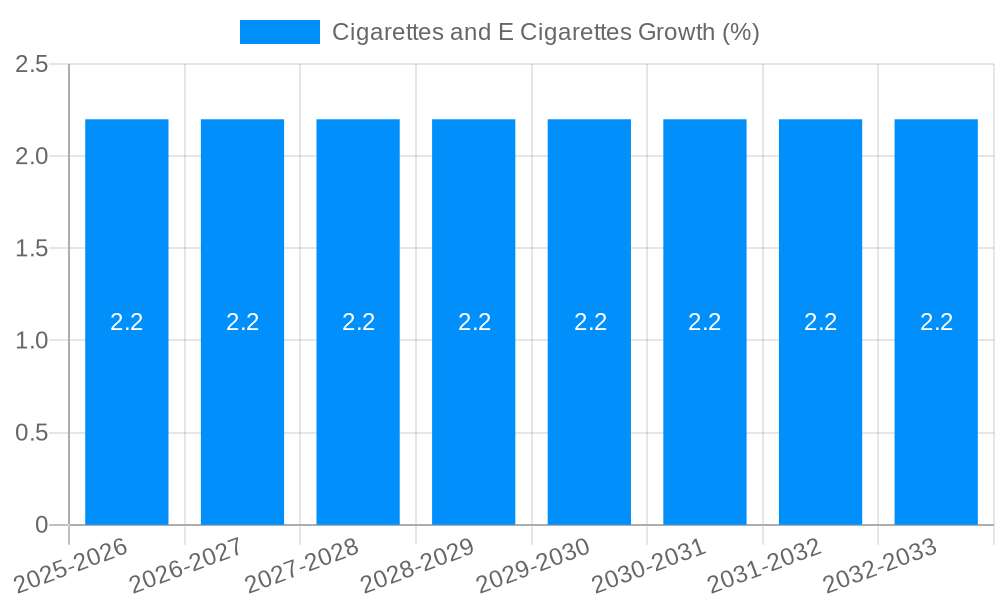

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarettes and E Cigarettes?

The projected CAGR is approximately 2.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cigarettes and E Cigarettes

Cigarettes and E CigarettesCigarettes and E Cigarettes by Type (Cigarettes, E Cigarettes), by Application (Offline, Online), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

