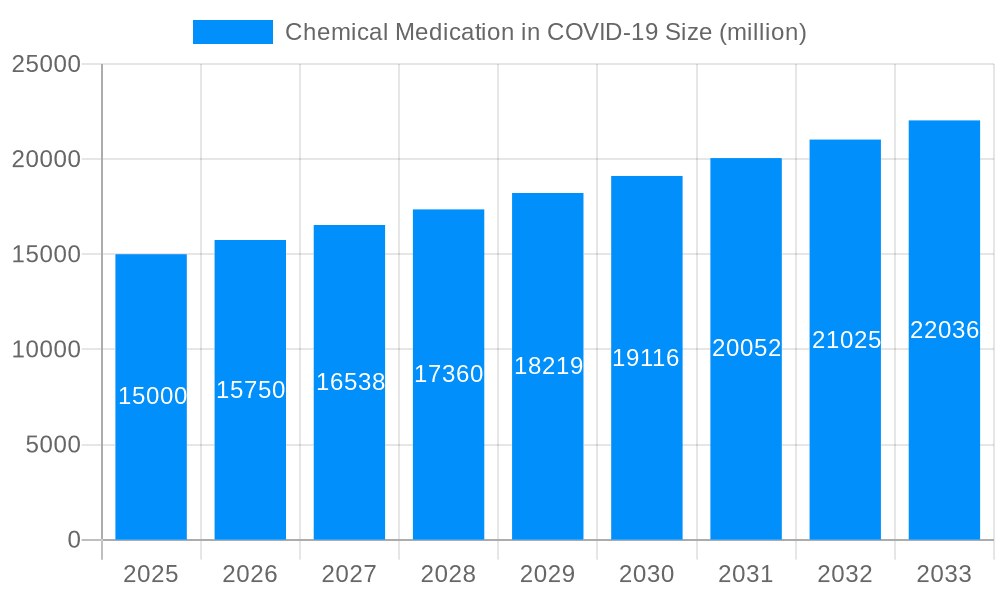

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemical Medication in COVID-19?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Chemical Medication in COVID-19

Chemical Medication in COVID-19Chemical Medication in COVID-19 by Type (Remedsivir, Ardidol, Favipivir, Lopinavir/ritonavir (LPV/r), Chloroquine, Others), by Application (COVID-19, Influenza, Malaria, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

