1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleaning Grease?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cleaning Grease

Cleaning GreaseCleaning Grease by Type (Solvent Based Cleaning Grease Products, Water Based Cleaning Grease Products, World Cleaning Grease Production ), by Application (Factory, Residence, World Cleaning Grease Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

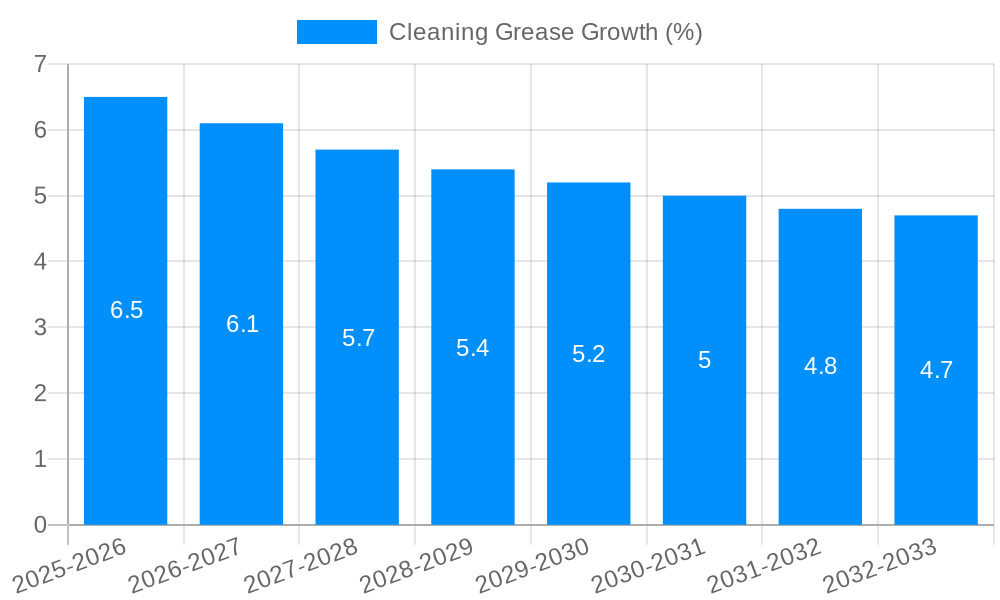

The global cleaning grease market is poised for substantial expansion, projected to reach an estimated market size of approximately $15,000 million by 2025, with a compound annual growth rate (CAGR) of around 6.5% anticipated throughout the forecast period extending to 2033. This robust growth is primarily driven by the increasing industrialization and manufacturing activities worldwide, necessitating effective lubrication and maintenance solutions. Furthermore, the rising demand for specialized cleaning agents in sectors like automotive, aerospace, and heavy machinery, where precision and performance are paramount, is a significant growth catalyst. The market is also benefiting from a growing awareness among consumers and businesses regarding the importance of regular equipment maintenance to enhance longevity and operational efficiency, thereby reducing downtime and associated costs. The development of eco-friendly and biodegradable cleaning grease formulations is also emerging as a key trend, catering to the increasing environmental regulations and consumer preference for sustainable products.

