1. What is the projected Compound Annual Growth Rate (CAGR) of the Chip Card Readers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chip Card Readers

Chip Card ReadersChip Card Readers by Type (Contact Type, Non Contact Type, World Chip Card Readers Production ), by Application (Small and Medium Enterprises (SMEs), Large Enterprises, World Chip Card Readers Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

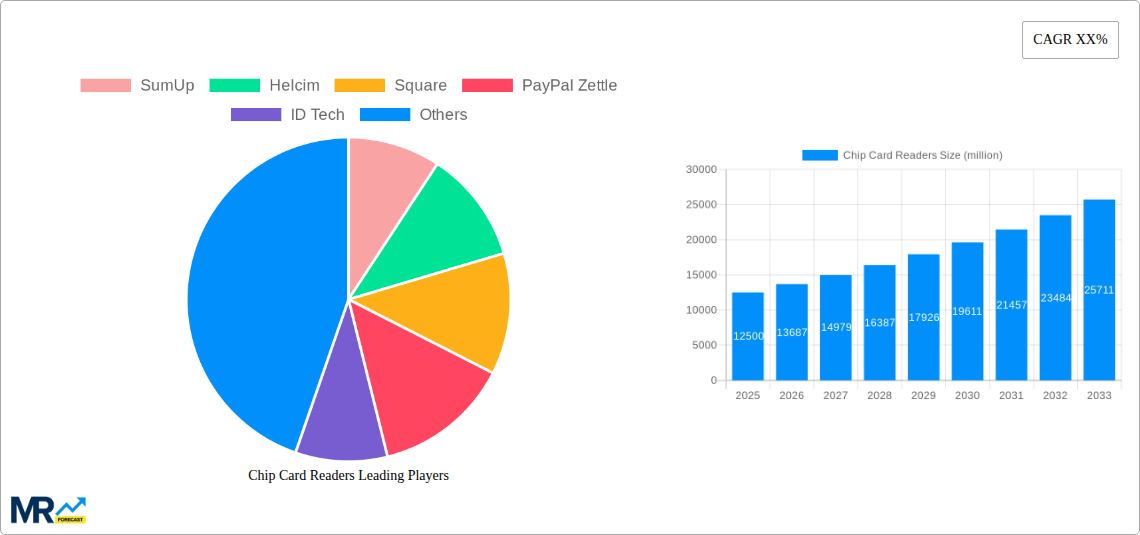

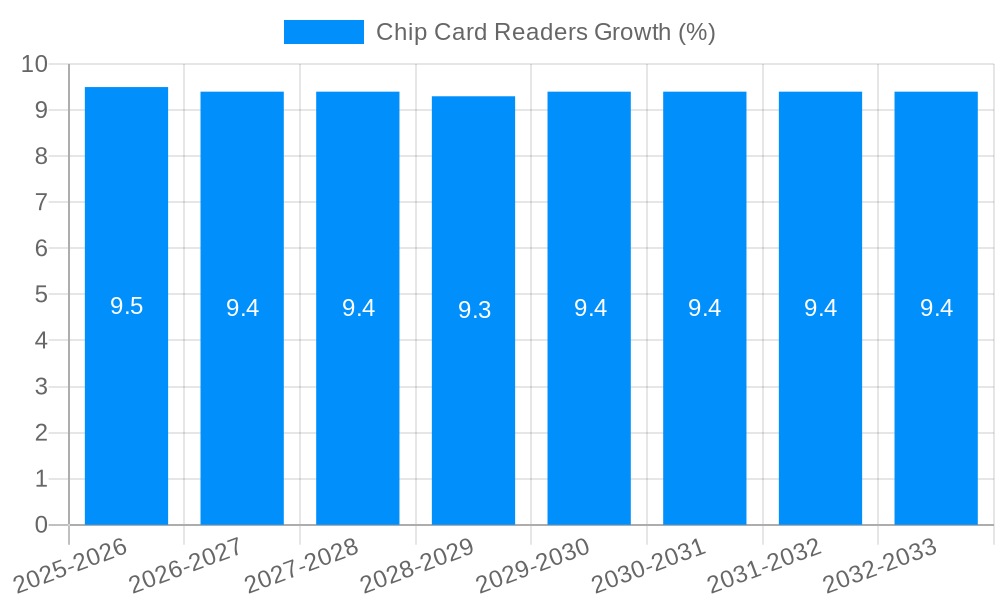

The global chip card reader market is poised for robust expansion, with an estimated market size of approximately $12,500 million in 2025, projected to grow at a compound annual growth rate (CAGR) of around 9.5% through 2033. This sustained growth is primarily fueled by the escalating adoption of secure payment technologies, driven by the imperative to combat card fraud and enhance transaction security. The increasing prevalence of EMV chip cards globally necessitates the widespread deployment of compatible readers across diverse business environments. Key market drivers include the ongoing digital transformation initiatives by businesses of all sizes, the growing demand for contactless payment solutions, and government regulations promoting secure transaction processing. The proliferation of small and medium-sized