1. What is the projected Compound Annual Growth Rate (CAGR) of the Cobalt-free Battery?

The projected CAGR is approximately 6.36%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cobalt-free Battery

Cobalt-free BatteryCobalt-free Battery by Application (BEV, PHEV, World Cobalt-free Battery Production ), by Type (Capacity 115Ah, Others, World Cobalt-free Battery Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

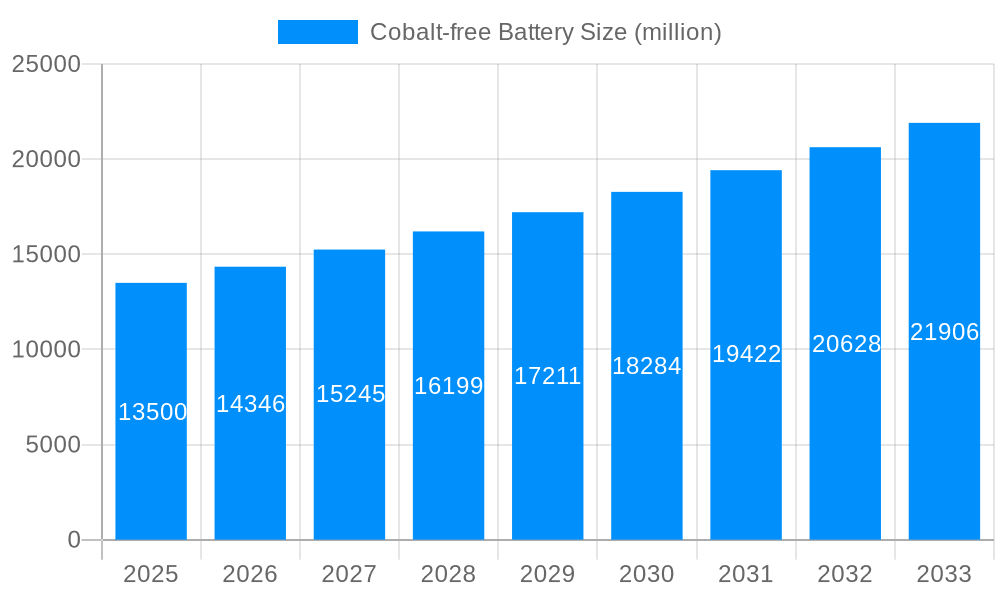

The global cobalt-free battery market is poised for significant expansion, projected to reach a substantial valuation by 2033, driven by the escalating demand for sustainable and ethically sourced energy storage solutions. With a compelling Compound Annual Growth Rate (CAGR) of 6.36%, the market is expected to transition from its current robust state to a much larger entity. The primary impetus behind this surge is the urgent need to mitigate reliance on cobalt, a resource often associated with ethical concerns and price volatility. This has spurred intense innovation and investment in alternative battery chemistries, particularly within the Electric Vehicle (EV) sector, where Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) are at the forefront of adoption. The increasing stringency of environmental regulations and growing consumer preference for eco-friendly products further bolster the adoption of these advanced battery technologies. The market's trajectory suggests a sustained period of growth, making it an attractive landscape for both established players and emerging innovators.

