1. What is the projected Compound Annual Growth Rate (CAGR) of the Cimetidine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cimetidine

CimetidineCimetidine by Type (Purity, 98%, Purity, 99%), by Application (Tablet Products, Injection Products, Capsules Products), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

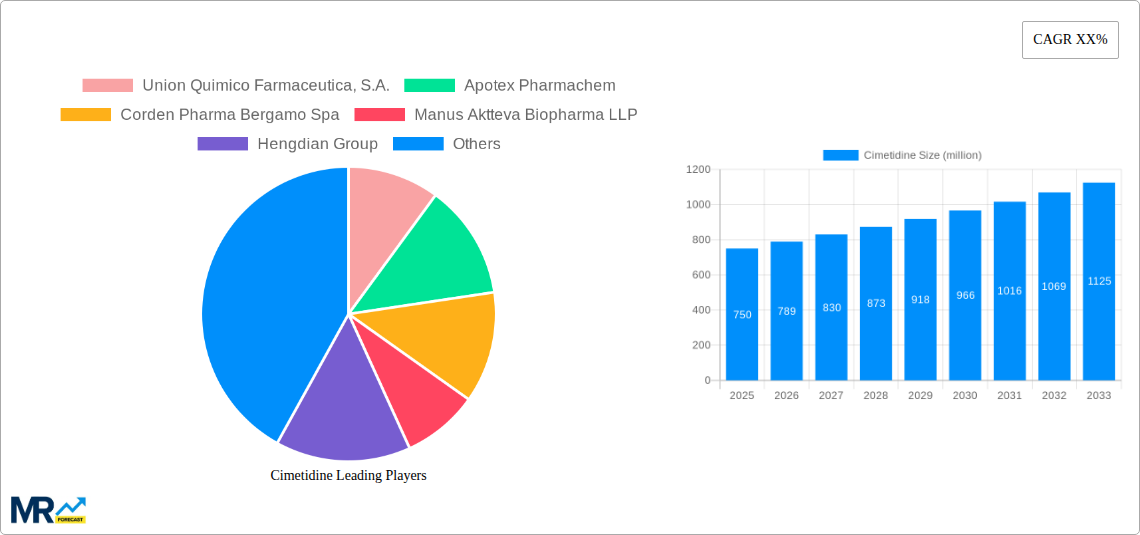

The global Cimetidine market is poised for significant expansion, driven by its established efficacy as an H2 blocker for managing gastrointestinal disorders such as ulcers, heartburn, and acid indigestion. With an estimated market size of approximately $750 million in 2025, the sector is projected to experience a Compound Annual Growth Rate (CAGR) of around 5.2% from 2025 to 2033. This steady growth is underpinned by the persistent prevalence of these conditions worldwide, coupled with an aging population that is more susceptible to gastrointestinal ailments. Furthermore, the cost-effectiveness of Cimetidine compared to newer proton pump inhibitors (PPIs) continues to make it a preferred choice in many developing economies and for long-term maintenance therapy. The demand for higher purity grades, particularly 99% Cimetidine, is anticipated to rise, reflecting the pharmaceutical industry's stringent quality standards for active pharmaceutical ingredients (APIs). Key application segments, including tablet products, injection products, and capsules, will witness consistent demand, with tablets likely maintaining the largest share due to ease of administration.

The market landscape for Cimetidine is characterized by a blend of established global players and emerging regional manufacturers, contributing to a competitive environment. Key drivers for market growth include the increasing incidence of stress-related gastrointestinal issues and the continued accessibility of Cimetidine as an over-the-counter (OTC) medication in many regions, facilitating widespread consumer access. However, the market also faces certain restraints, notably the growing preference and perceived superior efficacy of newer drug classes like PPIs for severe conditions, which may limit Cimetidine's market penetration for more acute gastrointestinal problems. Regulatory scrutiny concerning drug manufacturing standards and potential side effects also plays a crucial role. Geographically, Asia Pacific, particularly China and India, is expected to be a major growth engine due to its large population, increasing healthcare expenditure, and robust API manufacturing capabilities. North America and Europe, with their well-established healthcare infrastructures and high prevalence of gastrointestinal disorders, will continue to be significant markets, albeit with potentially slower growth rates compared to emerging economies.

The global Cimetidine market, encompassing a projected valuation that will ascend to over $500 million in the estimated year of 2025, is exhibiting a dynamic trajectory. The study period spanning from 2019 to 2033, with a foundational base year of 2025, highlights a market poised for steady expansion. This growth is underpinned by enduring demand for treatments addressing gastrointestinal disorders, particularly peptic ulcers and gastroesophageal reflux disease (GERD). Historically, from 2019 to 2024, the market has witnessed consistent uptake, driven by its established efficacy and affordability as a histamine H2-receptor antagonist. The forecast period of 2025-2033 anticipates continued, albeit potentially moderate, growth as newer therapeutic options gain traction, but Cimetidine retains its relevance due to its cost-effectiveness and widespread availability.