enterprises (SMEs), coupled with the continuous need for efficient payment infrastructure in large enterprises, further propels market demand. Innovations in reader technology, such as faster processing speeds, enhanced connectivity options, and integrated software solutions, are also contributing to market dynamism.

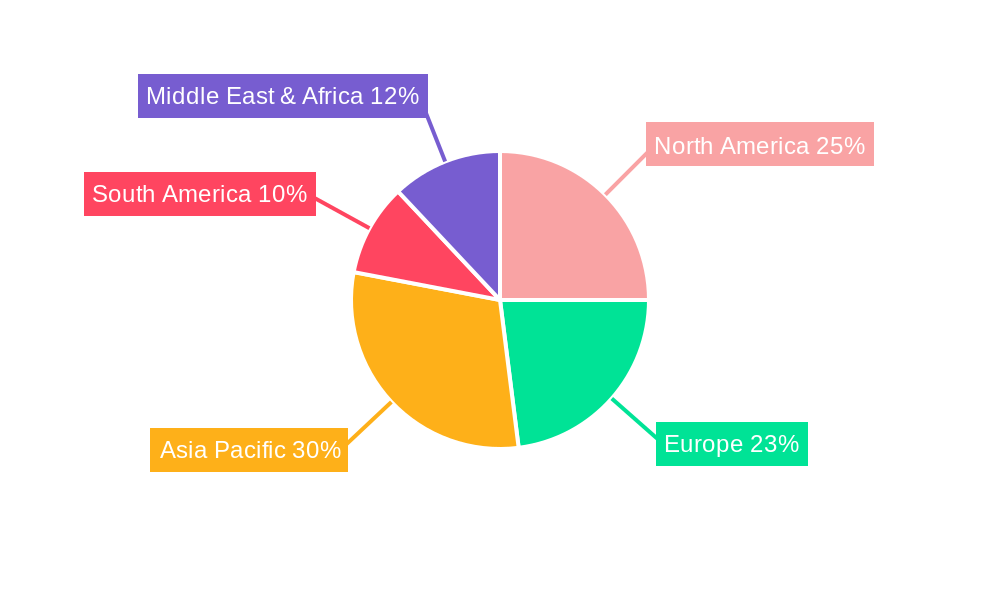

The chip card reader market is segmented into contact and non-contact types, with non-contact (contactless) readers experiencing a particularly significant surge in adoption due to convenience and speed, especially in high-traffic retail and transit environments. Geographically, Asia Pacific is emerging as a high-growth region, driven by rapid digitalization and increasing consumer spending power in countries like China and India. North America and Europe remain dominant markets due to mature payment infrastructures and strong consumer trust in chip card technology. However, the market faces certain restraints, including the initial cost of deployment for some businesses and the need for ongoing software updates and maintenance. Nevertheless, the overarching trend towards a cashless society and the continuous innovation in payment hardware and software are expected to overcome these challenges, ensuring a promising future for the chip card reader industry.

