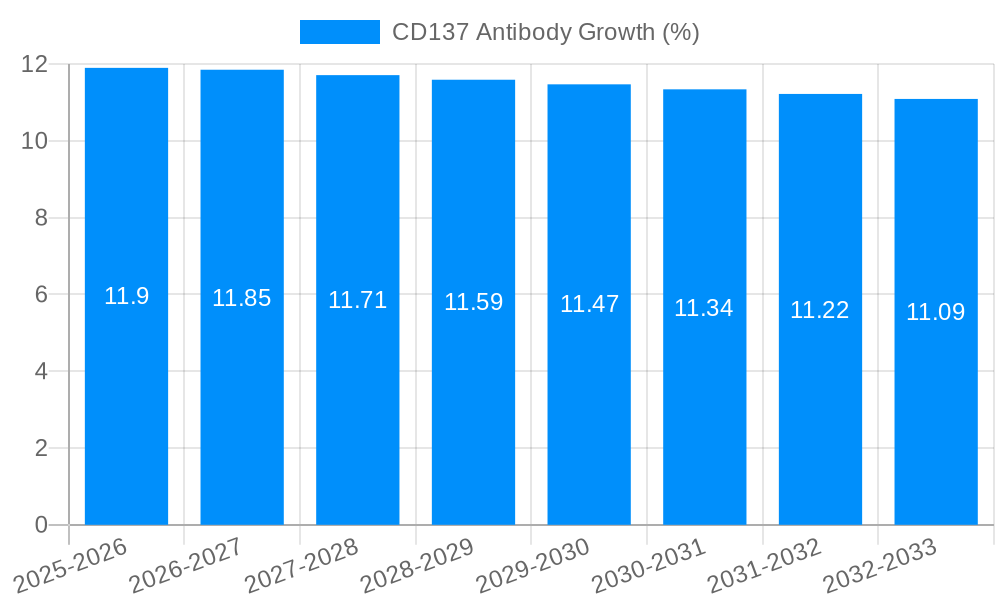

1. What is the projected Compound Annual Growth Rate (CAGR) of the CD137 Antibody?

The projected CAGR is approximately 11.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

CD137 Antibody

CD137 AntibodyCD137 Antibody by Type (Monoclonal Antibody, Polyclonal Antibody), by Application (Flow Cytometry, ELISA, Immunoprecipitation, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

