1. What is the projected Compound Annual Growth Rate (CAGR) of the Closed Pallet Boxes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Closed Pallet Boxes

Closed Pallet BoxesClosed Pallet Boxes by Type (Low Capacity, High Capacity, World Closed Pallet Boxes Production ), by Application (Industrial, Agricultural, Others, World Closed Pallet Boxes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

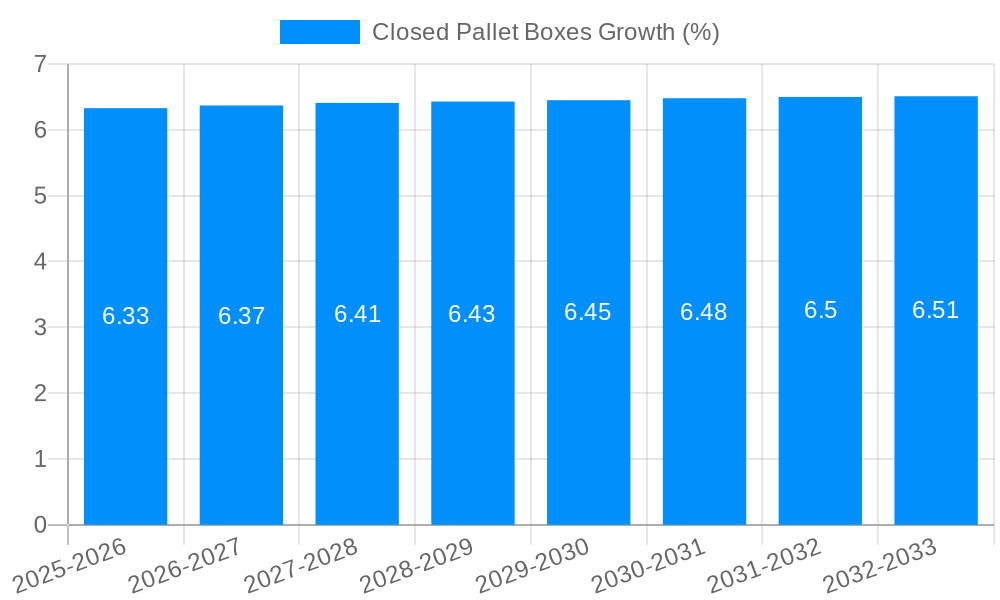

The global market for Closed Pallet Boxes is poised for robust growth, estimated to be valued at approximately $8,500 million in 2025. This expansion is fueled by a compound annual growth rate (CAGR) of around 6.2% projected from 2025 to 2033. The increasing adoption of standardized logistics and material handling solutions across various industries, particularly in industrial and agricultural sectors, is a primary driver. These closed pallet boxes offer superior protection for goods during transit and storage, mitigating damage and spoilage, which is crucial for maintaining product integrity and reducing waste. Furthermore, the growing emphasis on supply chain efficiency and sustainability is encouraging businesses to invest in durable, reusable, and eco-friendly packaging solutions, further accelerating market demand. The need for enhanced inventory management and the ability to stack boxes efficiently contribute to the appeal of closed pallet systems in modern warehousing.

