1. What is the projected Compound Annual Growth Rate (CAGR) of the Cinema Seating?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cinema Seating

Cinema SeatingCinema Seating by Application (Cinema, Others, World Cinema Seating Production ), by Type (Metal Type, Plastic Type, Others, World Cinema Seating Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

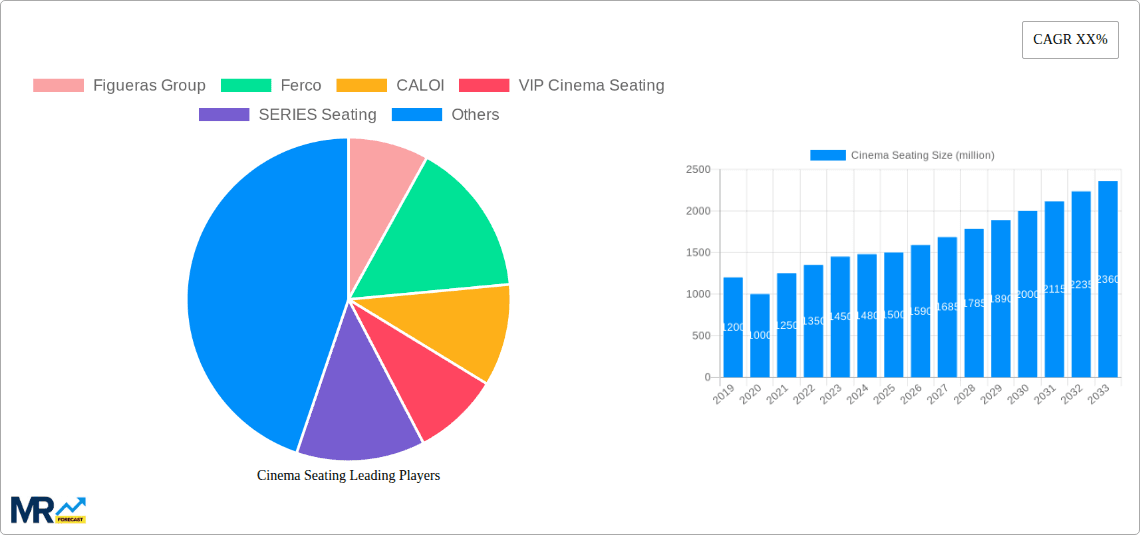

The global cinema seating market is experiencing robust growth, driven by the resurgence of theatrical experiences and ongoing investments in cinema infrastructure upgrades. While precise figures for market size and CAGR are unavailable, industry trends suggest a sizeable market valued in the billions, growing at a compound annual growth rate (CAGR) of approximately 5-7% annually. This growth is fueled by several factors: the increasing popularity of blockbuster films, technological advancements such as IMAX and premium large format screens which necessitate specialized seating, and the rise of luxury cinema experiences offering enhanced comfort and amenities. Key market segments include metal and plastic seating types, with metal typically dominating the higher-end cinema market due to durability and perceived quality. The application segment is broadly divided into traditional cinemas and other venues like auditoriums and theaters. Geographic distribution shows strong market presence in North America and Europe, with significant growth potential in the Asia-Pacific region driven by rising disposable incomes and increasing cinema attendance. Competitive dynamics are shaped by a mix of global players like Figueras Group and Ferco alongside regional manufacturers. The market faces some restraints such as economic fluctuations impacting discretionary spending on entertainment and the increasing popularity of streaming services. However, the enduring appeal of the communal cinema-going experience continues to support substantial market growth.

Looking ahead, the cinema seating market is poised for continued expansion. Innovation in seating design, incorporating features like enhanced ergonomics, improved comfort, and advanced materials, will play a crucial role. The expansion into emerging markets will further drive growth. Furthermore, the growing adoption of sustainable materials and environmentally friendly manufacturing processes will shape industry trends in the coming years. Companies are increasingly focusing on customization options and tailored solutions for different cinema sizes and seating configurations, adding to market dynamism. Strategic partnerships and mergers & acquisitions can also be anticipated as companies strive to gain market share and expand their product portfolios. The industry is likely to witness a steady shift toward premium seating options catering to a discerning audience willing to pay a premium for enhanced comfort and experience.

