1. What is the projected Compound Annual Growth Rate (CAGR) of the Chromated Copper Arsenate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chromated Copper Arsenate

Chromated Copper ArsenateChromated Copper Arsenate by Type (CCA-C, Others, World Chromated Copper Arsenate Production ), by Application (Agricultural Timber & Poles, Building and Fencing, Utility Poles, Others, World Chromated Copper Arsenate Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

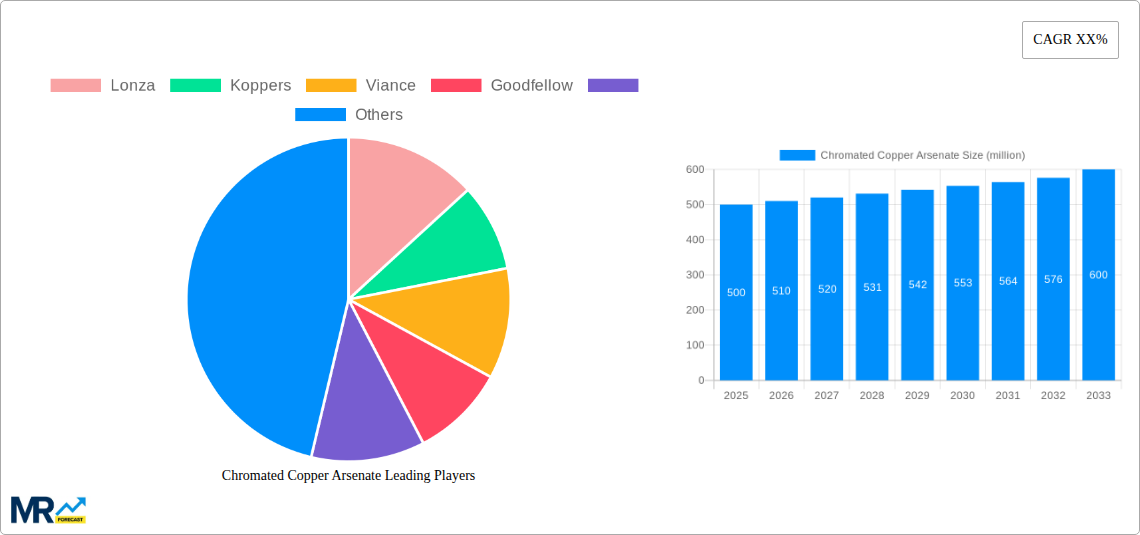

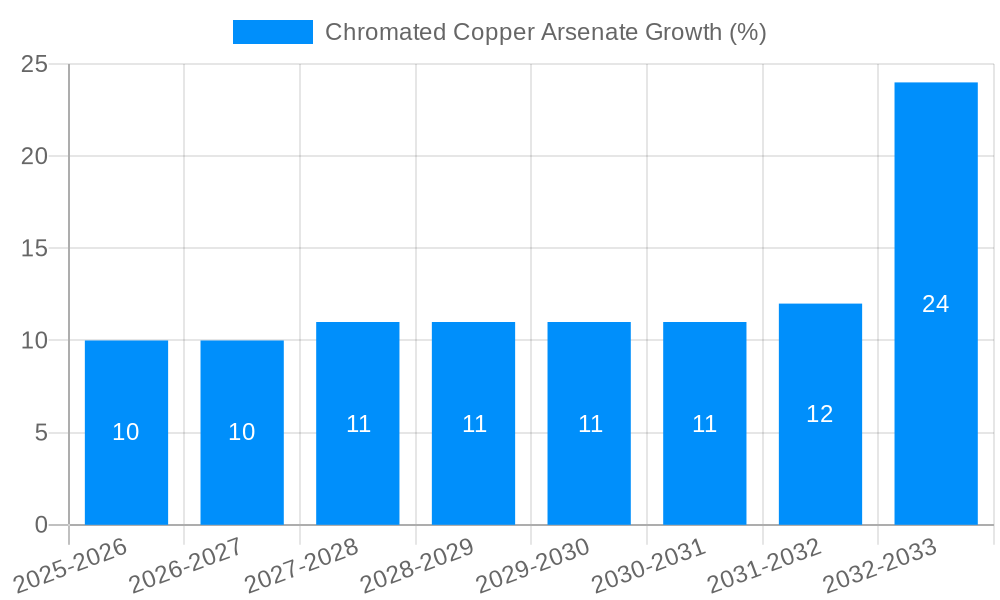

The Chromated Copper Arsenate (CCA) market, while facing significant headwinds due to environmental concerns, continues to hold relevance in specific niche applications. The market, estimated at $500 million in 2025, is projected to experience a moderate Compound Annual Growth Rate (CAGR) of 2% from 2025 to 2033, reaching approximately $600 million by 2033. This relatively slow growth reflects the increasing regulatory pressure to phase out CCA due to its arsenic content, leading to substitution with alternative wood preservatives. However, the market's resilience stems from its continued use in applications where alternatives are not yet fully effective or economically viable, such as industrial wood preservation in certain regions with less stringent environmental regulations. Key drivers include the enduring need for effective wood protection in demanding environments, especially in the infrastructure and utility sectors. The primary restraints include escalating environmental regulations globally, increasing consumer awareness of arsenic's toxicity, and the development of safer, more environmentally friendly alternatives. The market is segmented based on application (e.g., utility poles, railway sleepers, marine structures), with the utility sector remaining a key driver despite decreasing market share overall. Major players like Lonza, Koppers, Viance, and Goodfellow continue to adapt by investing in alternative wood treatment solutions while maintaining a presence in the dwindling CCA market.

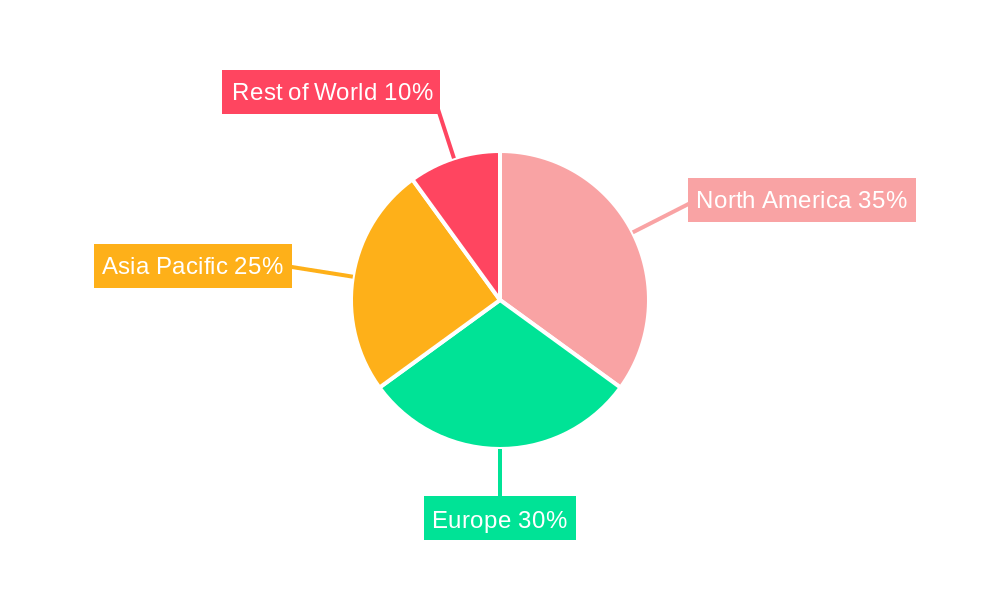

The regional distribution of the CCA market reflects varying regulatory landscapes and industrial needs. North America and Europe, while leaders in the transition to environmentally friendly wood preservatives, still retain a significant but diminishing share of the CCA market, primarily due to existing infrastructure requiring maintenance. Developing regions, with potentially