1. What is the projected Compound Annual Growth Rate (CAGR) of the Child Life Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Child Life Insurance

Child Life InsuranceChild Life Insurance by Type (/> Term Child Life Insurance, Permanent Child Life Insurance), by Application (/> Below 10 Years Old, 10~18 Years Old), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

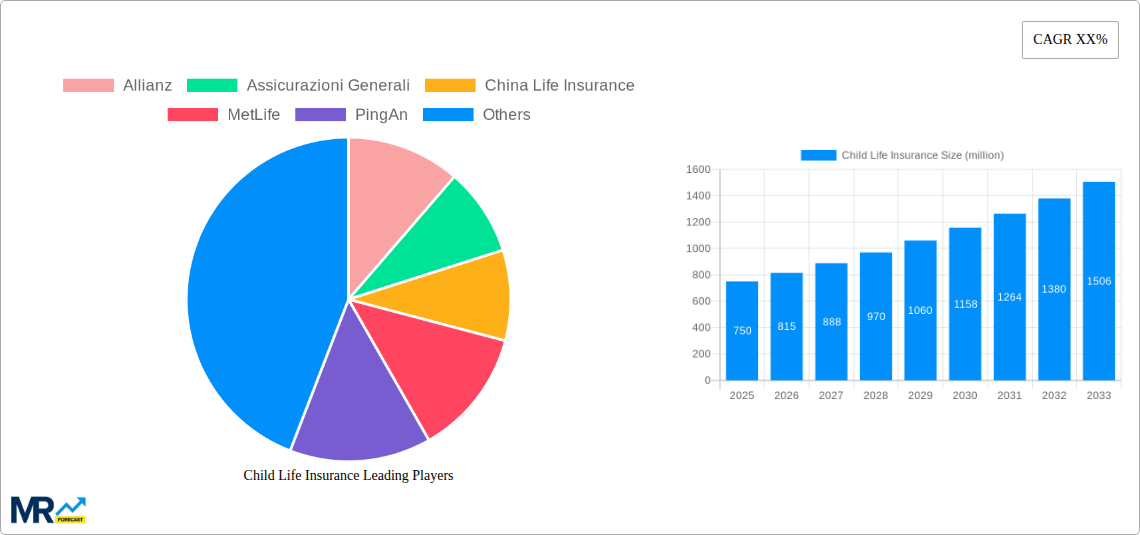

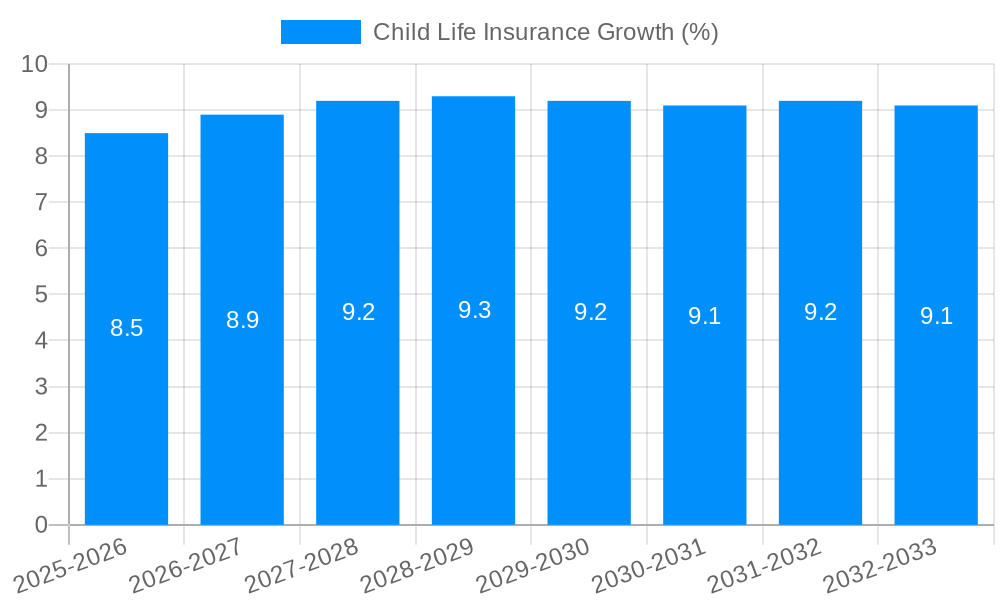

The global Child Life Insurance market is experiencing robust expansion, projected to reach a significant market size of approximately $750 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025-2033. This substantial growth is primarily fueled by increasing parental awareness regarding financial security for their children's future, coupled with a growing emphasis on long-term financial planning. The rising disposable incomes in emerging economies are also playing a crucial role, enabling more families to invest in life insurance products for their children. Furthermore, a proactive approach to securing funds for future education, marriage, and unforeseen eventualities is driving demand. The market is broadly segmented into Term Child Life Insurance and Permanent Child Life Insurance, with the former showing greater adoption due to its affordability and focused coverage. The application segment is also showing strong traction, with a significant demand observed for children below 10 years old and a steady increase in the 10-18 years old bracket as families plan for higher education expenses.

Key drivers underpinning this market's ascent include enhanced product offerings, innovative features tailored for child protection, and a burgeoning digital landscape that facilitates easier access to information and policy purchases. Insurance providers are actively developing child-centric policies that offer attractive benefits and flexible premium options, thereby widening their customer base. Conversely, certain factors may pose challenges to sustained growth. Economic uncertainties and fluctuating inflation rates can impact affordability for some households, potentially leading to a slowdown in new policy acquisitions. Moreover, a lack of comprehensive understanding of life insurance benefits among a segment of the population, particularly in rural or less developed regions, could limit market penetration. Despite these potential restraints, the overarching trend points towards a positive and sustained growth trajectory for the Child Life Insurance market, driven by a fundamental human desire to safeguard a child's financial future.