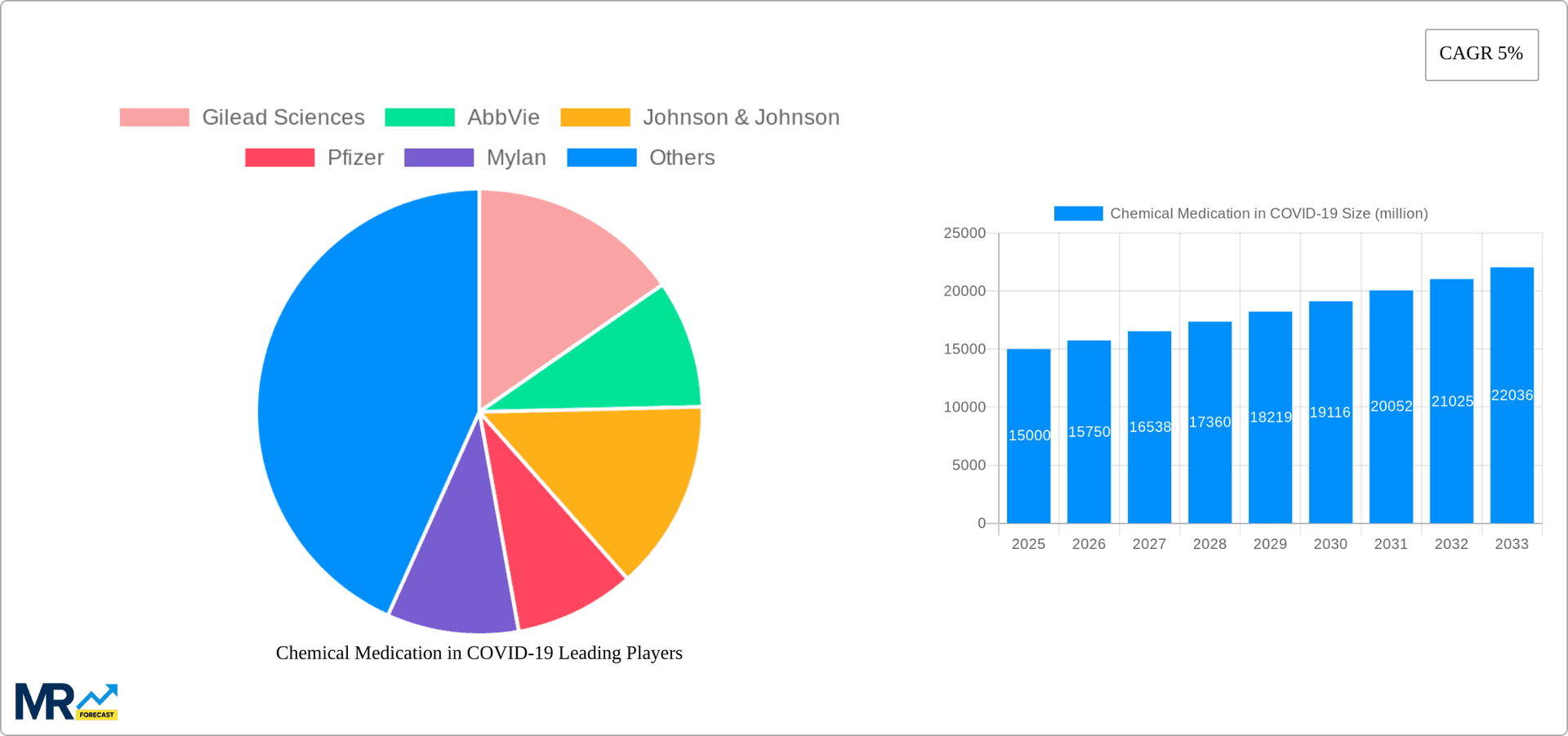

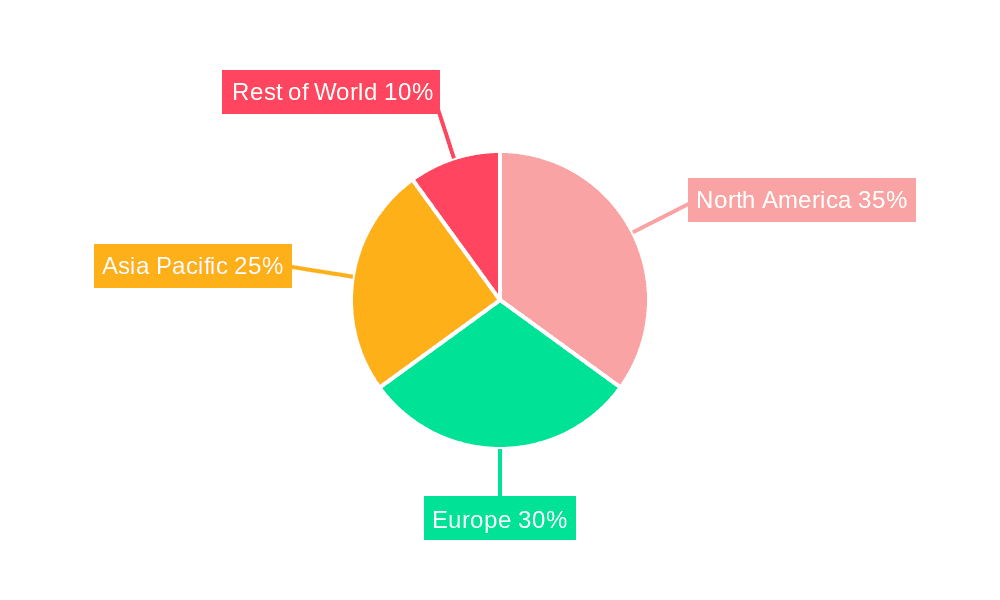

The global market for chemical medications used in the treatment of COVID-19, influenza, and malaria experienced significant growth during the period 2019-2024, driven primarily by the COVID-19 pandemic. While the initial surge in demand tapered off post-pandemic, the market continues to exhibit moderate growth, projected at a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. This sustained growth is fueled by the ongoing need for effective antiviral treatments for influenza and the persistent threat of emerging infectious diseases. The market is segmented by medication type (Remdesivir, Arbidol, Favipiravir, Lopinavir/ritonavir, Chloroquine, and others) and application (COVID-19, Influenza, Malaria, and others). Key players like Gilead Sciences, AbbVie, Johnson & Johnson, Pfizer, and numerous Chinese pharmaceutical companies dominate the market, showcasing the global nature of pharmaceutical development and distribution. Regional variations in market share reflect disparities in healthcare infrastructure and disease prevalence, with North America and Europe holding significant shares due to higher per capita healthcare expenditure and robust pharmaceutical markets. However, the Asia-Pacific region is anticipated to witness considerable growth due to increasing healthcare investments and a large population base.

The market's future trajectory will likely depend on several factors, including the emergence of new viral strains requiring updated treatments, the continued development of more effective and safer antiviral drugs, and government regulations impacting drug pricing and accessibility. The sustained demand for influenza treatments, along with the ongoing need for malaria control measures, will contribute to the market's steady expansion. Furthermore, the increasing prevalence of antibiotic resistance might lead to a greater reliance on antiviral medications, thereby positively influencing market growth. The competitive landscape is dynamic, with established pharmaceutical giants and emerging players continuously vying for market share through research and development, strategic partnerships, and mergers and acquisitions.

The chemical medication market for COVID-19 experienced explosive growth during the 2019-2024 historical period, driven by the unprecedented global pandemic. While the initial surge in demand for treatments like Remdesivir and chloroquine saw a rapid increase in production and sales reaching several billion USD, the market dynamics have shifted considerably. The introduction of effective vaccines and the development of improved treatment protocols have led to a decrease in the overall demand for some chemical medications specifically targeting