less stringent regulations and greater demand for cost-effective wood preservation, might show a slightly higher but limited growth in CCA usage compared to developed markets during this period. This scenario highlights the challenging market dynamics faced by the CCA industry, requiring a strategic shift towards sustainable and safer alternatives. The successful companies in this space will be those that can effectively navigate the environmental regulations, adapt to market demands for safer products, and offer efficient and cost-effective solutions for specific niche applications.

The global chromated copper arsenate (CCA) market, valued at USD XX million in 2024, is projected to reach USD YY million by 2033, exhibiting a CAGR of Z% during the forecast period (2025-2033). This growth trajectory, however, is complex and influenced by several interacting factors. The historical period (2019-2024) witnessed a fluctuating market, largely shaped by increasing environmental regulations and the consequent shift towards less toxic wood preservatives. While the base year of 2025 presents a relatively stable market size, the forecast period anticipates a moderate growth, driven primarily by persistent demand in specific niche applications, particularly in certain developing economies where regulatory pressures are less stringent. The market’s evolution reflects a delicate balance between the cost-effectiveness and enduring performance of CCA, weighed against the growing global awareness of its toxicity. While developed nations have largely phased out CCA, its usage continues in developing regions, contributing to the overall market volume. However, the future growth hinges heavily on the ongoing development and adoption of environmentally benign alternatives and the evolution of regulatory landscapes in key markets. Innovative formulations aiming to minimize arsenic leaching and improved disposal methods could contribute positively to the market’s future, though this remains contingent upon market acceptance and regulatory approvals. The continued need for effective wood preservation in diverse applications, especially in construction and infrastructure projects, presents a persistent underlying demand for CCA, albeit one that is increasingly subject to geographical limitations and strict adherence to safety protocols. The market's segmentation further complicates the overall picture, with varied growth rates across different regions and application segments.