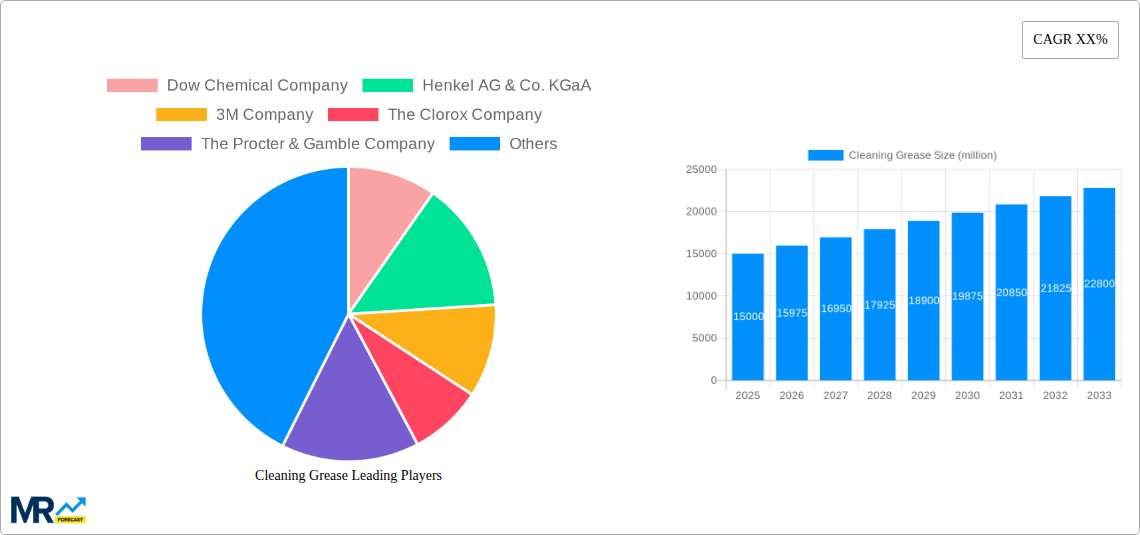

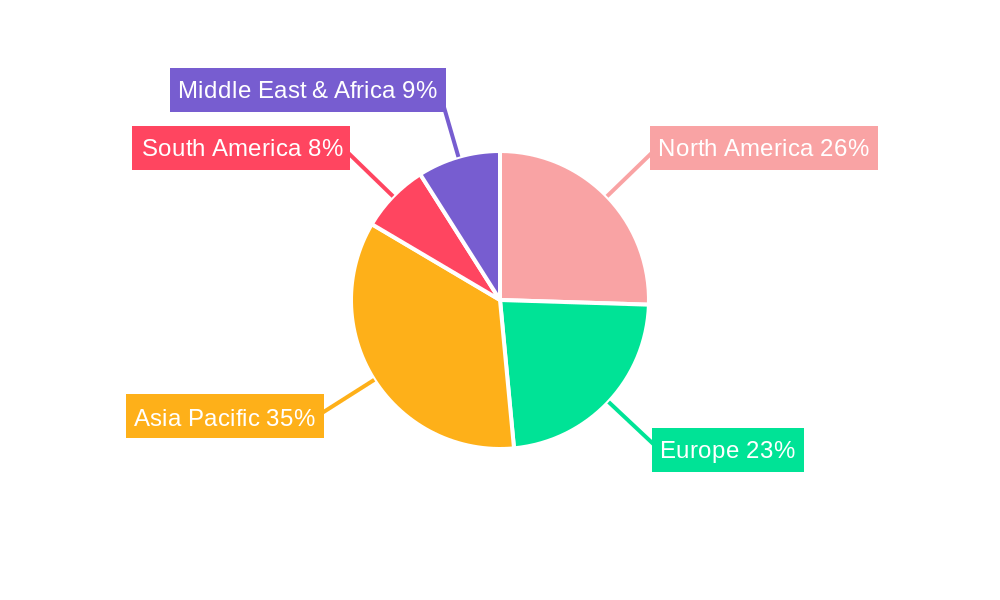

The market segmentation reveals a dynamic landscape. Solvent-based cleaning grease products currently hold a dominant share due to their strong solvency power for stubborn contaminants, though water-based alternatives are gaining traction owing to their reduced environmental impact and safer handling properties. Applications are broadly categorized into industrial and residential, with the industrial sector, encompassing factories and manufacturing plants, representing the larger segment. Geographically, Asia Pacific is expected to witness the most rapid growth, fueled by the expanding manufacturing base in countries like China and India. North America and Europe remain significant markets, driven by established industrial infrastructure and a strong emphasis on maintenance and equipment care. Key players like Dow Chemical Company, Henkel AG & Co. KGaA, and 3M Company are actively investing in research and development to introduce innovative products that address evolving market needs and regulatory landscapes, further shaping the trajectory of the cleaning grease industry.

