1. What is the projected Compound Annual Growth Rate (CAGR) of the Ceramic Fiber Textiles?

The projected CAGR is approximately 9.12%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ceramic Fiber Textiles

Ceramic Fiber TextilesCeramic Fiber Textiles by Application (Foundries, Refineries, Power Plants, Others), by Type (Ceramic Fiber Cloth, Tape, and Sleeving, Round and Square Ceramic Fiber Braid, 3-Ply Twisted Ceramic Fiber Rope, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

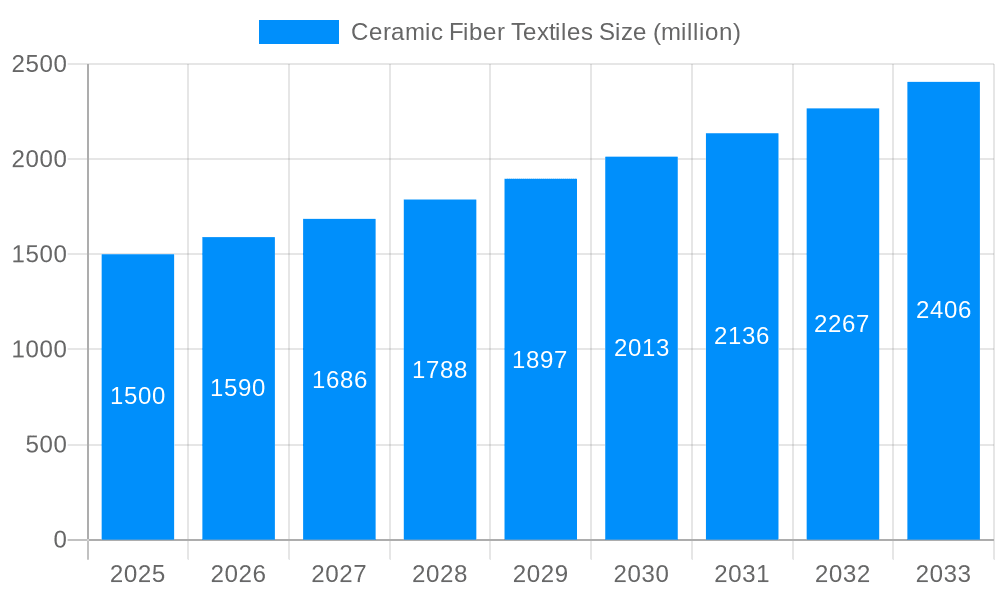

The global Ceramic Fiber Textiles market is poised for substantial expansion, projected to reach a market size of USD 13.62 billion by the estimated year of 2025. This growth trajectory is fueled by a robust Compound Annual Growth Rate (CAGR) of 9.12% throughout the forecast period of 2025-2033. Ceramic fiber textiles are indispensable in high-temperature applications due to their exceptional thermal insulation, chemical resistance, and lightweight properties. Key drivers propelling this market forward include the increasing demand for energy-efficient solutions across industries, stringent environmental regulations mandating improved thermal management, and the continuous technological advancements in ceramic fiber production yielding superior performance characteristics. Foundries, refineries, and power plants represent significant application segments, leveraging these textiles to enhance operational efficiency, reduce energy consumption, and ensure worker safety in extreme thermal environments. The Asia Pacific region, particularly China and India, is emerging as a dominant force due to rapid industrialization and a burgeoning manufacturing sector.

The market's segmentation into various product types, such as Ceramic Fiber Cloth, Tape, and Sleeving, Round and Square Ceramic Fiber Braid, and 3-Ply Twisted Ceramic Fiber Rope, caters to a diverse range of specific industrial needs. While the market benefits from strong demand drivers, it faces certain restraints. The relatively high initial cost of ceramic fiber textiles compared to traditional insulation materials can be a limiting factor for smaller enterprises. Furthermore, the availability of alternative insulation materials and the complexities associated with installation and maintenance in certain applications can pose challenges. However, ongoing research and development focused on cost reduction and enhanced product functionalities, alongside growing awareness of the long-term economic and environmental benefits of using ceramic fiber textiles, are expected to mitigate these restraints and sustain the market's upward momentum. Leading companies like 3M, Morgan Thermal Ceramics, and Unifrax are actively investing in innovation and expanding their global presence to capitalize on this expanding market opportunity.