This report offers an in-depth analysis of the global Child Life Insurance market, projecting a robust growth trajectory fueled by increasing parental awareness and evolving financial planning strategies. The study encompasses a comprehensive historical analysis from 2019 to 2024, with a base year of 2025, and extends its forecast through 2033. We delve into key market insights, identifying critical trends, driving forces, and inherent challenges that shape this dynamic sector. The report leverages statistical data in the million-unit denomination to quantify market size and predict future expansion. With a focus on segments like Term Child Life Insurance and Permanent Child Life Insurance, and applications spanning Below 10 Years Old and 10-18 Years Old, we provide actionable intelligence for stakeholders. Furthermore, the report scrutinizes significant industry developments and highlights the leading players within this vital segment.

XXX The global Child Life Insurance market is experiencing a significant paradigm shift, moving beyond traditional protection to encompass multifaceted financial planning tools for future generations. The overarching trend indicates a burgeoning demand for policies that not only offer financial security in unforeseen circumstances but also serve as nascent investment vehicles, particularly for longer-term goals like education and initial capital. During the historical period of 2019-2024, the market witnessed steady growth, largely driven by an increasing number of dual-income households and a heightened awareness among millennials and Gen Z parents regarding the importance of early financial planning. This demographic, often characterized by greater financial literacy and a proactive approach to safeguarding their children's futures, is contributing significantly to market expansion. The Estimated Year of 2025 is projected to see a market valuation exceeding \$50,000 million, a testament to the growing acceptance and adoption of child life insurance products.

