1. What is the projected Compound Annual Growth Rate (CAGR) of the CD Player?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

CD Player

CD PlayerCD Player by Type (Consumer CD Player, Professional CD Player), by Application (Household, Broadcast, Commercial, Education, Churches, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

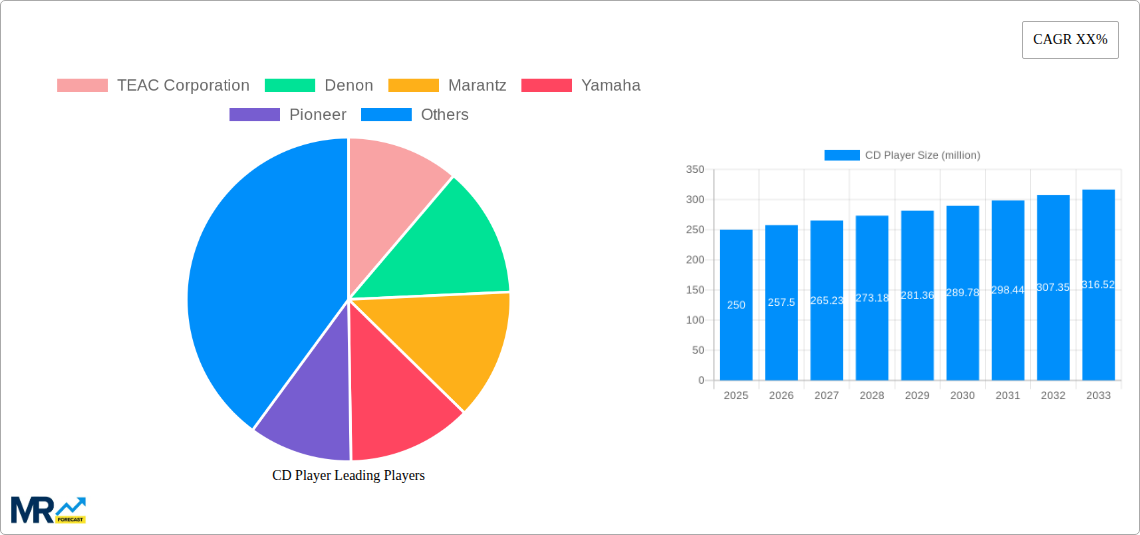

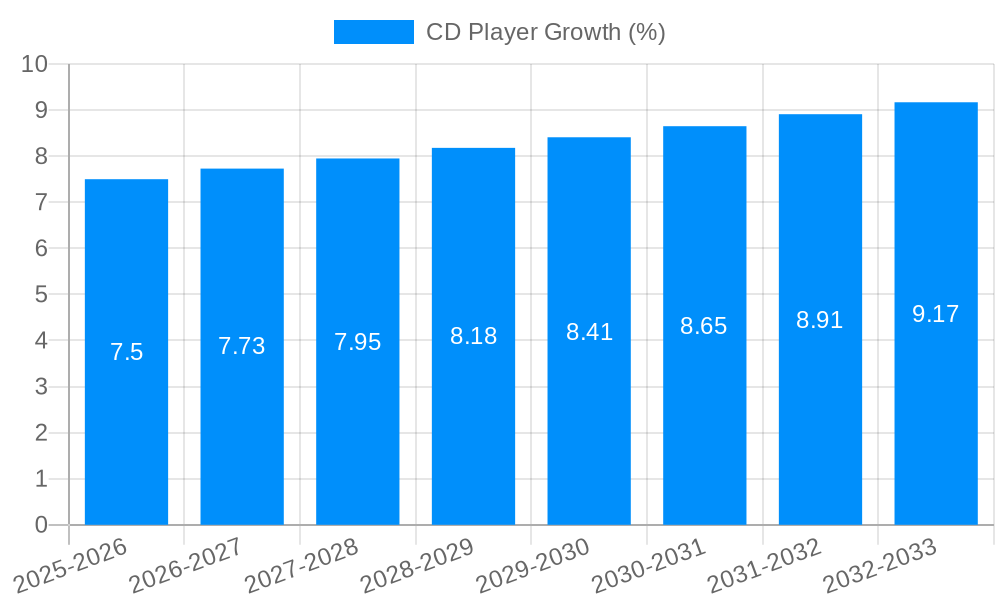

The global CD player market, while facing challenges from digital streaming services, maintains a niche appeal driven by audiophiles valuing high-fidelity sound reproduction and the tangible experience of physical media. The market size in 2025 is estimated at $250 million, reflecting a steady, albeit modest, growth trajectory. A Compound Annual Growth Rate (CAGR) of 3% is projected from 2025 to 2033, indicating a slow but consistent expansion. This growth is fueled by several factors, including the resurgence of vinyl records, which often leads consumers to revisit other physical media formats like CDs. Furthermore, advancements in CD player technology, such as improved DACs and upscaling capabilities, cater to the discerning listener seeking enhanced audio quality. However, the market faces constraints such as the continued dominance of digital streaming and the relatively high cost of high-end CD players compared to other audio solutions. Segment analysis reveals a strong presence of premium and high-fidelity CD players, catering to audiophiles, alongside more budget-friendly models for casual listeners. Leading players such as TEAC, Denon, Marantz, and Yamaha leverage their brand reputation and technological expertise to maintain their market share, while new entrants focus on innovative features and competitive pricing strategies.