This report offers an in-depth analysis of the global Ceramic Fiber Textiles market, providing a comprehensive overview of its current landscape and future trajectory. The study encompasses a Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year also of 2025, followed by a detailed Forecast Period from 2025-2033, building upon insights from the Historical Period of 2019-2024. The market is projected to witness substantial growth, with valuations expected to reach tens of billions of dollars within the forecast period.

The global Ceramic Fiber Textiles market is poised for remarkable expansion, projected to transcend tens of billions of dollars by 2033. This upward trajectory is fundamentally driven by the escalating demand for high-performance insulation materials across a spectrum of industrial applications. These textiles, renowned for their exceptional thermal resistance, chemical inertness, and low thermal conductivity, are becoming indispensable in environments subjected to extreme temperatures and corrosive substances. The historical period from 2019-2024 laid the groundwork for this growth, witnessing a steady increase in adoption as industries recognized the tangible benefits of enhanced energy efficiency and operational safety. The Estimated Year of 2025 marks a pivotal point, reflecting a robust market penetration and a clear indication of the market's sustained momentum.

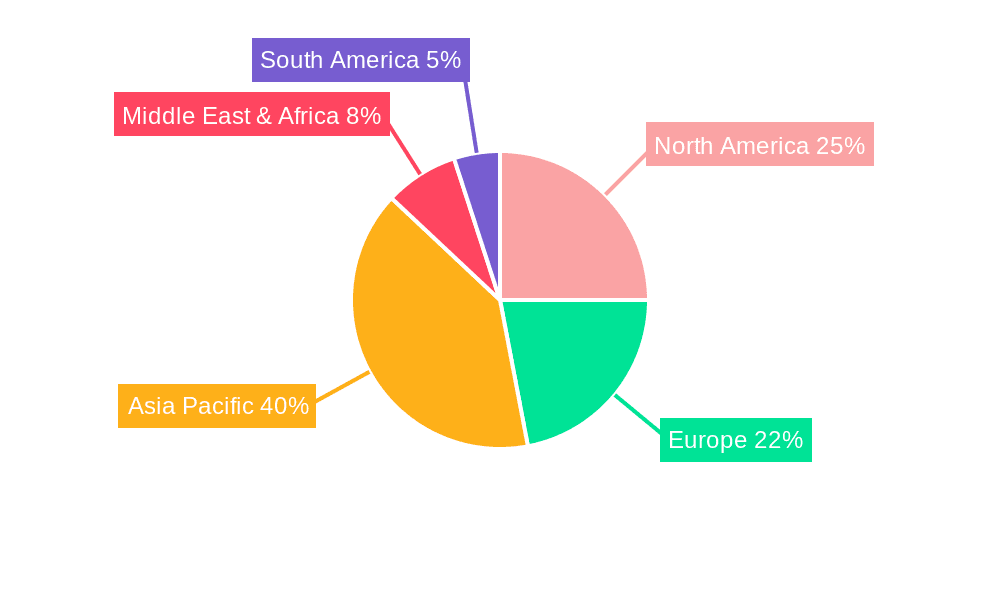

Within the Study Period of 2019-2033, the market is witnessing a significant shift towards more advanced and specialized ceramic fiber formulations. This includes the development of enhanced formulations with improved mechanical strength, higher temperature capabilities, and greater resistance to abrasion and vibration. The versatility of ceramic fiber textiles is a key trend, as they are being adapted into an ever-widening array of product forms to meet specific industrial needs. This has led to a proliferation of options including ceramic fiber cloth, tape, sleeving, round and square braids, and twisted ropes, each catering to distinct sealing, insulation, and protection requirements. The growing emphasis on sustainability and environmental regulations is also influencing market dynamics. Manufacturers are increasingly investing in R&D to develop eco-friendlier production processes and to explore biodegradable or recyclable ceramic fiber alternatives, although the inherent durability and longevity of traditional ceramic fibers often align with sustainability goals by reducing replacement frequency. Geographically, Asia-Pacific is emerging as a dominant force, driven by rapid industrialization and a burgeoning manufacturing sector. North America and Europe, with their established industrial bases and stringent performance standards, continue to be significant markets, focusing on high-end applications and technological advancements. The Forecast Period of 2025-2033 anticipates a period of intensified innovation, with smart textiles incorporating sensing capabilities and advanced composite materials gaining traction. Furthermore, the growing focus on lightweighting in various industries, such as aerospace and automotive, could also present new avenues for ceramic fiber textile applications, leveraging their strength-to-weight ratio in conjunction with other advanced materials. The overall market outlook remains exceptionally positive, with continuous innovation and expanding application scope underpinning its sustained growth.