The global cleaning grease market is projected to witness robust expansion, with an estimated market size of $2,500 million in 2025, escalating to $3,800 million by 2033. This growth trajectory, spanning from a historical period of 2019-2024 to a forecast period of 2025-2033, is underpinned by a confluence of factors. The increasing industrialization and manufacturing activities worldwide are directly correlating with a higher demand for specialized cleaning agents that can effectively tackle stubborn grease and grime. From the automotive sector to heavy machinery operations, the necessity for maintaining equipment in pristine condition for optimal performance and longevity is paramount. This drives the demand for industrial-grade cleaning greases. Furthermore, the residential sector, fueled by a growing awareness of hygiene and a desire for well-maintained living spaces, is also contributing significantly to market growth. As consumers become more discerning about the cleaning products they use, the demand for effective, convenient, and increasingly eco-friendlier cleaning grease solutions is on the rise. The historical data from 2019-2024 indicates a steady upward trend, a momentum that is expected to accelerate. The base year of 2025 serves as a critical benchmark, highlighting the significant market value and setting the stage for projected advancements. The study period of 2019-2033 encompasses both past performance and future outlook, providing a comprehensive understanding of the market dynamics. Innovations in product formulations, such as the development of low-VOC (Volatile Organic Compound) solvents and biodegradable water-based alternatives, are also playing a crucial role in shaping market trends. These advancements cater to evolving regulatory landscapes and consumer preferences for sustainable cleaning solutions, further propelling market expansion. The intricate interplay between industrial demand, residential needs, and technological innovation forms the bedrock of the cleaning grease market's promising future.

Several powerful forces are driving the growth of the cleaning grease market. The relentless pace of industrialization and expansion of manufacturing sectors globally are primary drivers. As factories and production facilities become more prevalent, the need for efficient and effective grease removal solutions becomes critical for maintaining machinery and ensuring smooth operations. This directly translates into increased consumption of cleaning grease products. Furthermore, the ever-growing automotive industry, with its complex network of manufacturing, maintenance, and repair services, presents a substantial demand. Vehicles, from production lines to garages, are constantly exposed to greases and oils that require specialized cleaning. The increasing disposable income and rising living standards in developing economies are also playing a vital role. As more households can afford to invest in home maintenance and cleaning, the demand for residential cleaning grease products, often used for kitchen appliances, ovens, and general household chores, is on the rise. The global focus on hygiene and cleanliness, particularly amplified in recent years, has also contributed to this surge. Consumers are increasingly prioritizing clean environments, leading to a greater adoption of cleaning solutions across all applications.

Despite the promising growth, the cleaning grease market is not without its hurdles. A significant restraint stems from the increasing stringent environmental regulations concerning the use of certain chemicals, particularly volatile organic compounds (VOCs) found in traditional solvent-based cleaning greases. Manufacturers are facing pressure to develop and adopt more environmentally friendly alternatives, which can involve higher research and development costs and potentially impact profit margins. The rising cost of raw materials, such as petroleum-based solvents, also presents a challenge, directly influencing the production costs of cleaning grease products and potentially leading to price increases for consumers. Furthermore, the availability of readily biodegradable and water-based cleaning grease products, while a positive development in terms of sustainability, can also pose a competitive threat to established solvent-based products. Consumers are increasingly opting for these greener alternatives, necessitating a strategic shift for companies heavily invested in solvent-based formulations. The need for specialized application knowledge and safety precautions associated with some potent cleaning greases can also limit their widespread adoption in certain residential applications, requiring consumers to seek professional help or opt for simpler solutions.

