1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleanroom Plastic Bags?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cleanroom Plastic Bags

Cleanroom Plastic BagsCleanroom Plastic Bags by Type (Cleanroom Poly Tubing, Cleanroom Poly Film), by Application (Biopharmaceutical, Medical, Food, Aerospace, Semi-conductor, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

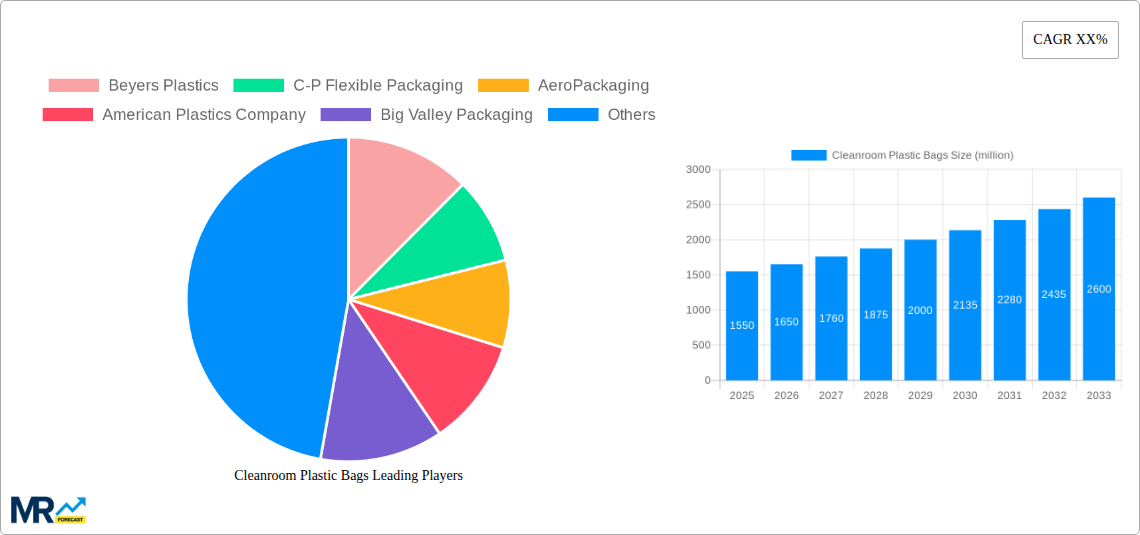

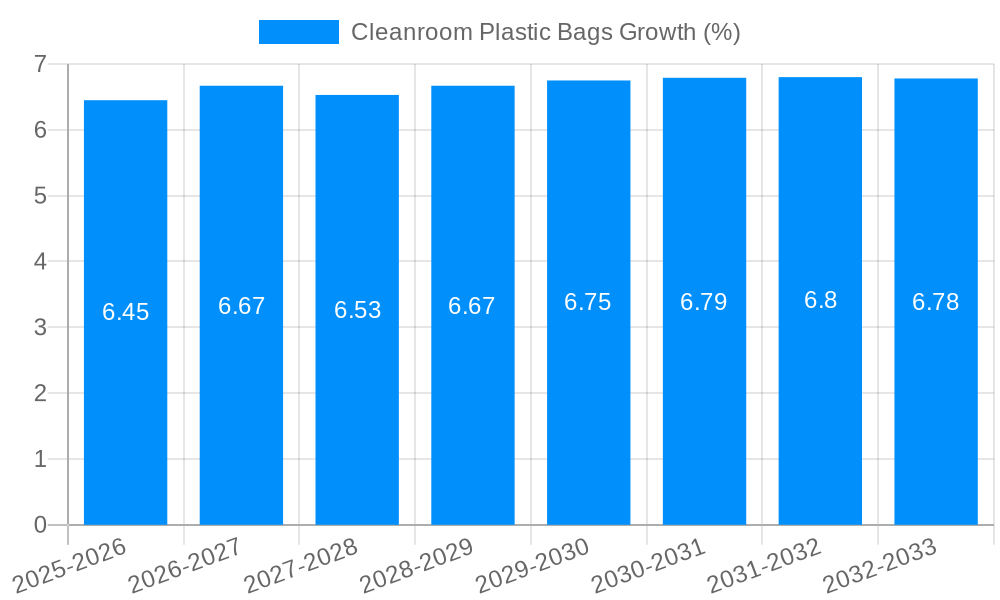

The global market for cleanroom plastic bags is poised for significant expansion, projected to reach an estimated market size of over $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% anticipated through 2033. This substantial growth is underpinned by the escalating demand for sterile and controlled packaging solutions across critical industries. The biopharmaceutical sector stands as a primary driver, owing to stringent regulatory requirements for drug manufacturing, storage, and transport, necessitating the use of high-purity, contamination-free materials. Similarly, the medical device industry's increasing reliance on advanced, sterile packaging to ensure patient safety and product integrity further fuels market expansion. The food industry's growing focus on extended shelf life and reduced spoilage through controlled packaging also contributes significantly to this demand. Emerging applications in aerospace and the semiconductor industry, where particulate contamination can have catastrophic consequences, are creating new avenues for market penetration.