The surge in demand for ceramic fiber textiles is propelled by a confluence of powerful industrial needs and technological advancements. Foremost among these is the relentless pursuit of energy efficiency across all industrial sectors. As energy costs continue to rise and environmental regulations tighten, industries are compelled to minimize heat loss and optimize energy consumption. Ceramic fiber textiles, with their superior thermal insulation properties, offer a highly effective solution, drastically reducing energy wastage in high-temperature processes. This translates directly into significant cost savings for businesses and a reduced carbon footprint, aligning with global sustainability objectives. Furthermore, the inherent safety benefits of these materials are a critical driver. In environments where extreme temperatures pose significant risks to personnel and equipment, ceramic fiber textiles provide essential protective barriers, preventing heat transfer and mitigating the potential for burns or fires. The chemical inertness of ceramic fibers ensures their stability and longevity even when exposed to corrosive chemicals and harsh operating conditions, making them ideal for applications in refineries, chemical plants, and foundries. This durability reduces the frequency of replacements and maintenance, leading to lower operational expenditures and enhanced plant reliability. The burgeoning growth of key end-use industries, such as power generation, metallurgy, and petrochemicals, further fuels this demand. As these sectors expand to meet global energy and material needs, the requirement for robust and reliable insulation and protective materials like ceramic fiber textiles escalates proportionally. The continuous innovation in manufacturing processes and product development also plays a crucial role, leading to improved performance characteristics and the creation of specialized textile forms that cater to increasingly complex industrial challenges, thereby broadening their applicability and market penetration.

Despite the robust growth prospects, the ceramic fiber textiles market is not without its hurdles. A primary concern revolves around health and safety regulations. While modern ceramic fibers have significantly improved safety profiles compared to older generations, concerns regarding airborne particulate matter and potential respiratory irritations persist. Regulatory bodies in various regions are continuously reviewing and updating guidelines for handling and disposal of these materials, which can lead to increased compliance costs for manufacturers and end-users. The stringent requirements for worker protection, including the use of personal protective equipment (PPE) and specialized ventilation systems, add to the operational expenses. Another significant challenge is the growing competition from alternative insulation materials. As research and development in material science advance, newer, potentially more cost-effective or environmentally friendly insulation solutions are emerging. These include advanced mineral wools, aerogels, and high-temperature polymer-based composites, which may offer comparable or even superior performance in certain niche applications, posing a threat to the market share of traditional ceramic fibers. The initial cost of high-performance ceramic fiber textiles can also be a restraining factor, especially for smaller enterprises or in cost-sensitive applications. While their long-term benefits in terms of energy savings and durability are undeniable, the upfront investment can be a barrier to adoption, particularly when compared to less expensive, albeit less effective, insulation options. Moreover, the complex manufacturing processes involved in producing high-quality ceramic fibers require significant capital investment and specialized expertise, which can limit the entry of new players and potentially create supply chain vulnerabilities. Fluctuations in raw material prices, such as alumina and silica, can also impact the profitability and pricing strategies of manufacturers, leading to market volatility. Finally, the disposal and recycling of spent ceramic fiber materials present an environmental challenge. While efforts are being made to develop sustainable disposal methods, current practices can be costly and labor-intensive, potentially hindering widespread adoption in regions with less developed waste management infrastructure.

The global Ceramic Fiber Textiles market is characterized by significant regional disparities in demand and consumption, with Asia-Pacific poised to be the dominant force throughout the forecast period (2025-2033). This dominance is underpinned by rapid industrialization, massive infrastructure development, and a burgeoning manufacturing base across countries like China, India, and Southeast Asian nations. These economies are experiencing unprecedented growth in sectors that are heavy consumers of ceramic fiber textiles, including power generation, automotive manufacturing, and heavy industries.

