1. What is the projected Compound Annual Growth Rate (CAGR) of the Closed Mold Carbon Fiber?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Closed Mold Carbon Fiber

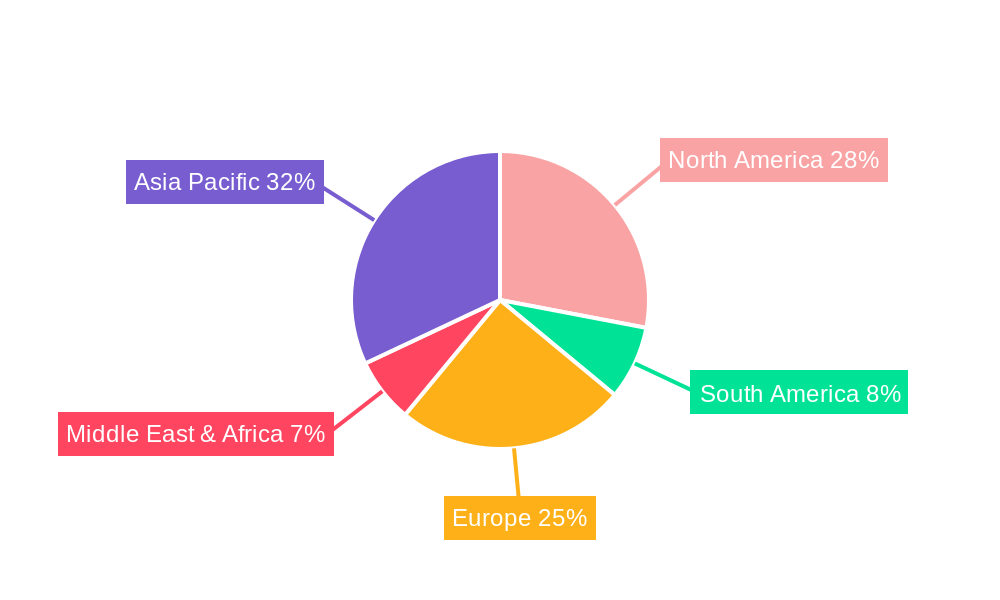

Closed Mold Carbon FiberClosed Mold Carbon Fiber by Type (Chopped Carbon Fiber, Continuous Carbon Fiber), by Application (Aviation, Electronic, Architecture, Energy, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