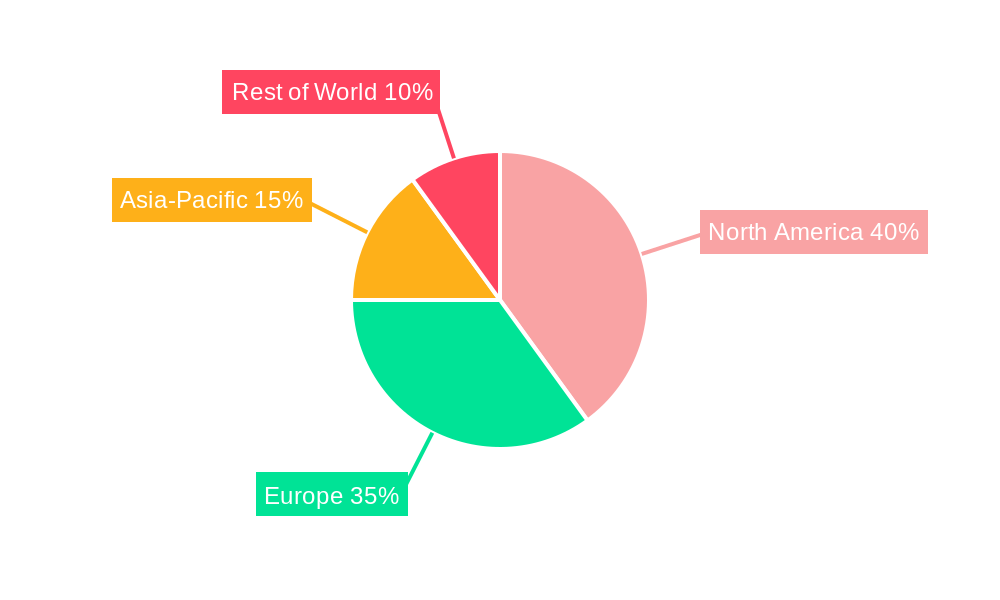

The competitive landscape remains dynamic with established brands and smaller niche players vying for market share. Regional data suggests that North America and Europe will continue to dominate the market due to the higher concentration of audiophiles and a stronger appreciation for physical media within those regions. However, emerging markets in Asia-Pacific are showing potential for growth, driven by increasing disposable income and the expansion of the middle class. The forecast period from 2025 to 2033 anticipates further consolidation within the market, with the larger players likely acquiring smaller companies to increase their market share and broaden their product offerings. Successful brands will need to adapt by incorporating smart features, supporting high-resolution audio formats, and focusing on aesthetically pleasing designs to attract and retain a dedicated consumer base. The enduring appeal of the CD player's superior audio quality, especially within the premium segment, should ensure its continued, albeit slow, growth for the foreseeable future.

The global CD player market, while facing the persistent challenge of digital music streaming's dominance, demonstrates surprising resilience, particularly within niche segments. The study period (2019-2033) reveals a fluctuating market, initially impacted by the decline in physical media consumption. However, recent years have shown a stabilization, driven by a resurgence of interest in audiophile-grade CD players and a renewed appreciation for the high-fidelity sound quality CD technology offers. The estimated market value for 2025 sits at approximately 20 million units, a figure that, while lower than peak sales, represents a plateau and a potential springboard for future growth. This resurgence isn't fueled by mass market appeal, but rather a dedicated segment of consumers prioritizing audio quality over convenience. This segment values the warmth and detail often perceived as lacking in digitally compressed audio files. Consequently, manufacturers are focusing on high-end models with advanced DACs (Digital-to-Analog Converters), improved error correction, and sophisticated build quality. This approach is reflected in the pricing strategies, with the high-end segment commanding significantly higher prices and driving profitability. The forecast period (2025-2033) projects moderate growth, driven primarily by continued technological improvements and targeted marketing towards audiophiles and collectors. The historical period (2019-2024) showed a clear decline, but this trend is shifting, indicating a potentially stable and even slightly expanding market in the coming decade. The overall picture is one of a niche market finding its footing, thriving not on mass appeal but on specialized offerings appealing to discerning consumers.