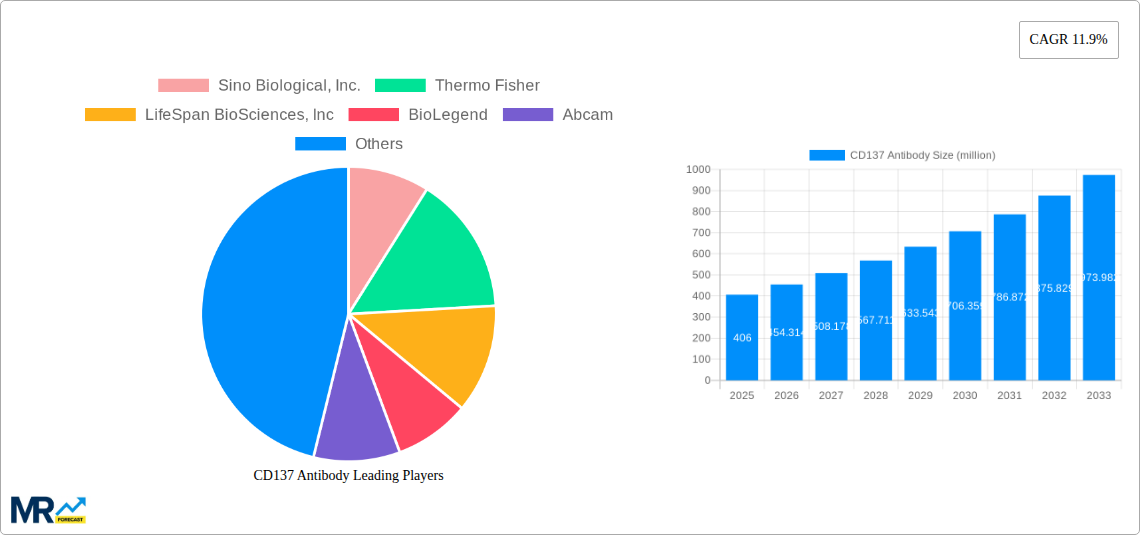

The CD137 Antibody market is poised for substantial expansion, driven by its critical role in immune system modulation and its increasing application in cancer immunotherapy. Valued at an estimated USD 406 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 11.9% during the forecast period of 2025-2033. This strong growth trajectory is primarily fueled by advancements in antibody engineering, a deeper understanding of T-cell activation pathways mediated by CD137 (also known as 4-1BB), and the escalating demand for targeted cancer therapies. The burgeoning field of immuno-oncology, where CD137 agonists have demonstrated significant promise in enhancing anti-tumor immune responses, is a pivotal driver. Furthermore, the expanding research and development activities exploring CD137 antibodies for autoimmune diseases and infectious diseases are contributing to market optimism. The market's growth is also supported by a growing pipeline of CD137-targeting therapeutics and the increasing commercial availability of high-quality CD137 antibodies for research and clinical applications.

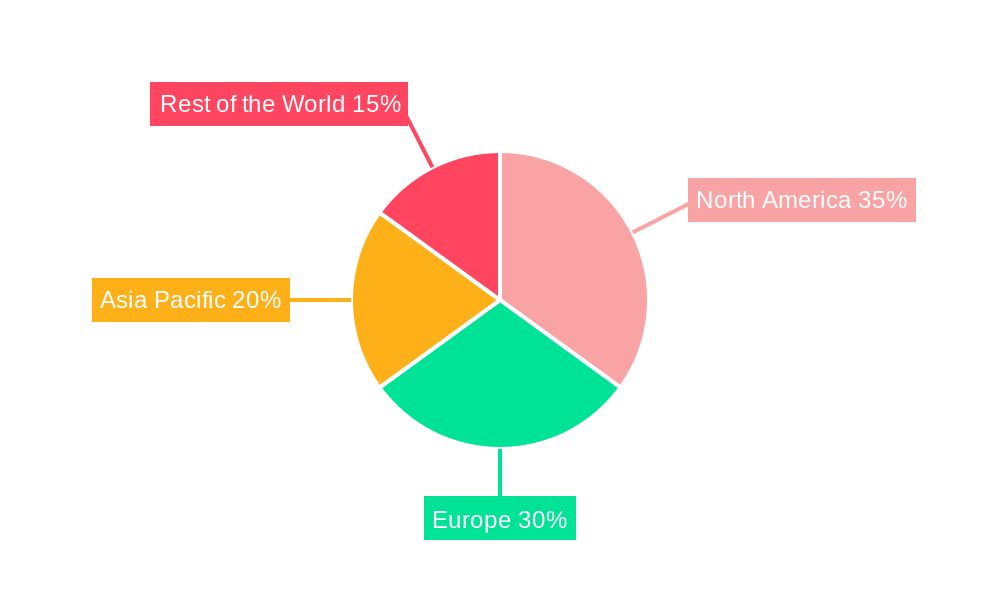

The market segmentation reveals a dynamic landscape. In terms of type, Monoclonal Antibodies are expected to dominate due to their specificity and efficacy, though Polyclonal Antibodies will continue to find niche applications. Key applications like Flow Cytometry, ELISA, and Immunoprecipitation are driving demand for these antibodies in diagnostic and research settings. Geographically, North America and Europe currently lead the market, owing to well-established biopharmaceutical industries and significant investments in R&D. However, the Asia Pacific region is anticipated to emerge as a high-growth market, driven by increasing healthcare expenditure, a growing number of research institutions, and a rising prevalence of cancer. Restraints such as the high cost of antibody development and complex regulatory pathways for therapeutic antibodies may pose challenges. Nevertheless, the continuous innovation by key players like Thermo Fisher, Sino Biological, Inc., and Abcam, coupled with strategic collaborations and the expansion of manufacturing capabilities, are expected to mitigate these challenges and ensure sustained market growth.

