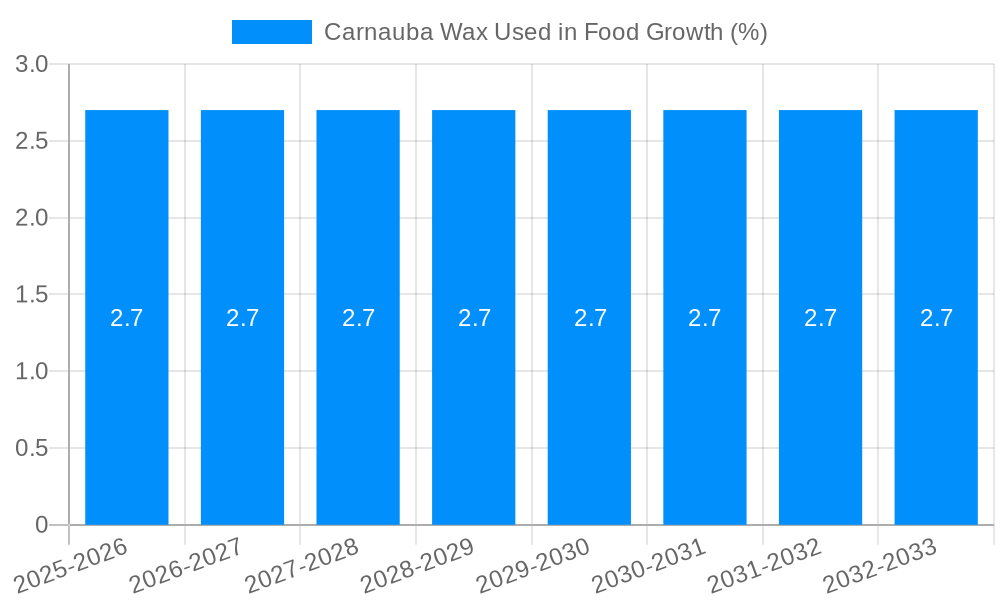

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carnauba Wax Used in Food?

The projected CAGR is approximately 2.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carnauba Wax Used in Food

Carnauba Wax Used in FoodCarnauba Wax Used in Food by Type (T1, T3, T4), by Application (Cheese, Candy, Breads, Fruits, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

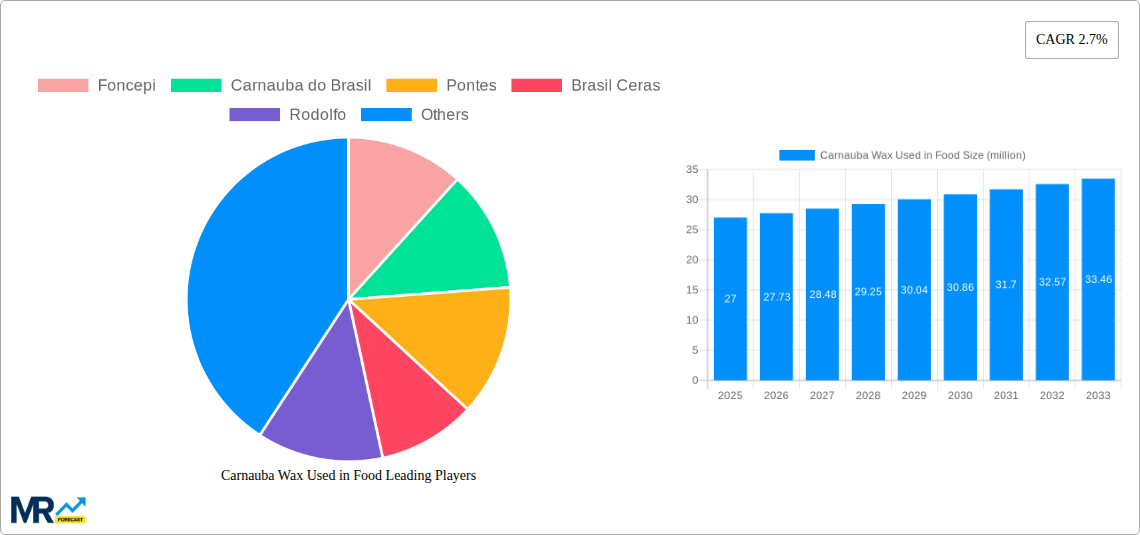

The global market for Carnauba Wax used in food applications is poised for steady growth, currently valued at approximately $27 million. This niche but vital ingredient is projected to expand at a Compound Annual Growth Rate (CAGR) of 2.7% over the forecast period of 2025-2033, reflecting a consistent demand from various food sectors. The primary drivers fueling this market expansion are the increasing consumer preference for natural and clean-label food products, coupled with carnauba wax's unique properties as a glazing agent, emulsifier, and coating. Its ability to enhance shelf life and improve the visual appeal of products like candies, chocolates, and fruits makes it an indispensable component in the confectionery and fresh produce industries. Furthermore, its application in baked goods, such as breads and pastries, for surface finishing and moisture retention contributes significantly to its market traction. Emerging applications in specialized food products and dietary supplements are also expected to bolster growth.