This comprehensive report delves into the dynamic global chip card reader market, providing in-depth analysis and future projections for the period spanning 2019 to 2033, with a focused base year of 2025. The study meticulously examines historical trends (2019-2024) and forecasts market evolution through 2033, offering a crucial understanding of this rapidly expanding sector. Our research encompasses a wide array of chip card reader types, including both Contact and Non-Contact solutions, and analyzes the global production landscape. Furthermore, the report scrutinizes the market’s application across diverse business segments, from Small and Medium Enterprises (SMEs) to Large Enterprises, while also considering the overarching "World Chip Card Readers Production" as a key segment. Industry developments and growth catalysts are thoroughly investigated to provide a holistic view of market drivers and potential impediments.

The global chip card reader market is experiencing a period of robust and sustained growth, propelled by several intersecting trends that are fundamentally reshaping transaction processing. A significant insight is the increasing ubiquity of contactless payment technologies, often referred to as NFC (Near Field Communication). This trend is not merely a preference but is rapidly becoming an expectation for consumers seeking faster, more convenient, and inherently more secure payment experiences. The widespread adoption of smartphones and smartwatches as payment devices, facilitated by chip card readers, is a major driver of this shift. Furthermore, the ongoing global transition away from magnetic stripe technology, which is inherently less secure and more susceptible to fraud, towards EMV chip technology is a foundational trend. This migration, mandated by financial institutions and security standards bodies, ensures that chip card readers are becoming indispensable for any business accepting card payments. The market is also witnessing a surge in the development of mPOS (mobile Point of Sale) solutions, where compact and portable chip card readers seamlessly integrate with smartphones and tablets. This democratization of payment acceptance empowers even the smallest businesses and independent contractors to process card payments efficiently and professionally, thereby expanding the market’s reach. The increasing demand for integrated payment solutions, where chip card readers are part of a larger POS system offering inventory management, customer relationship management, and analytics, is another key trend. This move towards holistic business management tools underscores the evolving role of chip card readers from simple transaction devices to integral components of a business’s operational infrastructure. The market is projected to witness production exceeding 500 million units annually by the estimated year of 2025, with continued growth expected.

Several powerful forces are collectively propelling the global chip card reader market forward. Foremost among these is the escalating global concern for payment security and the reduction of fraud. EMV chip technology inherently offers a higher level of security compared to older magnetic stripe technology, significantly reducing the risk of counterfeit card fraud. As consumers and businesses become more aware of these security advantages, the demand for chip-enabled payment devices, including readers, continues to climb. Another significant driver is the increasing adoption of digital payment methods across all demographics and business sizes. The convenience and speed of chip card transactions, especially contactless payments, are reshaping consumer behavior and creating an expectation for businesses to offer these options. Furthermore, the expanding reach of e-commerce and the rise of the gig economy have created a substantial need for mobile and versatile payment solutions. Chip card readers, particularly mPOS devices, are crucial in enabling small businesses, independent contractors, and service providers to accept payments anywhere, anytime, thereby fostering economic activity. The continuous innovation in payment hardware and software, including the development of more compact, feature-rich, and cost-effective chip card readers, also plays a pivotal role. Companies are investing heavily in research and development to offer readers that support various payment types, enhance user experience, and integrate with a wider ecosystem of business management tools, further stimulating market growth. The continued global rollout of EMV mandates by financial networks and regulatory bodies also acts as a persistent catalyst for adoption.

Despite the strong growth trajectory, the chip card reader market is not without its challenges and restraints. One of the primary hurdles is the initial cost of adoption for some businesses, particularly small enterprises that may have limited capital. While the price of chip card readers has decreased significantly over the years, the investment in new hardware, software integration, and potential terminal replacements can still be a barrier for some. Moreover, the rapid pace of technological advancement can lead to obsolescence, forcing businesses to upgrade their equipment more frequently than they might prefer, adding to the total cost of ownership. Another significant challenge is the ongoing threat of cyberattacks and data breaches. While chip technology enhances security, it does not eliminate all risks. Malicious actors are constantly developing new methods to compromise payment systems, requiring continuous investment in security updates, compliance, and employee training for businesses using chip card readers. The complexity of integrating new payment hardware and software with existing legacy systems can also pose a significant challenge for larger enterprises. Ensuring seamless compatibility and avoiding disruption to existing operations requires careful planning, skilled IT personnel, and potentially substantial integration costs. Furthermore, the market experiences intense competition, leading to price wars and pressure on profit margins for manufacturers and service providers. This competition, while beneficial for consumers, can restrain the profitability of individual players and necessitate significant investment in marketing and product differentiation. The fragmentation of the market with numerous players offering similar solutions also contributes to this competitive pressure.

