1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Cooking Wine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chinese Cooking Wine

Chinese Cooking WineChinese Cooking Wine by Application (Comercial Use, Home Use, World Chinese Cooking Wine Production ), by Type (Brewing Cooking Wine, Prepare Cooking Wine, World Chinese Cooking Wine Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

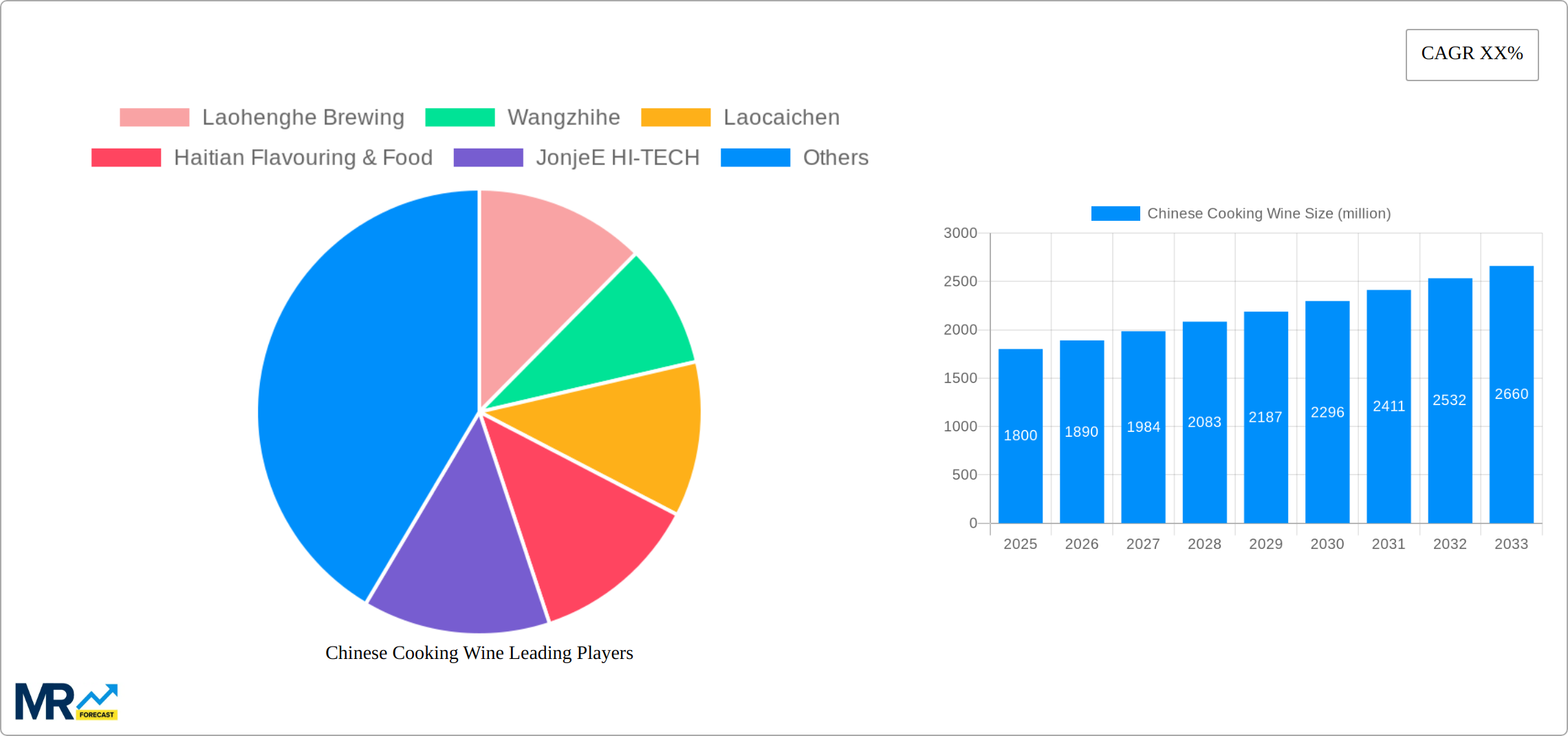

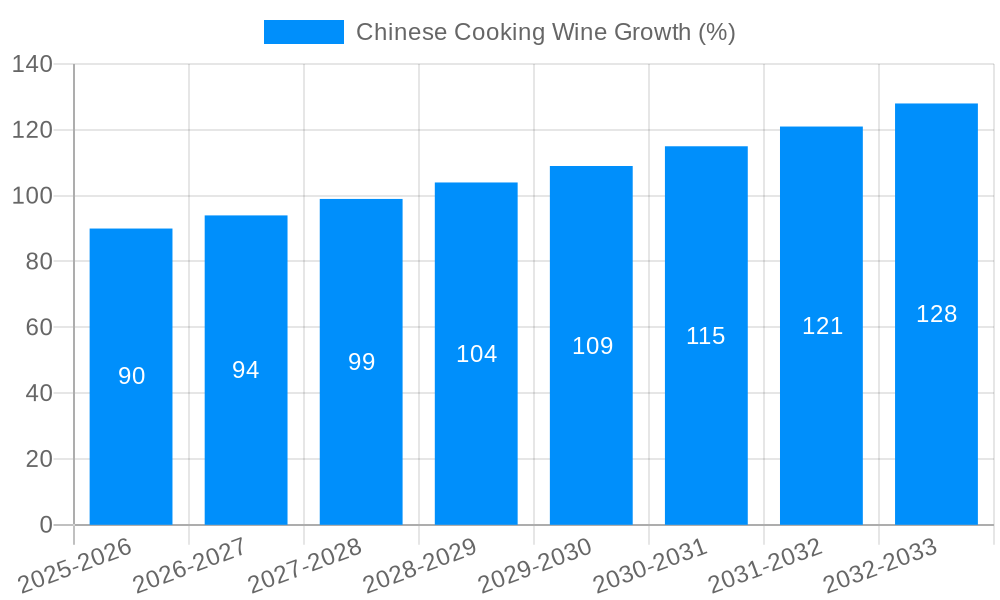

The Chinese cooking wine market, encompassing a diverse range of products from established brands like Laohenghe Brewing and Wangzhihe to newer players, presents a compelling investment opportunity. While precise market size figures for 2019-2024 are unavailable, a reasonable estimation, given the presence of numerous significant players and industry trends, would place the 2024 market value in the range of $1.5 to $2 billion USD. Assuming a conservative Compound Annual Growth Rate (CAGR) of 5% based on projected growth in the broader Chinese food and beverage sector, this market is anticipated to reach $2.3 to $3 billion by 2033. Key drivers include the rising popularity of Chinese cuisine globally, increasing demand for authentic flavor profiles in both domestic and international markets, and the growing preference for convenient, ready-to-use cooking ingredients among busy consumers. Trends point towards increased product diversification, with companies offering specialized cooking wines tailored to different regional cuisines and dietary preferences. Premiumization is another notable trend, with consumers increasingly willing to pay more for high-quality, organic, or traditionally-produced cooking wines. However, potential restraints include fluctuating raw material costs, stringent regulatory requirements, and intensifying competition, particularly from smaller, regional brands. Strategic partnerships, robust product innovation, and targeted marketing efforts will be critical for companies seeking sustained success within this dynamic market.

The segmentation of the Chinese cooking wine market is likely multifaceted, potentially categorized by product type (e.g., rice wine, yellow wine, etc.), price point (premium, mid-range, budget), distribution channel (online, offline retailers, restaurants), and geographical region. The regional data is unavailable but it is highly probable that the market is concentrated in major population centers in China but with growth potential in international markets that are increasingly exposed to Chinese cuisine. The existing competitive landscape shows a mix of large, established producers and smaller, regional players, suggesting ample opportunities for both consolidation and niche market penetration. Future growth will depend significantly on the success of companies in adapting to evolving consumer preferences and leveraging technological advancements in production and distribution. The forecast period (2025-2033) presents opportunities for substantial growth, providing ample incentive for businesses to invest in this vibrant and expanding sector.