Looking ahead, the Forecast Period of 2025-2033 is expected to witness accelerated growth, potentially reaching well over \$100,000 million by 2033. This expansion will be propelled by several interconnected trends. Firstly, there's a discernible shift towards more customizable and flexible policy structures. Parents are no longer seeking one-size-fits-all solutions; instead, they are demanding products that can adapt to their evolving financial situations and their children's changing needs, such as varying education costs or the potential for early entrepreneurship. Secondly, the integration of digital platforms for policy application, management, and even customer service is becoming a critical differentiator. Insurers that offer seamless online experiences and intuitive mobile applications are likely to capture a larger market share. Thirdly, there's a growing emphasis on the "living benefits" aspect of permanent child life insurance policies. These policies, while providing death benefit protection, are increasingly being marketed for their cash value accumulation features, which can be leveraged for educational expenses, emergency funds, or even as seed capital for future ventures. This dual functionality is proving highly attractive to parents who view these policies as a strategic component of their overall wealth management strategy. The penetration rate, although varying by region, is expected to rise considerably, especially in emerging economies where the concept of long-term financial security for children is gaining traction. The market is also seeing a rise in riders and add-ons that cater to specific needs, such as critical illness coverage for the child or waiver of premium benefits in case of parental disability, further enhancing the perceived value of these insurance products.

The global Child Life Insurance market's robust expansion is propelled by a confluence of compelling factors. Paramount among these is the escalating parental responsibility and a heightened awareness of the financial implications associated with a child's future, particularly concerning education and unforeseen life events. In an era where higher education costs are continuously escalating, parents are actively seeking financial instruments that can secure their children's academic aspirations. Child life insurance, especially permanent policies with cash value accumulation features, offers a structured savings mechanism that can grow over time, providing a substantial corpus for tuition fees, living expenses, and other educational necessities. This proactive approach to future planning is a primary driver of market growth. Furthermore, the increasing complexity of family structures and the growing prevalence of single-parent households also contribute to the demand for reliable financial safety nets.

Another significant propellant is the evolving perception of life insurance from a mere death benefit product to a comprehensive financial planning tool. Insurers are increasingly innovating to offer policies that provide not only protection but also wealth creation and accumulation opportunities. The introduction of riders and add-ons, such as critical illness cover for the child, disability benefits for the parent, and guaranteed insurability options, further enhances the attractiveness and perceived value of these policies. These features provide a holistic approach to safeguarding a child's well-being. The rise of digital channels for policy acquisition and management has also played a crucial role. Simplified application processes, accessible online portals, and mobile-friendly platforms are making it easier and more convenient for parents to research, purchase, and manage child life insurance policies, thereby expanding market reach and accessibility, particularly among younger, tech-savvy generations.

Despite the promising growth trajectory, the Child Life Insurance market is not without its challenges and restraints. A primary hurdle remains the perceived complexity and cost of permanent child life insurance policies. While offering long-term benefits, these policies often come with higher initial premiums compared to term life insurance, which can be a deterrent for some parents, especially those with tighter budgets. The abstract nature of long-term financial planning, coupled with the immediate financial pressures faced by many families, can lead to a prioritization of short-term needs over long-term insurance solutions. This can manifest as a reluctance to commit to policies that require sustained premium payments over many years, particularly if the tangible benefits are not immediately apparent.

Another significant restraint is the limited financial literacy and awareness regarding the nuances of child life insurance among a substantial portion of the population. Many parents may not fully understand the different types of policies available, the benefits of cash value accumulation, or the long-term implications of delaying coverage. This lack of comprehensive understanding can lead to the selection of suboptimal products or a complete avoidance of purchasing child life insurance altogether. The competitive landscape, while fostering innovation, also presents challenges. The sheer number of options and the intricate product features can be overwhelming for consumers, making it difficult to compare and choose the most suitable policy. Furthermore, economic downturns and periods of financial uncertainty can significantly impact disposable income, leading families to re-evaluate their spending on insurance products. Regulatory hurdles and varying insurance laws across different jurisdictions can also add to the complexity for global insurers and can influence market penetration. The ongoing need for trust and transparency in the insurance sector is paramount, and any instances of mis-selling or lack of clear communication can erode consumer confidence, acting as a considerable restraint.

