1. What is the projected Compound Annual Growth Rate (CAGR) of the Cocoa Butter Replacer for Food?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cocoa Butter Replacer for Food

Cocoa Butter Replacer for FoodCocoa Butter Replacer for Food by Type (Palm Oil-Based CBRs, Shea Butter-Based CBRs, Sal Fat-Based CBRs, Mango Kernel Oil-Based CBRs, Others), by Application (Chocolate and Confectionery, Bakery Products, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

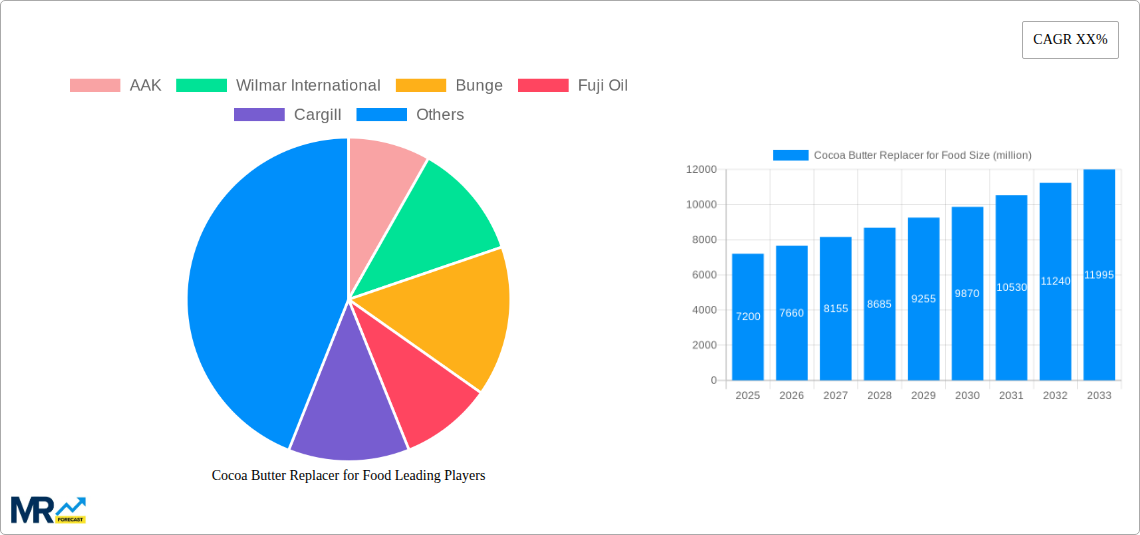

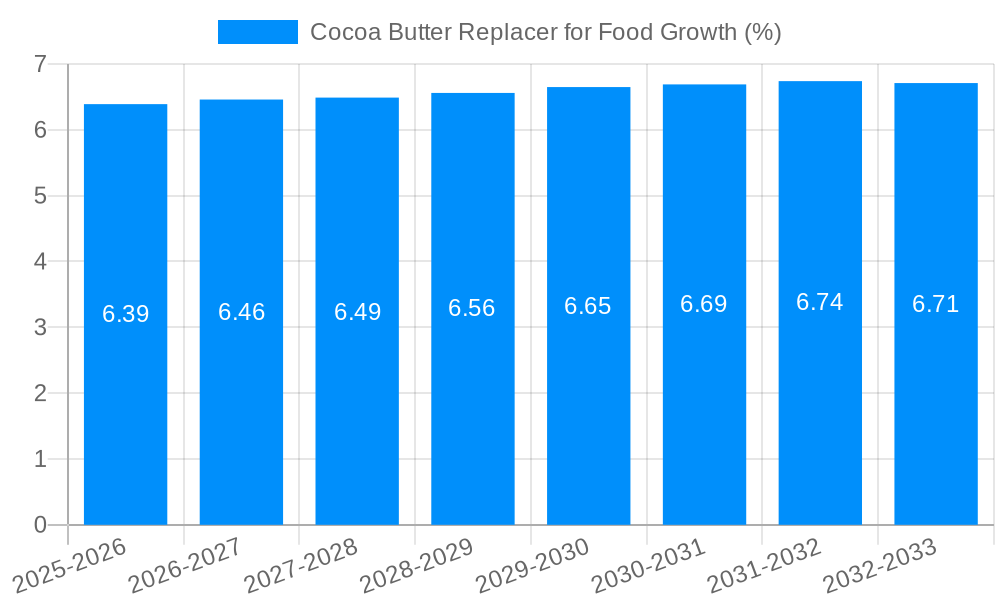

The global Cocoa Butter Replacer (CBR) for food market is poised for substantial growth, projected to reach a market size of approximately $7,200 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 6.5% from 2019 to 2033. This expansion is largely driven by the escalating demand for chocolate and confectionery products, a surge in bakery innovation, and the increasing consumer preference for cost-effective alternatives to pure cocoa butter. The market is witnessing a significant shift towards plant-based and sustainable sourcing, with palm oil-based CBRs currently holding a dominant share due to their widespread availability and functional properties. However, emerging trends like the utilization of shea butter and mango kernel oil for their unique nutritional profiles and healthier fat compositions are gaining traction, signaling a