The Chinese cooking wine market, valued at XXX million units in 2025, is experiencing robust growth, projected to reach XXX million units by 2033. This expansion is fueled by several key factors. Firstly, the increasing popularity of Chinese cuisine globally is driving demand for authentic ingredients, with cooking wine playing a crucial role in achieving the desired flavors and aromas. Secondly, the rising disposable incomes in China and other Asian countries are enabling consumers to spend more on premium and specialty food items, including higher-quality cooking wines. The market also witnesses a shift towards convenience. Ready-to-use, pre-packaged cooking wines are gaining traction, appealing to busy consumers who prioritize ease and speed in meal preparation. Furthermore, the growing awareness of the health benefits associated with moderate consumption of alcohol, coupled with the versatile culinary applications of cooking wine, are further boosting its consumption. Finally, innovative product development, such as the introduction of flavored cooking wines and organic options, caters to evolving consumer preferences and expands the market appeal. The historical period (2019-2024) demonstrated a steady growth trajectory, establishing a solid foundation for the anticipated expansion during the forecast period (2025-2033). The estimated year (2025) serves as a benchmark to analyze market performance and project future trends. This report, covering the study period of 2019-2033, offers in-depth insights into these trends and their implications for market players.

Several factors are synergistically driving the growth of the Chinese cooking wine market. The burgeoning global demand for authentic Chinese cuisine is a primary catalyst. Restaurants and home cooks worldwide are increasingly incorporating traditional Chinese cooking methods, significantly boosting the demand for specialized ingredients, including cooking wine. Simultaneously, the rising disposable incomes within China and across Asia are empowering consumers to explore premium and specialized food options. This translates into a willingness to invest in higher-quality cooking wines that enhance the taste and aroma of their dishes. Furthermore, the convenience factor plays a significant role. The increasing popularity of ready-to-use, pre-packaged cooking wines caters to the busy lifestyles of modern consumers, simplifying the cooking process without compromising on taste. Finally, innovative product development strategies, encompassing flavored varieties and organic options, are widening the market's appeal and attracting new consumer segments. These combined forces are creating a highly favorable environment for sustained growth in the Chinese cooking wine market throughout the forecast period.

Despite the promising outlook, several challenges and restraints could potentially impede the growth of the Chinese cooking wine market. Firstly, intense competition among numerous established and emerging players can lead to price wars and reduced profit margins. This requires companies to constantly innovate and differentiate their products to maintain competitiveness. Secondly, fluctuating raw material prices, particularly grains and other agricultural inputs, could negatively affect production costs and profitability. Effective supply chain management and strategic sourcing become crucial in mitigating these risks. Thirdly, stringent regulatory requirements regarding alcohol content and labeling in various regions can present compliance challenges for companies operating across multiple markets. Finally, changing consumer preferences and health consciousness may lead to reduced alcohol consumption overall, posing a threat to the market's long-term growth. Addressing these challenges requires a multi-pronged approach focusing on product diversification, cost optimization, and adaptation to evolving regulatory landscapes and consumer preferences.

