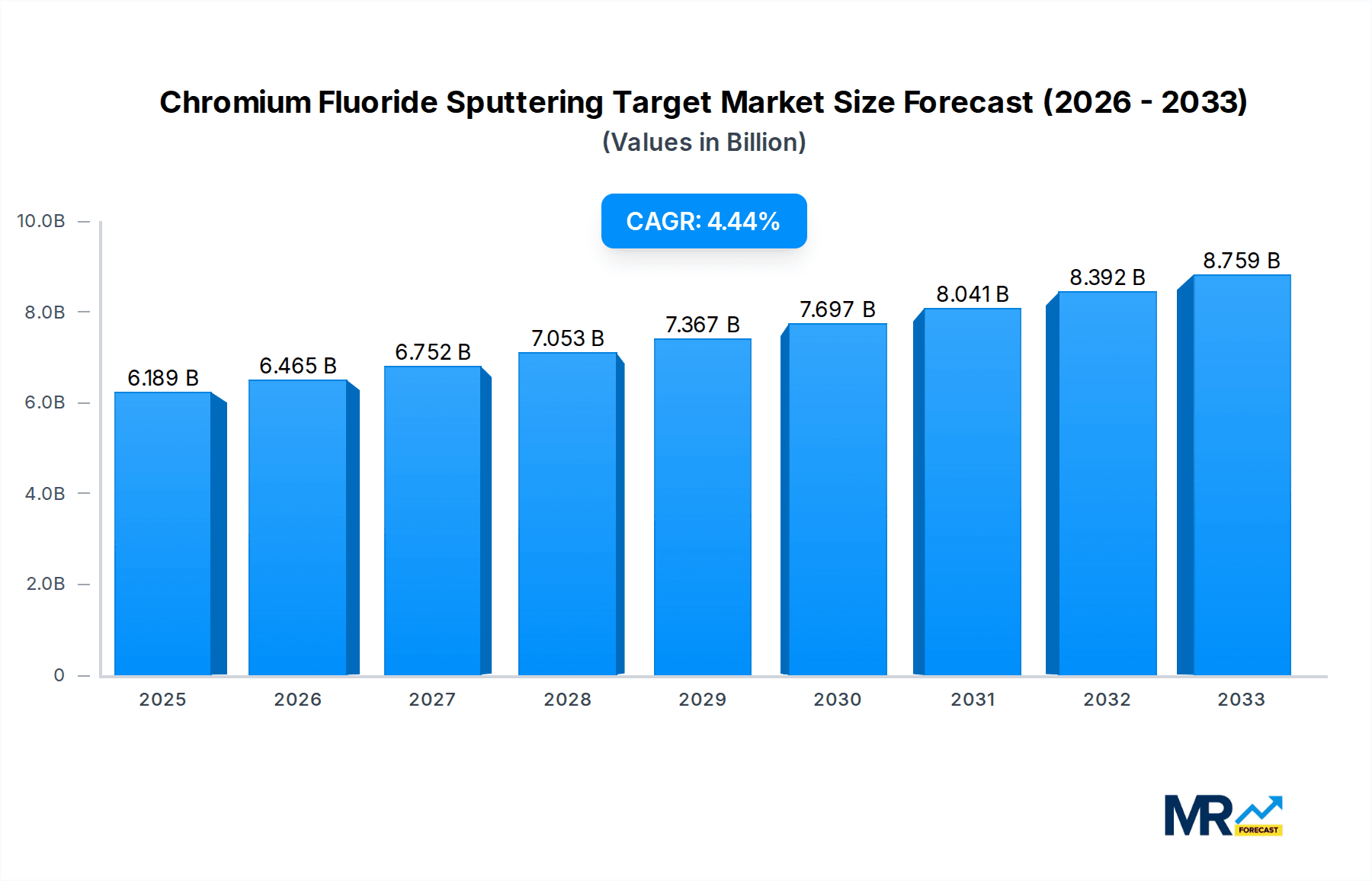

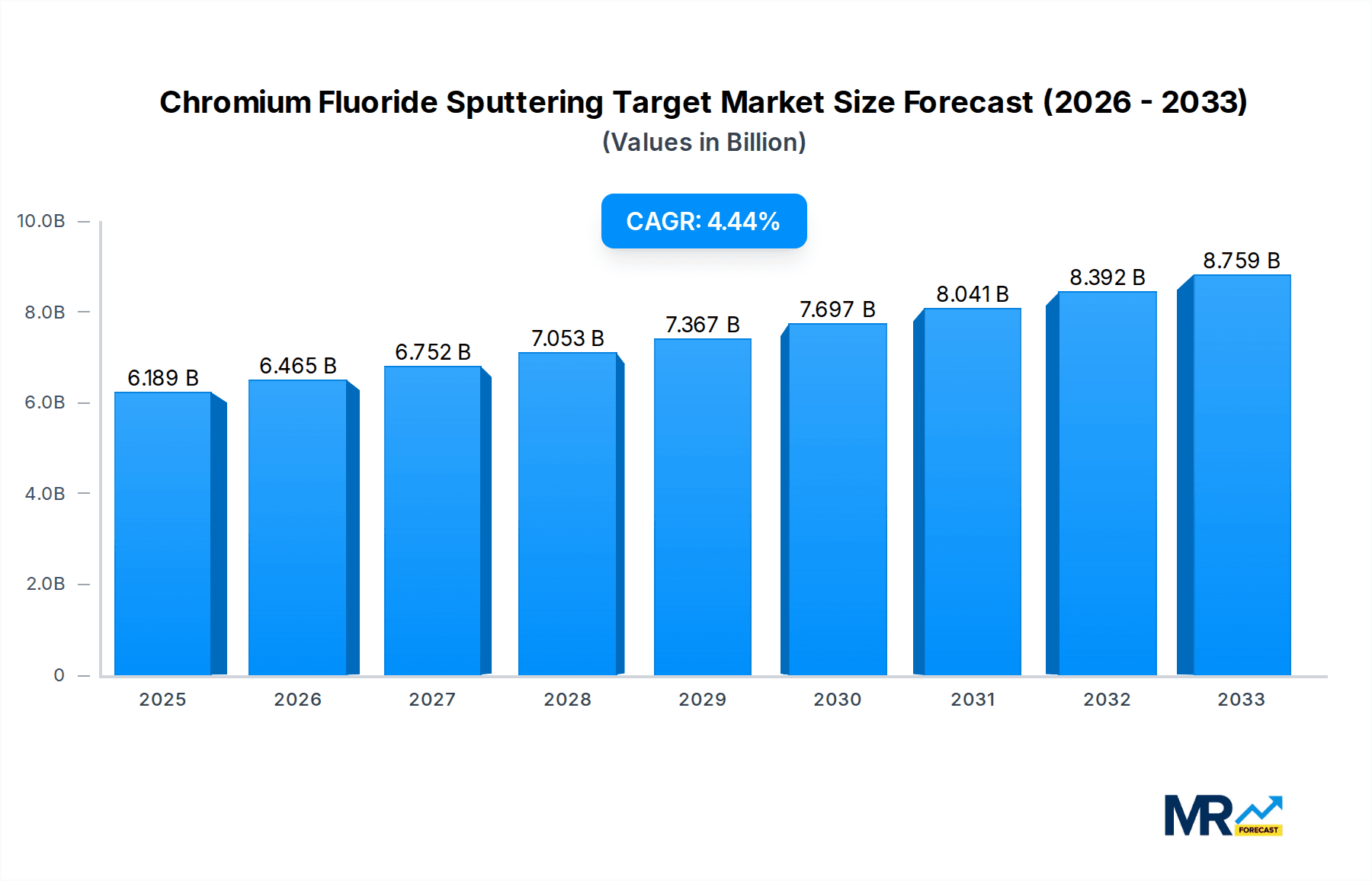

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chromium Fluoride Sputtering Target?