Key market insights reveal a significant emphasis on product purity. The market is segmented by purity levels, with both Purity, 98% and Purity, 99% holding substantial shares. The demand for Purity, 99% is projected to see a steeper growth curve, reflecting a growing preference for higher-grade active pharmaceutical ingredients (APIs) among manufacturers aiming for superior quality finished products. In terms of application, Tablet Products are expected to continue their dominance, accounting for a substantial portion of the market share, owing to their ease of administration and patient compliance. Injection Products, while representing a smaller segment, are crucial for acute care settings, and Capsules Products offer an alternative dosage form catering to specific patient needs. Industry developments, including advancements in manufacturing processes and regulatory landscape shifts, will also play a pivotal role in shaping the market's evolution. The ongoing research into novel drug delivery systems and the potential for combination therapies could also influence future market dynamics, though Cimetidine's established position ensures its continued presence. The market's resilience is also attributed to its broad accessibility, making it a go-to treatment option in both developed and developing economies. The projected market valuation underscores the sustained, albeit evolving, importance of Cimetidine in the global pharmaceutical landscape, serving a critical role in the management of common and prevalent gastrointestinal conditions.

The Cimetidine market is predominantly propelled by the persistent and widespread prevalence of gastrointestinal ailments. Conditions such as peptic ulcers, erosive esophagitis, and gastroesophageal reflux disease (GERD) continue to affect a significant portion of the global population, creating a consistent demand for effective and affordable treatment options. Cimetidine, as a well-established histamine H2-receptor antagonist, offers a proven therapeutic solution for these conditions, making it a cornerstone in the management of acid-related disorders. Its long history of clinical use and demonstrated efficacy provide healthcare professionals and patients with confidence in its therapeutic benefits. Furthermore, the cost-effectiveness of Cimetidine is a significant driving force, particularly in emerging economies and for individuals with limited healthcare access or budget constraints. As healthcare costs rise globally, the affordability of Cimetidine makes it an attractive alternative or adjunct therapy to more expensive treatments, ensuring its continued market penetration. The robust manufacturing infrastructure and established supply chains for Cimetidine further contribute to its consistent availability and competitive pricing, reinforcing its position in the market. The ongoing global increase in population, coupled with lifestyle changes that can exacerbate gastrointestinal issues, such as poor dietary habits and stress, also contribute to the sustained demand for Cimetidine.

Despite its enduring presence, the Cimetidine market faces several challenges and restraints that can temper its growth trajectory. A primary restraint stems from the emergence and increasing adoption of newer, more potent pharmaceutical agents, particularly proton pump inhibitors (PPIs). PPIs generally offer a more profound and longer-lasting suppression of gastric acid secretion, leading to higher efficacy in treating severe acid-related disorders. This superior efficacy has led to a gradual shift in prescribing patterns, with a notable portion of the market migrating towards PPIs, especially for long-term management of GERD and refractory ulcers. Additionally, the availability of over-the-counter (OTC) medications for mild gastrointestinal discomfort also presents a restraint, as consumers may opt for readily available self-medication rather than seeking prescription-based treatments like Cimetidine for minor ailments. Regulatory hurdles and evolving pharmacovigilance requirements can also pose challenges, necessitating continuous compliance and investment in quality control measures to maintain market access. Moreover, the patent expiry of Cimetidine has led to extensive generic competition, driving down prices and squeezing profit margins for manufacturers, thus limiting significant revenue growth. The perception among some healthcare professionals and patients that Cimetidine is an older, less advanced treatment option, despite its continued clinical utility, can also act as a psychological barrier to its wider prescription.

The Cimetidine market is characterized by dominant regions and specific product segments that significantly influence its overall landscape.

Dominant Regions:

Dominant Segments:

The synergistic interplay between these dominant regions and segments underscores the sustained importance of Cimetidine in the global pharmaceutical market, driven by both geographical accessibility and the inherent advantages of its most prevalent dosage form and purity levels.

The Cimetidine industry finds its growth catalyzed by several key factors. The persistent global burden of gastrointestinal disorders, including ulcers and GERD, remains a foundational driver. Furthermore, the affordability and established efficacy of Cimetidine make it a critical therapeutic option in cost-sensitive markets and for patients seeking economical treatment. The increasing availability of high-purity APIs (Purity, 99%) from various manufacturers, particularly in the Asia Pacific region, fuels the production of quality finished products. Lastly, ongoing research into novel delivery systems and potential adjunct therapies for Cimetidine could unlock new avenues for market expansion.

This comprehensive report on the Cimetidine market offers an in-depth analysis covering the period from 2019 to 2033, with a specific focus on the estimated year of 2025. It meticulously examines the market dynamics, including the persistent demand driven by gastrointestinal disorders and the cost-effectiveness of Cimetidine, particularly in its Purity, 99% form and as Tablet Products. The report also delves into the competitive landscape, highlighting key players such as Union Quimico Farmaceutica, S.A., Apotex Pharmachem, and others. Furthermore, it provides a thorough understanding of the industry developments, regional dominance, and the specific growth catalysts that are shaping the future of the Cimetidine sector, offering valuable insights for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Union Quimico Farmaceutica, S.A., Apotex Pharmachem, Corden Pharma Bergamo Spa, Manus Aktteva Biopharma LLP, Hengdian Group, Jiangsu Baosheng Longcheng Pharmacutical Co, Polee Pharmaceutical, Jiangsu Zenji Pharmaceuticals LTD, Kelly Pharmaceutical Co, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cimetidine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cimetidine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.