The continued demand for effective and affordable wood preservation remains a significant driver for the CCA market, particularly in developing nations where cost considerations outweigh environmental concerns. CCA's proven effectiveness against wood-destroying fungi and insects continues to make it a favored choice in certain applications, despite its toxicity. The robustness and longevity of CCA-treated wood, particularly in outdoor applications like utility poles, railway sleepers, and fence posts, contribute to its persistent usage. Furthermore, the established infrastructure and supply chains for CCA treatment facilities in some regions maintain a degree of market inertia. While stringent environmental regulations in developed countries are curtailing its use, the absence of readily available and cost-competitive alternatives in certain developing regions sustains demand. The relatively low initial cost of CCA treatment compared to newer, eco-friendly alternatives also contributes to its continued application in budget-conscious projects. However, this driver is constantly challenged by growing environmental awareness and the increasing availability of more sustainable preservation methods.

The primary challenge confronting the CCA market is the escalating global concern regarding its toxicity. The presence of arsenic, a known carcinogen, poses significant environmental and health risks associated with its production, handling, and disposal. Stringent environmental regulations implemented in many developed nations have severely restricted or outright banned the use of CCA, substantially impacting market growth. The increasing public awareness of the health and environmental hazards associated with arsenic is fostering a strong preference for environmentally friendlier wood preservatives. This is further exacerbated by the difficulty in safely disposing of CCA-treated waste wood, adding to the environmental burden and cost implications. The potential for arsenic leaching from treated wood into soil and groundwater continues to raise concerns, leading to strict regulations regarding its use and disposal. These factors are collectively creating significant headwinds for the CCA market, pushing manufacturers and users to seek safer alternatives.

Developing Economies: Regions with less stringent environmental regulations and a strong need for cost-effective wood preservation continue to exhibit significant demand for CCA. These markets typically prioritize affordability and functionality over eco-friendly considerations, driving a substantial portion of global CCA consumption. This includes certain parts of Asia, Africa, and South America, where infrastructure development and construction activities contribute significantly to the market. However, even within these regions, the regulatory landscape is gradually evolving, potentially impacting future growth.

Specific Applications: Demand for CCA remains strong in applications requiring exceptional durability and resistance to decay and insect damage. This includes utility poles, railway sleepers, and marine applications, where the cost-benefit analysis still favors CCA despite its environmental drawbacks. However, these applications are also witnessing the gradual introduction of alternative preservatives.

Construction: The construction sector, particularly in regions where CCA remains permitted, continues to utilize CCA-treated wood for various applications, such as fence posts, decking, and framing. This segment, however, is showing signs of a shift towards eco-friendly alternatives in several areas.

The paragraph below summarizes the above points. The dominance of developing economies and specific niche applications within the CCA market reflects a scenario where cost-effectiveness and proven performance continue to outweigh environmental concerns, at least for the foreseeable future. However, this dominance is increasingly fragile, as regulatory pressures and consumer awareness grow. The shift toward more sustainable alternatives will continue to put pressure on the CCA market's growth potential, potentially leading to further market segmentation and geographical diversification.

While facing numerous challenges, the CCA market could experience limited growth through the development of innovative formulations aimed at minimizing arsenic leaching and improved disposal techniques. Focusing on niche applications requiring exceptional durability where cost remains a significant factor could also present opportunities for sustained, albeit limited, market growth. However, this requires a delicate balance between functionality and compliance with increasingly strict environmental regulations.

This report offers a detailed analysis of the global chromated copper arsenate market, providing insights into market trends, driving forces, challenges, key players, and future growth prospects. The study comprehensively covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a holistic perspective on the market's evolution. It provides valuable information for stakeholders involved in the production, distribution, and usage of CCA, along with projections that allow informed decision-making regarding future investments and strategies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lonza, Koppers, Viance, Goodfellow, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Chromated Copper Arsenate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chromated Copper Arsenate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.