The market is segmented into key product types, including cleanroom poly tubing and cleanroom poly film, offering versatile solutions for diverse packaging needs. The prevailing trends indicate a shift towards specialized film formulations with enhanced barrier properties, anti-static features, and customizable dimensions to meet specific application requirements. Manufacturers are investing in advanced extrusion and converting technologies to produce these high-performance materials. However, the market faces certain restraints, primarily the higher cost associated with cleanroom-grade plastics compared to standard packaging materials, and the complexities of ensuring consistent quality control and certification. Despite these challenges, the continuous innovation in material science and the unwavering demand for sterile and controlled environments across various high-stakes industries will continue to propel the cleanroom plastic bags market forward. Key players such as Beyers Plastics, C-P Flexible Packaging, and AeroPackaging are actively engaged in expanding their product portfolios and global reach to cater to this evolving market.

Here is a unique report description on Cleanroom Plastic Bags, incorporating your specified requirements:

This comprehensive report delves into the dynamic global Cleanroom Plastic Bags market, providing an in-depth analysis of its trajectory from the historical period of 2019-2024, through the base and estimated year of 2025, and extending into a robust forecast period of 2025-2033. We anticipate the market to witness significant expansion, with projected volumes reaching tens of million units as it caters to the stringent demands of highly regulated industries. The study meticulously examines key market insights, driving forces, prevailing challenges, dominant regions and segments, critical growth catalysts, leading industry players, and significant developments.

The global Cleanroom Plastic Bags market is experiencing a profound and multifaceted evolution, driven by an increasing emphasis on contamination control and product integrity across a spectrum of critical industries. In the historical period (2019-2024), the market demonstrated steady growth, fueled by the burgeoning biopharmaceutical sector's need for sterile packaging solutions and the expanding medical device industry's reliance on contaminant-free materials. As we move into the base year of 2025, this upward trend is expected to accelerate. XXX, a pivotal insight, highlights the growing demand for advanced materials with enhanced barrier properties. This includes a surge in interest for bags exhibiting superior chemical resistance, particulate shedding reduction, and antistatic capabilities, all crucial for maintaining ISO-class cleanroom environments. The forecast period (2025-2033) will witness a substantial rise in the adoption of specialized cleanroom plastic bags, moving beyond basic polyethylene to embrace more sophisticated polymers and multilayer constructions. For instance, the biopharmaceutical segment, a key consumer, is increasingly requiring bags designed for aseptic filling, lyophilization, and temperature-controlled storage, pushing manufacturers to innovate in material science and product design. Similarly, the semiconductor industry's relentless pursuit of miniaturization and increased chip density necessitates packaging that actively prevents electrostatic discharge and particulate contamination, driving the development of specialized antistatic and ultra-clean films. The food industry, while often operating under different regulatory frameworks, is also adopting cleanroom-grade packaging for high-value, sensitive food products to extend shelf life and ensure consumer safety. This trend towards premiumization and enhanced safety protocols is a significant underpinning of the market's expansion. Furthermore, the "Others" segment, encompassing research laboratories, high-tech manufacturing, and advanced material production, is steadily contributing to the overall market volume, driven by a growing awareness of the detrimental impact of contamination on precision processes and product quality. The market is also seeing a greater emphasis on sustainability, with manufacturers exploring recyclable and biodegradable cleanroom plastic bag options where feasible without compromising critical cleanroom standards, albeit this remains a complex challenge given the performance requirements. The increasing complexity of manufacturing processes and the escalating cost of product recall due to contamination are acting as potent accelerators for the adoption of high-performance cleanroom plastic bags, making them an indispensable component of modern industrial operations. The projected volume of tens of million units in the coming years underscores the critical role these specialized bags play in safeguarding product integrity and ensuring regulatory compliance across the globe.