The global CD137 antibody market is poised for substantial expansion, driven by its critical role in immunotherapy research and development. During the historical period of 2019-2024, the market witnessed steady growth, fueled by increasing investments in oncology and autoimmune disease research. The base year of 2025 is projected to solidify this upward trajectory, with continued advancements in diagnostic and therapeutic applications. The study period from 2019 to 2033, with a forecast period spanning 2025-2033, anticipates a compound annual growth rate (CAGR) that will see the market value significantly increase, likely reaching the hundreds of millions of dollars. This growth is intricately linked to the rising prevalence of various cancers and the escalating demand for targeted therapies. CD137, also known as 4-1BB, is a costimulatory molecule found on activated T cells, playing a pivotal role in enhancing T cell immunity. Consequently, antibodies targeting CD137 are instrumental in modulating immune responses, making them invaluable tools for both pre-clinical research and the development of next-generation immunotherapies. The increasing sophistication of biotechnology and the continuous pursuit of novel therapeutic strategies for complex diseases are creating a fertile ground for the CD137 antibody market. Moreover, advancements in antibody engineering and production technologies are contributing to the availability of more potent and specific CD137 antibodies, further accelerating market adoption. The market is characterized by a dynamic interplay of established players and emerging companies, all vying to capture a significant share through innovation and strategic partnerships. The estimated year of 2025 will represent a key inflection point, where the market's potential begins to be more fully realized. The increasing understanding of the intricate mechanisms of immune system activation and regulation is directly translating into a greater demand for research reagents like CD137 antibodies. The expanding pipeline of CD137-targeting drugs in clinical trials is a significant indicator of future market growth, promising substantial revenue streams in the coming years. The market's trajectory is not merely a reflection of scientific curiosity but also a direct response to unmet medical needs and the relentless pursuit of more effective treatments for debilitating diseases. The overall trend indicates a robust and sustained demand for CD137 antibodies, driven by both research imperatives and the promising therapeutic potential of CD137 modulation.

The CD137 antibody market is experiencing a powerful surge propelled by several interconnected driving forces. Foremost among these is the burgeoning field of cancer immunotherapy. CD137 acts as a critical co-stimulatory receptor that enhances T cell responses against tumor cells. The development of CD137 agonistic antibodies, designed to activate this receptor, has shown significant promise in preclinical and clinical settings for various cancers, including melanoma, renal cell carcinoma, and lung cancer. This therapeutic promise is directly fueling the demand for high-quality CD137 antibodies for research, drug development, and potential clinical applications, contributing to market values in the tens of millions. Furthermore, the growing understanding of the immune system's intricate role in a wide array of diseases, beyond cancer, is broadening the scope for CD137 antibody utilization. Its involvement in modulating autoimmune responses and infectious diseases opens up new avenues for research and therapeutic development, further expanding the market's reach. The increasing global expenditure on research and development in the life sciences and pharmaceutical sectors, often in the hundreds of millions of dollars annually, provides a robust financial backbone for the sustained growth of the CD137 antibody market. This investment directly translates into more research projects utilizing these antibodies, driving demand. The continuous advancements in antibody engineering and biotechnology, allowing for the creation of more specific, potent, and cost-effective antibodies, also play a crucial role. These technological leaps make CD137 antibodies more accessible and effective for a wider range of applications, from basic research to the development of sophisticated diagnostics and therapeutics.