diversification in raw material preferences. The inherent price volatility of cocoa beans also acts as a primary catalyst, compelling manufacturers to explore and adopt CBRs to maintain competitive pricing and consistent product quality in their food formulations.

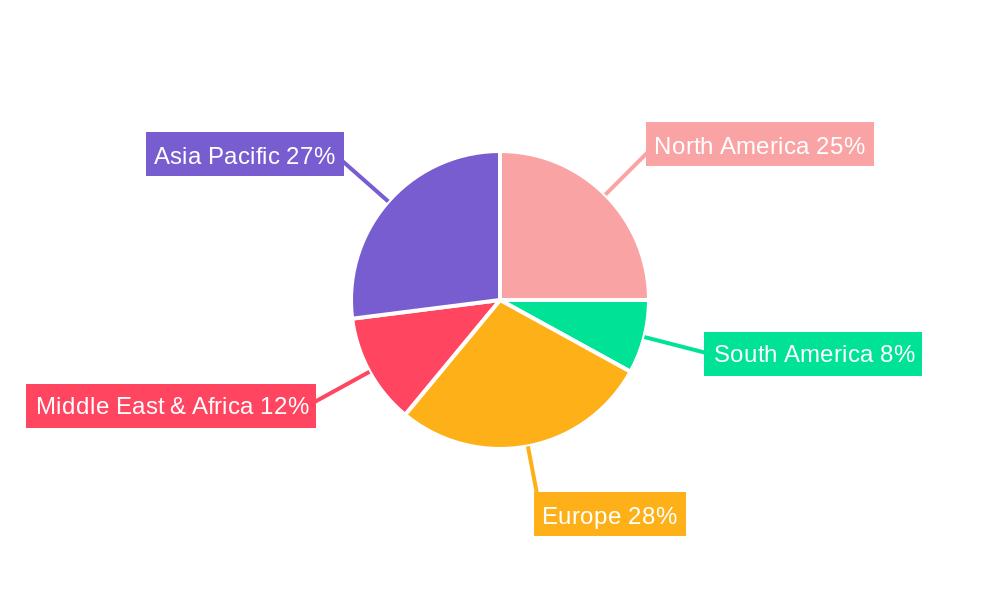

Despite the robust growth trajectory, the market faces certain restraints, including stringent regulations concerning food additives and labeling, particularly in developed regions, and consumer perception challenges regarding the "naturalness" of processed ingredients. Nonetheless, continuous innovation in blending technologies and the development of CBRs that closely mimic the sensory attributes of cocoa butter are expected to mitigate these challenges. Key players like AAK, Wilmar International, Bunge, Fuji Oil, and Cargill are actively investing in research and development, expanding production capacities, and forming strategic alliances to capture market share. The Asia Pacific region, led by China and India, is emerging as a significant growth engine, fueled by a burgeoning middle class and increasing disposable incomes, driving higher consumption of confectioneries and baked goods. North America and Europe, while mature markets, continue to represent substantial demand due to established food industries and a growing interest in premium and innovative confectionery offerings.