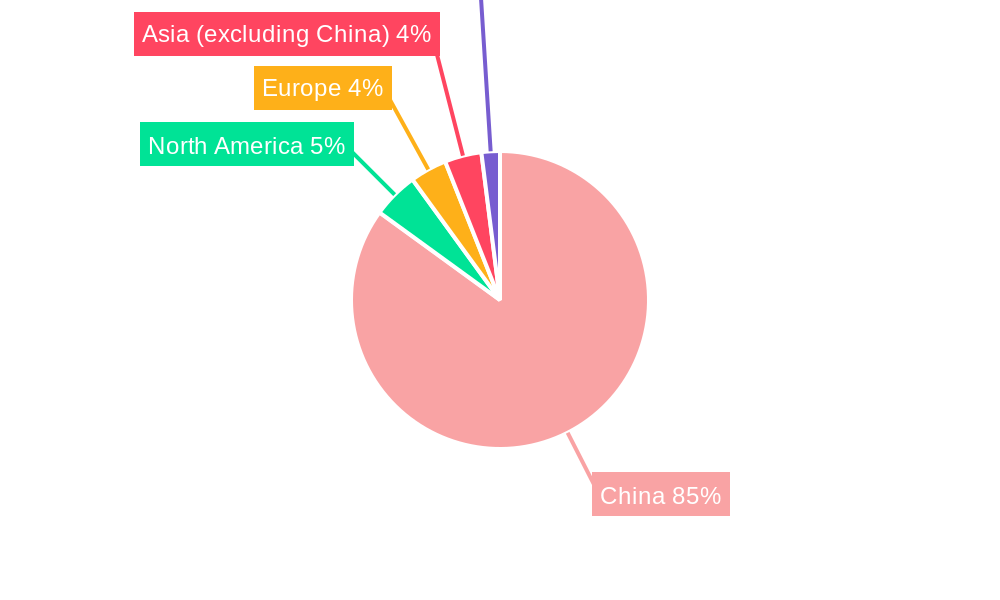

Key Regions: Urban centers in China, particularly in coastal provinces with a strong culinary tradition and higher disposable incomes, are anticipated to dominate the market. This includes regions like Guangdong, Jiangsu, and Zhejiang. Expanding into international markets with a significant Chinese diaspora or a growing interest in Chinese cuisine (e.g., North America, Southeast Asia, Europe) will be a key strategic move for leading players.

Dominant Segment: The segment of ready-to-use, pre-packaged cooking wines is poised for significant growth, driven by consumer preference for convenience. Premium and organic cooking wines represent another high-growth segment catering to consumers seeking higher-quality and healthier options. These segments are expected to show higher growth rates compared to traditional, bulk cooking wine sales.

The dominance of urban Chinese markets stems from higher purchasing power, greater exposure to diverse culinary trends, and a more established restaurant and food service sector. International markets offer promising untapped potential, however, require careful market entry strategies, localized product adaptation (e.g., accommodating different tastes and preferences), and effective distribution networks. Within the market segmentation, the convenience offered by ready-to-use options provides a clear advantage in terms of both sales volume and potential for higher margins due to reduced production and packaging costs. The rise of health-conscious consumers also positions premium and organic offerings as a significant growth driver in the coming years.

The Chinese cooking wine market is poised for substantial growth, fueled by several key catalysts. The rising popularity of Chinese cuisine globally, coupled with increasing disposable incomes in key markets, significantly boosts demand. The convenience offered by ready-to-use packaging also contributes greatly to market expansion. Furthermore, innovations like flavored and organic options cater to evolving consumer preferences, attracting new customer segments and driving market diversification. These combined factors create a powerful synergy that is accelerating market growth.

This report offers a comprehensive overview of the Chinese cooking wine market, providing detailed insights into market trends, drivers, challenges, key players, and significant developments. Its comprehensive nature, covering both historical and projected data, makes it an invaluable resource for industry stakeholders, including existing players, potential investors, and market analysts seeking a thorough understanding of this dynamic market. The report's detailed analysis allows for informed decision-making and strategic planning within the competitive landscape of the Chinese cooking wine sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Laohenghe Brewing, Wangzhihe, Laocaichen, Haitian Flavouring & Food, JonjeE HI-TECH, Qianhe Condiment and Food, Hengshun Vinegar, Tongkang Liquor, Luhua Group, Dingfeng Brewery, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Chinese Cooking Wine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chinese Cooking Wine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.