The global chip card reader market is characterized by dynamic regional growth and segment dominance, with North America and the Asia Pacific regions projected to be key players in shaping the market landscape. The dominance of these regions is driven by a confluence of factors including strong economic activity, high levels of consumer adoption of digital payments, and proactive regulatory environments.

Within the Type segment, the Non-Contact Type chip card readers are poised for significant market leadership. This dominance is directly linked to the burgeoning consumer preference for contactless payment methods, fueled by convenience, speed, and enhanced hygiene. The widespread adoption of smartphones and wearables as payment devices, which heavily rely on NFC technology facilitated by non-contact readers, further solidifies this trend. The increasing deployment of these readers in high-traffic retail environments, public transportation, and food service establishments underscores their growing importance.

The Application segment of Small and Medium Enterprises (SMEs) is anticipated to exhibit substantial market share and rapid growth. This segment’s dominance is a testament to the increasing financial inclusion and empowerment of smaller businesses. The availability of affordable, portable, and user-friendly mPOS solutions, powered by chip card readers, allows SMEs to compete effectively with larger retailers by offering modern payment options. The need for flexible and scalable payment solutions to manage fluctuating transaction volumes and expand customer reach is a critical factor driving adoption among SMEs. Furthermore, government initiatives and financial institutions actively supporting SME growth through accessible payment technologies contribute to their significant market presence. The production of these readers is projected to exceed 300 million units in the SME segment alone by 2025.

The World Chip Card Readers Production segment itself is a critical indicator of the overall market health and is expected to witness substantial volume. The increasing demand across both developed and emerging economies for EMV-compliant terminals, coupled with the ongoing lifecycle of device replacements and upgrades, will ensure a consistent and growing demand for chip card readers globally. The Asia Pacific region, in particular, is expected to be a manufacturing powerhouse for these devices, driven by cost-effective production capabilities and a rapidly expanding domestic market. The sheer volume of units produced will be a significant contributor to the overall market value, with projections indicating a sustained increase in output to meet global demand. The interplay between these dominant regions and segments creates a robust and expanding market for chip card readers.

The chip card readers industry is energized by several key growth catalysts. The ongoing global EMV migration, driven by enhanced security mandates, continues to necessitate the replacement of older payment terminals, creating a sustained demand for chip-enabled readers. The rapid proliferation of mobile payment solutions, including contactless payments via smartphones and wearables, further fuels the need for compatible readers. Additionally, government initiatives promoting financial inclusion and digital transactions in emerging economies are opening up new markets and driving widespread adoption. The increasing integration of chip card readers with broader business management software, offering a comprehensive POS experience, also acts as a significant growth catalyst.

This report offers an exhaustive analysis of the global chip card reader market, meticulously covering every facet of its evolution and future potential. We delve into the intricate details of market dynamics, providing an in-depth understanding of the driving forces, inherent challenges, and critical growth catalysts that shape this sector. The report meticulously examines the production landscape, application across diverse business segments, and the nuanced differences between contact and non-contact reader technologies. With a detailed forecast period from 2025 to 2033, based on a thorough historical analysis from 2019-2024 and a firm base year of 2025, this research equips stakeholders with the strategic insights necessary to navigate this dynamic and essential market. The inclusion of key regional market analyses and a comprehensive overview of leading players further ensures that this report serves as an indispensable resource for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SumUp, Helcim, Square, PayPal Zettle, ID Tech, Ingenico, CLOVER, PAX, Verifone, Dejavoo, SwipeSimple, Toast Go, Magtek, Shopify POS, Plum, Advanced Card Systems, Singular Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Chip Card Readers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chip Card Readers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.