing the base year of 2025 and covering the historical period of 2019-2024. The report delves into the crucial driving forces shaping the market, such as the escalating demand for enhanced passenger experiences and the relentless pursuit of operational efficiency by airlines. It also thoroughly examines the challenges and restraints, including high initial costs and stringent regulatory hurdles, providing a balanced perspective. Furthermore, the report identifies the key regions and dominant segments, offering strategic insights into market leadership and growth opportunities, particularly within Wide Body Aircraft, Narrow Body Aircraft, and Business General Aviation segments. The report also highlights significant developments and leading players, providing a complete ecosystem overview. This in-depth analysis equips stakeholders with the knowledge to make informed strategic decisions and capitalize on the evolving opportunities within the commercial aviation aircraft cabin lighting sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.0%.

Key companies in the market include Aerospace Optics, Airtechnics, Astronics, Avtech, B/E Aerospace, Bruce Aerospace, Dallas Avionics, Day-Ray Products, Devore Aviation, Diehl Luftfahrt Elektronik, Ducommun Technologies, Eaton Aerospace, Electro-Mech Components, Heads Up Technologies, Honeywell, Idd Aerospace, .

The market segments include Type, Application.

The market size is estimated to be USD 1055.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Commercial Aviation Aircraft Cabin Lighting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Aviation Aircraft Cabin Lighting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.