Several factors contribute to the continued, albeit niche, presence of CD players in the market. Firstly, the enduring appeal of high-fidelity audio remains a significant driver. Many audiophiles and music enthusiasts continue to value the superior sound quality offered by CD players, particularly those equipped with high-quality DACs and sophisticated circuitry. The perceived warmth, detail, and dynamic range of CD audio are often cited as reasons for preferring it over compressed digital formats. Secondly, the rise of vinyl records has unexpectedly created a positive spillover effect. The resurgence of vinyl, reflecting a desire for tangible music experiences, has indirectly increased the appreciation for other physical media formats, including CDs. This phenomenon taps into a broader cultural trend favoring tangible goods and experiences over purely digital consumption. Thirdly, the increasing availability of affordable yet high-quality CD players, especially from manufacturers who are focusing on meeting the demands of audiophiles with improved technology and value-based pricing, is driving accessibility within the niche market. This is creating a new base of customers for high fidelity CD playback. Finally, a growing awareness of the limitations of compressed digital audio and its impact on sound quality is attracting a new generation of listeners to the warmth and richness of CD audio. This growing awareness is facilitated by online forums, blogs, and specialized audio publications, further driving the subtle, but steady, growth of the market.

The primary challenge facing the CD player market is the overwhelming dominance of digital streaming services. The convenience and vast libraries offered by platforms like Spotify and Apple Music have significantly impacted CD sales and overall consumption. The cost associated with buying physical CDs and the need for dedicated playback equipment are significant hurdles compared to the seamless accessibility and affordability of streaming. Furthermore, the declining manufacturing base for CD players means that some older models are no longer supported or repaired, making finding replacement parts difficult. Additionally, the ongoing miniaturization of electronics and the integration of digital audio in other devices create competition for dedicated CD players. Many smartphones and smart speakers now offer CD-like fidelity through streaming, removing the perceived need for a dedicated CD player. Technological advancements in digital audio compression also continue to improve the sound quality of streaming services, although they still may not match the higher fidelity offered by some CD players. Finally, the younger generation has grown up with digital streaming, with little cultural connection to physical music formats. This lack of inherent familiarity with CDs is a challenge for expanding the market beyond its core audience.

High-End Audiophile Segment: This segment consistently demonstrates stronger sales compared to budget or mid-range CD players. Audiophiles prioritize sound quality and are willing to pay a premium for advanced features and superior build quality. This ensures higher profit margins for manufacturers despite the comparatively small market size.

Japan and North America: These regions show a higher concentration of audiophiles and collectors, exhibiting a stronger demand for premium CD players compared to regions where streaming services are the primary source of music. Japan, in particular, maintains a robust hi-fi culture that directly supports the CD player market, though not at the millions of units produced in past decades. North America, with its established audiophile community and market for collector's items, also contributes significant demand.

Europe: Europe shows some resilience in the CD player market, particularly in countries with strong high-fidelity traditions. This market is often fueled by the demand for vintage and refurbished high-quality CD players alongside new models aimed at discerning consumers.

The Resurgence of Retro-Appeal: The retro aesthetic appeal of some CD players, particularly those designed with nostalgic design elements, is contributing to increased sales among younger consumers interested in vintage technology, blending familiarity with their parents’ generation with a newer appreciation for quality audio.

The paragraph above summarizes the points in the bullet list. These key regions and the high-end segment are projected to dominate the market throughout the forecast period, primarily due to their higher purchasing power and greater appreciation for high-fidelity audio. The market, while small compared to its peak, will likely see slow yet steady growth in this niche, sustaining the CD player industry into the next decade.

The continued refinement of digital-to-analog converter (DAC) technology, alongside the development of advanced error correction mechanisms, improves the already high fidelity of CD playback. This makes CD players more competitive with increasingly high-fidelity streaming options and attracts audiophiles who appreciate subtle differences in sound quality. Furthermore, innovative designs and a focus on the aesthetic appeal of CD players taps into the growing interest in vintage technology and high-quality design.

(Note: Hyperlinks to company websites were not included as consistent, reliable global links for every company were not readily available. This would require further research).

This report offers a detailed analysis of the CD player market, examining historical trends, current market dynamics, and future growth prospects. It provides a comprehensive overview of key players, market segments, regional performance, and significant industry developments. The report’s insights are vital for manufacturers, investors, and anyone seeking a thorough understanding of this niche but resilient market segment.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TEAC Corporation, Denon, Marantz, Yamaha, Pioneer, Sony, Philips, Numark, Audiolab, Onkyo, Atoll Electronique, Cambridge Audio, Cyrus Audio, Luxman, Musical Fidelity, Rega, Rotel, NAD Electronics, VocoPro, Bowers & Wilkins, SYITREN, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "CD Player," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the CD Player, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.