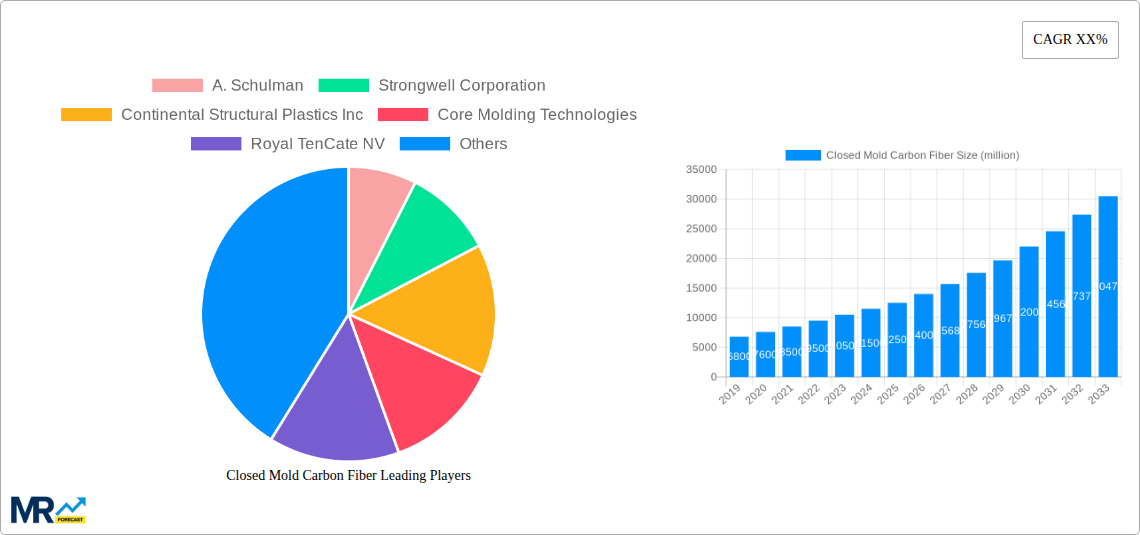

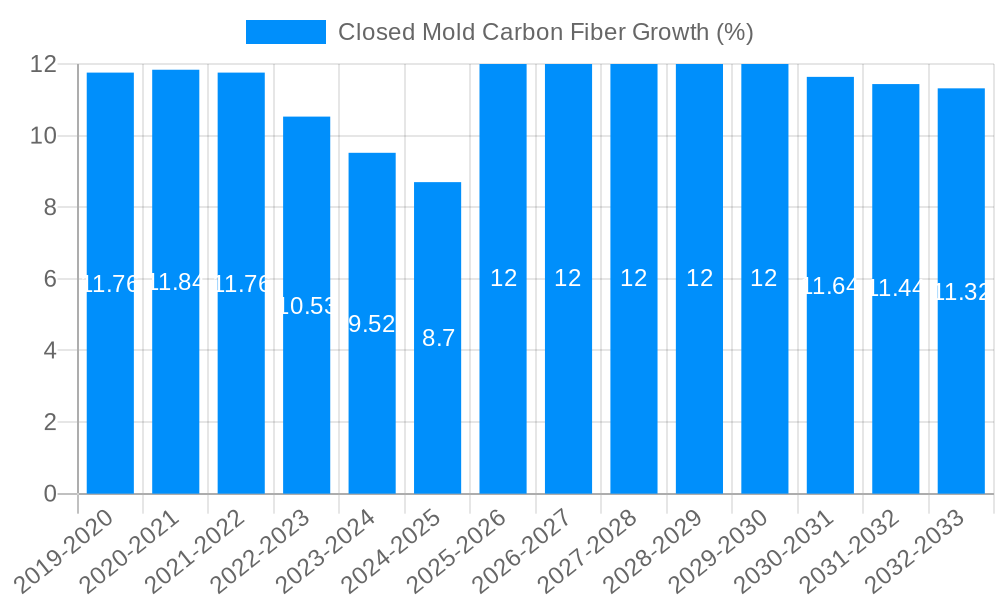

The global Closed Mold Carbon Fiber market is poised for significant expansion, projected to reach a substantial market size of approximately $12,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12% expected to persist through 2033. This upward trajectory is primarily fueled by the escalating demand for lightweight, high-strength materials across diverse sectors. The aviation industry continues to be a dominant force, driven by the relentless pursuit of fuel efficiency and enhanced performance. Simultaneously, the burgeoning electronics sector is increasingly adopting carbon fiber composites for their superior conductivity and structural integrity in advanced devices. Furthermore, the architectural and energy sectors are recognizing the transformative potential of these materials for innovative construction and renewable energy solutions, respectively. The market's growth is further bolstered by advancements in manufacturing technologies, leading to more cost-effective and scalable production of carbon fiber components.

The market's expansion is characterized by a dynamic interplay of drivers and restraints. Key drivers include the growing environmental consciousness and stringent regulations mandating lighter vehicles to reduce emissions, thereby boosting the adoption of carbon fiber in automotive applications, which are gaining traction alongside aviation. The increasing R&D investments in developing novel carbon fiber applications and composite materials are also critical growth enablers. However, certain restraints, such as the relatively high cost of raw materials and specialized manufacturing processes compared to traditional materials, can temper the pace of adoption in some price-sensitive segments. The availability of skilled labor for intricate composite manufacturing and the development of standardized recycling processes for carbon fiber composites are also areas that require continuous attention to ensure sustainable market growth. Despite these challenges, the overarching demand for superior material properties positions the Closed Mold Carbon Fiber market for continued impressive performance.

This comprehensive report delves into the dynamic global market for closed mold carbon fiber, providing an in-depth analysis of market trends, growth drivers, challenges, and key players. The study encompasses a historical period from 2019 to 2024, with a base year of 2025, and extends through a robust forecast period to 2033. Leveraging extensive market intelligence, the report offers critical insights into market size, segmentation, and regional dynamics, all expressed in millions of units. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving landscape of advanced composite materials.