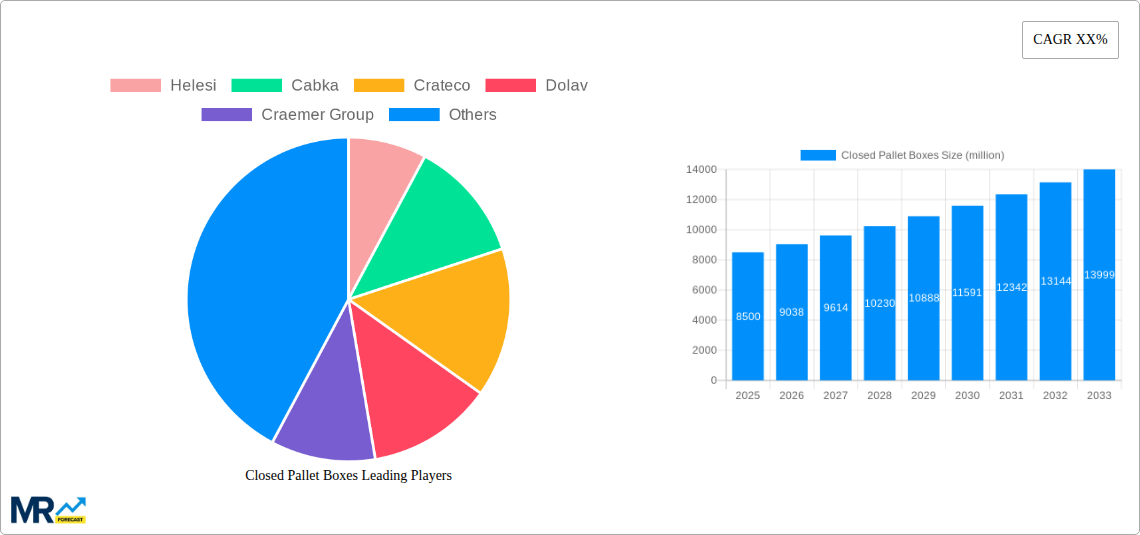

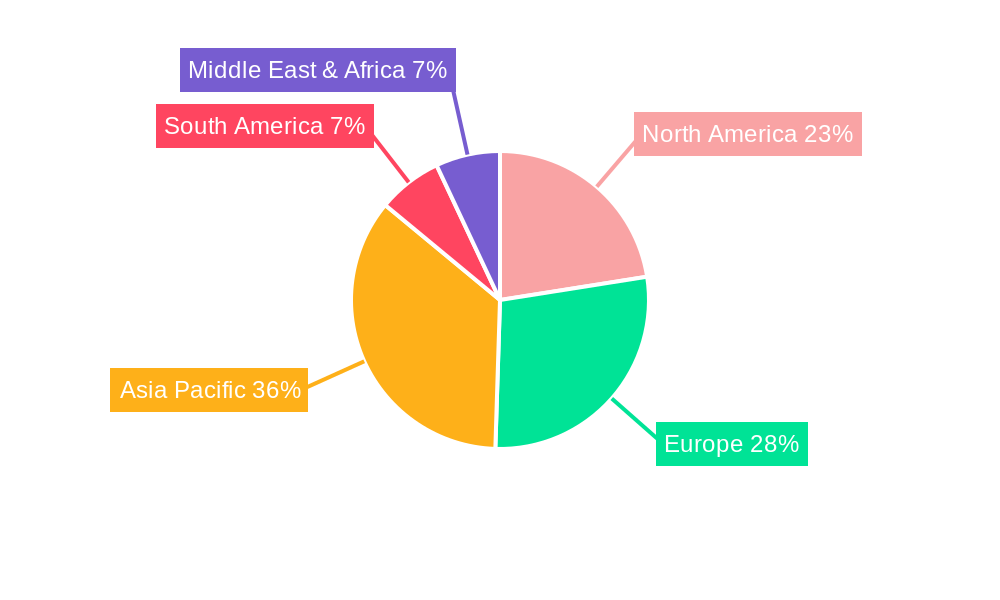

The market is segmented into Low Capacity and High Capacity types, with both experiencing steady demand, reflecting diverse application needs. Geographically, Asia Pacific is anticipated to lead in market share due to its rapidly industrializing economies, burgeoning manufacturing base, and significant investments in logistics infrastructure. Europe and North America also represent substantial markets, driven by mature industrial sectors and stringent regulations regarding product handling and safety. Key players like Helesi, Cabka, and Dolav are instrumental in shaping market dynamics through product innovation, strategic partnerships, and expanded distribution networks. While the market benefits from strong growth drivers, potential restraints could include the initial capital investment for bulk purchases and the availability of alternative material handling solutions. However, the long-term benefits of reduced operational costs and improved product protection are expected to outweigh these challenges, ensuring continued market expansion.

This report offers an in-depth analysis of the global Closed Pallet Boxes market, providing a detailed outlook for the Study Period: 2019-2033, with the Base Year and Estimated Year set as 2025, and a comprehensive Forecast Period: 2025-2033. The historical landscape from 2019-2024 is thoroughly examined, laying the groundwork for future projections. The research delves into critical market dynamics, including production volumes, technological advancements, regulatory influences, and shifting consumer preferences. With an estimated production of over 500 million units in the base year of 2025, the market exhibits robust growth potential. This report aims to equip stakeholders with actionable insights for strategic decision-making in this evolving industry.