The projected CAGR is approximately 4.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chromium Fluoride Sputtering Target

Chromium Fluoride Sputtering TargetChromium Fluoride Sputtering Target by Type (Disc Type, Tube Type, Others), by Application (Industrial, Laboratory, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Chromium Fluoride Sputtering Target market is poised for significant expansion, projected to reach an estimated USD 6,189.1 million by 2025. This robust growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.5%, indicating sustained demand and market vitality throughout the forecast period of 2025-2033. The primary drivers fueling this ascent are the burgeoning semiconductor industry's need for advanced materials in microchip fabrication, the increasing adoption of optical coatings for consumer electronics and automotive applications, and ongoing research and development in thin-film technologies. Furthermore, the expanding use of chromium fluoride targets in scientific research and specialized industrial processes is contributing to market momentum. Innovations in sputtering techniques, leading to higher deposition rates and improved film quality, are also playing a crucial role in driving market adoption and pushing the boundaries of material science.

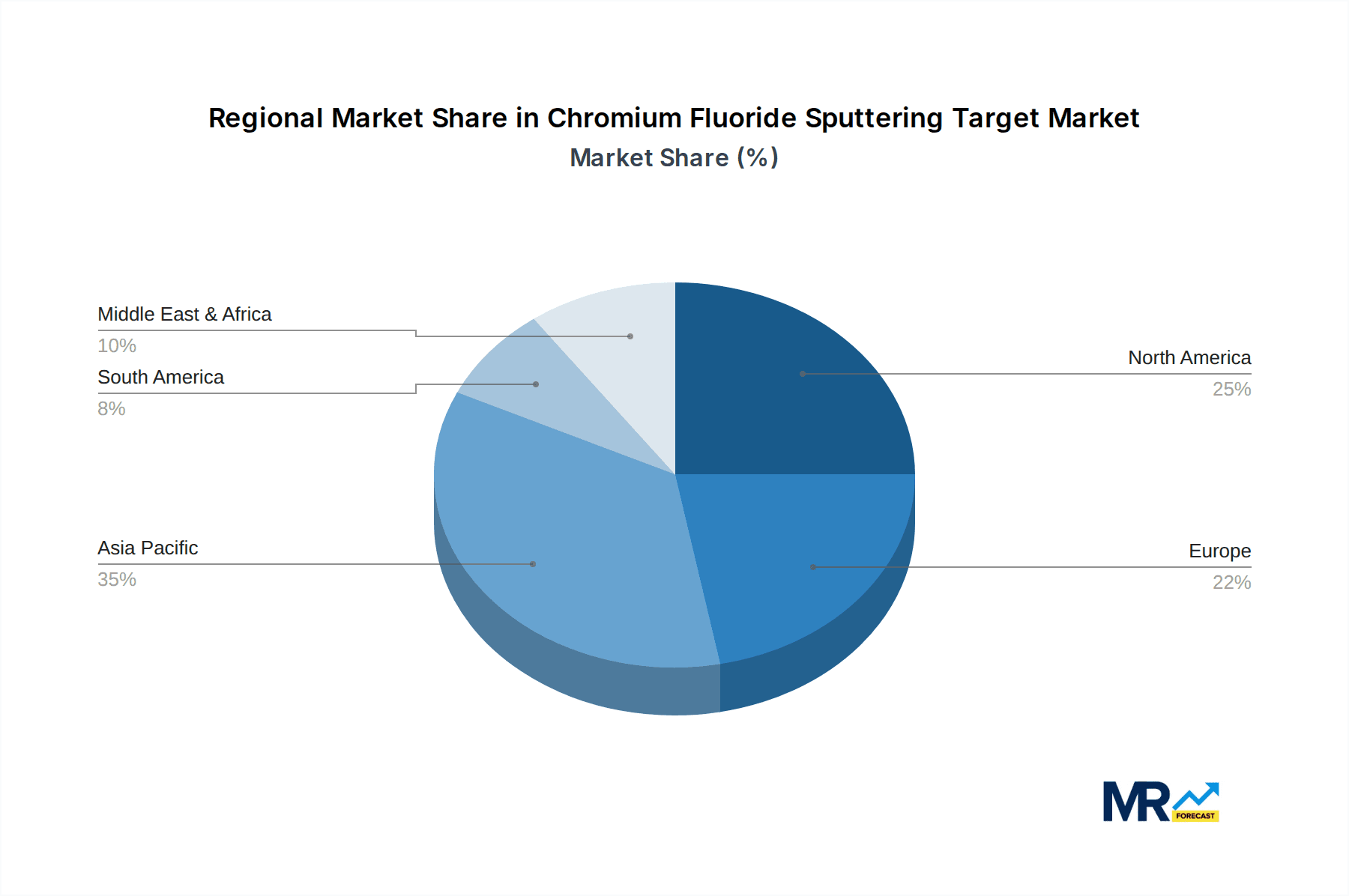

The market segmentation reveals a dynamic landscape with both Disc Type and Tube Type targets holding significant sway, catering to diverse application needs in industrial manufacturing and laboratory research. While the "Others" category for type and application suggests emerging niche markets, the established segments are expected to dominate in the near term. Geographically, Asia Pacific, particularly China and Japan, is anticipated to be a leading region due to its extensive manufacturing base for electronics and a strong focus on technological innovation. North America and Europe will also exhibit substantial growth, driven by their advanced research institutions and high-tech industries. However, the market faces certain restraints, including the high cost of raw material procurement and the complex manufacturing processes involved, which can impact pricing and scalability. Nevertheless, the continuous pursuit of higher performance thin films and the growing demand for specialized optical and electronic devices are expected to overcome these challenges, ensuring a positive growth trajectory for the Chromium Fluoride Sputtering Target market.

Here is a unique report description on Chromium Fluoride Sputtering Targets, incorporating the requested information and formatting:

The Chromium Fluoride Sputtering Target market is poised for substantial growth and evolution throughout the Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, and a Forecast Period spanning 2025-2033. Analysis of the Historical Period (2019-2024) reveals a steady upward trajectory, driven by increasing demand for advanced thin-film deposition technologies across various high-tech sectors. During this historical phase, market participants observed consistent improvements in target purity and density, directly impacting the quality and performance of deposited films. The market size, estimated to be in the tens of millions in the Historical Period, is projected to experience a CAGR exceeding a significant percentage in the coming years. Key market insights indicate a growing preference for chromium fluoride targets with exceptional stoichiometry and minimal