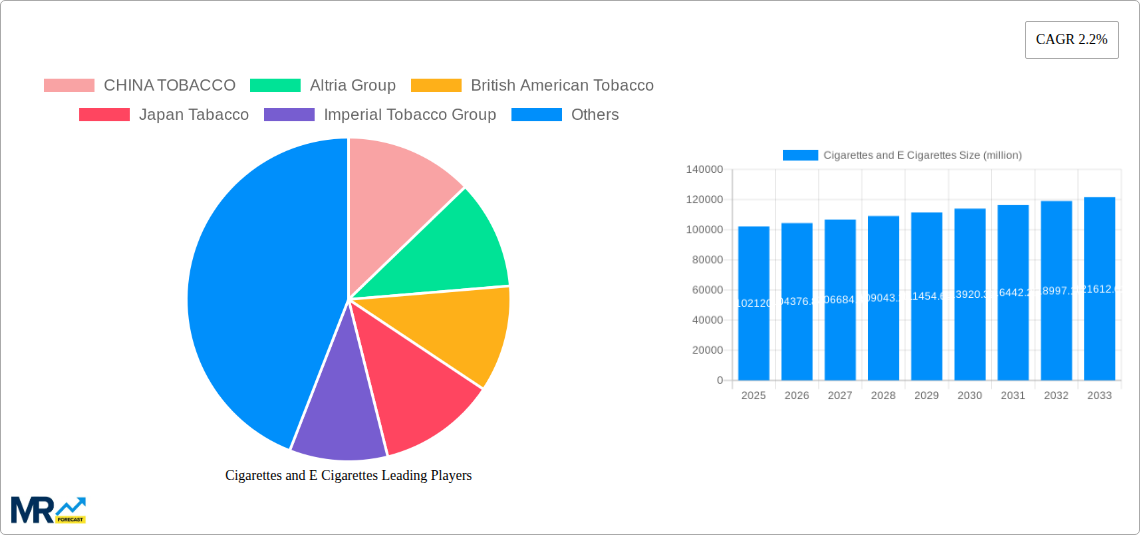

The global cigarettes and e-cigarettes market, valued at $102.12 billion in 2025, is projected to experience moderate growth, driven by persistent demand for nicotine products despite increasing health concerns and regulatory pressures. The Compound Annual Growth Rate (CAGR) of 2.2% from 2025 to 2033 reflects a maturing market, with traditional cigarettes still holding a significant share, albeit facing declining sales due to anti-smoking campaigns and the rise of alternative nicotine delivery systems. E-cigarettes, while experiencing substantial growth in recent years, are subject to fluctuating regulations and evolving consumer preferences. This segment's growth is influenced by factors such as the introduction of innovative vaping devices, diverse e-liquid flavors, and the perception of e-cigarettes as a less harmful alternative to traditional cigarettes, although this perception is debated. However, concerns regarding the long-term health effects of vaping and increasing restrictions on e-cigarette marketing are likely to moderate the market's growth trajectory. The market is segmented by product type (cigarettes and e-cigarettes) and distribution channels (offline and online). The online segment is anticipated to witness faster growth compared to the offline segment, owing to increased internet penetration and convenience of online purchasing. Leading players like China Tobacco, Altria Group, British American Tobacco, and others are actively strategizing to maintain their market share through product diversification, innovation, and strategic acquisitions. Regional variations in market dynamics are expected, with North America and Asia Pacific expected to maintain substantial market share.

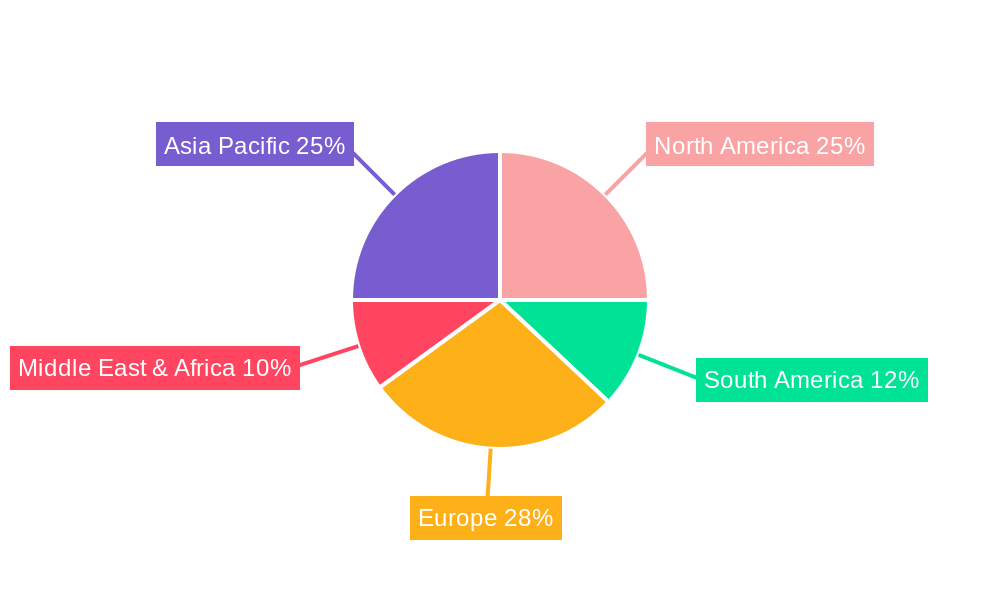

The geographical distribution of the market reveals significant regional variations. North America and Europe are expected to dominate the market, driven by established consumer bases and higher per capita consumption. However, the Asia Pacific region, particularly China and India, presents significant growth potential due to large populations and increasing disposable incomes. While growth in developed markets might be relatively slower, developing regions are poised for expansion as consumer habits evolve and awareness regarding nicotine products increases. The overall market landscape will continue to be shaped by stringent regulations aimed at controlling nicotine consumption, particularly for e-cigarettes, as well as ongoing public health initiatives focused on reducing smoking prevalence globally. The competitive landscape is intensely competitive, with established players constantly battling for market share while adapting to shifting consumer preferences and regulatory changes.

The global cigarettes and e-cigarettes market, valued at XXX million units in 2025, is poised for significant transformation over the forecast period (2025-2033). While traditional cigarettes continue to hold a substantial market share, driven by established consumer habits and deeply entrenched brand loyalty in certain regions, the e-cigarette segment is experiencing rapid growth, fueled by perceptions of reduced health risks compared to conventional cigarettes and the appeal of innovative product designs and flavors. This shift is particularly pronounced among younger demographics and in regions with stricter regulations on traditional tobacco products. The market has witnessed a complex interplay of factors, including evolving consumer preferences, stringent governmental regulations aimed at curbing smoking rates and mitigating the potential harms of vaping, and the aggressive marketing strategies employed by both established tobacco giants and emerging e-cigarette companies. The historical period (2019-2024) saw a decline in traditional cigarette consumption in several developed nations, counterbalanced by the explosive, albeit fluctuating, growth of the e-cigarette sector. This period also witnessed increased consolidation within the industry, with major players acquiring smaller companies to expand their product portfolios and market reach. Looking ahead, the forecast period will likely be characterized by continued competition, technological advancements in e-cigarette technology (e.g., improved battery life, advanced flavor delivery systems), and a continued focus on product diversification to cater to the changing needs and preferences of consumers. The balance between the decline of traditional cigarettes and the growth of e-cigarettes, however, remains a key factor impacting overall market dynamics. This report analyzes this intricate landscape, providing a detailed analysis of market trends and future projections.