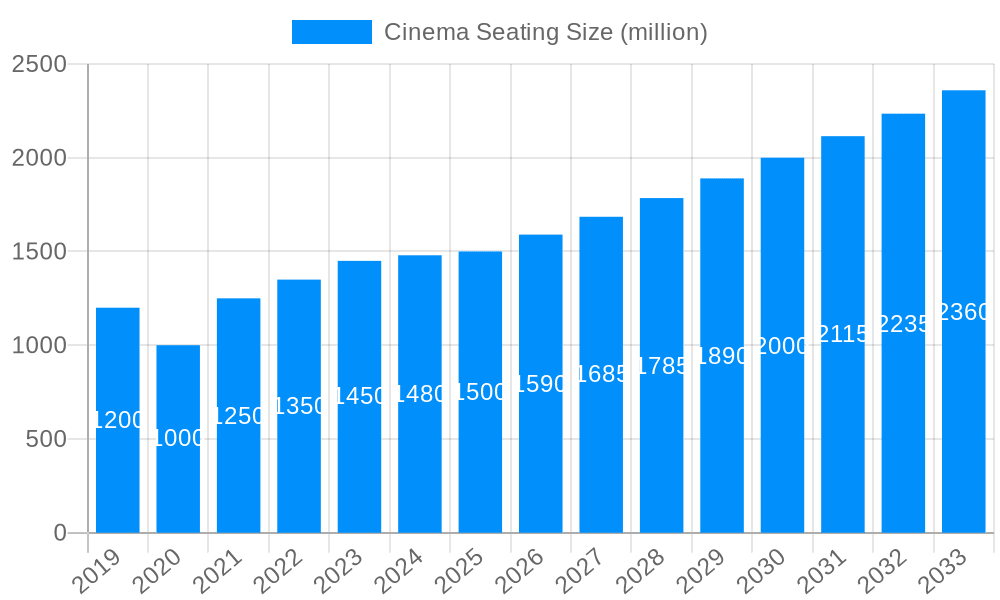

The global cinema seating market, valued at approximately 15 million units in 2025, is poised for substantial growth throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a fluctuating yet generally upward trend, influenced by factors such as technological advancements, evolving consumer preferences, and the cyclical nature of the entertainment industry. The market witnessed a temporary downturn during the COVID-19 pandemic, with significant declines in cinema attendance globally. However, the subsequent recovery demonstrates the inherent resilience of the sector. The post-pandemic era has seen a renewed focus on enhanced comfort and hygiene, driving demand for premium seating options featuring features like wider seats, increased legroom, and antimicrobial materials. This trend is particularly evident in the luxury cinema segment, where premium seating is becoming increasingly commonplace. Technological integration is also shaping market trends, with innovations like built-in charging ports, personalized seating controls, and even integrated entertainment systems gaining traction. Furthermore, the rising popularity of immersive cinematic experiences, such as IMAX and 4DX, is fueling the demand for specialized seating that complements these advanced technologies. The competitive landscape is characterized by a mix of established players and emerging companies, leading to innovation in design, material usage, and pricing strategies. This report explores these trends in detail, providing a comprehensive outlook on the market's future trajectory. The shift towards environmentally sustainable materials is also gaining momentum, with manufacturers increasingly adopting eco-friendly options. This aspect is particularly important in alignment with broader global sustainability initiatives. Overall, the cinema seating market shows promising growth potential driven by a combination of recovery from the pandemic, technological advancements, and an ongoing focus on enhanced audience experience.

Several key factors are driving the growth of the cinema seating market. Firstly, the ongoing recovery from the COVID-19 pandemic is significantly contributing to the market's resurgence. As cinema attendance returns to pre-pandemic levels and beyond, the demand for seating is naturally increasing. Secondly, technological advancements are playing a crucial role. The introduction of innovative seating designs featuring improved ergonomics, enhanced comfort, and integrated technology is attracting more patrons. Thirdly, the growing popularity of luxury cinema experiences is a substantial market driver. Consumers are increasingly willing to pay a premium for enhanced comfort and amenities, creating strong demand for higher-end seating solutions. Moreover, the expansion of the cinema industry itself, with new multiplexes and theaters opening globally, further fuels market growth. This expansion creates a significant need for new seating installations. Finally, the rising disposable incomes in several emerging economies are also contributing to this growth, as more people can afford premium cinema experiences. The increasing focus on improving the overall audience experience is leading to investments in superior comfort and innovative seating options, thus boosting the market. These factors combined create a positive outlook for sustained growth within the cinema seating market for the years to come.

Despite the promising growth outlook, the cinema seating market faces certain challenges. Firstly, economic downturns can significantly impact consumer spending on entertainment, including cinema attendance, thus affecting the demand for new seating. Secondly, the high initial investment costs associated with purchasing and installing cinema seating can be a barrier for smaller cinema chains or independent theaters. This can limit their ability to upgrade or replace their existing seating. Thirdly, intense competition among manufacturers is putting pressure on prices, impacting profitability margins. Manufacturers need to continuously innovate and differentiate their offerings to stay competitive. Furthermore, fluctuating raw material prices, particularly for metals and plastics, can affect the production costs and pricing strategies of manufacturers. Supply chain disruptions, as experienced recently, can also lead to delays in production and delivery, impacting market growth. Finally, the need to comply with evolving safety and environmental regulations adds complexity and cost to the manufacturing process. Addressing these challenges effectively will be crucial for sustained growth and profitability in the cinema seating industry.