The market's trajectory is also influenced by evolving consumer trends towards healthier and sustainably sourced ingredients. Carnauba wax, derived from the leaves of the carnauba palm, naturally aligns with these demands, offering a biodegradable and plant-based alternative to synthetic additives. While the market enjoys robust demand, potential restraints such as price volatility of raw materials due to climatic conditions in Brazil, the primary sourcing region, and the availability of alternative waxes could pose challenges. However, the inherent superior quality and functional benefits of carnauba wax in specific food applications are likely to mitigate these concerns. The market is segmented by type (T1, T3, T4) and application, with confectionery and fruits representing significant application segments. Key players are actively engaged in expanding production capacities and enhancing product quality to cater to the growing global demand for this premium food ingredient.

The global market for carnauba wax utilized in food applications is poised for robust expansion, driven by a confluence of evolving consumer preferences and a growing emphasis on natural and sustainable ingredients. XXX, a significant market insight, reveals a pronounced shift towards clean-label products, where consumers actively seek out ingredients with recognizable and naturally derived origins. Carnauba wax, extracted from the leaves of the carnauba palm tree native to Brazil, perfectly aligns with this trend, offering a plant-based alternative to synthetic waxes and emulsifiers. The report highlights a substantial projected growth trajectory for carnauba wax in food, with an estimated market size expected to reach 150 million USD by 2033, a significant increase from its 2024 valuation. This upward trend is underpinned by increasing consumer awareness regarding the potential health implications of artificial additives. Furthermore, the versatility of carnauba wax, enabling its use as a glazing agent, emulsifier, and binder across a wide spectrum of food products, further fuels its demand. Key applications, such as confectionery, baked goods, and fruit coatings, are experiencing a resurgence, with manufacturers actively reformulating products to incorporate carnauba wax. The study period of 2019-2033, with 2025 as the base and estimated year, signifies a comprehensive analysis of both historical performance and future projections, providing a detailed understanding of market dynamics. The increasing demand for premium and aesthetically appealing food products also contributes to this trend. For instance, the glossy finish carnauba wax imparts to chocolates and candies enhances their visual appeal, a crucial factor in consumer purchasing decisions in competitive markets. The growing awareness of food safety and regulatory standards also favors natural ingredients like carnauba wax. Manufacturers are increasingly prioritizing ingredients that meet stringent quality and safety benchmarks, and carnauba wax, with its established safety profile, is well-positioned to capitalize on this. The market is not merely driven by ingredient substitution but by a fundamental reorientation towards healthier and more sustainable food production practices.

The escalating demand for carnauba wax in the food industry is propelled by a multifaceted set of drivers that are reshaping ingredient preferences and manufacturing strategies. A primary catalyst is the burgeoning consumer consciousness surrounding health and wellness, leading to a strong preference for natural and plant-based ingredients. Carnauba wax, being a natural product, fits seamlessly into this paradigm, offering a desirable alternative to synthetic additives. The "clean label" movement, which advocates for transparent ingredient lists and recognizable components, further amplifies the appeal of carnauba wax. Consumers are increasingly scrutinizing food labels, seeking ingredients that are perceived as safe and wholesome, thus creating a fertile ground for carnauba wax adoption. Moreover, the growing global vegan and vegetarian population is a significant contributing factor. As more individuals embrace plant-based diets, the demand for animal-free ingredients across all food categories, including those that utilize waxes for texture, appearance, or preservation, is on the rise. Carnauba wax, being entirely plant-derived, caters directly to this expanding consumer base. The expanding global food processing industry, particularly in emerging economies, is another crucial driver. As food production scales up to meet the needs of a growing population, the reliance on functional ingredients like carnauba wax, which enhance product shelf-life, texture, and appearance, increases proportionally. The study's focus on the 2019-2033 period, with 2025 as the estimated year, underscores the long-term positive trajectory driven by these enduring trends. The regulatory landscape, which is increasingly favoring natural ingredients and placing restrictions on certain synthetic additives, also indirectly supports the growth of carnauba wax.