Several factors contribute to the dynamism of the cigarettes and e-cigarettes market. Firstly, established consumer behavior and deeply ingrained habits among long-term smokers continue to underpin the demand for traditional cigarettes, particularly in developing economies. Secondly, the e-cigarette sector benefits from the perception (rightly or wrongly) of reduced health risks compared to combustible cigarettes, attracting smokers looking for alternatives and new users entirely. The development and marketing of diverse e-cigarette devices and flavors cater to a wide range of consumer preferences, further driving adoption. Technological innovations in e-cigarette technology, such as improved battery life, enhanced vapor production, and more sophisticated flavor delivery systems, also continuously enhance consumer experience and market appeal. Moreover, the aggressive marketing and branding strategies of both established tobacco companies and newer e-cigarette ventures play a significant role in shaping market trends and influencing consumer choices. Finally, while often controversial, the accessibility of e-cigarettes online and through various retail channels contributes to their widespread availability. Conversely, stringent regulations and public health initiatives aimed at curbing smoking and vaping have had, and will continue to have, a substantial impact on market growth. The interplay of these driving forces shapes the evolving landscape of the global cigarettes and e-cigarettes industry.

The cigarettes and e-cigarettes market faces numerous challenges and restraints. The most significant is the increasing regulatory scrutiny and governmental interventions aimed at controlling tobacco consumption and mitigating the potential harms associated with both cigarettes and vaping. These regulations often include taxation increases, restrictions on advertising and marketing, and limitations on the sale and distribution of these products. Public health concerns surrounding the long-term health effects of vaping, especially among young people, pose a significant obstacle to the e-cigarette sector's growth. Fluctuations in consumer preferences and the emergence of new trends can also affect market stability. Competition is fierce, with established tobacco companies competing with numerous smaller e-cigarette manufacturers, leading to price wars and pressure on profit margins. The ongoing debate surrounding the effectiveness of e-cigarettes as smoking cessation aids, and the potential for nicotine addiction among new users, also casts a shadow over the industry's future. Finally, the cost of manufacturing and distribution, coupled with the need for continuous research and development to stay ahead of competitors and regulatory changes, presents a significant challenge to all players in the market.

The Asia-Pacific region, particularly China, is projected to dominate the global cigarettes market throughout the forecast period due to high smoking rates and substantial consumption. Within the e-cigarette segment, North America and Europe are anticipated to hold significant shares, driven by higher adoption rates and a more established regulatory framework (despite ongoing debates).

The dominance of the Asia-Pacific region in cigarettes can be attributed to high population density, established smoking cultures, and relatively lower regulatory pressure in comparison to some other parts of the world. This contrasts with the e-cigarette market where the developed economies of North America and Europe show leading market share due to higher disposable incomes, technological adoption, and increased awareness concerning harm reduction alternatives.

The continued dominance of offline sales in both cigarettes and e-cigarettes highlights the importance of established distribution networks and customer familiarity with existing retail channels. Online sales will undoubtedly experience growth but will need to overcome regulatory challenges and concerns around age verification to reach its full potential.

The industry's growth is spurred by technological advancements in e-cigarette design and functionality, resulting in products that mimic the experience of smoking more closely while also expanding flavor profiles. Further growth is driven by the expansion of the e-cigarette user base, as consumers seek perceived lower-risk alternatives to traditional cigarettes. The increasing regulatory pressure on traditional tobacco products, forcing companies to adapt and invest heavily in harm reduction products, is also driving investment and growth within the e-cigarette segment.

This report provides a comprehensive overview of the cigarettes and e-cigarettes market, analyzing historical trends, current market dynamics, and future projections. It encompasses detailed segmentation, competitive landscape analysis, and an assessment of key drivers, restraints, and growth opportunities. The report serves as a valuable resource for industry stakeholders, investors, and policymakers seeking a thorough understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.2%.

Key companies in the market include CHINA TOBACCO, Altria Group, British American Tobacco, Japan Tabacco, Imperial Tobacco Group, KT&G, Universal, Alliance One International, R.J. Reynolds, PT Gudang Garam Tbk, VMR Product, Njoy, 21st Century, Vaporcorp, Truvape, FirstUnion, Hangsen, Buddy Group, Kimree, .

The market segments include Type, Application.

The market size is estimated to be USD 102120 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cigarettes and E Cigarettes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cigarettes and E Cigarettes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.