impurities, as these are critical for achieving desired optical, electrical, and mechanical properties in sputtered layers. The advent of more sophisticated deposition techniques, such as pulsed DC sputtering and reactive sputtering, has further amplified the need for highly engineered chromium fluoride targets. Innovations in manufacturing processes, including advanced powder metallurgy and vacuum hot pressing, are enabling the production of targets with superior microstructure and uniformity, directly addressing the stringent requirements of next-generation electronics and optical coatings. Furthermore, the increasing investment in research and development for novel materials with enhanced sputter yields and deposition rates is a dominant trend. The market is also witnessing a gradual shift towards more sustainable and cost-effective production methods, as manufacturers strive to balance performance with environmental considerations and economic viability. The inherent versatility of chromium fluoride as a sputtering material, lending itself to a wide array of applications, underpins its consistent market relevance. The increasing complexity of semiconductor manufacturing, the expansion of the display industry, and the ongoing development of advanced optical components are all contributing factors to the positive market outlook. The market valuation, which has steadily climbed into the tens of millions, is expected to accelerate, reaching substantial figures in the hundreds of millions by the end of the forecast period.

Several potent forces are propelling the Chromium Fluoride Sputtering Target market forward, marking it as a segment with significant momentum. Foremost among these is the insatiable demand from the semiconductor industry for increasingly sophisticated thin-film deposition processes. As integrated circuits become smaller, more complex, and require specialized dielectric or passivation layers, the need for high-purity, precisely formulated chromium fluoride targets intensifies. These targets are crucial for depositing uniform and defect-free chromium fluoride layers, which play vital roles in etch stop layers, diffusion barriers, and passivation coatings in advanced semiconductor fabrication. Beyond semiconductors, the burgeoning display market, encompassing everything from high-resolution televisions and smartphones to flexible and wearable displays, presents another substantial growth driver. Chromium fluoride films are integral in optical coatings for displays, contributing to anti-reflective properties, color enhancement, and scratch resistance, thereby improving visual experience and product durability. The expansion of optical technologies, including advanced lenses, optical filters, and laser optics, further fuels demand. Chromium fluoride's unique optical properties make it an ideal material for these applications, where precise refractive indices and transmission characteristics are paramount. Moreover, the ongoing miniaturization and performance enhancement of electronic devices across consumer electronics, automotive, and aerospace sectors necessitate advanced material solutions, with sputtering targets like chromium fluoride being at the forefront of this innovation. The continuous research and development efforts aimed at improving the sputtering characteristics and film quality of chromium fluoride are also indirectly driving market growth by making it a more attractive and viable option for a broader range of applications.