Despite the promising growth trajectory, the CD137 antibody market faces several challenges and restraints that could temper its expansion. A significant hurdle is the inherent complexity of the immune system and the precise mechanisms of CD137 agonism. While promising, the development of effective and safe CD137-targeting therapies has encountered setbacks due to the potential for overstimulation of the immune system, leading to cytokine release syndrome and other adverse events. This necessitates extensive preclinical and clinical testing, which is both time-consuming and resource-intensive, potentially slowing down the commercialization of new antibody-based drugs and impacting market values. The high cost associated with the research, development, and manufacturing of monoclonal antibodies can also be a limiting factor. Developing and validating a high-affinity, highly specific CD137 antibody requires substantial investment, making them a premium research reagent. Consequently, smaller research institutions or those with limited budgets may find it challenging to access these tools, thus impacting overall market penetration. Regulatory hurdles represent another significant restraint. The stringent approval processes for novel immunotherapies, including CD137-targeting agents, can lead to prolonged development timelines and increased costs. Companies must navigate complex regulatory landscapes, which can be a barrier to entry and slow down market adoption. Furthermore, the availability of alternative therapeutic strategies or research tools for modulating immune responses could also pose a competitive challenge. While CD137 is a key target, other immune checkpoints and pathways are also being explored, potentially diverting research focus and investment. Finally, the sensitivity and specificity of antibodies, while crucial, can vary significantly between different manufacturers and clones. Ensuring lot-to-lot consistency and high performance is critical, and any inconsistencies can lead to research variability, potentially impacting the perceived reliability and adoption of certain CD137 antibodies. These factors collectively contribute to a cautious optimism, highlighting areas where innovation and strategic planning are essential for continued market growth.

The Monoclonal Antibody segment, specifically within the North America region, is projected to dominate the CD137 antibody market.

Dominance of Monoclonal Antibodies:

North America's Leading Position:

The CD137 antibody industry is propelled by several key growth catalysts. The escalating global burden of cancer and autoimmune diseases necessitates novel and effective therapeutic strategies, with immunotherapy emerging as a frontrunner. CD137, as a critical co-stimulatory molecule, is a prime target for enhancing anti-tumor immunity and modulating aberrant immune responses in autoimmune conditions. This therapeutic potential is a significant driver, pushing market values into the tens of millions. Furthermore, continuous advancements in antibody engineering and biotechnology are yielding more precise, potent, and cost-effective CD137 antibodies, expanding their applications in research and development. The increasing global investment in life sciences research and the growing number of CD137-targeting drug candidates progressing through clinical trials are also fueling demand, promising further market expansion into the hundreds of millions.

The comprehensive coverage of the CD137 antibody report delves into the intricate dynamics of this rapidly evolving market. It provides an in-depth analysis of market trends, driving forces, challenges, and regional landscapes. The report details the projected growth trajectory, with specific attention to the forecast period of 2025-2033, highlighting the estimated market value in the hundreds of millions. It meticulously dissects the key market segments, including the dominance of monoclonal antibodies and their applications in flow cytometry, ELISA, and immunoprecipitation. Furthermore, the report offers a panoramic view of the leading industry players and significant developments that have shaped and will continue to influence the CD137 antibody sector. This holistic approach ensures stakeholders are equipped with the insights necessary to navigate this complex and promising market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.9%.

Key companies in the market include Sino Biological, Inc., Thermo Fisher, LifeSpan BioSciences, Inc, BioLegend, Abcam, Bio-Techne, GeneTex, Bio-Rad Laboratories, Inc., Arigo Biolaboratories Corp., Merck, Cell Signaling Technology, Inc., MyBiosource, Inc., Boster Biological Technology, Biocare Medical, LLC, Signalway Antibody LLC, NSJ Bioreagents, Leinco Technologies, Wuhan Fine Biotech Co., Ltd., Elabscience Biotechnology Inc., Biotium, Bioss Inc, Miltenyi Biotec, .

The market segments include Type, Application.

The market size is estimated to be USD 406 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "CD137 Antibody," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the CD137 Antibody, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.