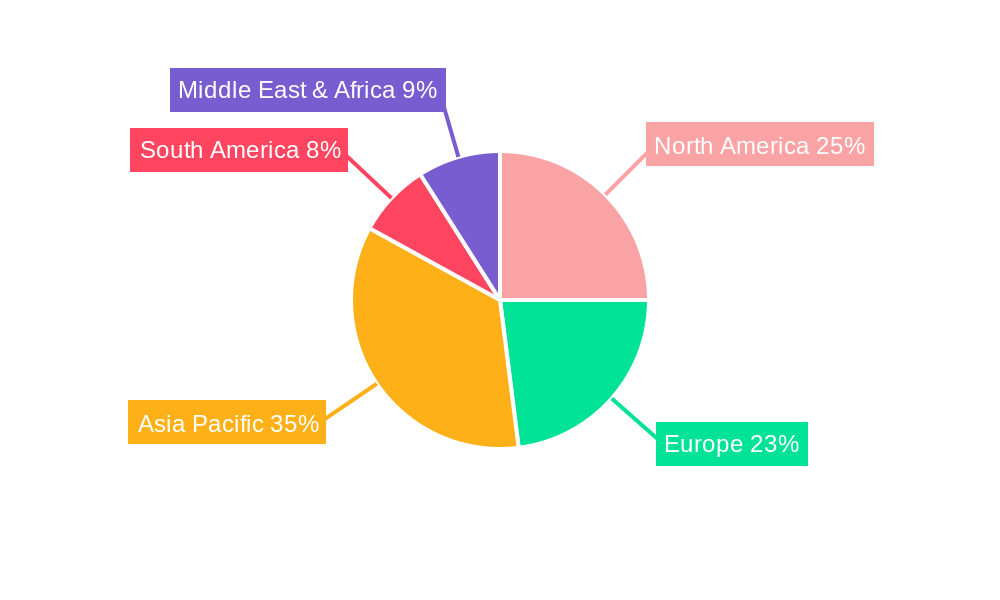

The global Child Life Insurance market is poised for significant growth, with certain regions and segments demonstrating a clear dominance and potential for future expansion.

Key Dominating Segments:

Permanent Child Life Insurance: This segment is expected to witness substantial growth and command a significant market share.

Application: Below 10 Years Old: This age demographic represents a critical and burgeoning segment for child life insurance.

Key Dominating Regions/Countries:

Asia-Pacific: This region is projected to be a significant growth engine for the Child Life Insurance market.

North America: This region, led by the United States, continues to be a mature yet strong market for Child Life Insurance.

The Child Life Insurance industry is experiencing significant growth catalysts, primarily driven by an increasing global awareness of long-term financial planning and the imperative to secure children's futures. The escalating costs of higher education worldwide are prompting parents to seek proactive solutions, with child life insurance, particularly permanent policies offering cash value accumulation, emerging as a favored instrument. Furthermore, a growing emphasis on financial literacy and the desire to provide a financial safety net against unforeseen events are encouraging more parents to invest in these policies at an early age, thereby locking in lower premiums and guaranteed insurability. The expansion of digital channels for policy acquisition and management is also democratizing access to these products, making them more convenient and appealing to a wider demographic.

This comprehensive report provides an in-depth analysis of the global Child Life Insurance market, offering valuable insights for industry stakeholders. It meticulously examines market trends, driving forces, and challenges, leveraging data in the million-unit denomination for quantitative analysis. The report delves into the dominance of key segments like Term Child Life Insurance and Permanent Child Life Insurance, and applications such as Below 10 Years Old and 10-18 Years Old, along with identifying leading regions. With a study period spanning 2019-2033, a Base Year of 2025, and projections extending to 2033, it offers a forward-looking perspective crucial for strategic decision-making. The report also highlights significant industry developments and profiles leading players, providing a holistic understanding of this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz, Assicurazioni Generali, China Life Insurance, MetLife, PingAn, AXA, Sumitomo Life Insurance, Aegon, Dai-ichi Mutual Life Insurance, CPIC, Aviva, Munich Re Group, Zurich Financial Services, Nippon Life Insurance, Gerber Life Insurance, AIG.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Child Life Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Child Life Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.