Here's a comprehensive report description for Cocoa Butter Replacer (CBR) for Food, incorporating your specified elements and values:

XXX, a pivotal report delving into the global Cocoa Butter Replacer (CBR) for Food market, forecasts a robust expansion of $7,850.5 million in 2025, driven by a confluence of evolving consumer preferences, economic factors, and technological advancements. The study period, spanning from 2019 to 2033, with a base year of 2025, meticulously analyzes historical trends and projects future trajectories. The CBR market is experiencing a significant shift towards healthier and more sustainable ingredients, directly influencing product formulations across the food industry. A growing awareness among consumers regarding the health implications of excessive fat consumption, coupled with a desire for ethically sourced and environmentally friendly products, is fueling the demand for CBRs that offer comparable sensory attributes to cocoa butter with enhanced nutritional profiles. The Chocolate and Confectionery segment, a perennial powerhouse, continues to be the dominant application, accounting for a substantial portion of the market share. However, the Bakery Products segment is witnessing accelerated growth, as manufacturers increasingly leverage CBRs to improve texture, shelf-life, and cost-effectiveness in a wide array of baked goods. Furthermore, the "Others" application segment, encompassing diverse uses in ice cream, dairy alternatives, and even specialized nutrition products, is an emerging frontier, poised for significant expansion. The report will also highlight the increasing influence of regulatory landscapes, as governments worldwide implement stricter guidelines on food labeling and ingredient transparency, further pushing manufacturers towards well-defined and traceable CBR solutions. This detailed analysis aims to provide stakeholders with a comprehensive understanding of market dynamics, identifying lucrative opportunities and emerging challenges within this dynamic sector.

The global Cocoa Butter Replacer (CBR) for Food market is experiencing a significant upswing, driven primarily by the persistent demand for cost-effective yet high-quality ingredients in the food industry. The volatility of cocoa bean prices, subject to climatic conditions, geopolitical instability, and supply chain disruptions, has made cocoa butter an increasingly unpredictable and expensive commodity. This inherent price fluctuation creates a compelling economic incentive for food manufacturers to explore and adopt CBRs as a means to stabilize their production costs and maintain competitive pricing for their end products. Moreover, the ongoing quest for improved product performance is a major catalyst. CBRs offer manufacturers the ability to fine-tune the textural properties, melting points, and bloom resistance of their confectionery and baked goods, leading to enhanced shelf appeal and consumer satisfaction. The continuous innovation in CBR formulations, particularly the development of non-hydrogenated and healthier alternatives, is also a key driving force, aligning with the growing consumer demand for clean-label and wellness-oriented food options. As such, the market is not just about cost savings, but also about achieving superior product attributes and meeting the evolving expectations of a discerning consumer base.

Despite its burgeoning growth, the Cocoa Butter Replacer (CBR) for Food market faces several significant challenges and restraints that can temper its expansion. A primary concern is the inherent consumer perception and the lingering preference for genuine cocoa butter in premium chocolate products. Many consumers associate the authentic taste, mouthfeel, and aroma of chocolate directly with the presence of cocoa butter, and CBRs, even with advanced formulations, may struggle to perfectly replicate these sensory attributes, leading to resistance in certain high-end markets. Furthermore, the complexity of regulatory approvals for novel CBR ingredients in different regions can create significant hurdles for manufacturers looking to introduce new products. Stringent food safety standards and the need for extensive testing and documentation can prolong market entry timelines and increase development costs. Another restraint stems from the potential for supply chain vulnerabilities in the sourcing of raw materials for certain types of CBRs, particularly those derived from niche oils. Fluctuations in the availability and pricing of these specialized ingredients can impact the stability and cost-effectiveness of CBR production. Finally, the ongoing research and development required to create CBRs that offer a complete and seamless replacement for cocoa butter in all applications remains a technical challenge, demanding continuous innovation and investment.