The global Cleanroom Plastic Bags market is experiencing robust expansion, propelled by a confluence of powerful driving forces that underscore the increasing criticality of contamination control. Foremost among these is the relentless growth and innovation within the Biopharmaceutical and Medical sectors. The development of complex biologics, advanced therapies, and sophisticated medical devices necessitates packaging that provides an uncompromising barrier against particulate and microbial contamination. As regulatory bodies worldwide tighten their oversight and demand higher standards for product safety and efficacy, the adoption of certified cleanroom plastic bags becomes not merely an option but a necessity. The increasing prevalence of chronic diseases and an aging global population further amplifies the demand for healthcare products, directly translating into higher consumption of cleanroom packaging. Furthermore, the Semi-conductor industry, characterized by its pursuit of ever-smaller and more intricate components, is a significant growth engine. The extreme sensitivity of microelectronic circuits to even minute particulate contamination or electrostatic discharge mandates the use of specialized cleanroom bags that offer exceptional protection. As the world becomes increasingly reliant on advanced electronics for everything from consumer devices to critical infrastructure, the demand for high-purity semiconductor manufacturing environments, and consequently, the packaging used within them, will only intensify. The expanding scope of Aerospace applications, which require materials with extreme reliability and purity for sensitive components, also contributes to this growth. Finally, a growing awareness across various manufacturing sectors about the financial and reputational costs associated with product contamination is prompting a wider adoption of cleanroom practices and, by extension, cleanroom plastic bags. This holistic shift towards prioritizing product integrity and regulatory compliance is the fundamental impetus behind the market's significant upward trajectory.

Despite the promising growth trajectory of the Cleanroom Plastic Bags market, several significant challenges and restraints temper its full potential. A primary hurdle is the high cost of production and raw materials. Achieving the ultra-high purity and specialized properties required for cleanroom applications often necessitates the use of premium-grade polymers and advanced manufacturing processes, leading to higher unit costs compared to standard plastic bags. This can be a deterrent for smaller businesses or those operating in cost-sensitive segments. Secondly, the stringent regulatory landscape presents a dual-edged sword; while driving demand, it also imposes rigorous compliance requirements for manufacturers. Obtaining and maintaining certifications for various cleanroom classifications (e.g., ISO Class 1-9) requires substantial investment in quality control, testing, and documentation, posing a barrier to entry for new players. Furthermore, material compatibility and leachables/extractables remain critical concerns. Manufacturers must ensure that the plastic bags do not leach any substances that could contaminate the sensitive products they are designed to protect, particularly in biopharmaceutical and medical applications. Developing and validating materials that meet these exacting standards is a complex and time-consuming process. The disposal and environmental impact of these specialized bags also pose a challenge. While some efforts are being made towards sustainable solutions, the inherent properties required for cleanroom performance can limit the recyclability or biodegradability of these materials, raising environmental considerations for end-users. Lastly, technical expertise and education within the user base are crucial. Misunderstanding the proper usage and limitations of cleanroom plastic bags can lead to compromised contamination control, necessitating ongoing efforts to educate industries on best practices for selection and application.

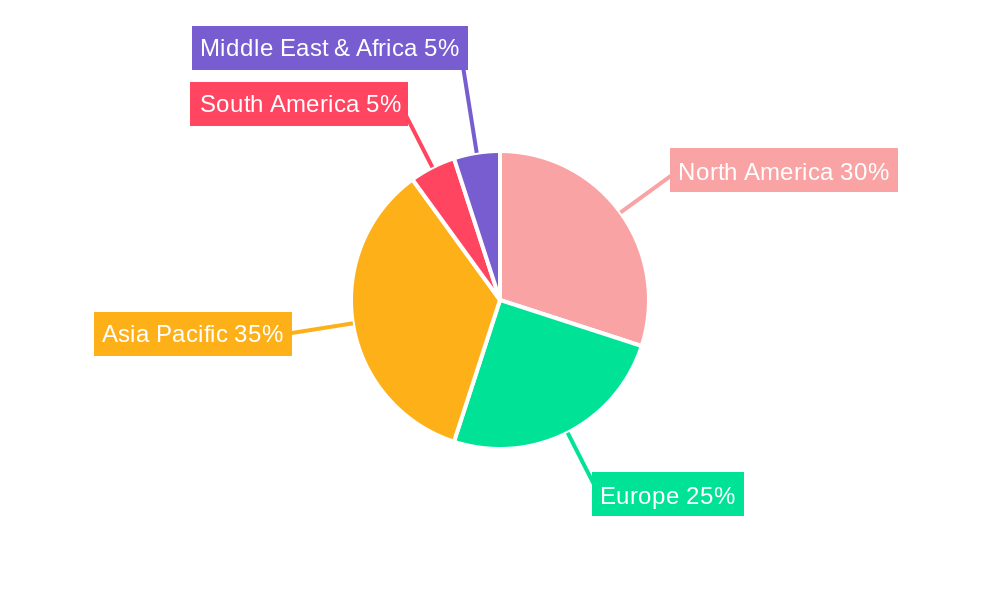

The global Cleanroom Plastic Bags market is poised for significant growth and is expected to see dominance from both key regions and specific segments, driven by unique industrial demands and regulatory environments.