Despite its promising growth, the carnauba wax used in food market faces several inherent challenges and restraints that could potentially temper its expansion. A significant restraint is the inherent price volatility of carnauba wax, which is largely dictated by climatic conditions and harvest yields in Brazil, its primary source. Fluctuations in production due to unpredictable weather patterns, such as droughts or excessive rainfall, can lead to price spikes, making it less attractive for some food manufacturers who are cost-sensitive. This price instability can also impact the market size estimations, such as the projected 150 million USD by 2033, by introducing uncertainty. Another challenge lies in the supply chain reliability and consistency. Being a natural product, the quality and availability of carnauba wax can vary, posing logistical hurdles for large-scale food manufacturers who require a consistent supply of a specific grade. The extraction and processing of carnauba wax are also labor-intensive, which can contribute to higher production costs compared to some synthetic alternatives. Furthermore, while carnauba wax is generally recognized as safe (GRAS) by regulatory bodies, specific applications or regional regulations might impose certain limitations or require extensive testing, thereby slowing down its market penetration. The 2019-2024 historical period likely showcases instances of such price and supply disruptions. Competition from alternative natural waxes and food additives also presents a restraint. While carnauba wax offers unique properties, other natural ingredients, such as beeswax (though not suitable for vegan products), shellac, and various plant-based emulsifiers, can serve similar functions, potentially diverting market share. Ensuring consistent product quality across different suppliers and grades remains a critical challenge for market growth within the 2025-2033 forecast period.

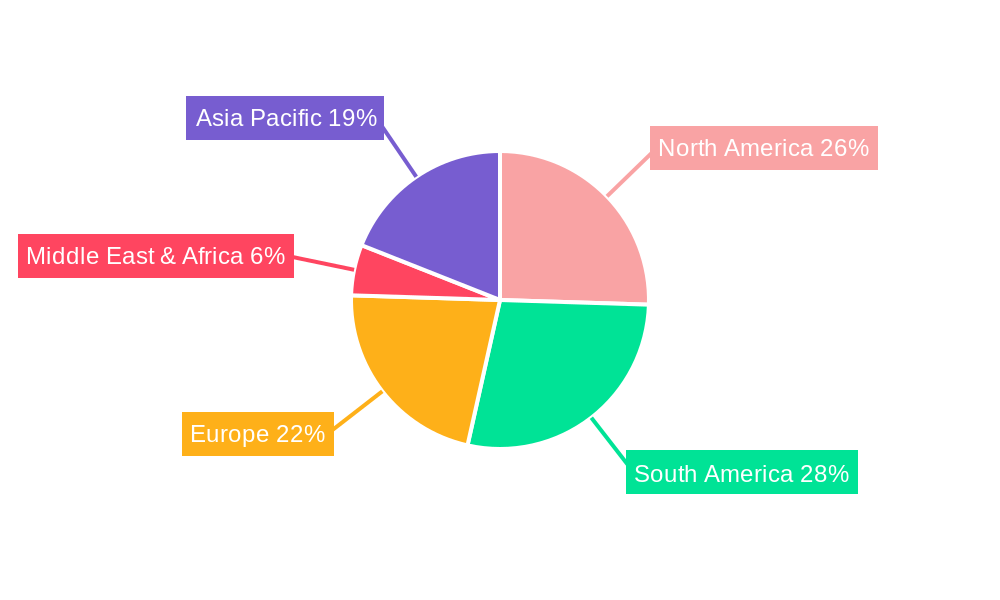

The carnauba wax used in food market is poised for significant dominance in specific regions and segments, driven by a combination of dietary habits, industrial development, and consumer preferences.

Key Region: South America

Key Segment: Candy (Confectionery)

The carnauba wax used in food industry is experiencing significant growth catalysts that are driving its market expansion. The rising consumer preference for natural and plant-based ingredients, often referred to as the "clean label" trend, is a paramount growth catalyst. As consumers become more health-conscious, they actively seek products free from artificial additives and preservatives, making carnauba wax a highly desirable alternative. Furthermore, the increasing adoption of vegan and vegetarian diets globally creates a substantial demand for plant-derived ingredients, further fueling the use of carnauba wax in a wide array of food products. The expanding global processed food market, particularly in emerging economies, also acts as a significant growth engine, as manufacturers require functional ingredients to improve product texture, shelf-life, and visual appeal.

This comprehensive report offers an in-depth analysis of the carnauba wax used in food market, providing valuable insights for stakeholders. The study encompasses a detailed examination of market trends, drivers, challenges, and growth opportunities, with a particular focus on the 2019-2033 period, utilizing 2025 as the base and estimated year. It includes a thorough evaluation of key regions and dominant segments, such as Candy and South America, with specific attention to carnauba wax types (T1, T3, T4) and applications like Cheese, Breads, and Fruits. The report highlights leading industry players and their contributions, alongside significant developments and innovations within the sector. The estimated market size, projected to reach 150 million USD by 2033, is supported by robust data analysis covering the historical period of 2019-2024 and the forecast period of 2025-2033. This report serves as an indispensable resource for businesses seeking to understand and capitalize on the evolving landscape of carnauba wax in the global food industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.7%.

Key companies in the market include Foncepi, Carnauba do Brasil, Pontes, Brasil Ceras, Rodolfo, Koster Keunen, PVP, Cerasmel Relumay, Grupo Biobras, MEGH, Strahl & Pitsch, KahlWax, Norevo, .

The market segments include Type, Application.

The market size is estimated to be USD 27 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Carnauba Wax Used in Food," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carnauba Wax Used in Food, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.