The global market for closed mold carbon fiber is experiencing a transformative period, driven by an insatiable demand for lightweight, high-strength materials across a multitude of industries. This surge is underpinned by significant technological advancements in processing techniques and resin systems, enabling greater precision, efficiency, and cost-effectiveness in manufacturing. The shift towards sustainable solutions further bolsters the adoption of carbon fiber composites, as their inherent durability and recyclability align with growing environmental consciousness. In the historical period of 2019-2024, the market witnessed steady growth, fueled by early adoption in aerospace and automotive sectors. The base year of 2025 marks a pivotal point, with projected market expansion accelerating significantly in the forecast period of 2025-2033. This expansion is expected to be characterized by an increasing diversification of applications, moving beyond traditional high-performance sectors into emerging fields like renewable energy infrastructure and consumer electronics. Innovations in closed molding processes, such as Resin Transfer Molding (RTM) and Vacuum Assisted Resin Transfer Molding (VARTM), are key enablers of this trend, allowing for complex geometries and improved surface finishes, thereby reducing post-processing requirements. Furthermore, the development of advanced carbon fiber types, including both chopped and continuous fibers, caters to a broader spectrum of performance needs and manufacturing methodologies, from high-volume component production to specialized, intricate designs. The projected market value, expressed in millions of units, reflects a substantial upward trajectory, indicating a market poised for sustained and accelerated growth. The report highlights an increasing preference for tailor-made composite solutions, where material properties can be precisely engineered to meet specific application demands, a trend that is likely to define the market's evolution in the coming years. The convergence of material science, manufacturing engineering, and application-specific innovation is creating a fertile ground for the continued ascendancy of closed mold carbon fiber.

Several compelling forces are collectively propelling the growth of the closed mold carbon fiber market. Foremost among these is the unyielding global imperative for weight reduction across various industries. In sectors like automotive and aerospace, reducing the mass of components directly translates to enhanced fuel efficiency, reduced emissions, and improved performance characteristics. Carbon fiber composites, with their exceptional strength-to-weight ratio, are the material of choice for achieving these objectives. The increasing stringency of environmental regulations worldwide further amplifies this demand, as manufacturers seek advanced materials to meet or exceed emission standards. Moreover, the burgeoning demand for high-performance and aesthetically appealing products is also a significant driver. Closed mold processes allow for the creation of intricate shapes and smooth surface finishes, making carbon fiber composites ideal for applications where both functionality and visual appeal are paramount. The growing emphasis on renewable energy technologies, particularly in areas like wind turbine blades and energy storage systems, presents a substantial market opportunity, as these applications require materials that are both robust and lightweight. Finally, advancements in automation and manufacturing technologies are making closed mold processes more scalable and cost-effective, thereby broadening their accessibility and adoption across a wider range of manufacturing segments, moving beyond niche applications to mainstream production.

Despite its promising growth trajectory, the closed mold carbon fiber market faces several significant challenges and restraints that could temper its expansion. A primary hurdle remains the high initial cost of raw materials, particularly high-grade carbon fibers and specialized resin systems. While prices have been trending downwards, they still present a barrier to entry for cost-sensitive applications, especially when compared to traditional materials like steel or aluminum. Complex manufacturing processes and tooling requirements associated with closed molding techniques also contribute to higher production costs and longer lead times, posing challenges for high-volume production scenarios. Limited processing expertise and a shortage of skilled labor in certain regions can further hinder widespread adoption. Furthermore, recycling and end-of-life management of carbon fiber composites remain a complex issue. Developing efficient and cost-effective recycling methods is crucial for achieving true sustainability and addressing environmental concerns. While progress is being made, widespread industrial-scale recycling infrastructure is still in its nascent stages, potentially limiting long-term market acceptance in environmentally conscious markets. Finally, competition from other advanced lightweight materials, such as advanced aluminum alloys and high-strength polymers, especially in applications where extreme performance is not the sole determinant, presents an ongoing competitive pressure.