The global Closed Pallet Boxes market is experiencing a dynamic evolution, driven by an increasing demand for efficient and secure material handling solutions across a multitude of industries. In the Base Year of 2025, the market is projected to witness a production volume exceeding 500 million units, with significant expansion anticipated throughout the Forecast Period: 2025-2033. A key trend is the escalating adoption of high-capacity closed pallet boxes, catering to the burgeoning logistics and supply chain requirements of e-commerce, automotive, and food & beverage sectors. These larger containers offer enhanced space utilization and improved stackability, leading to substantial cost savings in transportation and storage. Furthermore, the integration of smart technologies, such as RFID tagging and IoT sensors, is gaining traction, enabling real-time tracking, inventory management, and condition monitoring of goods during transit. This heightened focus on traceability and data-driven logistics is a pivotal development.

The ongoing shift towards sustainable manufacturing practices is also shaping the market. Manufacturers are increasingly investing in the development of closed pallet boxes made from recycled and recyclable materials, aligning with global environmental regulations and consumer demand for eco-friendly products. This focus on circular economy principles is not only reducing the environmental footprint of the industry but also creating new market opportunities for innovative material solutions. The market is also witnessing a growing preference for lightweight yet durable plastic pallet boxes over traditional wooden alternatives, owing to their superior resistance to moisture, chemicals, and pests, as well as their longer lifespan and ease of cleaning. This preference is particularly pronounced in industries with stringent hygiene requirements. The Historical Period: 2019-2024 has already shown a steady upward trajectory in the adoption of plastic pallet boxes, and this momentum is expected to accelerate. The market is bifurcating into distinct segments based on capacity – Low Capacity for specialized applications and High Capacity for bulk storage and transport. The production of World Closed Pallet Boxes Production is expected to reach over 700 million units by 2033, underscoring the sustained growth and diversification within this segment.

The global Closed Pallet Boxes market is being propelled by a confluence of robust economic factors and evolving industrial demands. The relentless growth of the e-commerce sector is a primary driver, necessitating efficient, protective, and stackable packaging solutions for the online retail boom. Businesses are seeking containers that can withstand the rigors of extensive shipping networks while safeguarding a diverse range of products. Coupled with this, the expansion of global trade and the increasing complexity of supply chains are fueling the demand for standardized and reusable pallet boxes that facilitate seamless intercontinental logistics. The automotive industry, with its intricate assembly lines and just-in-time delivery schedules, relies heavily on robust pallet boxes for the secure transportation of components, thus contributing significantly to market growth.

Furthermore, the inherent advantages of plastic closed pallet boxes, such as their durability, resistance to environmental factors like moisture and chemicals, and ease of cleaning and sanitization, are making them increasingly indispensable in sectors like food and beverage and pharmaceuticals, where hygiene and product integrity are paramount. The increasing emphasis on operational efficiency and cost reduction across industries also plays a crucial role. Reusable closed pallet boxes offer a sustainable and economical alternative to single-use packaging, reducing waste and long-term expenditure. The ongoing technological advancements in material science and manufacturing processes are enabling the production of lighter, stronger, and more versatile pallet boxes, further broadening their applicability and market appeal. The Base Year of 2025 is expected to see a global production of over 500 million units, a testament to these powerful driving forces.

Despite the promising growth trajectory, the Closed Pallet Boxes market is not without its challenges and restraints. One significant hurdle is the initial capital investment required for acquiring high-quality, durable plastic pallet boxes. While they offer long-term cost savings, the upfront expenditure can be prohibitive for smaller businesses or those operating with tighter budgets. This can lead to a preference for cheaper, less durable alternatives, thereby limiting the penetration of advanced pallet box solutions. Furthermore, the complexity of reverse logistics and collection systems for reusable pallet boxes can be a bottleneck. Establishing efficient networks for collecting, cleaning, and redeploying these containers across various locations requires significant planning and investment, particularly in regions with underdeveloped infrastructure.

The fluctuating prices of raw materials, primarily virgin and recycled plastics, can also impact the profitability and pricing strategies of manufacturers. Volatility in the petrochemical market can directly affect the cost of production, making it challenging to maintain stable pricing for end-users. Moreover, competition from alternative packaging solutions, including traditional wooden pallets, metal containers, and specialized flexible packaging, presents a continuous challenge. While plastic pallet boxes offer distinct advantages, some applications or cost-sensitive markets may still opt for these alternatives. The environmental concerns and disposal challenges associated with end-of-life plastic products, despite the growing trend towards recyclability, can also lead to regulatory pressures and negative consumer perceptions, requiring ongoing efforts in waste management and sustainable disposal initiatives. The Study Period: 2019-2033 will likely see these challenges addressed through innovation and strategic partnerships.