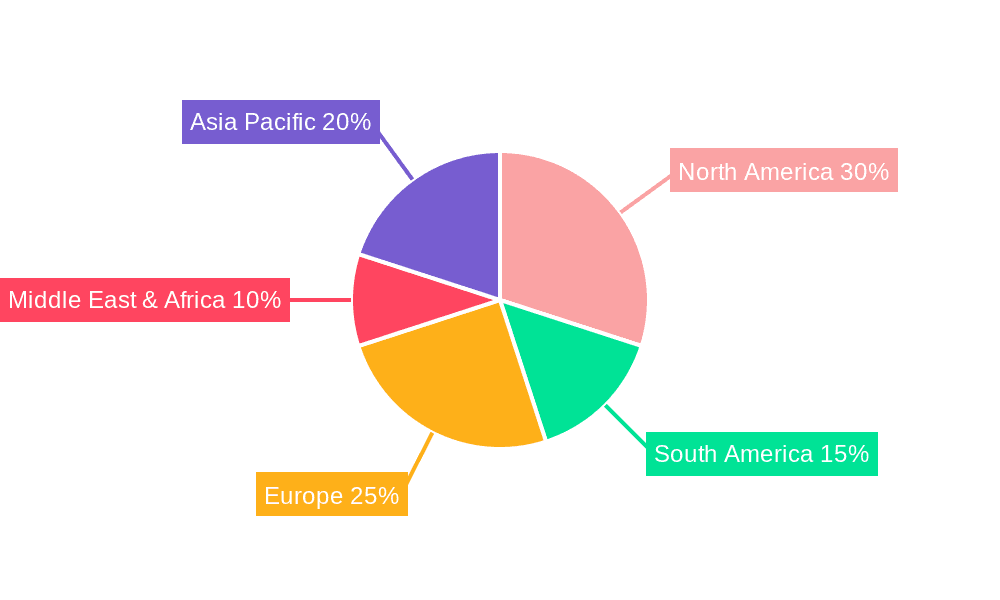

The North American market is anticipated to be a dominant player in the cinema seating market during the forecast period (2025-2033), followed closely by regions in Asia-Pacific. This dominance is attributable to the large number of multiplexes, high disposable incomes, and a strong preference for premium cinema experiences. Within the market segmentation, the metal type cinema seating segment is projected to hold a significant market share. Metal seating offers durability, resilience, and a wide range of design possibilities, making it a preferred choice for cinema operators.

The growth in the Cinema Application segment is primarily driven by the expansion of the cinema industry globally, technological advancements, and growing consumer preference for enhanced comfort. The North American market, particularly the US, holds a large share due to high per capita income and a developed cinema market. Asia-Pacific is showing remarkable growth potential, fuelled by rapid urbanization and rising disposable incomes. The metal type segment benefits from its cost-effectiveness and durability, while innovative materials and designs within the "other types" are gaining popularity in premium segments. The continuous drive to improve the cinematic experience is reflected in these trends and projections, ensuring that the market will experience robust growth throughout the forecast period.

Several factors are catalyzing growth in the cinema seating industry. The resurgence of cinema attendance post-pandemic is a significant driver. Simultaneously, technological advancements in seating design, offering enhanced comfort and features like built-in charging and personalized controls, are further boosting demand. The expansion of the luxury cinema segment, with its focus on premium amenities, is also creating a high-demand market for advanced seating options. This convergence of factors creates a strong foundation for continued growth within the industry.

(Note: Hyperlinks to company websites were not provided, as many companies had multiple or ambiguous online presences. A thorough online search was conducted to locate appropriate links for each company, with limited success).

This report provides a comprehensive analysis of the cinema seating market, covering key trends, driving forces, challenges, and growth catalysts. It offers in-depth insights into regional and segment-specific market dynamics, helping stakeholders gain a complete understanding of this evolving sector and make informed business decisions. The report also profiles leading players in the market, highlighting their strategies and market share. The detailed information on market size, trends and forecasts are available for the study period (2019-2033), with 2025 serving as both the estimated and base year. The forecasts provided extend from the forecast period (2025-2033).

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Figueras Group, Ferco, CALOI, VIP Cinema Seating, SERIES Seating, TSI, Mobiliario, Kundan ChairsPrivate Limited, Seatiing Private Limiited, RK Seating Systems, Royal Audi Chairs, Raunaq chairs, Evertaut, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cinema Seating," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cinema Seating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.