Dominant Regions:

North America: This region is a powerhouse in the cleanroom plastic bags market, largely due to its robust and well-established Biopharmaceutical and Medical industries. The presence of a high concentration of leading pharmaceutical companies, biotechnology firms, and medical device manufacturers, coupled with stringent regulatory requirements enforced by bodies like the FDA, necessitates the widespread adoption of high-quality cleanroom packaging. Furthermore, significant investment in research and development within these sectors fuels the demand for advanced packaging solutions. The region's advanced manufacturing capabilities and emphasis on quality control further solidify its leadership. The demand for Cleanroom Poly Tubing and Cleanroom Poly Film for specialized applications like sterile product transfer and protective wrapping is particularly high. The estimated volume for this region is projected to be in the tens of millions of units annually.

Asia-Pacific: This region is emerging as a rapidly growing market, driven by the expanding Semi-conductor manufacturing hubs, particularly in countries like South Korea, Taiwan, and China. The burgeoning electronics industry’s insatiable demand for precision components requires highly controlled manufacturing environments, and consequently, a significant volume of cleanroom plastic bags. Additionally, the growing healthcare infrastructure and increasing investments in the biopharmaceutical sector in countries like China and India are also contributing to substantial market growth. The region's cost-effectiveness in manufacturing, combined with a growing emphasis on quality, positions it as a key player. The demand for Cleanroom Poly Film for wafer protection and the use of Cleanroom Poly Tubing for cleanroom environment control are significant drivers. The projected annual volume for Asia-Pacific is also in the tens of millions of units, with a strong growth potential.

Dominant Segments:

Application: Biopharmaceutical and Medical: These two segments collectively represent the largest share of the cleanroom plastic bags market. The critical nature of pharmaceuticals and medical devices, where patient safety and product efficacy are paramount, dictates the use of the highest grade of cleanroom packaging. From sterile sampling and transfer to primary packaging for sensitive drugs and disposables, the demand is immense. The increasing prevalence of biologics, vaccines, and complex medical implants further bolsters this demand. The need for specialized properties like sterilizability, low particulate shedding, and chemical inertness makes these applications the primary consumers of high-performance cleanroom plastic bags, contributing significantly to the projected tens of millions of units in volume. Companies like Beyers Plastics, C-P Flexible Packaging, and Liberty Industries are key players in catering to these stringent demands.

Type: Cleanroom Poly Film: While both tubing and film are essential, Cleanroom Poly Film is expected to dominate in terms of volume and value due to its versatility. Poly film is used in a myriad of applications, including protective covers, liners for cleanroom equipment, static-shielding bags for sensitive electronic components, and shrink-wrapping for sterile products. Its adaptability to different sizes and shapes makes it a staple in almost every cleanroom environment. The continuous need for surface protection, containment, and environmental control across various industries, from pharmaceuticals to electronics and food processing, ensures a sustained and high-volume demand for cleanroom poly film. The estimated annual volume for this segment alone is projected to reach tens of millions of units.

The interplay between these dominant regions and segments, driven by technological advancements, regulatory pressures, and evolving industry needs, will shape the overall trajectory of the Cleanroom Plastic Bags market in the coming years, with projected market volumes reaching tens of million units across the forecast period.

Several key factors are acting as significant growth catalysts for the Cleanroom Plastic Bags industry. The escalating stringency of regulatory standards across the Biopharmaceutical, Medical, and Food sectors is a primary driver, compelling companies to invest in superior contamination control measures. The rapid advancements in Semi-conductor technology, demanding ever-higher levels of purity and static protection, are creating a substantial demand for specialized cleanroom bags. Furthermore, the increasing outsourcing of manufacturing and packaging processes by global companies, especially in emerging economies, is expanding the market reach. The continuous pursuit of product innovation, leading to the development of novel materials with enhanced properties, is also spurring growth by offering solutions tailored to niche applications.

This report offers a comprehensive overview of the global Cleanroom Plastic Bags market, meticulously analyzing its various facets from 2019 to 2033. It provides an in-depth understanding of market trends, key drivers, and emerging challenges, alongside regional and segment-specific analyses. The report details significant industry developments and highlights the strategic initiatives of leading market players. By leveraging a combination of historical data, base year estimations, and future projections, this study aims to equip stakeholders with the critical insights needed to navigate the evolving landscape of cleanroom plastic bag solutions and capitalize on the projected market growth reaching tens of million units.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Beyers Plastics, C-P Flexible Packaging, AeroPackaging, American Plastics Company, Big Valley Packaging, Riverstone Holdings, Jarrett Industries, Southern Packaging LP, NCI, Liberty Industries, LBU, Packform USA, Protective Packaging, Thomas Scientific Holdings, Diamond Flexible Packaging, Keaco, Excellent Poly, Flexible Packaging, Power Bag & Film, IG Industrial Plastics, Custom Pack, Terra Universal.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cleanroom Plastic Bags," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cleanroom Plastic Bags, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.