The global Closed Pallet Boxes market is poised for significant growth, with certain regions and product segments expected to take the lead. Among the key regions, North America is anticipated to dominate the market, driven by its mature industrial landscape, extensive e-commerce penetration, and stringent regulatory requirements for product safety and traceability. The region's strong focus on supply chain optimization and operational efficiency across sectors like manufacturing, automotive, and food & beverage positions it as a prime market for high-capacity closed pallet boxes. The United States, in particular, with its vast logistics networks and advanced warehousing infrastructure, will be a significant contributor to this dominance. The adoption of advanced material handling solutions is deeply ingrained in the North American business culture, fostering a receptive environment for innovative pallet box technologies.

Simultaneously, Europe is expected to exhibit robust growth, propelled by its strong manufacturing base, a high concentration of stringent environmental regulations, and a growing emphasis on sustainability and circular economy principles. Countries like Germany, France, and the United Kingdom are leading the charge in adopting reusable and eco-friendly packaging solutions, making them key markets for closed pallet boxes. The increasing demand for hygienic and easily cleanable containers in the European food and pharmaceutical industries further bolsters this segment. Asia-Pacific, particularly China and India, is also emerging as a rapidly growing market, fueled by rapid industrialization, a burgeoning middle class, and a significant expansion of the e-commerce and logistics sectors. While the World Closed Pallet Boxes Production is substantial across all regions, these two regions are expected to command a larger share of the market in terms of value and volume during the Forecast Period: 2025-2033.

In terms of product segments, High Capacity Closed Pallet Boxes are projected to dominate the market. This dominance is attributed to the increasing need for efficient handling of bulk goods in large-scale manufacturing, distribution centers, and global supply chains. The Industrial Application segment will be the primary consumer of these high-capacity boxes. Industries such as automotive, manufacturing, chemicals, and general warehousing require robust, secure, and stackable solutions that can accommodate large volumes of materials and components. The ability of high-capacity boxes to optimize storage space, reduce transit costs through better load consolidation, and protect goods during long-haul transportation makes them indispensable. The Base Year of 2025 is expected to see the High Capacity segment contributing over 60% of the total market volume. The increasing trend towards automation in warehouses and factories further favors the use of standardized, high-capacity pallet boxes that are compatible with automated handling equipment. The growing emphasis on supply chain resilience and the need to mitigate potential disruptions also drive the demand for secure and efficient bulk storage solutions offered by high-capacity closed pallet boxes. This segment's growth is further amplified by its versatility across diverse industrial applications, making it a cornerstone of the global Closed Pallet Boxes market.

The Closed Pallet Boxes industry is experiencing significant growth catalysts that are propelling its expansion. The rapid advancement of the e-commerce sector, with its escalating volumes of goods requiring secure and efficient transit, is a primary driver. Furthermore, the increasing global focus on sustainability and the adoption of circular economy principles are encouraging the use of reusable and recyclable plastic pallet boxes, reducing waste and environmental impact. The demand for enhanced supply chain efficiency and cost optimization across various industries, from automotive to food & beverage, is also a key catalyst. Technological innovations in material science, leading to lighter yet stronger and more durable pallet boxes, are broadening their application scope.

This comprehensive report delves into the intricacies of the global Closed Pallet Boxes market, providing an exhaustive analysis for the Study Period: 2019-2033. With the Base Year and Estimated Year set at 2025, and a detailed Forecast Period: 2025-2033, the report offers invaluable insights into market dynamics. It examines production volumes, projected to exceed 500 million units in 2025, and forecasts significant growth throughout the forecast period. The report meticulously analyzes key drivers, including the e-commerce boom and sustainability initiatives, alongside challenges such as raw material price volatility and initial investment costs. It highlights dominant regions like North America and Europe and key segments like High Capacity boxes for Industrial Applications. Furthermore, it details significant industry developments and lists leading players, providing a holistic view for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Helesi, Cabka, Crateco, Dolav, Craemer Group, Logimarkt, Agrico Plastics Ltd, Engels, Rotom Group, Nordcontenitori, Naeco, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Closed Pallet Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Closed Pallet Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.