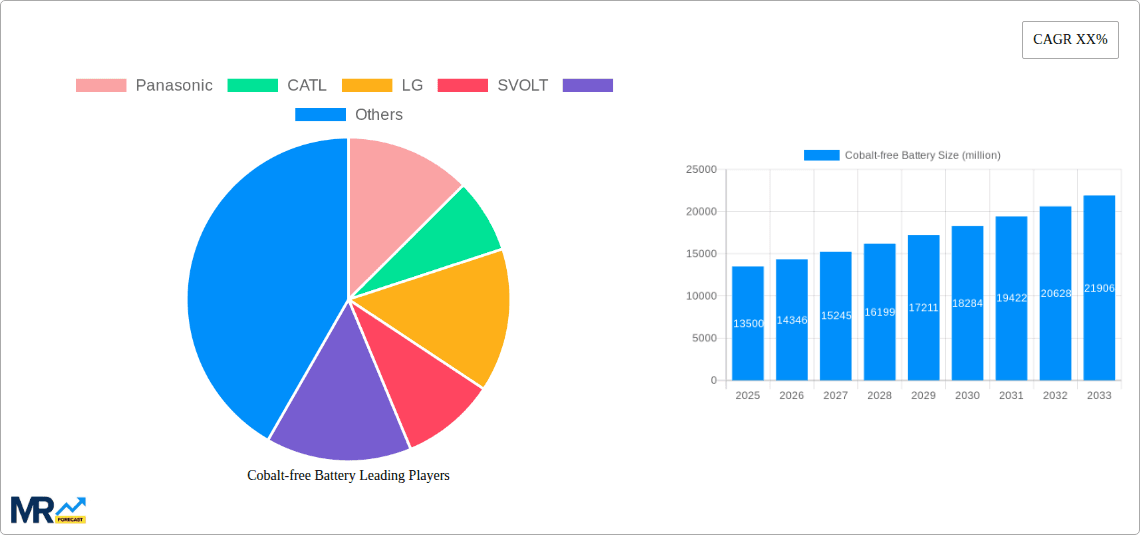

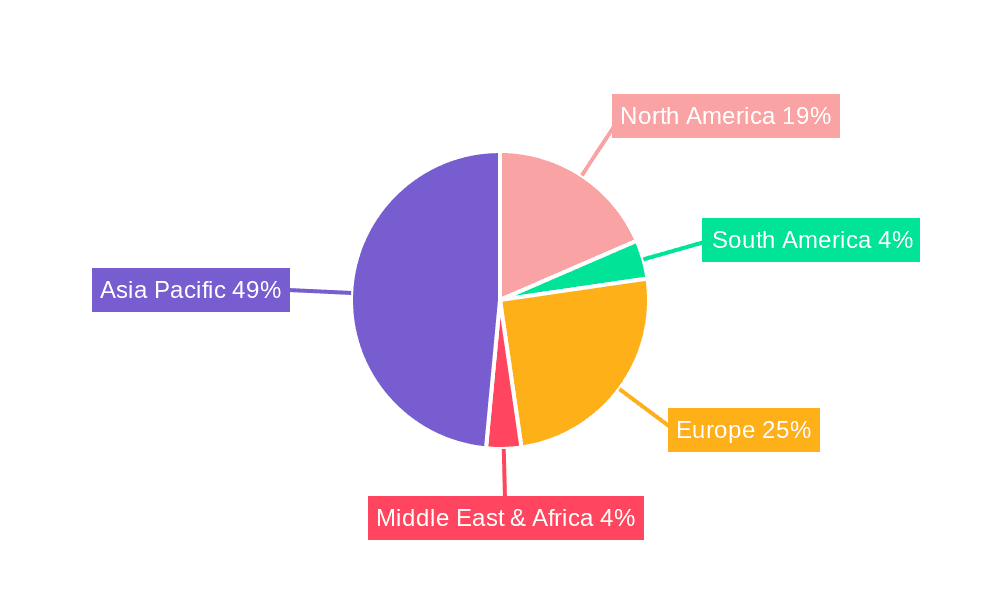

This dynamic market is characterized by a strong emphasis on technological advancements and capacity expansion. The development of high-capacity cells, such as those with a 115Ah rating and beyond, alongside continuous improvements in energy density and charging capabilities, are key differentiators. Leading companies like Panasonic, CATL, LG, and SVOLT are heavily investing in research and development and expanding their production capabilities to meet the burgeoning demand for cobalt-free battery solutions. Geographically, Asia Pacific, led by China, is anticipated to dominate the market due to its established manufacturing prowess and a significant concentration of EV production. However, North America and Europe are also showing promising growth, fueled by supportive government policies and a strong commitment to decarbonization initiatives. The strategic expansion of production facilities across these key regions will be crucial for capitalizing on the market's immense potential and addressing the global shift towards cleaner energy storage.