COVID-19. However, the market continues to evolve. The ongoing need for treatments for long COVID and the potential for future outbreaks or pandemics ensures continued interest in antiviral and anti-inflammatory medications. The forecast period (2025-2033) anticipates a more stable yet significant market, driven by a combination of factors including the ongoing management of long COVID, the potential for new variants requiring updated treatments, and the broader application of some antiviral medications for influenza and other respiratory illnesses. The market value is projected to be in the tens of billions of USD range by 2033, with significant regional variations. This is a shift from the peak years of the initial pandemic response where the focus was almost entirely on COVID-19 specific treatments. The market is now diversifying, driven by the need to adapt to changing circumstances and ensure preparedness for future health crises. Market segmentation by drug type (Remdesivir, Favipiravir, etc.) and application (COVID-19, Influenza, etc.) continues to be relevant for understanding this dynamic landscape. Growth in certain segments will be higher than others, creating diverse opportunities within the broader market. The overall picture shows a market transition from emergency response to more strategic long-term preparedness and management of viral infections.

Several factors propelled the chemical medication market for COVID-19. The most significant was the sheer scale of the pandemic itself. Millions of infections globally created an urgent and massive demand for effective treatments. The initial lack of specific antiviral therapies further exacerbated the need, leading to rapid research, development, and deployment of existing medications with potential antiviral properties, like Remdesivir and Lopinavir/ritonavir. Government initiatives, including emergency use authorizations and large-scale procurement of medications, played a vital role in supporting market growth. Significant investments in research and development by pharmaceutical companies accelerated the pace of innovation. Furthermore, the global collaboration between scientists, researchers, and healthcare providers facilitated the rapid sharing of knowledge and data, leading to faster progress in treatment development and deployment. The potential for future outbreaks and the need for a robust response infrastructure continued to drive the market. This ensured ongoing demand for antiviral medications with a broad spectrum of activity and the development of newer, potentially more effective treatments. The market is not just driven by the pandemic's immediate impact but also by a long-term focus on improving pandemic preparedness, thus ensuring continued, although possibly slower growth.