Despite the promising outlook, the Chromium Fluoride Sputtering Target market faces certain challenges and restraints that could temper its growth trajectory. One significant hurdle is the inherent complexity and cost associated with the manufacturing of high-purity chromium fluoride sputtering targets. Achieving the required stoichiometry and minimizing contamination to levels suitable for advanced applications demands sophisticated manufacturing processes, stringent quality control, and specialized equipment. This can lead to higher production costs, which may translate into higher pricing for the end-user, potentially impacting market adoption in cost-sensitive segments. Furthermore, the availability and price volatility of raw materials, particularly high-purity chromium and fluorine sources, can pose a risk. Fluctuations in the supply chain or significant price hikes for these essential components can disrupt production schedules and negatively affect profit margins for manufacturers. Another challenge lies in the development and adoption of alternative materials or deposition techniques that could potentially compete with chromium fluoride. Ongoing research in material science may uncover novel compounds or processes that offer comparable or superior performance at a lower cost, thereby eroding the market share of chromium fluoride targets. Moreover, stringent environmental regulations concerning the handling and disposal of fluorine-containing compounds can add to compliance costs and operational complexities for manufacturers, potentially impacting their ability to scale up production efficiently. The specialized nature of sputtering target applications also means that the market can be susceptible to shifts in demand within niche industries. A slowdown or significant change in demand from key sectors like semiconductor manufacturing or advanced optics could have a ripple effect on the overall market. Finally, the intricate process of quality assurance and characterization of sputtering targets to meet the exacting specifications of advanced applications requires significant investment in analytical instrumentation and expertise, adding to the overall operational burden.

The Chromium Fluoride Sputtering Target market is projected to witness dominant growth driven by specific regions and segments, with Asia Pacific emerging as a pivotal region and Industrial Application as a leading segment.

Key Regions/Countries Dominating the Market:

Key Segments Dominating the Market:

The Chromium Fluoride Sputtering Target industry's growth is significantly catalyzed by the relentless advancements in the semiconductor sector, where demand for thinner, more complex dielectric and passivation layers continues to rise. The expanding market for advanced displays, including OLED and flexible screens, further fuels the need for high-performance optical coatings that chromium fluoride excels at providing. Moreover, ongoing research and development into new applications for chromium fluoride thin films in emerging technologies, such as next-generation energy storage devices and specialized sensors, are opening new avenues for market expansion. The increasing global adoption of 5G technology and the proliferation of Internet of Things (IoT) devices are also creating sustained demand for advanced electronic components, thereby indirectly boosting the sputtering target market.

This report provides an in-depth analysis of the global Chromium Fluoride Sputtering Target market, covering the Study Period (2019-2033) with a detailed breakdown of the Historical Period (2019-2024), Base Year (2025), Estimated Year (2025), and Forecast Period (2025-2033). It offers a comprehensive understanding of market trends, identifying key drivers such as the escalating demand from the semiconductor and display industries, and examining critical challenges including manufacturing complexities and raw material price volatility. The report further delineates dominant market segments, with a particular focus on Industrial applications and Disc Type targets, and highlights key geographical regions poised for significant growth, such as Asia Pacific. Expert insights into industry developments and a detailed overview of leading players are also included.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include Stanford Advanced Materials, American Elements, ALB Materials, QS Advanced Materials, Edgetech Industries, Heeger Materials, Bimo Metals, ATT, Princeton Scientific, Oasis Materials Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Chromium Fluoride Sputtering Target," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chromium Fluoride Sputtering Target, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.