The Palm Oil-Based CBRs segment is poised to dominate the global Cocoa Butter Replacer (CBR) for Food market, driven by its widespread availability, cost-effectiveness, and versatile properties, particularly within the Asia Pacific region.

Dominant Segment: Palm Oil-Based CBRs: This segment's leadership is underpinned by several critical factors. Palm oil, a globally abundant and relatively inexpensive vegetable oil, serves as a primary feedstock for a significant portion of CBR production. Its inherent physical properties, such as a semi-solid consistency at room temperature and a melting profile that can be tailored through fractionation and interesterification, make it highly suitable for mimicking the functionality of cocoa butter. Manufacturers can achieve desired textures, prevent fat bloom, and enhance gloss in confectionery and baked goods using palm oil-based CBRs. The extensive global cultivation of oil palms, particularly in Southeast Asia, ensures a stable and large-scale supply, which is crucial for meeting the high demand from food manufacturers.

Dominant Region: Asia Pacific: The Asia Pacific region is expected to lead the CBR market for several compelling reasons. Firstly, it is a major production hub for palm oil, which directly fuels the dominance of palm oil-based CBRs. Countries like Indonesia and Malaysia are the world's largest palm oil producers, providing a readily accessible and cost-competitive raw material base for CBR manufacturing within the region. Secondly, the burgeoning food processing industry in Asia Pacific, driven by a large and growing population with increasing disposable incomes, translates into a substantial demand for food ingredients. The Chocolate and Confectionery and Bakery Products segments are experiencing rapid growth in this region as consumer preferences for these treats evolve. The cost-sensitive nature of a significant portion of the consumer base also makes CBRs an attractive option for manufacturers seeking to offer affordable yet appealing products. Furthermore, the increasing focus on food innovation and the development of localized confectionery and baked goods within Asia Pacific will continue to drive the adoption of CBRs to meet specific product requirements and cost targets. The presence of key global CBR manufacturers with significant operations in this region further solidifies its dominant position.

Several key growth catalysts are propelling the Cocoa Butter Replacer (CBR) for Food industry forward. The sustained volatility and rising costs of raw cocoa beans present a significant economic incentive for food manufacturers to seek out cost-effective alternatives, thereby driving demand for CBRs. Concurrently, advancements in food technology are enabling the development of CBRs that more closely replicate the sensory attributes and functionalities of cocoa butter, addressing historical limitations and enhancing product quality. The increasing consumer preference for healthier food options, coupled with a growing awareness of ingredient sourcing and sustainability, is also a potent catalyst, favoring CBRs that offer improved nutritional profiles and environmentally responsible production.

This comprehensive report offers an in-depth analysis of the global Cocoa Butter Replacer (CBR) for Food market, projecting a robust expansion to $7,850.5 million by 2025. The report meticulously examines the market from 2019 to 2033, providing a detailed understanding of historical trends, current dynamics, and future projections. It delves into key market drivers, such as the cost volatility of cocoa butter and the demand for improved product performance, alongside critical challenges including consumer perception and regulatory hurdles. The analysis highlights dominant segments like Palm Oil-Based CBRs and key regions like Asia Pacific, offering strategic insights for market participants. Furthermore, the report identifies leading players, significant industry developments, and emerging trends that will shape the market's trajectory. This extensive coverage aims to equip stakeholders with the knowledge needed to navigate this dynamic sector and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AAK, Wilmar International, Bunge, Fuji Oil, Cargill, Mewah, Musim Mas, 3F Industries, Felda Iffco, Nisshin OilliO, Manorama, EFKO, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cocoa Butter Replacer for Food," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cocoa Butter Replacer for Food, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.