Despite the significant growth, the chemical medication market for COVID-19 faced various challenges. The rapid development and deployment of vaccines significantly reduced the demand for some antiviral treatments. The emergence of new variants presented an ongoing challenge, requiring continuous research and development to adapt treatments to remain effective. Supply chain disruptions and manufacturing limitations impacted the availability of certain drugs, especially during the initial stages of the pandemic. Regulatory hurdles, including the need for accelerated approvals, presented complexity for manufacturers. Concerns regarding drug safety, efficacy, and potential side effects led to uncertainties and affected market confidence in certain treatments. The need for continuous monitoring and evaluation of treatment efficacy posed an ongoing challenge. The high cost of some treatments created access barriers, particularly in low- and middle-income countries. Finally, the fluctuating demand based on pandemic waves and the changing epidemiology of COVID-19 created unpredictable market conditions for manufacturers and distributors. These various challenges and constraints required agile adaptation and strategic planning to navigate the complexities of the market.

The COVID-19 pandemic impacted the global chemical medication market significantly, but the distribution of this impact was uneven. Analyzing market dominance requires looking at both geographical regions and specific drug types.

Regional Dominance: Initially, North America and Europe showed a higher demand for chemical medications due to the high infection rates and established healthcare infrastructure. However, as the pandemic spread globally, regions like Asia (specifically India and China due to large-scale manufacturing capabilities), and parts of South America saw significant increases in demand and production. While the initial focus was on treating severe cases in wealthier nations, the long-term market may see greater growth in regions with substantial populations and higher incidences of related infections such as Influenza.

Segment Dominance: Initially, Remdesivir held a prominent position. However, the market share dynamics shifted as other treatments emerged and vaccine uptake increased. The "Others" segment, encompassing various repurposed drugs and emerging antivirals, gained significant traction. This segment's potential for future growth is substantial, driven by continuous research and development aimed at improving the treatment of viral infections, including COVID-19. The application segment of the market focusing on broad-spectrum antiviral activity rather than purely COVID-19 treatment is particularly promising for long-term growth, given the ongoing need for treating influenza and other viral respiratory infections. The potential expansion of these medications to other applications beyond COVID-19 and influenza adds complexity and further opportunity to the "Others" segments.

In summary: While initial dominance belonged to certain regions and specific drugs, the long-term market will likely be characterized by broader geographic distribution and a diversification in terms of drug types, as the focus shifts towards broader applications and long-term preparedness for future pandemic threats.

The growth of the chemical medication market for COVID-19 and related viral infections is primarily catalyzed by ongoing research and development efforts focusing on improved treatment efficacy and broader applications. The increasing prevalence of drug-resistant viral strains further drives this need for continuous innovation. Governmental support for research and the potential for large-scale procurement contracts provide significant incentives for pharmaceutical companies to invest in this area. The long-term consequences of COVID-19, particularly long COVID, create a sustained demand for treatments addressing lingering symptoms.

This report provides a detailed analysis of the chemical medication market for COVID-19 and related viral infections, covering the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033). The report analyzes market trends, driving forces, challenges, key players, and significant developments, offering valuable insights for stakeholders involved in this rapidly evolving market. The study period covers both the peak demand period and the transition to long-term management, offering a complete picture of this critical sector of the healthcare industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Gilead Sciences, AbbVie, Johnson & Johnson, Pfizer, Mylan, Bayer, Zhejiang Hisun, CSPC Pharmaceutical Group, Reyoung Pharmaceutical, Sihuan Pharmaceutical, Hikma Pharmaceuticals, Rising Pharmaceutical, Sun Pharma, Shanghai Pharma, Guangzhou Baiyunshan Guanghua Pharmaceutical, KPC Group, Jinghua Pharmaceutical Group, Zhongsheng Pharma, North China Pharmaceutical Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Chemical Medication in COVID-19," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chemical Medication in COVID-19, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.