The global Closed Mold Carbon Fiber market is poised for significant growth and regional dominance, with Asia Pacific expected to emerge as a key region driving market expansion. This dominance is attributed to a confluence of factors including robust industrialization, increasing investments in advanced manufacturing, and a growing focus on sectors that heavily utilize carbon fiber composites. Within Asia Pacific, China stands out as a pivotal country, driven by its massive manufacturing base and ambitious initiatives to develop its aerospace, automotive, and renewable energy sectors. The country's extensive investments in carbon fiber production facilities and a rapidly growing domestic demand are instrumental in its market leadership.

In terms of dominant segments, Continuous Carbon Fiber is anticipated to hold a significant share and exhibit substantial growth. This is primarily due to its superior mechanical properties, offering unparalleled strength and stiffness, which are critical for high-performance applications. The Aviation segment is a primary consumer of continuous carbon fiber in closed mold processes, leveraging its lightweight and durable characteristics for aircraft structural components, wings, and fuselage sections. The continuous nature of the fibers allows for the creation of large, complex, and highly integrated parts with exceptional performance characteristics, contributing to fuel efficiency and payload capacity.

The Energy segment, particularly the wind energy sector, is another significant driver for continuous carbon fiber. The increasing size and efficiency demands of wind turbine blades necessitate materials like continuous carbon fiber composites, which can be manufactured using closed mold techniques to achieve the required aerodynamic profiles and structural integrity. These blades need to withstand extreme environmental conditions over extended periods, making the inherent durability and strength of continuous carbon fiber indispensable.

Furthermore, the Automotive sector is increasingly adopting continuous carbon fiber for structural components and body panels in high-performance vehicles and electric vehicles, where weight reduction is paramount for enhancing performance and extending range. While chopped carbon fiber also finds significant application, the inherent strength and anisotropy offered by continuous fibers make it the preferred choice for critical structural applications within the closed mold framework.

The Aviation segment itself is a major contributor to the overall market dominance of closed mold carbon fiber. The stringent safety and performance requirements in aviation necessitate the use of advanced materials. Closed mold processes, such as RTM and VARTM, enable the precise control of fiber placement and resin impregnation, leading to high-quality, defect-free components that meet the exacting standards of the aerospace industry. The ability to produce complex, integrated parts with excellent surface finish using closed molding techniques significantly reduces assembly time and weight, crucial factors in aircraft design.

The report's analysis will delve deeper into the specific market dynamics within these regions and segments, providing quantitative forecasts and qualitative insights into their future development, all expressed in millions of units.

Several key growth catalysts are poised to accelerate the expansion of the closed mold carbon fiber industry. The relentless pursuit of lightweighting across industries, particularly automotive and aerospace, for improved fuel efficiency and reduced emissions, remains a primary catalyst. Growing investments in renewable energy infrastructure, such as wind turbines, which demand high-strength, lightweight materials, further fuels demand. Advancements in closed molding technologies, leading to faster cycle times, lower tooling costs, and improved part quality, are making carbon fiber composites more accessible and cost-competitive. The increasing demand for high-performance and aesthetically pleasing components in consumer goods and electronics also presents a significant growth opportunity.

This report offers a comprehensive examination of the global closed mold carbon fiber market, providing detailed insights into its intricate dynamics. The analysis spans a historical period from 2019 to 2024, with 2025 serving as the base year, and extends through an extensive forecast period to 2033. Leveraging advanced market intelligence methodologies, the report meticulously quantifies market sizes, segmentation, and regional influences, all expressed in millions of units. It identifies the key drivers, such as the persistent demand for lightweight materials in transportation and the growing renewable energy sector, alongside critical challenges like high material costs and recycling complexities. Furthermore, the report profiles leading industry players and highlights significant technological advancements that are reshaping the market landscape, making it an essential strategic tool for all stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include A. Schulman, Strongwell Corporation, Continental Structural Plastics Inc, Core Molding Technologies, Royal TenCate NV, Menzolit GmbH, GKN, NitPro Composites, Harper International, Master Composites, Inc, Element6 Composites, Kangde Xin Composite Material Group Co.,Ltd, Weihai Guangwei Composites Co.,Ltd, Zhongfu Shenying Carbon Fiber Co., Ltd, Sinofibers Technology Co.,Ltd, Jiangsu Hengshen Co.,Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Closed Mold Carbon Fiber," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Closed Mold Carbon Fiber, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.