The Application Segment of Refineries is also a key driver of market growth within this region, as existing and new petrochemical facilities require robust high-temperature insulation for their complex processes, contributing significantly to market value, potentially in the billions of dollars. The sheer scale of new refinery constructions and expansions in the Asia-Pacific region, driven by increasing energy demand, directly translates into a substantial and sustained need for ceramic fiber textiles for piping, vessels, and other critical equipment. These textiles are crucial for maintaining process temperatures, enhancing energy efficiency, and ensuring operational safety in the harsh chemical environments prevalent in refineries. The economic growth in these nations also leads to increased demand in the Foundries and Power Plants segments, as industrial output and energy consumption rise in tandem.

Within the Type Segment, Ceramic Fiber Cloth, Tape, and Sleeving are expected to hold a commanding market share globally and particularly within the dominant Asia-Pacific region. This is due to their unparalleled versatility and widespread application across numerous industries.

Ceramic Fiber Cloth: This form is essential for creating custom insulation blankets, gaskets, and seals in high-temperature equipment. Its flexibility and woven structure allow it to conform to irregular shapes, making it ideal for lining furnaces, kilns, and industrial ovens found extensively in the manufacturing sectors of Asia-Pacific. The demand for cloth is further amplified by its use in creating flexible expansion joints and as a protective wrap for cables and hoses operating in hot environments.

Ceramic Fiber Tape: The ease of application and adaptability of tapes make them a preferred choice for sealing joints, wrapping pipes, and reinforcing insulation systems. In industrial settings like refineries and power plants, where efficient sealing is paramount to prevent heat loss and maintain process integrity, ceramic fiber tapes offer a practical and effective solution. Their ability to withstand thermal shock and chemical attack ensures their longevity in demanding applications.

Ceramic Fiber Sleeving: This product form is specifically designed to protect pipes, wires, and hoses from extreme heat and abrasion. In the rapidly expanding automotive and industrial machinery sectors within Asia-Pacific, where high-performance components are becoming standard, the need for effective thermal protection is increasing. Sleeving provides a crucial layer of defense, ensuring the reliability and lifespan of sensitive components operating under challenging conditions.

The continuous development of new manufacturing techniques and the increasing focus on specialized applications within these segments will further solidify their dominance. The market value for these specific types of ceramic fiber textiles is projected to reach billions of dollars within the forecast period, driven by both the sheer volume of industrial activity and the critical role these materials play in ensuring efficient and safe operations. The ongoing investment in manufacturing capacity and technological advancements by both domestic and international players in the Asia-Pacific region will further cement its leadership position in the global ceramic fiber textiles market.

The growth of the ceramic fiber textiles industry is catalyzed by several key factors. The escalating global demand for energy efficiency across industrial sectors is a primary driver, as these textiles offer superior insulation, reducing energy consumption and operational costs. Furthermore, increasingly stringent safety regulations worldwide necessitate the use of high-performance protective materials in high-temperature environments, a role ceramic fiber textiles excel at. The expansion of end-use industries, particularly in emerging economies within the Asia-Pacific region, such as petrochemicals, power generation, and metallurgy, directly translates into increased demand for these insulation and protective materials. Continuous innovation in product development, leading to enhanced thermal performance, durability, and specialized forms like advanced braids and ropes, also fuels market growth by expanding application possibilities and catering to evolving industrial needs.

This report provides a holistic understanding of the Ceramic Fiber Textiles market, delving into its intricate dynamics from 2019 to 2033. With a Base Year of 2025, the analysis leverages historical data and future projections to offer actionable insights. The market is expected to reach valuations in the tens of billions of dollars by the end of the forecast period. The report meticulously examines key trends, driving forces, challenges, and growth catalysts that shape the industry's landscape. It highlights dominant regions and segments, offering a granular view of their market contributions and future potential. Leading players and their strategic developments are comprehensively documented, providing a competitive intelligence overview. The report's extensive coverage ensures that stakeholders, from manufacturers and suppliers to end-users and investors, are equipped with the knowledge to navigate this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.12% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.12%.

Key companies in the market include 3M, CeraMaterials, Vitcas, PTI Thermal Solutions, Tespe srl, Morgan Thermal Ceramics, Mid-Mountain Materials, Inc, GLT Products, Shandong Luyang Share, Unifrax, Shanghai YESO Insulating Products, Luyang Energy-Saving Materials, KT Refractories, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Ceramic Fiber Textiles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ceramic Fiber Textiles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.