The Asia Pacific region is poised to emerge as the dominant force in the global cleaning grease market, with its market share projected to be substantial throughout the study period of 2019-2033. This dominance is fueled by a confluence of robust industrial growth, burgeoning manufacturing sectors, and a rapidly expanding middle class across key economies like China, India, and Southeast Asian nations. The manufacturing powerhouses within Asia Pacific are experiencing unprecedented levels of industrial activity, from automotive production and electronics assembly to heavy machinery manufacturing. This intensifies the demand for effective cleaning grease products to maintain operational efficiency and equipment longevity. For instance, in 2025, the estimated market value within this region is expected to reach $850 million, representing a significant portion of the global $2,500 million market.

The "Factory" application segment is expected to lead the market in terms of volume and revenue, driven by the aforementioned industrial expansion. The continuous operation of machinery in factories necessitates regular and thorough cleaning to prevent wear and tear, minimize downtime, and ensure product quality. This segment's projected value in 2025 alone could be in the region of $1,200 million.

Within the "Type" segmentation, Solvent Based Cleaning Grease Products are anticipated to maintain a significant market share, particularly in industrial applications where their high efficacy in dissolving stubborn greases and oils is unparalleled. However, the growth rate of Water Based Cleaning Grease Products is expected to be notably higher. This surge is attributable to increasing environmental consciousness, stricter regulations on VOC emissions, and advancements in water-based formulations that are becoming increasingly effective. By 2033, water-based products could command a market share close to that of solvent-based alternatives, potentially reaching $1,500 million in value globally. The estimated market size for solvent-based products in 2025 is around $1,400 million, while water-based products are estimated at $1,000 million, with a projected growth rate for water-based products exceeding that of solvent-based.

The "Residence" application segment, while smaller than "Factory," is also expected to witness steady growth. This is driven by urbanization, increasing disposable incomes, and a growing awareness of home hygiene. Consumers are investing more in maintaining their homes, leading to a higher demand for cleaning grease products for kitchens, garages, and general household maintenance. The estimated market size for the residence segment in 2025 is around $300 million.

The interplay of these factors – industrialization, regulatory shifts, and evolving consumer preferences – positions Asia Pacific and the "Factory" application, with a significant and growing contribution from water-based products, as the key drivers of the cleaning grease market.

The cleaning grease industry is experiencing several growth catalysts. The increasing emphasis on industrial hygiene and equipment maintenance is a major driver, ensuring machinery operates efficiently and prolonging its lifespan. Furthermore, the growing trend towards sustainable and eco-friendly products is spurring innovation in water-based and biodegradable cleaning grease formulations. This caters to both regulatory demands and consumer preferences. The expanding automotive and manufacturing sectors globally are also creating a sustained demand for these specialized cleaning solutions.

This report offers a comprehensive analysis of the global cleaning grease market, spanning from the historical period of 2019-2024 to a robust forecast period of 2025-2033. With a base year of 2025, it delves into market trends, driving forces, challenges, and key growth catalysts. The report provides an in-depth look at dominant regions and segments, including detailed insights into solvent-based and water-based product types, and factory versus residential applications. It highlights the estimated market size of $2,500 million in 2025, with projections reaching $3,800 million by 2033, underscoring the market's significant expansion potential.

The report also includes a detailed overview of leading industry players and significant developments, offering a forward-looking perspective on the sector's evolution. This comprehensive coverage ensures stakeholders have the necessary information to navigate this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dow Chemical Company, Henkel AG & Co. KGaA, 3M Company, The Clorox Company, The Procter & Gamble Company, The Sherwin-Williams Company, BASF SE, Akzo Nobel N.V., PPG Industries, Inc., Ecolab Inc., Zep, Inc., Berryman Products, Inc., Radiator Specialty Company, Lubriplate Lubricants Co., RectorSeal, Chemtronics, GUNK, Permatex, Kafko International Ltd., Kano Laboratories, Slip 2000, Purple Stuff LLC, B'laster Corporation, Super Lube.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cleaning Grease," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cleaning Grease, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.