Here's a unique report description for Cobalt-free Batteries, incorporating your specified structure, keywords, and numerical values:

The global landscape of battery technology is undergoing a transformative shift, with the burgeoning adoption of cobalt-free chemistries at its vanguard. This evolution is not merely a incremental improvement but a foundational reimagining of energy storage, driven by both ethical considerations and the pursuit of enhanced performance and cost-effectiveness. The market for cobalt-free batteries is projected to witness a dramatic surge, moving from nascent stages in the historical period (2019-2024) to a significant and established presence by the end of the study period (2033). Our analysis forecasts the world cobalt-free battery production to reach hundreds of billions of dollars in value. Key insights reveal a strong correlation between advancements in material science and the increasing viability of these new battery types. For instance, the development of advanced cathode materials like Lithium Iron Phosphate (LFP) and Nickel-Manganese-Oxide (NMO) has been instrumental, offering comparable or even superior energy densities to traditional cobalt-containing counterparts, while simultaneously mitigating the supply chain risks associated with cobalt mining. The base year of 2025 represents a critical inflection point, with production volumes and investment expected to accelerate significantly. The estimated year of 2025 and the subsequent forecast period (2025-2033) indicate a compound annual growth rate that will redefine the energy storage market. Furthermore, the increasing demand from the electric vehicle (EV) sector, particularly for Battery Electric Vehicles (BEVs), is a primary driver. As manufacturers strive to meet ambitious sustainability goals and consumer demand for ethically sourced and affordable EVs, the appeal of cobalt-free solutions intensifies. The report delves into the intricate interplay of technological innovation, regulatory pressures, and market dynamics that are shaping this exciting frontier. We anticipate that the world cobalt-free battery production will not only meet but exceed current projections as R&D continues to unlock new possibilities in energy density, cycle life, and charging speeds. This paradigm shift signifies a move towards a more sustainable and democratized future for energy storage, impacting everything from personal electronics to large-scale grid storage solutions. The estimated market size in terms of production capacity, particularly for segments like 115Ah cells and beyond, will be substantial, measured in the tens to hundreds of billions of units, underscoring the scale of this technological revolution.

The ascent of cobalt-free battery technologies is a complex phenomenon underpinned by a confluence of powerful driving forces. Foremost among these is the escalating global awareness and concern surrounding the ethical and environmental implications of cobalt mining. The historically volatile and often ethically fraught supply chains for cobalt, predominantly sourced from regions with documented human rights abuses and environmental degradation, have created a significant imperative for alternative chemistries. Consumers and regulatory bodies alike are increasingly demanding transparency and sustainability throughout the product lifecycle. This ethical imperative is amplified by the intrinsic cost volatility of cobalt. Its price fluctuations, often dictated by geopolitical factors and limited extraction sites, introduce considerable uncertainty into battery manufacturing costs. By eliminating cobalt, manufacturers can achieve greater cost predictability and potentially lower overall battery prices, a crucial factor for mass-market adoption, particularly in the rapidly expanding electric vehicle (EV) sector. Moreover, advancements in material science have significantly matured, making cobalt-free alternatives not just viable but often superior in certain performance metrics. Technologies such as Lithium Iron Phosphate (LFP) have demonstrated exceptional safety profiles, longer cycle lives, and remarkable thermal stability, making them increasingly attractive for applications where safety and durability are paramount. This technological maturation has reduced the perceived performance gap, convincing major players to invest heavily in research and development, thereby creating a virtuous cycle of innovation and adoption. The sheer scale of the demand, especially from the automotive industry for both BEVs and PHEVs, acts as a powerful catalyst. With governments worldwide setting ambitious targets for EV adoption and emissions reduction, the need for scalable, cost-effective, and ethically sourced battery solutions has never been greater.

Despite the immense promise and accelerating momentum, the widespread adoption of cobalt-free batteries is not without its hurdles. A primary challenge lies in achieving parity with or exceeding the energy density of traditional cobalt-containing lithium-ion batteries, particularly for high-performance applications where range anxiety remains a concern for consumers. While chemistries like LFP are rapidly improving, their volumetric and gravimetric energy densities can still be lower, requiring larger battery packs for equivalent range in some BEV models. This necessitates ongoing research into novel cathode materials and cell designs to bridge this gap. Another significant restraint is the current state of manufacturing infrastructure and expertise. The transition to entirely new battery chemistries requires substantial capital investment in retooling existing production lines and developing new manufacturing processes. Companies like Panasonic, CATL, LG, and SVOLT are at the forefront of this investment, but the sheer scale of global battery production means that a complete shift will take time and considerable financial commitment. Furthermore, the development and standardization of testing protocols and safety certifications for these novel cobalt-free chemistries are still evolving. Ensuring consistent performance, longevity, and safety across diverse operating conditions and battery sizes, from smaller 115Ah cells to larger pack configurations, requires rigorous validation. While the industry is moving towards world cobalt-free battery production, the pace of this transition can be hindered by the need for extensive testing and regulatory approval. Lastly, the long-term degradation mechanisms and end-of-life management strategies for these emerging cobalt-free battery types are still areas of active research. Understanding and addressing these aspects are crucial for ensuring the sustainability and recyclability of the next generation of batteries, which will be critical as the world cobalt-free battery production escalates.

The global cobalt-free battery market is poised for significant dominance by specific regions and segments, driven by a confluence of policy, investment, and market demand.

Dominant Regions:

Dominant Segments:

The dominance of APAC, particularly China, is attributable to its established supply chain, massive domestic market for EVs, and government incentives that actively promote the development and deployment of cobalt-free battery technologies. This concentration of manufacturing capability allows for economies of scale and faster innovation cycles. Europe's leadership stems from its aggressive climate policies and a strong consumer push towards sustainable transportation. The continent is actively investing in localizing battery production to reduce reliance on external supply chains and ensure a stable supply of cobalt-free batteries for its burgeoning EV market. North America is catching up rapidly, with significant investments in gigafactories and a growing commitment to building a robust domestic battery ecosystem.

In terms of segments, the Battery Electric Vehicle (BEV) application will undoubtedly be the primary driver. As the world transitions away from internal combustion engine vehicles, the demand for batteries that are cost-effective, safe, and sustainable will skyrocket. Cobalt-free batteries are perfectly positioned to meet these demands. The focus on higher capacity cells, such as the 115Ah benchmark and beyond, is critical for providing the necessary range and performance for modern EVs. This means that the development and mass production of these larger, more powerful cobalt-free cells will be a focal point for leading companies. The overall projected growth in world cobalt-free battery production, encompassing all applications and stages of the value chain, underscores the immense market potential and the strategic importance of this technology for global energy transitions.

Several key factors are acting as powerful catalysts for the growth of the cobalt-free battery industry. Firstly, stringent government regulations and incentives aimed at promoting electric vehicle adoption and reducing carbon emissions are creating a robust demand pull. Secondly, significant advancements in material science, particularly in LFP and NMO chemistries, are improving energy density, safety, and lifespan, making cobalt-free options increasingly competitive. Thirdly, escalating concerns over the ethical sourcing and price volatility of cobalt are pushing manufacturers to seek more stable and sustainable alternatives. Lastly, substantial investments by leading battery manufacturers and automotive OEMs in research, development, and production capacity are accelerating the pace of innovation and scaling up manufacturing for world cobalt-free battery production.

This report offers a comprehensive analysis of the cobalt-free battery market, providing in-depth insights into its current trajectory and future potential. It meticulously examines market trends, identifies key drivers and restraints, and pinpoints the regions and segments poised for significant growth, with a particular focus on applications like BEVs and PHEVs, and cell types such as 115Ah. The study details the leading players in the industry and chronicles significant developments over the historical period (2019-2024) and into the forecast period (2025-2033), all while considering the projected world cobalt-free battery production. With a study period spanning from 2019 to 2033 and a base year of 2025, the report delivers a robust and forward-looking perspective on this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.36% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.36%.

Key companies in the market include Panasonic, CATL, LG, SVOLT, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Cobalt-free Battery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cobalt-free Battery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.